Long-end bond risks to persist as JGB auction disappoints

JPY: JGB auction disappoints

The scale of the drop in JGB yields in response to the news that the MoF was seeking feedback from JGB market participants about its issuance plans looked somewhat overdone and the result of today’s 40-year JGB auction has disappointed and seen a renewed jump higher in yields. After a period of sustained selling of JGBs, positioning was likely a factor in the sharp drop in yields. But tweaks to issuance plans will only go so far in helping curtail yields. The MoF in its FY25 issuance plans has already reduced 30-year and 40-year issuance by JPY 1.2trn in each tenor – or by 11% and 29% respectively. The issuance of 5-year JGBs and t-bills are both set to increase to offset this issuance cut. The MoF today sold JPY 500bn worth of 40-year paper at a yield of 3.135% with a bid-to-cover of 2.21, compared to 2.92 in March. It was the lowest bid-to-cover since July 2024. The fallout in yields has been contained which was likely down to comments earlier by BoJ Governor Ueda. After the BoJ had previously come across as indifferent, Ueda’s comments have changed that. He sounded much more focused on the issue when speaking in the Diet today, stating that the BoJ would “carefully watch market movements and their economic impact” adding that “significant fluctuations” in super-long yields can affect yields across the entire yield curve. This was a signal that the BoJ acknowledges that the moves at the very long-end can impact the transmission of the BoJ’s monetary stance. That implies the potential for action if it undermined the achievement of the BoJ’s inflation goals.

While Governor Ueda’s comments have helped to contain the JGB yield rise, we suspect the BoJ will remain very reluctant to alter its current policy plans that would be portrayed as the BoJ shifting its policies quickly in response to inevitable rises in yields. The BoJ is determined to normalise the monetary policy framework and not reacting would be the best signal that decades of mild deflation have come to an end. The onus therefore is likely to fall back on the government to address fiscal deficit concerns. A Japanese government advisory panel – The Fiscal System Council – warned today that the government “must manage finances with a heightened sense of urgency to prevent rising debt costs from crowding out essential policy spending”. For now, PM Ishiba is at least rejecting calls for additional spending financed by JGB issuance.

There is a risk going forward that long-end JGB risks could encourage a shift to a more dovish stance by the BoJ which could be deemed as yen negative. However, external circumstances would be important in determining the FX impact. At this juncture we doubt the BoJ is close to any shift in stance and international factors will continue to lend to yen appreciation over the nearer-term.

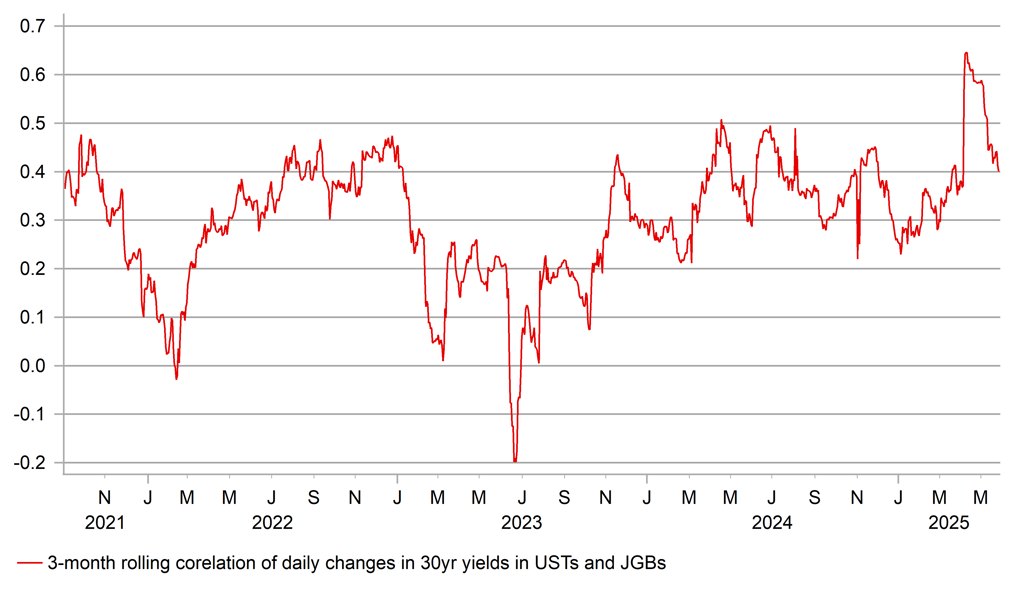

30-YEAR UST AND JGB YIELD CORRELATION HAS BEEN STRONGER

Source: Bloomberg, Macrobond & MUFG GMR

USD: Consumer confidence rebound ahead of FOMC minutes

UST bond yields declined yesterday helped by the plans in a number of countries to ease the supply burden on the long-end of yield curves. The UK’s Debt Management Office confirmed a plan to bring issuance to shorter duration bonds and Japan looks set to consider the same. US trade tariff de-escalation has also helped ease concerns over inflation risks in the US.

