No quick fix to reverse yen weakening trend

JPY: The yen quickly gives back gains after intervention

The yen has weakened overnight giving back some of yesterday’s sharp gains. It has resulted in USD/JPY rising back up to the 157.00-level during the Asian trading session as it moves further above yesterday’s low of 154.54. As we highlighted yesterday the price action appears similar to from the autumn of 2022 when Japan last intervened. Japanese officials have not yet confirmed that they intervened yesterday but various press reports including the Dow Jones Newswires and the FT have indicated that they did intervene yesterday to support the yen according to “people familiar with the matter”. The FT went further and reported that the size of intervention was likely about USD20 billion to USD35 billion of yen purchases. While the official data on intervention operations will not be released until the end of May, market participants will be closely scrutinizing the release today of the BoJ’s forecasts for its current account balance on 1st May in attempt to assess the likely size of intervention. A figure between USD20 billion and USD35 as reported by the FT would be in the same ballpark in terms of size to intervention undertaken on 22nd September 2022 when Japan purchased around USD20 billion and intervention on 21st October 2022 when Japan purchased around USD38 billion. Less liquid market conditions during the Golden Week holidays might mean that Japan was able to get more bang for its buck in weakening the yen through less intervention although that remains to be seen. The size of the move lower in USD/JPY was similar to on 22nd September and 21st October when it fell by around 5 big figures from intra-day highs. The fact the USD/JPY has already quickly reversed just over 40% of yesterday’s move lower highlights that Japan will find it challenging to prevent the yen from weakening further in the current market environment. It will keep pressure on Japan to intervene on multiple occasions in the coming months if they are attempting to buy time until fundamentals move more in line with lower USD/JPY. The pushing back of Fed rate cut expectations until the end of this year and optimism over softer landing for the US economy are making it difficult to swim against the tide in favour of a higher USD/JPY.

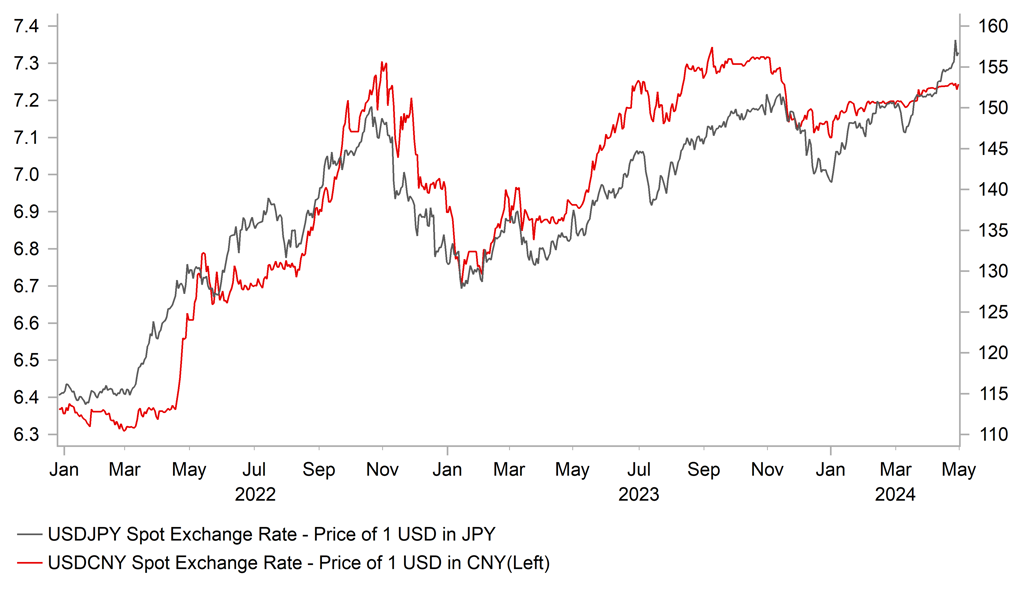

Yen weakness is also encouraging speculation that China will allow their own currency to weaken further in the near-term. The PBoC has been setting the daily fix marginally higher since the middle of this month which is allowing USD/CNY to continue moving gradually higher as it has recently moved up against the top of the daily +/- 2% trading band which is currently set at 7.2480. We still believe that domestic policymakers are more likely to tolerate a gradual move higher in USD/CNY back up towards last year’s highs at just above the 7.3000-level rather than allow an even bigger one-off devaluation for the renminbi. A weaker renminbi has been encouraged overnight by the release of softer PMI surveys from China which casts further doubt on the health of China’s economy. While economic growth picked up in Q1, the weaker than expected PMI surveys for April signal that China’s economy has lost upward momentum at the start of Q2. The deterioration in business confidence was most evident in the non-manufacturing sector.

