Trade policies & domestic politics drive USD/CAD

USD/CAD: US auto tariffs & Canadian election result in focus

The US dollar has strengthened modestly overnight against other G10 currencies as it continues to consolidate at lower levels following the heavy sell-off during this month. The US dollar has been supported in part by further reports overnight that the Trump administration is considering easing tariff plans. Bloomberg has reported that President Trump is on track to ease the impact of his auto tariffs, with changes sought by the industry that would lift some levies on foreign parts for cars and trucks made inside the US. Imported automobiles would also be given a reprieve from separate tariffs on aluminium and steel, an effort to prevent multiple levies from sacking on top of each other according to a White House official. US Commerce Secretary Howard Lutnick described the deal as “a major victory for the president’s trade policy by rewarding companies who manufacture domestically while providing runway to manufacturers who have expressed their commitment to invest in America and expand their domestic manufacturing”. A proclamation setting the changes in motion could be signed as soon as today, and comes just before the 25% tariff on foreign auto parts is set to take effect from 3rd May. Under the proposed changes, automakers would be able to secure a partial reimbursement for tariffs on imported auto parts, based on the value of their US car production. The extent of the reimbursements would decline over time with the phase out designed to incentivise automakers to shift more of the supply chain to the US while giving them time to adapt. The proposed changes follows complaints from the Us auto industry that duties on imported auto parts could raise would raise costs for US manufacturing facilities and jeopardize efforts to revitalize domestic car production.

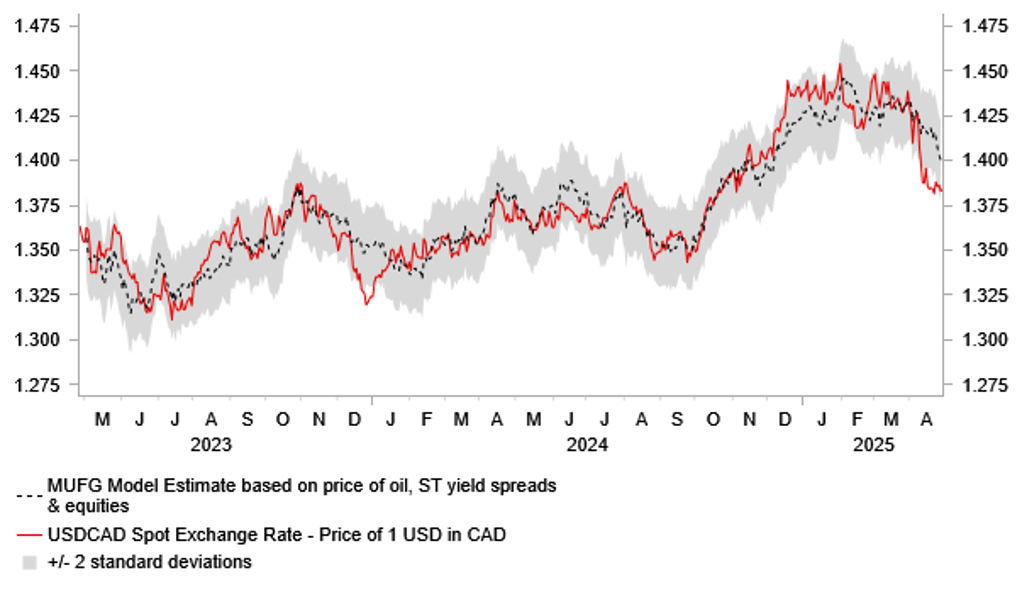

In other news overnight, it has been reported that the Liberal Party led by Mark Carney has won re-election in Canada. It concludes a sharp turn around in fortunes for the Liberal Party who were well behind in the polls when former Prime Minister Justin Trudeau resigned. Mark Carney’s handling of the trade war with the US at the start of Trump’s second term has played an important role in the election victory for the Liberal Party. However, the margin of victory appears to be narrower than indicated by the final polls. According to reports, the Liberal Party won about 43% of the national vote, but may fall short of the 172 seats needed for a majority in the House of Commons which would require the new government to work with other parties to pass budgets and together legislation. The Canadian dollar initially strengthened after it was announced that the Liberal Party had won resulting in USD/CAD falling to a low overnight of 1.3809 but the pair has since risen back to up towards 1.3870 as it became clear that they may not win a majority.

Prime Minister Carney stated that if he won re-election, he will seek talks with President Trump that are comprehensive, ambitious, and respect Canada’s sovereignty with the USMCA trade deal scheduled to be reviewed in July of next year. The Canadian dollar has already staged a strong rebound over the past month after Canada alongside Mexico were hit less than feared by President Trump’s Liberation day tariff plans and the US dollar weakened more broadly resulting in USD/CAD dropping back towards the 1.3800-level from closer to the 1.4400-level. We are still wary of the risk that Canada’s economy could slow more sharply in response to trade disruption and policy uncertainty requiring the BoC to cut rates deeper so are not yet convinced that recent strong gains for the Canadian dollar are built on strong foundations. The Liberals have pledged though to loosen fiscal policy to increase defence spending and cut taxes to provide more support for growth.

