Fragile US sentiment underlines risks of renewed volatility

USD: Trump defends policies as consumer confidence falls again

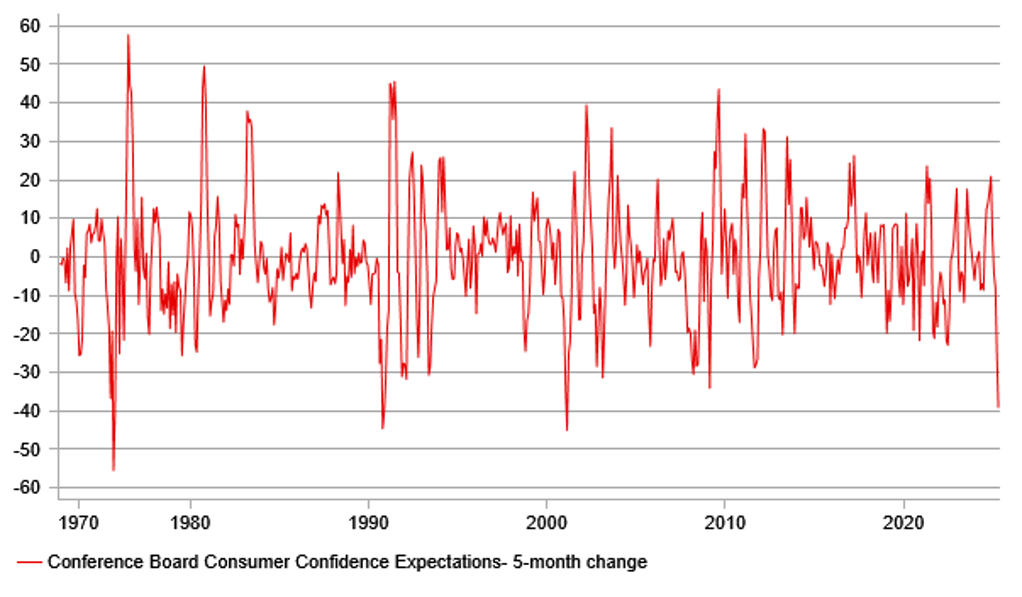

The FX markets are relatively calm this morning but US Treasury yields continue to decline with investors’ concerns over the impact of Trump’s tariffs on the real economy building. The 2-year UST note yield fell back to levels seen during the initial turmoil following the reciprocal tariff announcement. The 2-year yield has now declined 20bps in five trading days. President Trump speaking in Michigan to mark 100 days in office renewed his criticism of Fed Chair Powell and again praised his tariff plans as the road to a better economy. That doesn’t appear to be the views of US consumers with data again showing the negative impact of the uncertainty created by the tariff announcements. The Conference Board consumer expectations index plunged again to a level last seen in 2011 in the aftermath of the financial market turmoil following the debt ceiling crisis and the downgrade of the US’ sovereign rating. The index increased in November in response to Trump’s election victory but has since then plunged by nearly 40pts – that’s the largest drop in that period (5mths) since February 2001 just as the US was falling into recession. Consumers expecting there to be fewer jobs available in 6mths time surged to the highest level since April 2009 during the worst period of the Global Financial Crisis. The JOLTS job openings data also pointed to softer demand ahead. There is compelling evidence now that the US labour market is set to deteriorate although whether that will be evident as soon as in the NFP data for April to be released on Friday is less clear. Data released in China also highlights the negative impact of trade uncertainty. The PMI Manufacturing index fell from 50.5 to 49.0, the largest drop since April 2023.

Given the incoming economic data and the likelihood that policy uncertainty will remain elevated, the resilience of the equity market is surprising and in that context the earnings reports this week will be important. Four of the Magnificent Seven are reporting this week – Microsoft, Apple, Meta and Amazon. US equity futures are lower in response to poor results from Super Micro Computer Inc. that could be a sign of disappointment ahead. Certainly, the price action in equities indicates recession is not anticipated and if the data points in that direction, which we believe is likely, then equities are unlikely to hold these levels. Renewed risk-off in equities combined with falling front-end yields as Fed rate cuts become more likely will only reinforce the downside momentum for the dollar against core G10 – the Swiss franc, yen and euro are likely to be the favoured currencies in such a scenario.

LARGEST DROP IN CONSUMER EXPECTATIONS OVER 5MTHS SINCE 2001

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Strong expectations of yen gains ahead as BoJ meets