SPECULATIVE YEN SHORTS HAD REACHED MULTI-YEAR HIGHS

Source: Bloomberg, Macrobond & MUFG GMR

EM FX: Macro backdrop remains challenging for emerging market currencies

Emerging market currencies have rebounded modestly over the past week resulting in a partial reversal of the losses sustained earlier this month. The best performing emerging market currencies since the start of last week have been the ZAR (+2.7% vs. USD), COP (+1.3%), CLP (+1.3%) and HUF (+1.1%). In contrast, the PEN (-0.9%), ARS (-0.5%), IDR(-0.3%), KRW (-0.2%) PHP (-0.2%) and INR (-0.2%) have weakened further against the USD. Emerging market currencies have rebounded over the past week even as US yields have continued to adjust higher indicating that the USD has lost some upward momentum ahead of the upcoming FOMC meeting. The Fed is expected to deliver a hawkish policy update in the week ahead. We expect Fed Chair Powell to reiterate that the recent run of stronger US activity and inflation data will delay their plans to begin lowering rates into the 2H of this year. However, he is unlikely to completely drop plans for rate cuts. The US rate market has already pushed out the timing of the first rate cut until the end of this year in November or December which should help limit upside risks for the USD. At the same time, the Fed is expected to unveil plans to slowdown the pace of QT. The monthly roll off pace of UST holdings is likely to be cut in half. For emerging market currencies to extend their rebound, it will require evidence of much weaker US labour market conditions in April when the latest NFP report is released on Friday.

Within EMEA EM FX, the Central European currencies of the CZK and HUF have outperformed over the past week. It has resulted in EUR/CZK testing the bottom of the recent trading range between 25.000 and 25.500. The CZK has derived support in recent months from the scaling back of CNB rate cut expectations. The yield on the Czech 9X12 month FRA has risen by almost 100bps since last month’s low. The CNB is still expected to cut rates by a further 50bps in the week ahead lowering the policy rate to 5.25%, but market participants will be watching closely for any signs of a slowdown in the pace of rate cuts that would offer more support for the CZK. In addition, the CEE-3 currencies have been deriving support as well from evidence of improving cyclical momentum in Europe at the start of this year as the negative energy price shock continues to fade. We expect the release of the latest Czech and Hungarian GDP reports for Q1 in the week ahead to provide further confirmation of improving cyclical momentum. In contrast, Asian currencies continue to underperform undermined in part by heightened concerns over the risk of bigger devaluations for the JPY and CNY in the near-term. Please see our latest EM EMA Weekly for more details (click here).

WEAKER YEN POINTING TO FURTHER CNY WEAKNESS?

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SZ |

08:00 |

KOF Leading Indicators |

Apr |

102.1 |

101.5 |

!! |

|

GE |

08:55 |

German Unemployment Change |

Apr |

7K |

4K |

!! |

|

IT |

09:00 |

Italian GDP (QoQ) |

Q1 |

0.1% |

0.2% |

! |

|

GE |

09:00 |

German GDP (QoQ) |

Q1 |

0.1% |

-0.3% |

!!! |

|

UK |

09:30 |

M3 Money Supply |

Mar |

-- |

3,011.7B |

! |

|

EC |

10:00 |

Core CPI (YoY) |

Apr |

2.6% |

2.9% |

!! |

|

EC |

10:00 |

CPI (YoY) |

Apr |

2.4% |

2.4% |

!!! |

|

US |

13:30 |

Employment Cost Index (QoQ) |

Q1 |

1.0% |

0.9% |

!! |

|

CA |

13:30 |

GDP (MoM) |

Feb |

0.3% |

0.6% |

!! |

|

NZ |

23:45 |

Employment Change (QoQ) |

Q1 |

0.3% |

0.4% |

! |

Source: Bloomberg