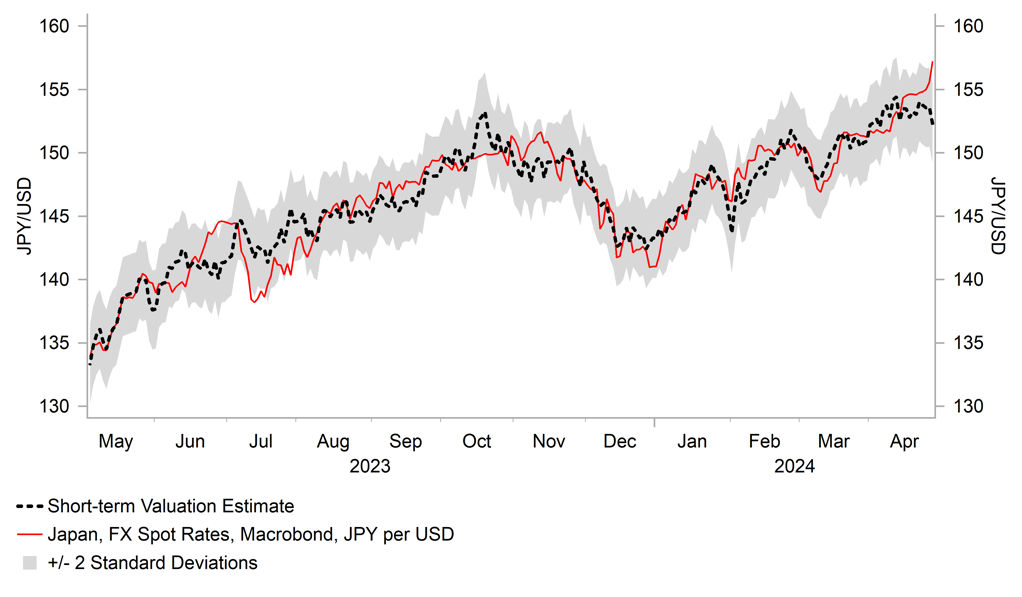

JPY selling accelerates after BoJ policy meeting

JPY: Heightened yen volatility justifies intervention

It has been a volatile trading session for the yen overnight. The yen continued to weaken sharply at the start of the Asian trading session resulting in USD/JPY hitting an intra-day high overnight of 160.17 but has since fallen back sharply to an intra-day low of 155.06. The price action appears similar to in the autumn of 2022 when Japan last intervened. When asked by reporters whether or not Japan had intervened in foreign exchange market to support the yen overnight, Japan’s top currency official Masato Kanda stated “no comment for now” suggesting he has more to say at a later date. While there has been no official confirmation of intervention, the marked step up in the pace of yen weakness since the BoJ’s policy meeting at the end of last week has provided justification for action. USD/JPY had risen by around five figures from the low on Friday to the high overnight after the BoJ failed to provide pushback against further yen weakness on Friday. As we highlighted in our FX Daily Snapshot from Friday (click here), Governor Ueda did not provide a stronger signal that plans to hike rates further have been brought forward while indicating that they were not overly concerned by the recent weakening of the yen. Yen weakness is not yet judged sufficient to significantly impact the underlying trend for inflation which would alter plans for monetary tightening. As we suspected the BoJ’s policy update was viewed as greenlight by market participants to continue selling the yen, and further highlights why it will be difficult for Japan to reverse the yen weakening through intervention at the current juncture. At best direction intervention to support the yen can slow the weakening trend, and hope to buy time for change in economic fundamentals.

One problem for Japanese officials is that US yields are continuing to trade close to year to date highs in anticipation of a hawkish policy update from the Fed in the week ahead. Fed Chair Powell has already indicated recently that the Fed will likely require more time before they have sufficient confidence to begin cutting rates this year. A decision to delay rate cut plans will have been supported further by last week’s US economic data releases revealing an even stronger pick-up in the core PCE deflator in Q1 (+3.7%) while private domestic demand remained strong expanding by around 3% for the third consecutive quarter in Q1 after stripping out the drag from inventories. The recent run of upside US economic data surprises has encouraged US rate market participants to push back expectations for the first Fed rate cut until the end of this year. It would require a much weaker nonfarm payrolls report for April to challenge to challenge the hawkish repricing of Fed rate cut expectations in the week ahead.

