AUD & NZD in focus at start of the week

AUD/NZD: Widening expectations for policy divergence ahead of RBNZ meeting

It has been a relatively quiet trading session overnight. The biggest movers amongst G10 currencies have been the Australian dollar and yen as the US dollar continues to trade on the back foot. It has resulted in USD/JPY briefly falling back below the 148.00-level. The Australian dollar has been one of the main beneficiaries from the sharp improvement in global investor risk sentiment this month. MSCI’s ACWI global equity index has staged a powerful rebound (~10%) since late last month supported by building optimism over a softer landing for the global economy encouraged by slowing inflation and more confidence that central banks have ended their rate hike cycles. The Australian dollar has strengthened by around 4.5% against the US dollar, and in recent days has climbed back above resistance from the 200-day moving average that comes in at around 0.6580 for the first time since July. It is returning to the narrow trading range between 0.6600 and 0.6800 that held for most of the time between November of last year and July of this year. The Australian dollar is also deriving some support from expectations that the RBA’s policy stance could diverge from other G10 central banks. While market participants are increasingly confident that the major central banks of the Fed, ECB and BoE have finished their hiking cycles, the Australian rate market continues to price in higher probability of one further hike by the RBA. There is currently around 16bps of hikes priced in by the May RBA policy meeting. At the same time, market participants expect the RBA’s policy rate to finish next year largely unchanged in comparison to the lower policy rates expected from other major central banks. Those relatively hawkish policy expectations were supported overnight by comments from RBA Governor Bullock who stated that demand in the economy is proving “a little bit stronger” than expected and helping to keep inflation pressures elevated. She noted that “businesses are finding that demand is sufficient that they are able to pass those costs on” although she emphasized that “we’re in a period now where we have to be a little bit careful”. She believes that Australian households and businesses are in a pretty good position, and that those coming off fixed-rate loans on to higher rates are managing quite well. The comments helped to offset the release of the weaker retail sales report for October. The next market focus will be the release tomorrow of the monthly Australian CPI report for October.

In contrast to the relatively hawkish policy outlook for the RBA, the New Zealand rate market has been moving more in line with other major central banks. Market participants are similarly more confident that the RBNZ’s rate hike cycle has ended, and has moved to price in around 55bps of cuts by the end of next year. One important difference is that the policy rate in New Zealand (5.50%) is already at more restrictive levels than in Australia (4.35%). Furthermore, the recent top tier economic data flow from New Zealand has disappointed expectations. Since the RBNZ’s last policy meeting on 4th October, the release of the CPI report for Q3 revealed inflation slowed more than expected to 5.6% and the labour market for Q3 revealed an unexpected quarterly contraction in employment. It has encouraged expectations that the RBNZ could adopt less hawkish policy guidance at tomorrow’s meeting. In the FX market the recent widening of yield spreads in favour of the Australian dollar over the New Zealand dollar has not been fully reflected in the AUD/NZD rate. The New Zealand dollar has benefitted more this month from the improvement in global investor risk sentiment. Yield spreads indicate that there is room for AUD/NZD to move back closer to the 1.1000-level.

AUD/NZD HAS DIVERGED FROM YIELD SPREADS THIS MONTH

Source: Bloomberg, Macrobond & MUFG GMR

EM FX: Losing upward momentum after sharp rebound this month

Emerging market currencies have lost upward momentum against the USD over the past week. The breakdown of EM FX performance has been more mixed. The top two performing currencies last week were the CLP (+0.8% vs. USD) and CZK (+0.7%). In contrast, the ZAR (-2.2% vs. USD), BRL (-1.0%), and KRW (-0.9%) all underperformed. It follows strong gains for EM FX for this month as a whole. Within EMEA, the Central and Eastern European currencies of the PLN (+6.0% vs. USD MTD), RUB (+5.3%), MXN (+5.1%), CZK (+4.5%), KRW (+4.4%) and HUF (+4.3%) have all outperformed in November while the TRY (-2.2%) and ZAR (-0.3%) have both underperformed.