CANADIAN DOLLAR HAS BEEN REBOUNDING FROM WEAK LEVELS

Source: Bloomberg, Macrobond & MUFG GMR

EM FX: Trade disruption continues to drive EM FX performance

It has been a more mixed week for EM FX performance. The best performing currencies since last Monday have been the Latam currencies of the BRL (+2.7% vs. USD), CLP (+1.9%), and COP (+1.5%). In contrast, the worst performing currencies have been the ARS (-6.9% vs. USD), RUB (-1.7%), KRW (-1.2%), RON (-1.2%) and PLN (-1.0%).

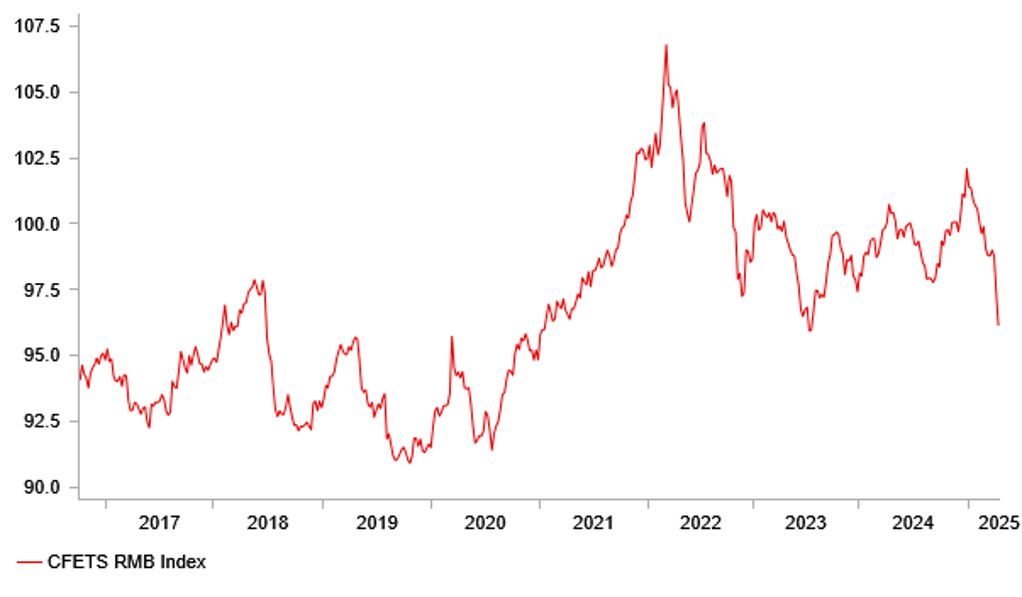

Latam currencies have benefitted from building investor optimism that President Trump will take action in the coming months to further reverse more disruptive tariff hikes especially on China where the current 145% tariffs are judged to be “unsustainable”. The CNY continues to be held stable against the USD despite the high tariffs in place although the CNY has weakened sharply against other currencies alongside the USD. As a result, the CFETS index has fallen by around 2.7% since the end of March and extended its decline to -5.7% since the start of this year. It was reported at the end of last week that Chinese policymakers were considering exempting some US goods from its 125% tariff including medical equipment and some industrial chemicals, and for plane leases. Chinese policymakers have also laid out policies at the start of this week to support exporters affected by tariffs including plans to ensure troubled firms get the loans they need and to boost domestic consumption. President Xi has vowed to make boosting domestic consumption a top economic policy this year which if delivered would help to ease downside risks to commodity-related emerging market currencies going forward.

Within EMEA FX, the recent underperformance of the PLN continues to stand out. The PLN has been undermined recently by the dovish repricing of the outlook for NBP policy. Market speculation over NBP rate cuts as soon as next month have been encouraged by comments from NBP officials who are weighing up whether to deliver a larger 50bps rate cut to start the easing cycle. At the same time, Poland will hold the upcoming presidential election on 18th May. If no candidate secures more than 50% of the vote then a second round vote will take place on 1st June. Recent opinion polls continue to show that Rafa Trzaskowski of the Civic Platform is the favourite to win which would strengthen the government’s grip on power. However, his lead over Karol Nawrocki who is backed by the main opposition party has narrowed. A victory for Rafa Trzaskowski would be viewed as supportive for the PLN. Please see our latest EM EMEA Weekly report (click here) for more details.

TRADE-WEIGHTED CNY HAS WEAKENED SHARPLY

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

10:00 |

BoE Deputy Governor Woods Speaks |

-- |

-- |

-- |

!! |

|

EC |

10:00 |

M3 Money Supply (YoY) |

Mar |

4.0% |

4.0% |

! |

|

UK |

10:40 |

MPC Member Ramsden Speaks |

-- |

-- |

-- |

!! |

|

EC |

11:00 |

Business Climate |

Apr |

-- |

-0.73 |

! |

|

US |

13:30 |

Retail Inventories Ex Auto |

Mar |

-- |

0.1% |

!! |

|

US |

14:00 |

S&P/CS HPI Composite - 20 n.s.a. (YoY) |

Feb |

4.6% |

4.7% |

!! |

|

US |

14:00 |

S&P/CS HPI Composite - 20 n.s.a. (MoM) |

Feb |

-- |

0.1% |

!! |

|

US |

15:00 |

JOLTS Job Openings |

Mar |

7.490M |

7.568M |

!!! |

Source: Bloomberg