US dollar rebound marks a shift in focus to US growth

USD: Rebound underlines US growth optimism

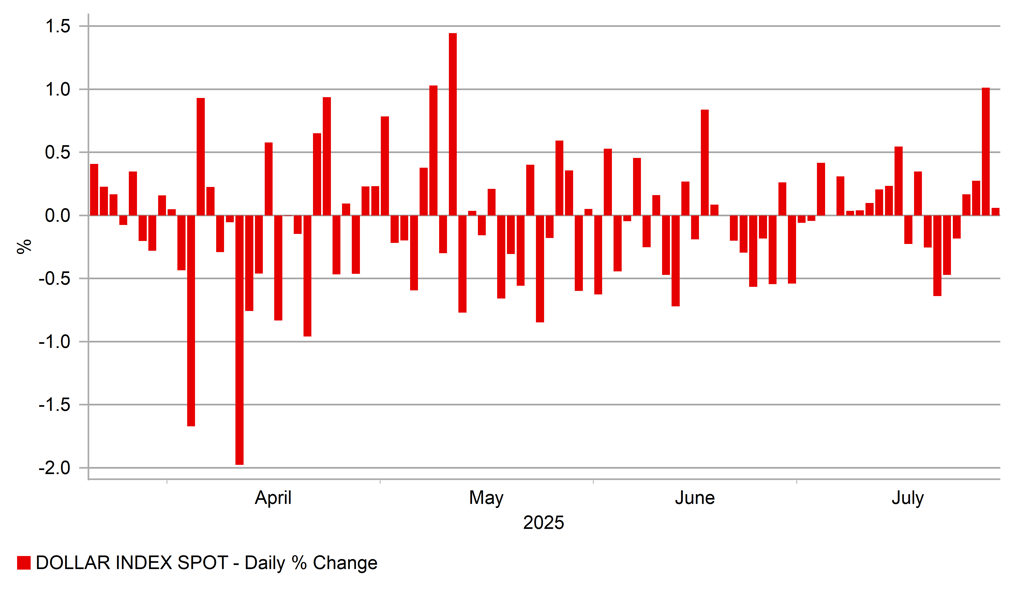

The US dollar had its biggest daily gain (1.0%) yesterday since 12th May and it is clear that for now at least the focus for FX market participants has shifted away from the trade uncertainty and on to the resilience of the US economy. This is understandable when you consider the performance of equities alone – a huge 28% gain from the closing low after the ‘Liberation Day’ sell-off. As of last Friday, according to Factset with 34% of companies having reported, the blended year-on-year earnings growth is 6.4% in Q2. At the end of Q2, the market consensus was for earnings growth of 4.9% and 80% of companies so far have reported a positive EPS surprise. Apple, Microsoft and Amazon all report earnings tomorrow and will be the key day this week for determining whether the positive momentum for equities can continue. The forward 12-month P/E ratio is rising and equities are expensive – currently at 22.4 times, above both the 5-year (19.9) and 10-year (18.4) averages. Certainly for now the so-called demise of “US exceptionalism” is not evident and that is clearly helping to prompt some short dollar position liquidation built up through the first half of the year.

This shift in focus away from trade to US growth is understandable over the short-term given the key labour market data this week and the FOMC meeting tomorrow. Trade uncertainty is unlikely to go away though and certain deals may not get done by Friday (India possibly for example) while other deals hardly have the details to class them as deals (Japan for example). So a lot can still go wrong to create renewed and more elevated uncertainty. The legal challenge to the use of the IEEPA to implement reciprocal tariffs also lies ahead. The Court of Appeals for the Federal Circuit will hear oral arguments on this on Thursday. The legality of the tariff approach will place in question the revenue stream for the government that has recently helped alleviate investor concerns over the financing of the ‘ One Big Beautiful Bill’ and the debt outlook.

For now the focus will be on the data and strong labour market data this week (JOLTS today) and an FOMC press conference that sees Fed Chair Powell remain cautious over the prospect of rate cuts will certainly help sustain the positive momentum for the dollar. But the outlook for the jobs market will remain mixed whatever the data this week. The Supreme Court this month ruled in favour of Trump’s job cutting plans and the Department of Health and Human Services is pushing ahead now with the termination of employment for 10,000 workers. Other government departments that held back will also commence with firing plans. But these developments won’t impact the data this week and based on the initial claims data there is no evidence of any imminent downturn of the labour market. The dollar strength so far looks to be positioning on easing trade uncertainties but a cautious Fed and solid labour market data this week could see the move extend – a break below 1.1500 in EUR/USD would suggest the move could prove more extensive.