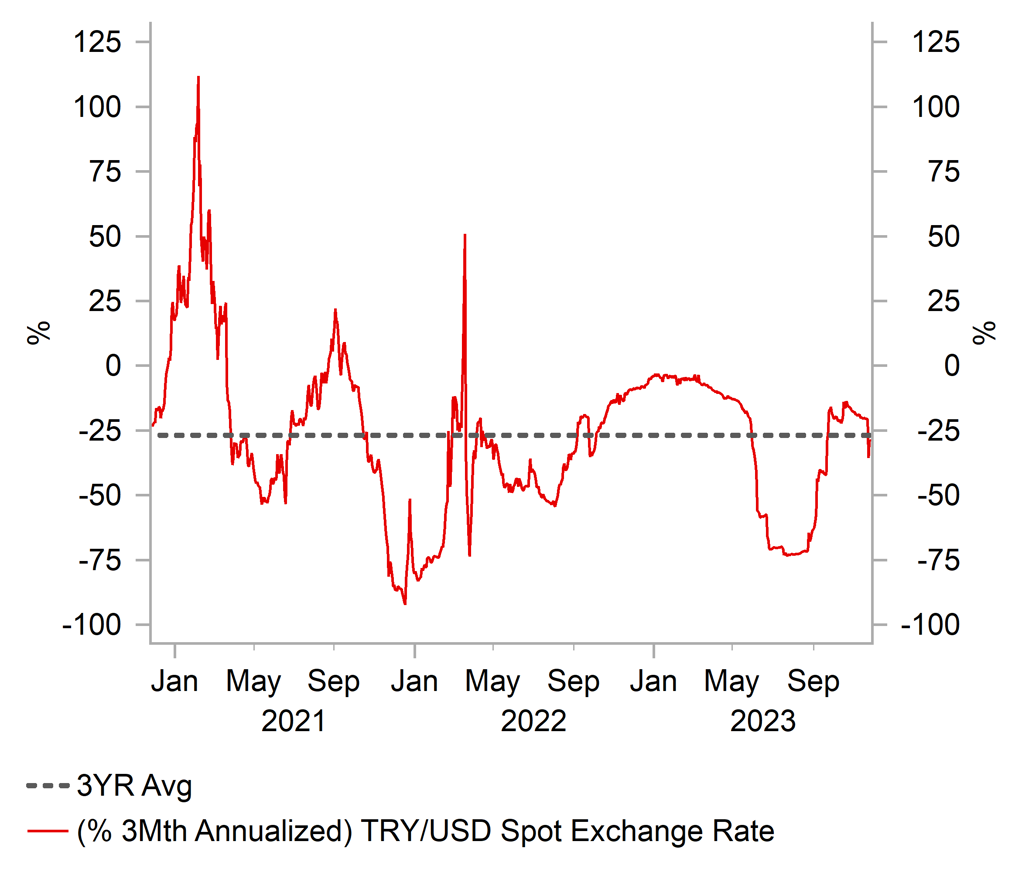

Last week’s decision from the CBRT to deliver a larger than expected 5.0 percentage point hike has not altered the recent weakening tend for the TRY. Over the last three months, the TRY has declined by an annualized rate of just under 30% against the USD. It represents a modest slowdown in the pace of depreciation after it declined by an annualized rate of just over 40% in the first eight months of this year. The one-year forward rate is currently expecting the recent slower pace of depreciation to continue that would result in USD/TRY rising to just over the 40.000-level. The price action highlights that it remains hard work for domestic policymakers to regain investor confidence in the TRY. The CBRT have now raised rates aggressively by 31.50ppts sine the May elections. The updated guidance from the CBRT signalled that further hikes will be more gradual as rates move closer to a peak between 40.0% and 50.0%. If the CBRT’s forecasts prove to be correct, the real policy rate is on course to move into positive territory next year. The CBRT expects inflation to decline sharply from 65% at the end of this year to 36% by the end of next year.

In contrast, the NBH’s decided to lower rates further last week by 0.75 point to 11.50%. The sharper than expected drop in headline inflation which fell to an annual rate of 9.9% in October is creating more room for the NBH to keep lowering rates. With the real positive rate still comfortably in positive territory, it should give the NBH confidence that policy remains sufficiently restrictive to slow inflation further without undermining confidence in the HUF. EUR/HUF has increased only modestly from around 370.00 up to 380.00 since NBH rate cut expectations intensified in the 2H of this year making the HUF relatively less attractive as a carry currency. The NBH continues to push back against government pressure for even larger rates cuts and a negative policy rate. On the plus side for the HUF it was reported at the end of last week that the EU is finalizing a decision to release as much as EUR1 billion of funds for Hungary. Please see our latest EM EMEA Weekly for more details (click here).

RATE OF TRY DEPRECIATION HAS SLOWED IN RECENT MONTHS

Source: Bloomberg, Macrobond & MUFG GMR

xKEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:00 |

ECB's Nagel Speaks in Cyprus |

!! |

|||

|

EC |

09:00 |

M3 Money Supply YoY |

Oct |

-0.9% |

-1.2% |

!! |

|

US |

14:00 |

S&P CoreLogic CS 20-City MoM SA |

Sep |

0.8% |

1.0% |

!! |

|

US |

15:00 |

Conf. Board Consumer Confidence |

Nov |

101.0 |

102.6 |

!! |

|

US |

15:00 |

Fed Governor Waller speaks |

!!! |

|||

|

EC |

16:00 |

ECB's Lagarde Speaks (Pre-Recorded) |

!!! |

|||

|

EC |

18:30 |

ECB's Lane Speaks |

!!! |

Source: Bloomberg