US policy concerns ease – further dollar gains to be limited

USD: Reciprocal tariffs thrown into doubt

The US dollar has advanced further today after gains yesterday following the decision of the US Court of International Trade to rule that President Trump did not have the authority to use the emergency economic powers legislation (IEEPA) to impose his reciprocal tariffs on US trading partners. The dollar has now advanced by 1.4% in three trading days fuelled by a declined in concerns over damage done via tariffs. The S&P 500 future is trading 1.6% higher and UST bond yields are higher. The court decision also covers the 20% fentanyl tariff which was also introduced under the IEEPA but excludes the sector-specific tariffs implemented under Section 232, like the 25% tariff on steel and aluminium. The Trump administration has of course stated it intends to appeal the decision although as of now this court decision means the reciprocal tariffs “are declared to be invalid as contrary to law”. It is unclear at this stage how long an appeal would take but the fentanyl and baseline reciprocal tariffs will have to be removed within 10 days. If after the completion of the appeals process the ruling remains that the tariffs are illegal, the government would have to repay the tariffs with interest. What action is taken in the immediate future is unclear and today we may get a sense of the speed in which action can be taken to appeal and reverse the ruling but the 9th July reciprocal date and the date in August for China are obviously now in doubt. For sure though the leverage the Trump administration trade representatives have in their negotiations with trading partners has just gone down.

The news hit the wires just after midnight London time and the dollar immediately responded. Given the negativity of trade uncertainty and how that has triggered periods of widespread selling of US assets, the prospect of this threat being removed or considerably diluted justifies the market response. However, there are questions still ahead. It seems highly implausible that the Trump administration will simply accept this even if the appeal is unsuccessful. Trump could go down different avenues and avoid the IEEPA route. Other trade acts are available and while those would be difficult to use on all countries in the sweeping way the reciprocal tariffs were used, there are still options to tackle the more significant trading partners. Section 301 under the Trade Act 1974 is one avenue that could be explored and possibly Section 338 under the Tariff Act 1930. Appeal courts could well also be more sympathetic and there is nothing stopping Trump taking it all the way to the Supreme Court which would obviously take considerable time. What we can be sure of is that Trump won’t take this sitting down and is likely to push on and use other options to extract better trade deals. So this rebound of the US dollar will have its limits.

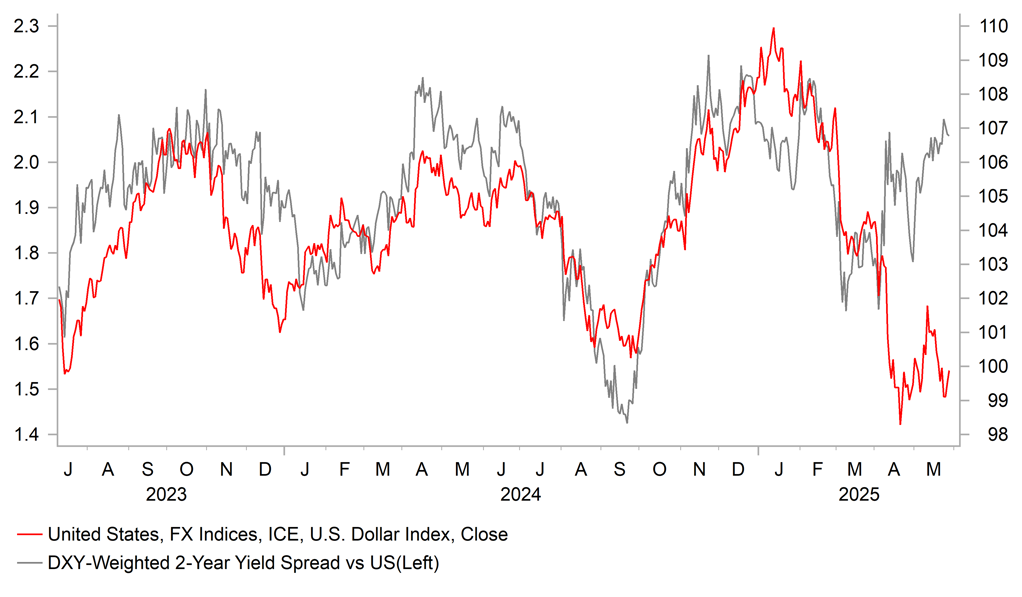

YIELD SPREAD INFLUENCE ON FX COULD SEE SOME REVIVAL

Source: Bloomberg, Macrobond & MUFG GMR

EUR: EU-US trade deal progress

The easing of trade risks due to this court decision could also mean we see some revival of the FX-rate spread correlation. US data flow has been limited but the sentiment indicators continue to point to a rebound reflecting the de-escalation of US-China trade tensions. Key jobs data will be released next week.

Yesterday, we also had reports of progress being made in relation to trade negotiations between the US and the EU. The Handelsbatt reported yesterday that BMW, Mercedes and VW were in intensive negotiations with US Commerce Secretary Howard Lutnick on a plan to lower auto tariffs based on a deal to redirect more of US production by these auto companies to domestic consumption rather than to export back into the EU. Separately, EU Trade Commissioner, Maros Sefcovic stated that he is planning to talk to Howard Lutnick and US Trade Representative Jamieson Greer today following the EU’s commitment to fast-track negotiations ahead of the 9th July deadline. The 50% tariff announcement by President Trump on Friday does appear to have intensified negotiations and does raise the prospect of some kind of deal being done. While that would be a positive we suspect such a deal would be very limited in nature given areas of contention would be unlikely to pass quickly within the EU framework. Dropping tariffs on industrial goods, opening the EU to ethanol exports from the US and other commitment to purchases could be about all that is likely. The EU’s regulatory framework in regard to health and safety standards, the protection of the agricultural sector and climate related rules leaves a lot of sectors off-limits.

