FOMC in focus as US dollar momentum stays positive

USD: Fed set to leave all options open

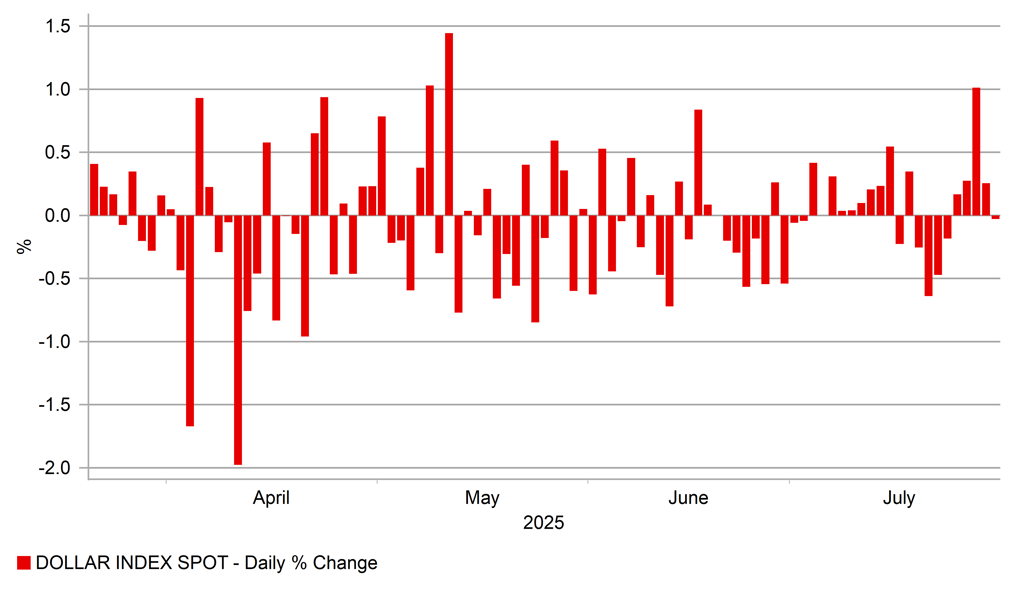

The US dollar has advanced further in the FX markets and after the biggest gain on Monday (1.0%) since mid-May, the dollar has advanced by a further modest 0.25%. As stated here already this week, there is a shift in focus underway with tariff risks receding for now and the 1st August no longer seen as a key risk-event day, and the focus shifting to relative macro with the FOMC this evening and the jobs data on Friday. The JOLTS report continued to point to a labour market that may be weakening but is certainly not deteriorating in a marked fashion that warrants a shift in monetary stance by the Fed.

Fed Chair Powell is of course in a tricky position and his press conference will be dissected for evidence of him being influenced by the blatant criticism from President Trump and the pressure to cut. But it is important to note that this time there seems likely to be greater pressure from within the FOMC to cut. Of course, we can debate the motives of both Governors Waller and Bowman but Waller’s call for a cut and Bowman being open to a cut could compel Chair Powell to incorporate this apparent shift in thinking favouring a sooner rate cut. As the Nick Timiraos WSJ article highlighted yesterday – centrist FOMC members may be concluding that while there has been no compelling information one way or the other on the labour market or inflation, you can’t wait forever and there comes a point when a cut could be justified. Given the uncertainties over inflation are likely to persist through the remainder of the year (the latest round of tariffs effective 1st Aug will take months to come through) waiting to assess the damage could do more harm than good given the monetary stance remains restrictive. The fact that the median dot profile from June also indicated two rate cuts this year, there is some logic based on that median for one of those cuts to be delivered.