DXY HAS BIGGEST DAILY GAIN SINCE MAY

Source: Bloomberg, Macrobond & MUFG GMR

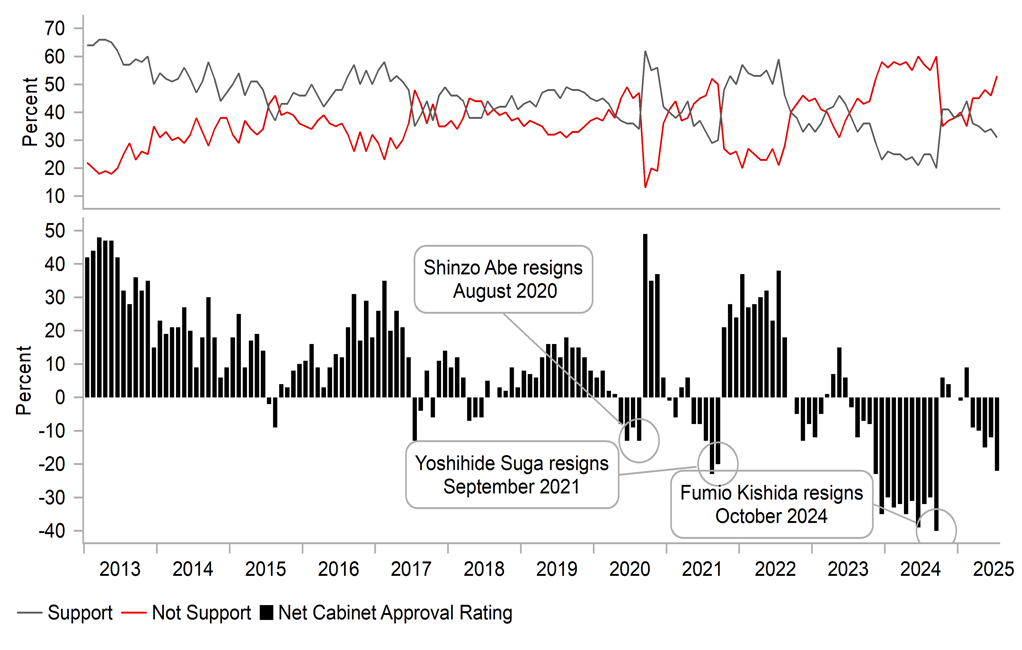

JPY: Political risks will linger going forward

The uncertainty over a way forward for the LDP-New Koneito ruling coalition could well persist for now and there remains pressure on PM Ishiba to step down although he appears to be pushing back on this for now. Yesterday, the LDP held a meeting of both houses of parliament and PM Ishiba confirmed that he intended to remain in power. He stated that his cabinet had a “heavy responsibility to steadily implement the Japan-US tariff negotiation agreement”. Secretary General Hiroshi Moriyama suggested resignations were possible and a party executive committee meeting was held to discuss calling a general meeting of both houses of parliament. That was confirmed and a joint plenary meeting of LDP members of both houses will be held in the coming days. This will inevitably intensify speculation that PM Ishiba could soon be forced to step down. Kyodo News reported that one of the participants stated that “more than half” of those that attended yesterday’s meeting called for PM Ishiba to resign. Even after this meeting that went on for far longer than usual according to Kyodo News, PM Ishiba reiterated that he intended to remain in position to implement the trade deal.

That could be one of the issues for PM Ishiba. The deal has caused a backlash in Japan with growing accusations that the deal if implemented as stated by the US would encroach on Japan’s sovereignty. As of yet there remains limited details over how the investment fund would operate – other than chief trade negotiator Akazawa stating it would be financed with just 1% to 2% of capital with the remainder leveraged up via loans and guarantees.

The backdrop could well increase market participants’ conviction for selling the yen. It’s a big week for the financial markets and in particular for the outlook for USD/JPY given the FOMC tomorrow, the BoJ meeting on Thursday and the US jobs report on Friday. It was a year ago at the same BoJ meeting that triggered a plunge in USD/JPY and the Topix Index but we certainly won’t get a rate hike this week like back then. The political landscape is contributing to ongoing uncertainty that could see the BoJ emphasise near-term downside risks to growth and inflation. The fact that the US-Japan trade deal is so unclear may well mean the initial positive interpretation of the deal by Deputy Governor Uchida last Wednesday is toned down by Governor Ueda in his press conference on Thursday. A divergence in tone from Ueda this week relative to Uchida last week, who was perceived as being hawkish, could certainty be a catalyst for further yen selling over the near-term.

CURRENT CABINET APPROVAL RATING HAS PM ISHIBA IN THE DANGER ZONE BASED ON PREVIOUS RECENT RESIGNATIONS

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

ECB 3-Year CPI Expectations |

Jun |

2.40% |

2.40% |

!! |

|

EC |

09:00 |

ECB 1-Year CPI Expectations |

Jun |

2.80% |

2.40% |

!! |

|

UK |

09:30 |

BoE Consumer Credit |

Jun |

1.200B |

0.859B |

! |

|

UK |

09:30 |

M4 Money Supply (MoM) |

Jun |

0.3% |

0.2% |

! |

|

UK |

09:30 |

Mortgage Approvals |

Jun |

63.00K |

63.03K |

! |

|

US |

13:30 |

Goods Trade Balance |

Jun |

-98.30B |

-96.59B |

!! |

|

US |

13:30 |

Wholesale Inventories (MoM) |

Jun |

-0.1% |

-0.3% |

! |

|

US |

14:00 |

S&P/CS HPI Composite - 20 (YoY) |

May |

2.9% |

3.4% |

! |

|

US |

15:00 |

CB Consumer Confidence |

Jul |

95.9 |

93.0 |

!!! |

|

US |

15:00 |

JOLTS Job Openings |

Jun |

7.490M |

7.769M |

!!!! |

|

US |

16:30 |

Atlanta Fed GDPNow |

Q2 |

2.4% |

2.4% |

! |

|

US |

17:00 |

7-Year Note Auction |

-- |

-- |

4.022% |

!!! |

Source: Bloomberg & Investing.com