Nonetheless, it doesn’t really matter how all-encompassing the deal is, if it’s good enough to avoid the reciprocal tariff rate (20 or 50%, nobody is quite sure) and takes the EU to the 10% baseline rate, then that would be good news. If a deal was to happen with the EU and then coincided with other deals, say with Japan and India, it would greatly dilute the global impact of the reciprocal tariffs going live on 9th July. This would ease concerns over damaging economic policies from Washington and ease fears over declining confidence in US assets. So we would expect the more bilateral deals done prior to the reciprocal tariff rates to be dollar positive. By that we do not mean the dollar would be set for a notable rebound but more it takes away some of the negativity associated with trade policy uncertainties.

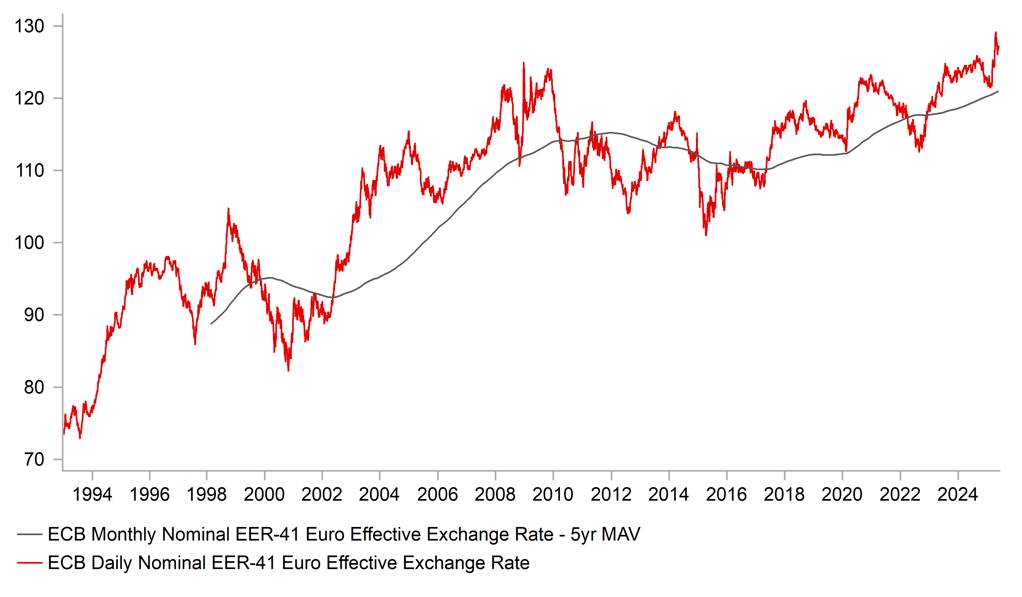

Market participants would still have to contend with the China reciprocal tariff go-live date in August, the sector-specific tariffs on pharma and semi-conductor chips being implemented, increasing fiscal concerns as Trump’s tax bill progresses and in our view a pending economic slowdown will all ensure any correction lower in EUR/USD on improved US dollar sentiment is unlikely to be sustained for long.

EUR RECENTLY HIT A NEW RECORD IN EER TERMS

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Business Confidence |

May |

86.2 |

85.7 |

! |

|

IT |

09:00 |

Italian Consumer Confidence |

May |

93.0 |

92.7 |

! |

|

UK |

10:00 |

BoE Breeden Speaks |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

229K |

227K |

!! |

|

US |

13:30 |

Continuing Jobless Claims |

-- |

1,900K |

1,903K |

! |

|

US |

13:30 |

GDP Price Index (QoQ) |

Q1 |

3.7% |

2.3% |

!!! |

|

US |

13:30 |

Core PCE Prices |

Q1 |

3.50% |

2.60% |

!!! |

|

US |

13:30 |

Corporate Profits (QoQ) |

Q1 |

5.9% |

-0.4% |

! |

|

US |

13:30 |

GDP (QoQ) |

Q1 |

-0.3% |

2.4% |

!!! |

|

US |

13:30 |

GDP Sales |

Q1 |

-2.5% |

3.3% |

! |

|

US |

13:30 |

Real Consumer Spending |

Q1 |

1.8% |

4.0% |

! |

|

US |

13:30 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

!!! |

|

CA |

13:30 |

Average Weekly Earnings (YoY) |

Mar |

-- |

5.40% |

!! |

|

CA |

13:30 |

Current Account |

Q1 |

-3.4B |

-5.0B |

! |

|

US |

15:00 |

Pending Home Sales (MoM) |

Apr |

-0.9% |

6.1% |

! |

|

US |

15:00 |

Pending Home Sales Index |

Apr |

-- |

76.5 |

! |

|

US |

15:40 |

Fed Goolsbee Speaks |

-- |

-- |

-- |

!! |

|

US |

19:00 |

FOMC Member Kugler Speaks |

-- |

-- |

-- |

!! |

|

UK |

20:00 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!! |

|

US |

21:00 |

FOMC Member Daly Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg & Investing.com