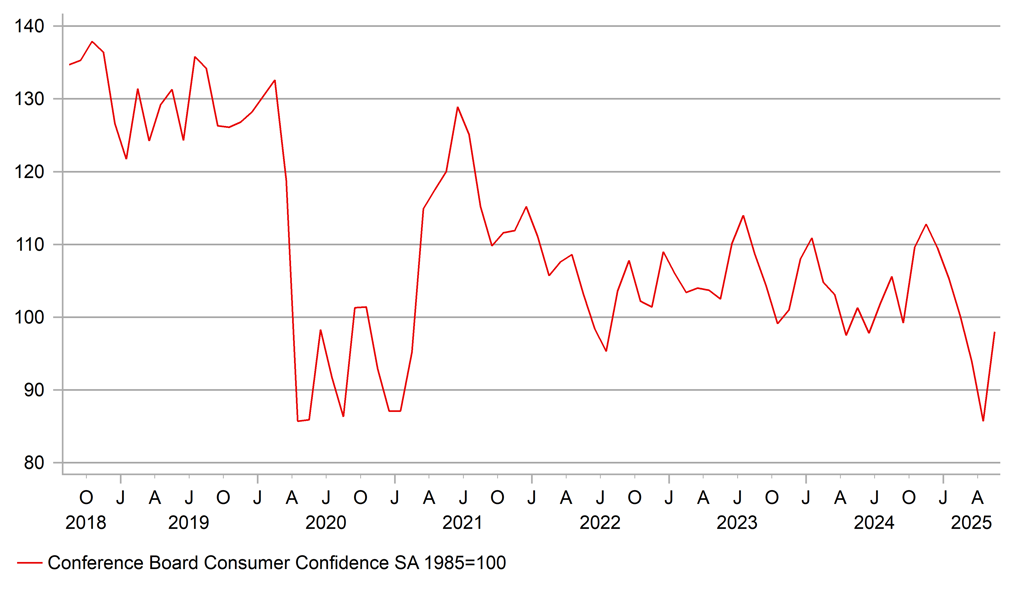

The impact of trade tariff de-escalation was clear to see yesterday by the surge in US consumer confidence. The main index jumped from 85.7 in April to 98.0 in May – the largest one-month increase since March 2021 when diminishing covid concerns sparked a surge in confidence. This time it was tariff-related with inflation expectations easing and consumer expectations surging as a result. The median inflation expectation in 12mths fell from 5.9% to 5.3%. The Dallas Fed Manufacturing Index also jumped considerably, which sets us up for an improvement in the ISM manufacturing index next week as well. The result of these clear benefits to sentiment from trade de-escalation was ‘triple buying’ of US assets as yields fell, and the dollar and equities advanced. What must President Trump be thinking about these positive developments in the financial markets due to trade conflict de-escalation? Perhaps the scale of equity market recovery will be viewed as allowing Trump the capacity to go aggressive again with tariff threats as the expiry date of the suspension of reciprocal tariffs approaches.

The minutes from the FOMC meeting on 7th May will be released this evening and the details will be important in providing a sense of the level of conviction on the Fed’s willingness to remain on the side-lines in order to assess the uncertainty created by trade tariffs. Fed Chair Powell was quite clear on that in the press conference so the minutes likely also will present a clear message on the need to pause to assess the outlook. Comments on the risks to inflation will be important as well, in particular to what extent the FOMC believes tariff increases will be one-offs and hence only a temporary impact on inflation. Furthermore, how much attention will signs of a demise in confidence in US assets get given the aftermath of the reciprocal tariff announcements coincided with long-term yields rising and the dollar falling.

We remain in the camp of “damage done” and hence continue to expect weaker economic activity ahead given the likely curtailment of business and household decision-making. That’s exactly the view of Fed President Barkin who yesterday stated that people and businesses were “waiting out” the uncertainty created by Trump’s trade policy uncertainty. That could turn into quite a wait, at least through the summer, which we believe will be damaging to the economy. That could pressure yields further to the downside but we would not expect to see dollar strength coincide like what took place yesterday.

SHARP REBOUND IN CONSUMER CONFIDENCE BUT FROM DEPRESSED LEVELS AND TO A LEVEL BELOW 2022-2024 RANGE

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

08:55 |

Unemployment Change (000's) |

May |

12.0k |

4.0k |

!! |

|

GE |

08:55 |

Unemployment Claims Rate SA |

May |

6.30% |

6.30% |

! |

|

EC |

09:00 |

ECB 3 Year CPI Expectations |

Apr |

2.50% |

2.50% |

!! |

|

EC |

09:00 |

ECB 1 Year CPI Expectations |

Apr |

2.80% |

2.90% |

!! |

|

US |

09:00 |

Fed's Kashkari speaks |

!! |

|||

|

US |

15:00 |

Richmond Fed Manufact. Index |

May |

-9 |

-13 |

! |

|

US |

15:00 |

Richmond Fed Business Conditions |

May |

-- |

-30 |

! |

|

US |

15:30 |

Dallas Fed Services Activity |

May |

-- |

-19.4 |

! |

|

UK |

16:00 |

BoE's Pill speech |

!!! |

|||

|

US |

19:00 |

FOMC Minutes |

!!!! |

Source: Bloomberg & Investing.com