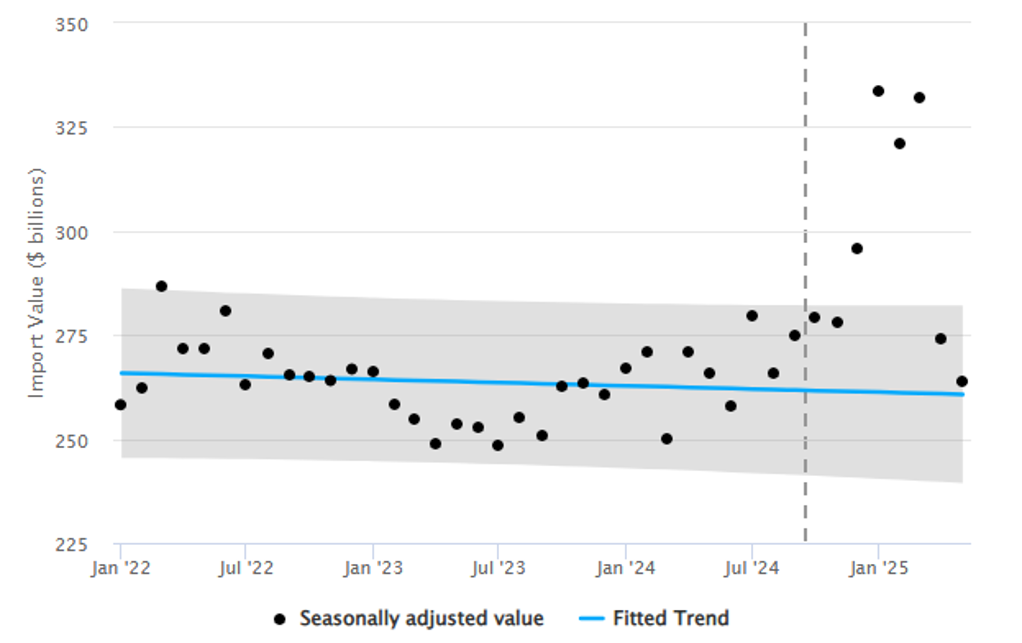

All that said, the median dot profile is close call on two cuts. Seven FOMC members are expecting no rate cuts with two expecting just one. Eight expect two cuts and two expect three cuts. That could easily drop to one in September with no rate cut delivered. The big issue for the FOMC to determine is whether waiting longer to assess inflation risks is damaging or not and the labour market doesn’t scream weakness that is anything other than gradual. The S&P 500 at a record high also does not scream the need for monetary easing at this juncture. The lag on tariffs hitting the hard inflation data is certainly a justifiable risk to wait longer. An interesting piece by Wharton University estimated US companies avoided nearly USD 43bn in tariffs by front-loading imports. Imports surged in Q1 and aggregate import values were 26% above historical trends. So those inventories need to be worked off before the inflation hit from tariffs can be assessed.

The key tonight is that Powell will have to keep his options open for September. There will be NFP and CPI reports before the September FOMC and while the uncertainties over tariffs impacting inflation will still exist then, if inflation has remained broadly stable by then and the jobs market hasn’t weakened, the FOMC will cut. While that outcome is still very unclear, getting positioned for possibly cut does suggest Powell tonight will make clear it’s an option dependent on certain outcomes. That could well bring to a halt the positive dollar momentum we have seen so far this week.

DXY HAS BIGGEST DAILY GAIN SINCE MAY

Source: Bloomberg, Macrobond & MUFG GMR

EUR: Still plenty of uncertainties

The European Commission yesterday published an EU-US trade deal outline explaining some of the key elements (here). The piece interestingly refers to the “political agreement” reached and not an economic one or even a trade agreement. The key commitments are therefore political commitments – the point being that the deal as it stands has no legal basis as of yet. The outline confirms a work toward a quota-based deal on trade in steel, aluminium and copper in order to protect both the US and EU markets from overcapacity. But there remains no timeline on this being implemented. The 3-year purchase of LNG, oil and nuclear energy products worth USD 750bn is confirmed and the commitment to make a further USD 600bn worth of investments will be done over a period to 2029.

The final paragraph is important with the EU stating that the political agreement is not legally binding and that beyond the immediate actions committed, the EU and the US “will further negotiate, in line with their relevant internal procedures, to fully implement the political agreement”.

So, it’s clear from this deal and the lack of detail in parts of the US-Japan deal that ongoing negotiations are likely which may well include renewed threats in the future over tariff rates. We also have the oral legal hearings tomorrow in relation to the legality of using the IEEPA by describing trade deficits as a national emergency. For now, the markets are relieved that deals are being done, but in time investors may well question the extent and longevity of some of these deals.

U.S. IMPORT VOLUMES (2022-2025)

Source: Penn Wharton Budget Model, USITC Calculations

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

09:00 |

German GDP (YoY) |

Q2 |

0.2% |

0.0% |

!! |

|

GE |

09:00 |

German GDP (QoQ) |

Q2 |

-0.1% |

0.4% |

!!! |

|

EC |

10:00 |

Consumer Confidence |

Jul |

-14.7 |

-15.3 |

! |

|

EC |

10:00 |

GDP (QoQ) |

Q2 |

0.0% |

0.6% |

!! |

|

EC |

10:00 |

GDP (YoY) |

Q2 |

1.2% |

1.5% |

!! |

|

EC |

10:00 |

Industrial Sentiment |

Jul |

-11.2 |

-12.0 |

! |

|

US |

13:15 |

ADP Nonfarm Employment Change |

Jul |

77K |

-33K |

!!! |

|

US |

13:30 |

Core PCE Prices |

Q2 |

2.40% |

3.50% |

!! |

|

US |

13:30 |

GDP (QoQ) |

Q2 |

2.5% |

-0.5% |

!!! |

|

US |

13:30 |

GDP Price Index (QoQ) |

Q2 |

2.2% |

3.8% |

!! |

|

US |

13:30 |

Real Consumer Spending |

Q2 |

-- |

0.5% |

! |

|

CA |

14:45 |

BoC Monetary Policy Report |

-- |

-- |

-- |

!! |

|

CA |

14:45 |

BoC Rate Statement |

-- |

-- |

-- |

!! |

|

CA |

14:45 |

BoC Interest Rate Decision |

-- |

2.75% |

2.75% |

!!! |

|

US |

15:00 |

Pending Home Sales (MoM) |

Jun |

0.2% |

1.8% |

!! |

|

CA |

15:30 |

BOC Press Conference |

-- |

-- |

-- |

!! |

|

US |

19:00 |

FOMC Statement |

-- |

-- |

-- |

!!! |

|

US |

19:00 |

Fed Interest Rate Decision |

-- |

4.50% |

4.50% |

!!! |

|

US |

19:30 |

FOMC Press Conference |

-- |

-- |

-- |

!!! |

Source: Bloomberg & Investing.com