Markets continue to weigh up inflation risks as AUD to corrects lower

AUD: Weaker CPI report hits Aussie but underlying details are less favourable

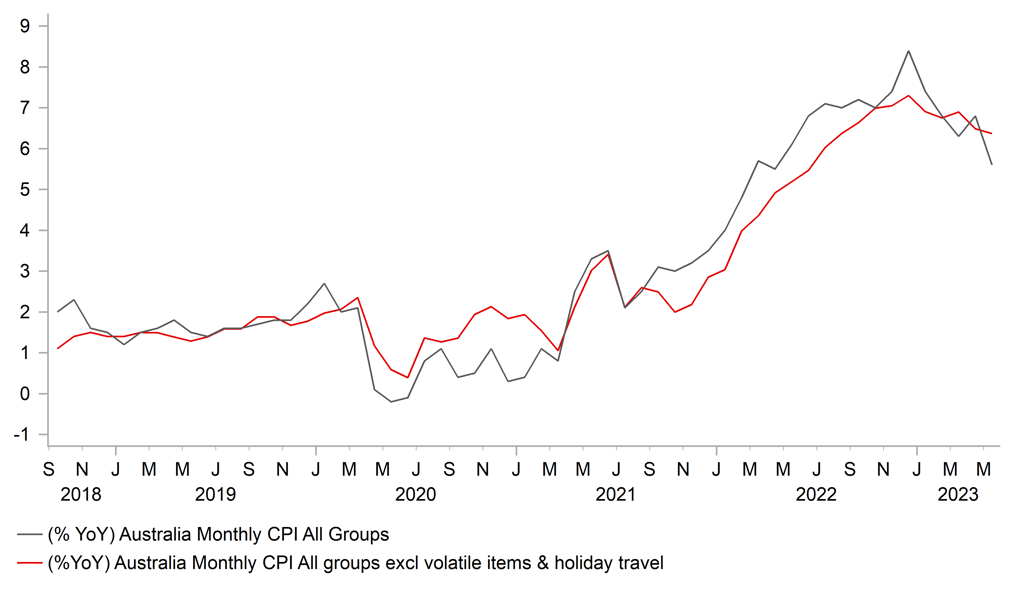

The Australian and New Zealand dollars have been the biggest moves overnight with both currencies underperforming following the release of the weaker than expected Australian CPI report. It has resulted in AUD/USD falling back towards support at the 0.6600-level, and NZD/USD has moved closer to the 0.6100-level. The main trigger for the sharp sell-offs over was the release of the Australian CPI report for May that revealed headline inflation slowed more than expected by 1.2ppts to an annual rate of 5.6% as it continued to move further below the peak from the end of last year at 8.4%. The sharp drop in the headline rate of inflation was driven by favourable base effects from lower fuel prices and a sharp fall in travel prices. Fuel prices fell by -6.7% this May compared to an increase of +11.0% last May which subtracted -0.6ppts from the annual headline rate. Holiday travel and accommodation fell sharply as well this May by -11.3% with weakness most evident in for domestic travel hat fell by -15.5%. While the RBA will be pleased by the bigger drop in the headline rate, the underlying details of the report were not as favourable. Core inflation measures have peaked but they remain too high. The trimmed mean measure of core inflation slowed by 0.6ppt to an annual rate of 6.1% as it moved further below the peak from December at 7.2%. The RBA has also cited the excluding fuel, fruit & vegetables and travel measure of inflation which slowed only marginally by -0.1ppt to 6.4%. Evidence of still elevated inflation pressures in the service sector will keep the RBA concerned over the risk of higher inflation remaining persistent despite the large drop in the headline rate. As a result, we still expect the RBA to raise rates further although it could now choose to skip next week’s policy meeting and leave rates on hold until the following meeting in August. The minutes from their last meeting earlier this month had already revealed that it was a close call to raise rates. The Australian rate market has since moved to price in smaller probability of back to back 25bps hikes next month. There is currently around 7bps of hikes priced in for the July meeting and 19bps for the August meeting. A final hike in the cycle to a peak of 4.60% is also judged as more finely balanced now with 37bps of hikes priced in by December. Overall, it is a further near-term setback for the Australian dollar which has been correcting lower since the middle of the month.

CORE CPI MEASURES DID NOT SLOW AS MUCH AS HEADLINE

Source: Bloomberg, Macrobond & MUFG GMR

EUR/USD: ECB sticks to hawkish policy stance despite weaker data

The US dollar was supported yesterday by the release of another batch of stronger US economic data which continues to show resilience in the near-term to the negative impact of higher rates and tightening credit conditions. It is the strongest run of positive US economic data surprises since early April which keeps the Fed on track to deliver at least one of their planned two further hikes in July. The US rate market is currently pricing in around 19bps of hikes by July and has been gradually pricing in a higher probability of a second hike which currently stands at 29bps by November. The modest move higher in US rates yesterday was encouraged by stronger durable goods orders for May, a sharp increase in new home sales for May and a bigger than expected improvement in the Conference Board’s measure of consumer confidence. The Atlanta Fed’s GDPNow forecast for Q2 currently stands at +1.8% which compares to the Bloomberg consensus forecast amongst US economists for GDP growth of +1.2%.

Outside of the US, the focus has been on comments from policymakers at the ECB’s annual conference on central banking. The hawkish comments yesterday from ECB President Lagarde have attracted the most attention. She stated clearly that “it is unlikely that in the near future the central bank will be able to state with full confidence that the peak rates have been reached. Barring a material change to the outlook, we will continue to increase rates in July”. She also emphasized that “we need to communicate clearly that we will stay at those levels for as long as necessary” to “ensure that hiking rates does not elicit expectations of a too-rapid policy reversal and will allow the full impact of our past actions to materialize”. It provides further evidence that the ECB’s policy message is starting to place more emphasis on the need to keep higher rates in place for longer as they move closer to the peak in the cycle. A message that was repeated by ECB Chief Economist Lane who stated that “we will have a sustained period where rates will remain restrictive to make sure we don’t have any new shock that takes us away from 2%”. He doesn’t think it is appropriate for markets to have rapid rate cuts priced in over the next couple of years.

Overall, the comments continue to highlight that the weak euro-zone economic data flow is not yet encouraging the ECB to shift way from their hawkish policy stance which is helping to dampen the negative impact on the euro. It leaves EUR/USD continuing to trade towards the top of this year’s trading range. ECB President Lagarde is scheduled to speak again later today alongside Fed Chair Powell, BoE Governor Bailey and BoJ Governor Ueda. The ECB, BoE and Fed have all expressed concern recently about the risk of more persistent inflation.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

M3 Money Supply YoY |

May |

1.5% |

1.9% |

!! |

|

IT |

10:00 |

CPI EU Harmonized YoY |

Jun P |

6.8% |

8.0% |

!! |

|

UK |

11:30 |

BOE's Huw Pill Speaks in Sintra |

!!! |

|||

|

US |

13:30 |

Advance Goods Trade Balance |

May |

-$93.7b |

-$96.8b |

!! |

|

EC |

14:30 |

Fed's Powell, ECB's Lagarde, BOJ's Ueda, BOE's Bailey: Sintra |

!!! |

Source: Bloomberg