YEN WEAKNESS IS STARTING TO OVERSHOOT

Source: Bloomberg, Macrobond & MUFG GMR

EUR & GBP: Showing resilience amidst broad-based USD strength

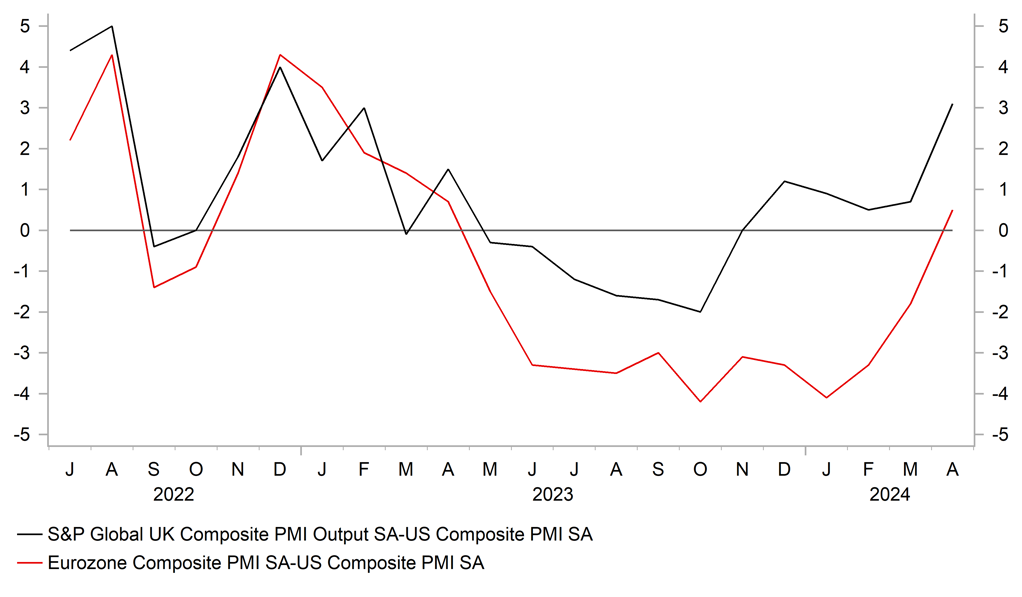

In contrast to the continued weakness for the JPY, the European currencies of the EUR and GBP have held up much better against the USD despite the unfavourable move in yield spreads. The two-year swap spread between the euro-zone and US has widened by just over 30bps so far this year in favour of US, and it has moved back to levels that were last recorded in late 2022 when EUR/USD was trading between 1.0000 and 1.0500. A similar adjustment has taken place in short-term yield spreads between the UK and US. Cable was trading closer to the 1.2000-level when yield spreads were last at current levels just over a year ago. Rate markets have moved along way now to price in more policy divergence this year between the Fed and major European central banks. A rate cut is not fully priced in now in the US until November compared to by July in the euro-zone and September in the UK. It should help to limit the room to price in further policy divergence in the near-term unless the US rate market really starts to seriously question whether the Fed will cut rates at all this year.

One of the reasons why we believe that the EUR and GBP have held up better against the USD than implied by yield spreads on their own, has been the improving cyclical outlook in Europe. The negative impact from the energy price shock in the region continues to fade, and we saw more convincing evidence over the past week that economic growth is beginning to pick up. The euro-zone and UK services PMI surveys both climbed to their highest levels in almost a year, and are signalling that the period of economic stagnation/mild recession has ended. It gives us more confidence that rising real incomes will drive a consumption-led recovery this year.

Our forecasts for a weaker USD in the 2H of this year are built on the assumption that the US economy will no longer appear as exceptional as US growth momentum moderates and growth picks up outside of the US. We have been encouraged by the recent pick-up in growth momentum in both China and the euro-zone at the start of this year, but so far there is little convincing evidence yet that the US economy is slowing in response to tighter Fed policy and the running down of COVID savings. In light of recent developments, it appears unlikely that the hawkish repricing of Fed policy will be sufficient to trigger a bearish break out of current trading ranges for EUR/USD and cable between 1.0500 and 1.1000, and 1.2000 and 1.3000 respectively. The US rate market is already well priced for a hawkish Fed policy update in the week ahead. We would expect a bigger USD reaction (sell off) if the US labour market revealed more evidence of softening demand. Please see our latest FX Weekly for more details (click here).

CYCLICAL MOMENTUM IS TURNING UP IN EUROPE

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

10:00 |

Business Climate |

Apr |

-- |

-0.30 |

! |

|

EC |

10:00 |

Consumer Confidence |

Apr |

-14.7 |

-14.9 |

! |

|

EC |

11:00 |

Eurogroup Meetings |

-- |

-- |

-- |

!! |

|

GE |

13:00 |

German CPI (YoY) |

Apr |

2.3% |

2.2% |

!! |

|

US |

15:00 |

Dallas Fed PCE |

Mar |

-- |

3.40% |

! |

|

EC |

20:20 |

ECB's De Guindos Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg