US yields take US dollar lower still as Fed official talks cuts

USD: 2-year yield drops sharply but on what exactly?

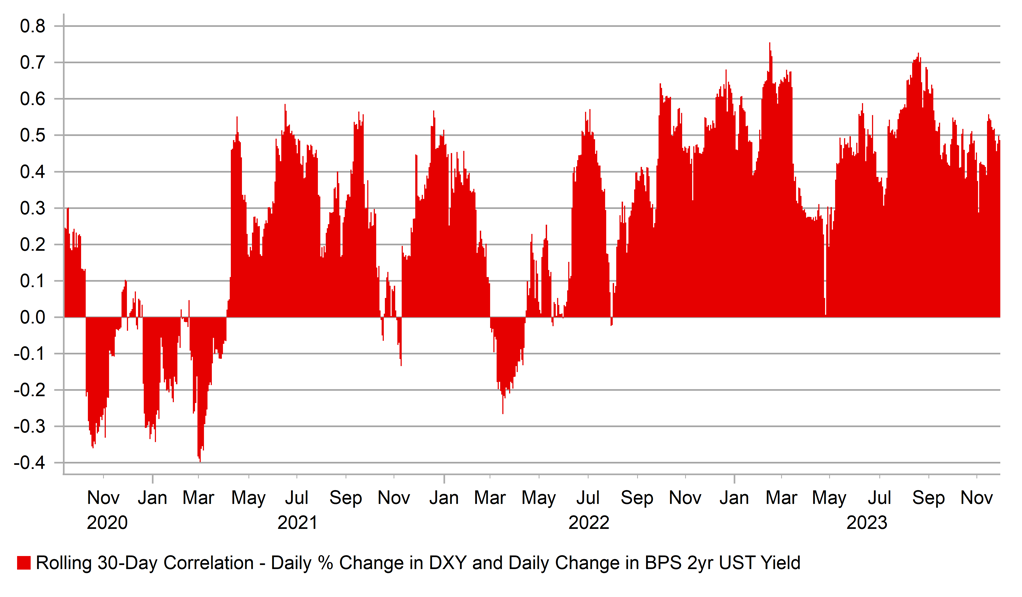

The US dollar has taken another lurch lower and the DXY index is approaching a 4% drop on a month-to-date basis which if sustained will be the worst monthly dollar performance since November last year. We argued in our FX Weekly last Friday that the scale of the move could start to peter out given the conditions outside of the US are not exactly conducive to currency appreciation but the momentum remains firmly in place fuelled now by a sharp drop in short-term yields in the US. Is this the start of a more sustained bull-steepening of the US yield curve? If so it would signal plenty of more dollar selling to come. But what prompted this yield move yesterday?

The point in which the 2-year UST bond yield dropped most sharply came after a speech by Fed Governor Waller and just before comments hit the wires from Fed Governor Bowman. The comments from Governor Bowman were as you’d expect – she is the most hawkish governor at the Fed and repeated her view that she believes further hikes will be needed. Governor Waller’s comments were more interesting – in particular in Q&A after his speech and around the time of the plunge in the 2-year UST bond yield in which he was willing to discuss the scenario of rate cuts. Waller is also deemed more on the hawkish side of the FOMC. This can certainly be viewed as one step in the process of the Fed moving toward lowering rates. Until now, the standard rhetoric has been that it is too soon to even discuss rate cuts and that the only focus was repeating the “higher for longer” mantra.

But in response to a question Waller stated that “if you see this (lower) inflation continuing for several more months, I don’t know how long that might be – say 3mths, 4mths, 5mths – you could then start lowering the policy rate because inflation is lower”. He added that “if inflation goes down, you would lower the policy rate. There’s no reason to say you would keep it high if inflation’s back at target, for example”.

In a way, there’s nothing too ground-breaking in these comments but it Waller’s willingness to discuss a scenario that is key. Although mentioning “3mths” in the scenario will likely encourage some to consider a sooner than previously through start to rate cuts and this was certainly the key catalyst to the short-end move in rates.

5bps of cuts has now been added to the OIS curve for the March FOMC meeting, taking the probability to over 30% and with 100bps of cuts now priced for next year. While inflation could continue to fall (tomorrow’s PCE is likely to decline further) we will likely see further easing priced but it is hard to see this extend much further on inflation data alone. Hard activity data will need to weaken for rate cut pricing to extend much further from here. Our bias in FX to take advantage of this shift in rates is short USD/JPY, our current trade idea in our FX Weekly. Yesterday’s close was the lowest since September and positioning has remained stubbornly short and this move lower could extend further from here as these positions start to get liquidated.

DXY & 2YR WEIGHTED SPREAD CORRELATION REMAINS ROBUST

Source: Macrobond

NZD: Hawkish RBNZ adds to USD selling

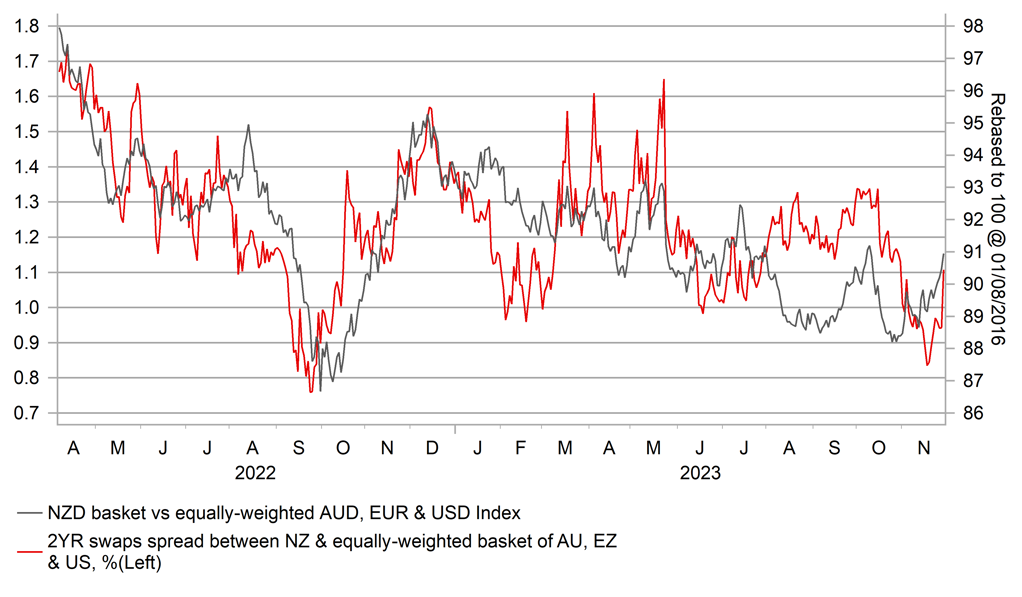

The US dollar in Asia trading today was hit with another reason for selling after a more hawkish than expected RBNZ monetary policy announcement. The announcement of an unchanged policy rate of 5.50% was accompanied by updated forecasts and projections for the official policy rate. The peak for the Official Cash Rate was nudged a little higher from 5.59% to 5.69% and the forecast for the OCR in 2026 showed the RBNZ now expected to cut by 50bps less by that stage.

Throughout all of next year the RBNZ expects the OCR to remain between 5.60%-5.70% which we believe is highly unlikely. The RBNZ revised away a technical recession and now assumes the first rate cut would come in Q2 2025 rather than in Q1. Governor Orr today stated that the RBNZ was “nervous” that inflation has been outside its 1.0%-3.0% target range since early 2021 and was moving lower too slowly. He also cited rising inflation expectations although that’s hard to argue with any conviction. The 10-year breakeven rate currently sits at 2.30%, which is 7bps below the average over the last 12mths and down from a peak of close to 2.50% at the start of this month. Inflation in Q3 fell from 6.0% to 5.6%, below the consensus of 5.9%. We suspect the level of hawkishness communicated today by the RBNZ is somewhat excessive and unlikely to be sustained in an environment of further declines in inflation on a global basis.

Like elsewhere market participants had begun to believe with more conviction that the RBNZ was done and that the next change from the RBNZ would be a cut. We still believe that’s still the most likely scenario but the bias remains firmly to hike again with the RBNZ clearly still concerned over inflation risks. The 10-year swap rate today jumped 10bps but is still down close to 40bps since the start of November. The surprise tone from today’s RBNZ meeting leaves short NZD positioning vulnerable. Leveraged Funds have recently increased short NZD positions. As of last Friday, a short NZD position was maintained for the second consecutive week, and was the largest in eight weeks. Given the current poor USD sentiment, the RBNZ’s hawkish stance could see NZD advance further from here although NZD was already the 2nd best performing G10 currency this month before today’s gain.

EQUALLY-WEIGHTED FX BASKET NZ VS US; EZ & AU & 2YR SPREAD

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

09:00 |

Regional CPIs |

Nov |

!! |

||

|

IT |

09:00 |

Consumer Confidence |

Nov |

102.0 |

101.6 |

! |

|

IT |

09:00 |

Manufacturing Confidence |

Nov |

95.9 |

96.0 |

! |

|

UK |

09:30 |

Net Consumer Credit |

Oct |

£1.5bn |

£1.4bn |

! |

|

UK |

09:30 |

Mortgage Approvals |

Oct |

45.3k |

43.3k |

!!! |

|

UK |

09:30 |

M4 Money Supply MoM |

Oct |

-1.1% |

! |

|

|

EC |

10:00 |

OECD publishes Economic Outlook |

! |

|||

|

EC |

10:00 |

Economic Confidence |

Nov |

93.6 |

93.3 |

!! |

|

EC |

10:00 |

Services Confidence |

Nov |

4.5 |

4.5 |

!! |

|

GE |

13:00 |

CPI EU Harmonised MoM |

Nov P |

-0.5% |

-0.2% |

!!! |

|

GE |

13:00 |

CPI EU Harmonised YoY |

Nov P |

2.5% |

3.0% |

!!! |

|

US |

13:30 |

Advance Goods Trade Balance |

Oct |

-$86.5bn |

-$86.8bn |

!! |

|

US |

13:30 |

Real GDP Q/Q |

Q3 S |

5.0% |

4.9% |

!! |

|

US |

13:30 |

Core PCE Price Index Q/Q |

Q3 S |

2.4% |

2.4% |

!! |

|

UK |

15:05 |

BoE's Baily speaks |

!!!! |

|||

|

UK |

15:15 |

BoE's Hauser speaks |

!! |

|||

|

US |

18:45 |

Fed's Mester speaks |

!!! |

|||

|

US |

19:00 |

Fed's Beige Book released |

!! |

Source: Bloomberg