Fed policy update is likely to prove pivotal for USD direction

USD: Will the Fed give the green light for a March rate cut?

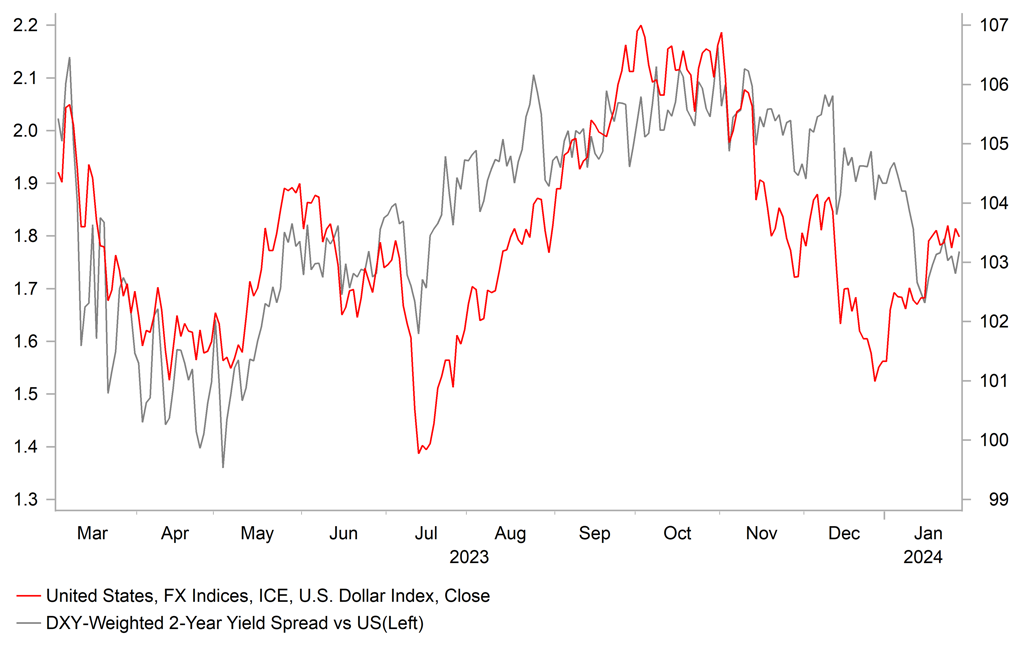

The US dollar is continuing to consolidate at higher levels ahead of this week’s FOMC meeting. The dollar index is still trading just below resistance from the 200-day moving average that comes in at around 103.50. The release on Friday of the latest PCE deflator report for December provided further confirmation that underlying inflation in the US slowed sharply in the second half of last year. The core PCE deflator slowed to an annualized rate of 1.9% over the last six months to the end of December compared to 4.0% in the six months to the end of June. The sharp slowdown in inflation has encouraged market expectations that the Fed will signal at this week’s FOMC meeting that it is moving closer to cutting rates despite the surprising strength of the US economy in the second half of last year. The release last week of the latest US GDP report for Q4 revealed that the economy expanded by robustly by an annualized rate of 4.1% in the second half of last year and by 2.5% for the year as a whole. The ongoing resilience of the US economy at the end of last year has made market participants less confident that the Fed will signal that it is planning to cut rates as soon as at the following FOMC meeting in March.

The US rate market is currently pricing in around a 50:50 probability of the first 25bps rate cut being delivered in March. With the US rate market finely balanced over the prospect of an earlier start to the Fed’s rate cut cycle, this week’s FOMC meeting could prove pivotal for US dollar performance in the near-term. Two further unknowns ahead of the FOMC meeting are the releases of the latest Employment Cost Index report for Q4 and nonfarm payrolls report for January that could impact the Fed’s updated policy guidance. Further evidence of slowing employment growth could tip the balance in favour of an earlier start to the Fed’s rate cut cycle. In our latest FX Weekly report (click here) released on Friday, we maintained our long US dollar trade recommendation against the Swiss franc but are wary of downside risks posed by this week’s FOMC meeting if the Fed gives the green light for a rate cut in March that could provide a temporary setback. Our outlook for the US dollar to rebound further at the start of this year has been supported by the resilience of the US economy, and less hawkish policy guidance provided by the ECB at last week’s policy meeting that has increased the likelihood of the ECB delivering their first rate cut as soon as in April.

Furthermore, the heightened state of geopolitical tensions in the Middle East remains supportive for the US dollar at the start of this year. The price of Brent crude oil has risen back up towards USD85/barrel overnight as it moves further above the low from December at USD72.29/barrel. The White House has stated that Iranian-backed militants killed three US service members and wounded 25 others in a drone attack near the Syrian border over the weekend. President Biden responded by warning that “we will hold all those responsible to account at a time and in a manner of our choosing”. The developments have increased investor concerns over the risk of the Middle East conflict broadening out.

OVERSOLD USD HAS REBOUNDED AT START OF THIS YEAR

Source: Macrobond & Bloomberg

GBP: Pound outperforming ahead of BoE policy update

The other major central bank update in the week ahead will be from the BoE. The pound has been the second best performing G10 currency at the start of this year after the US dollar. It has resulted in EUR/GBP falling back to last year’s lows at closer to the 0.8500-level. The pound has been supported by expectations that the BoE will be more cautious compared to the ECB and Fed when lowering rates in the year ahead. The release of the latest survey data has also signalled that domestic demand in the UK could be improving at the start of this year although the UK economy may still have fallen into a mild technical recession in the second half of last year. Ahead of this week’s BoE policy meeting, the UK rate market is currently positioned for 100bps of rate cuts this year with a 50/50 probability of the rate cutting cycle commencing in May.

As outlined in more detail in our latest FX Weekly report (click here), we expect the BoE to provide a less hawkish policy update by dropping their tightening bias. The BoE is currently committed to keeping policy “restrictive for an extended period of time” and has signalled it is willing to raise rates further if there is more evidence of persistent inflationary pressures”. If either or both of these statements are dropped it would send a dovish signal that the BoE is moving closer to cutting rates this year. A dovish policy shift will be encouraged by the slowdown in UK inflation at the end of last year. Headline inflation could now fall back towards the BoE’s target by the middle of this year. However, we still expect the BoE to sound relatively cautious by not giving a clear indication over the timing of the first rate cut at the current juncture while core and services inflation remain uncomfortably high. The BoE’s policy outlook also faces additional uncertainty from the government’s budget on 6th March. A bigger fiscal giveaway ahead of the election later this year could discourage the BoE from cutting rates as soon as in May. So long as the BoE does not provide a strong signal in favour of a May cut, we see room for EUR/GBP to fall further below the 0.8500-level.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

13:10 |

ECB's De Guindos Speaks |

-- |

-- |

-- |

!! |

|

US |

14:00 |

Dallas Fed PCE |

Dec |

-- |

1.50% |

! |

Source: Bloomberg