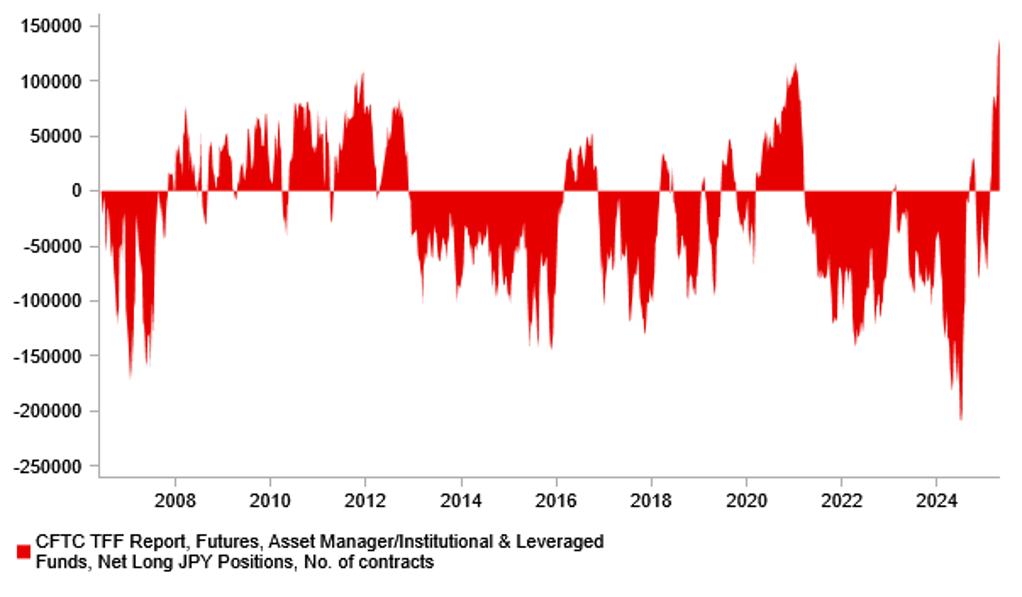

The USD/JPY rate is close to retracing 50% of the 2022-24 global inflation shock-related surge higher when USD/JPY advanced from around 115.00 through to the highs above 160.00. Throughout that period, as can be seen in the chart, the CFTC measure of positioning amongst Leveraged Funds and Institutional Investors combined showed a persistent and at one stage a record short yen position. We have since then seen a dramatic swing the other way and that same measure is now showing a record long yen position. The Leveraged Funds position alone is showing the largest long yen position since 2019. This is a good illustration of the now very strong conviction of continued yen appreciation ahead.

While we agree with the medium-term direction, there are always periods in which we see a move against this conviction and the BoJ shifting its stance or guidance coupled with say some further easing of trade tariff fears (perhaps triggered by bilateral trade deals with countries like Japan) would be an example of when you could get some potential renewed USD/JPY buying. While we expect BoJ Governor Ueda to maintain the overall guidance that further rate hikes are likely if the BoJ’s economic forecasts are realised, there is always a risk of a shift in tone or emphasis and some sign of an injection of caution given the uncertainties would be understandable and not a surprise. Given the positioning in the markets shown in the CFTC data there is then a risk of some liquidation of yen long positions that could reinforce yen declines.

But the bigger medium-term picture remains USD/JPY moving lower. Our sense going forward from here is that BoJ policy deliberations will become less of an influence in USD/JPY direction with US economic conditions, recession risks and falling US yields likely taking precedence. If US recession risks increase, which we expect, then US equities will have further to fall and falling yields and equities have always resulted in a drop in USD/JPY. When you consider how elevated US dollar valuations are at the moment, it makes a continued decline in USD/JPY all the more likely. So we would expect any bounce in USD/JPY to be pretty shallow and short-lived in current financial market conditions. The plunge in the US Consumer Confidence Expectations component in the data release yesterday is further compelling evidence of the damage being done by Trump’s trade policies.

CFTC LEVERAGED FUNDS AND INSTITUTIONAL INVESTOR JPY POSITIONING REACHES A RECORD HIGH IN DATA BACK TO 2006

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

08:55 |

German Unemployment Change |

Apr |

16K |

26K |

!! |

|

GE |

08:55 |

German Unemployment Rate |

Apr |

6.3% |

6.3% |

!! |

|

IT |

09:00 |

Italian GDP (QoQ) |

Q1 |

0.2% |

0.1% |

! |

|

GE |

09:00 |

German GDP (QoQ) |

Q1 |

0.2% |

-0.2% |

!!! |

|

GE |

09:00 |

German GDP (YoY) |

Q1 |

-0.2% |

-0.2% |

!! |

|

IT |

10:00 |

Italian CPI (MoM) |

Apr |

0.2% |

0.3% |

! |

|

IT |

10:00 |

Italian CPI (YoY) |

Apr |

2.0% |

1.9% |

! |

|

EC |

10:00 |

GDP (QoQ) |

Q1 |

0.2% |

0.2% |

!! |

|

EC |

10:00 |

GDP (YoY) |

Q1 |

1.0% |

1.2% |

!! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

-12.7% |

! |

|

GE |

13:00 |

German HICP (MoM) |

Apr |

0.4% |

0.4% |

!!! |

|

GE |

13:00 |

German HICP (YoY) |

Apr |

2.1% |

2.3% |

! |

|

US |

13:15 |

ADP Nonfarm Employment Change |

Apr |

123K |

155K |

!!!! |

|

US |

13:30 |

Employment Benefits (QoQ) |

Q1 |

-- |

0.80% |

!! |

|

US |

13:30 |

Employment Cost Index (QoQ) |

Q1 |

0.9% |

0.9% |

!!! |

|

US |

13:30 |

Employment Wages (QoQ) |

Q1 |

-- |

0.90% |

! |

|

US |

13:30 |

GDP (QoQ) |

Q1 |

0.4% |

2.4% |

!!!! |

|

US |

13:30 |

GDP Price Index (QoQ) |

Q1 |

3.0% |

2.3% |

!! |

|

CA |

13:30 |

GDP (MoM) |

Feb |

0.0% |

0.4% |

!! |

|

US |

14:45 |

Chicago PMI |

Apr |

45.9 |

47.6 |

!! |

|

US |

15:00 |

Core PCE Price Index (MoM) |

Mar |

0.1% |

0.4% |

!!! |

|

US |

15:00 |

Core PCE Price Index (YoY) |

Mar |

2.6% |

2.8% |

!!! |

|

US |

15:00 |

PCE price index (MoM) |

Mar |

0.0% |

0.3% |

!! |

|

US |

15:00 |

PCE Price index (YoY) |

Mar |

2.2% |

2.5% |

!! |

|

US |

15:00 |

Pending Home Sales (MoM) |

Mar |

0.9% |

2.0% |

!! |

|

US |

15:00 |

Pending Home Sales Index |

Mar |

-- |

72.0 |

! |

|

US |

15:00 |

Personal Spending (MoM) |

Mar |

0.6% |

0.4% |

!! |

Source: Bloomberg