An important week ahead for the USD & JPY

JPY: Japanese politics in focus ahead of LDP leadership election

The yen has strengthened during the Asian trading session after failing to break back above the 150.00-level at the end of last week. The main event risk from Japan in the week ahead will be the LDP leadership election that is scheduled to take place on Saturday 4th October. With less than a week to go before the election, the latest opinion polls have revealed that support amongst LDP supporters is split between Shinjiro Koizumi and Sanae Takaichi although none of the five candidates appears likely to win an outright majority that would then require a run-off election between the two leading candidates. The latest opinion poll from Kyodo News revealed that Takaichi has taken a 34% to 31% lead over Koizumi amongst eligible, fee-paying LDP party members. In contrast, the latest opinion poll from the Yomiuri newspaper revealed that Koizumi has a clearer lead over Takaichi by 41% to 28%. The mixed results suggests that support amongst LDP supporters for Sanae Takaichi maybe increasing ahead of the election although Shinjiro Koizumi has consistently lead in most opinion polls.

At the same time, the Kyodo News poll revealed that Shinjiro Koizumi has so far secured the most support amongst LDP Diet members. The poll revealed that Koizumi has the backing of over 80 LDP Diet members which is more than double the support for Takaichi of around 40 Diet members. Chief Cabinet Secretary Yoshimasa Hayashi has the second strongest support amongst LDP Diet members having secured the backing of about 60. However, there still appears a lot of votes up for grabs. Overall, the opinion poll results still support our view that Shinjiro Koizumi remains the favourite to be elected the next leader of the LDP and likely Prime Minister of Japan. If there is a second round vote, the votes of LDP Diet members will become relatively more important as they will account for 295 ballots compared to 47 ballots for regional branches of the party. Still, downside risks for the yen from Sanae Takaichi winning the leadership election can’t be ruled out at the current juncture but she would have to secure more support from Diet members when votes are transferred to the remaining candidates in the second round run-off.

Our forecast for the BoJ to resume rate hikes as soon as the October policy meeting is based on the view that Shinjiro Koizumi wins the leadership election. The reduction in political uncertainty should give the BoJ more confidence to resume rate hikes. The BoJ will also be watching closely to see how Japan’s economy is holding up to higher tariffs. The release this week of the latest Tankan survey for Q3 will attract even more market attention than normal to assess if conditions are falling into place for the BoJ to tighten policy. Market expectations for a BoJ rate hike as soon as next month have been encouraged by comments overnight from BoJ board member Noguchi who stated that steady progress is being made toward the BoJ’s inflation target and “this suggests that the need to adjust the policy interest rate is increasing more than ever”.

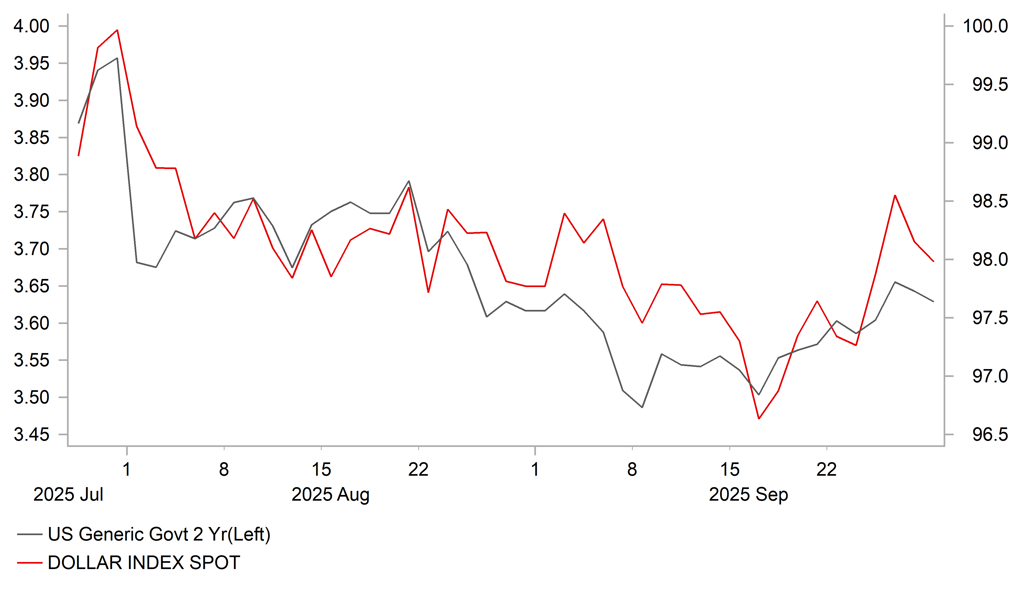

TIGHT CORRELATION BETWEEN USD & SHORT-TERM US RATES

Source: Bloomberg, Macrobond & MUFG GMR

USD: Recent rebound falters ahead of US shutdown risk & NFP report

The US dollar has also weakened more broadly at the start of this week resulting in the dollar index falling back below the 98.000-level. The release of the latest nonfarm payrolls report for September at the end of the week will be important in determining whether the US dollar’s recent rebound will extend further in the near-term. The dollar index had strengthened by almost 2.5% at the highest point last week from the low recorded just after the latest FOMC policy update. The US dollar has benefitted from the scaling back of Fed rate cut expectations which has lifted the 2-year US Treasury bond yield by almost 20bps. The release last week of the significant upward revision to services consumption alongside evidence of record tech investment in the 1H of the year has helped to ease concerns over the risk of sharper slowdown for the US economy. Please see our latest FX Weekly for more details (click here).

The upward revision to US growth in Q2 widened the divergence with the performance of the US labour which has been much weaker. Employment growth slowed sharply to an average of 55k/month in Q2 and was even briefly negative (-13k) in June. The weakness in the US labour market was the main reason the Fed resumed rate cuts this month when Fed Chair Powell stated clearly they took a risk management approach to guard against the risk of further weakness ahead. If employment growth continues to remain weak in September then it will support market expectations for the Fed to cut rates again as soon as next month. The US rate market is still pricing in high probability of a cut next month (~22bps). Headwinds to hiring from trade disruption, heightened policy uncertainty and tighter immigration remain considerable. The US government is also facing the risk of another shutdown on 1st October adding to near-term economic uncertainty. On the other hand if employment growth picks up helping to close the divergence with stronger economic growth, then it could trigger a bigger hawkish repricing of Fed rate cut expectations and extend the US dollar’s recent rebound. Our forecast for the US dollar to weaken further heading into year end are built on the assumption the Fed will deliver two further 25bps cuts by the end of this year as the labour market remains weak.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:30 |

M3 Money Supply |

Aug |

-- |

3,146.6B |

! |

|

EC |

10:00 |

Business Climate |

Sep |

-- |

-0.72 |

! |

|

EC |

10:00 |

Consumer Confidence |

Sep |

-14.9 |

-14.9 |

! |

|

EC |

10:00 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

!! |

|

US |

12:30 |

Fed Waller Speaks |

-- |

-- |

-- |

!! |

|

UK |

13:00 |

MPC Member Ramsden Speaks |

-- |

-- |

-- |

!! |

|

EC |

13:00 |

ECB's Lane Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

Pending Home Sales (MoM) |

Aug |

0.2% |

-0.4% |

!! |

|

US |

18:30 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!! |

|

US |

23:00 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg & Investing.com