Key EU-US trade deal reached reducing market volatility risks further

EUR: Neutral reaction underlines better USD sentiment

An EU-US deal being reached was well priced with the FT last week reporting that a deal was close – an article that helped propel EUR/USD higher and EUR/USD remains in touching distance of the recent intra-day high of 1.1829 set at the start of July. The financial markets also had the US-Japan trade deal as a benchmark to use to shape expectations for this deal and indeed large part of the details in the EU-US deal are similar to the US-Japan deal. Like Japan, the EU will pay a 15% baseline tariff on all goods, including autos. This effectively takes the rate down from 27.5%. The list of zero-tariff goods appears a little larger for the EU covering aircraft, chemicals, semiconductors (to be confirmed) and agri-products. For Japan it was more focused on green energy products. The EU has also made an explicit commitment to purchase USD 750bn worth of LNG over a three-year period. EU investments in the US was set at USD 600bn (versus USD 400bn for Japan). The EU has also committed to buying more defense equipment from the US and open up the EU auto market further to US auto imports. The US has agreed to finalise the tariffs on semiconductor chips and pharma in two weeks’ time. The steel and aluminium tariffs remain at 50% but a plan is being completed to shift to a quota system.

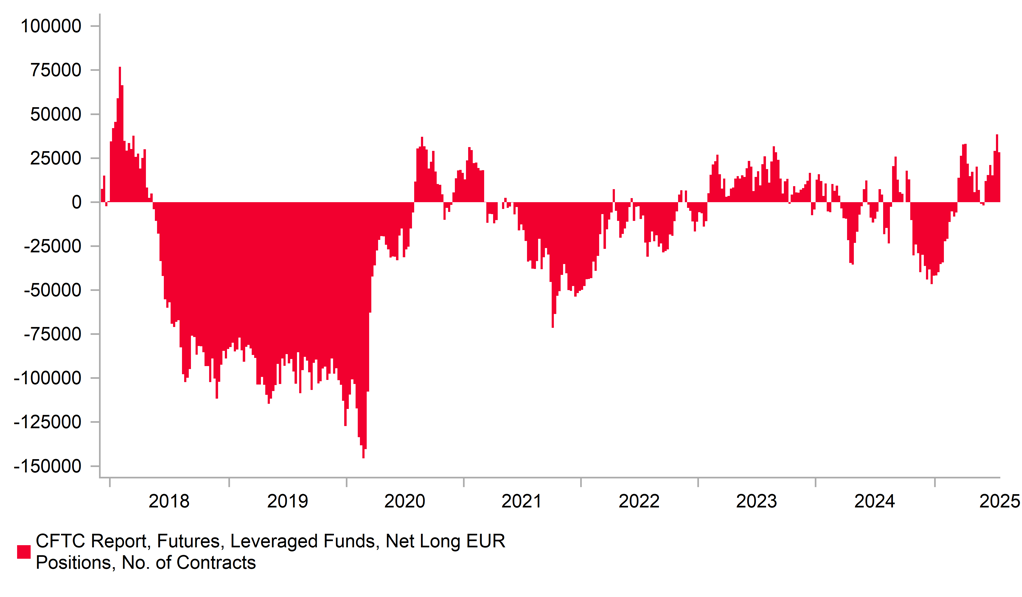

But ultimately this is good news from a financial markets perspective as it reduces uncertainty further still ahead of the 1st August, which is now looking like an insignificant date. As Ursla von der Leyen’s statement points out this deal covers USD 1.7trn worth of trade per year impacting 800mn people and 44% of global GDP. While the German automakers won’t be particularly happy with this deal, and we need to see more details on US access to EU markets, the clarity will be greeted positively for now. EUR/USD gapped higher on the open to hit close to 1.1780, but has now fully retraced the move and is down on Friday’s close. This move likely reflects more general US dollar sentiment that was improving toward the end of last week and we suspect could extend further this week as investors’ optimism over the US economy improves. Positioning also makes further gains difficult with Leveraged Funds’ long EUR positions two weeks ago reaching the largest since 2018. Those positions were partially cut in data released on Friday. In regard to general US optimism, Friday’s jobs report will be key.

There was also some separate positive news in regard to US-China trade relations. US and China trade negotiators are meeting in Sweden today and Scott Bessent has indicated that the focus will be on extending the current status beyond the mid-August deadline with the US set possibly to ease tech export restrictions with the objective of a summit between President Trump and Xi later in the year. If the truce is extended, which seems very likely, then most of the countries running the largest trade deficits from a US perspective will have reached a deal. South Korea and Taiwan the exceptions and Canada and Mexico are more protected by the USMCA deal. This status will likely help investors shift focus to the ongoing evidence that the US is proving more resilient to tariffs than expected that should help provide support for the US dollar at least through to the NFP report, especially if the other jobs market-related data this week show resilience.

LEVERAGED FUNDS EUR LONGS RECENTLY HIT HIGHEST SINCE 2018

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Key central bank events & volatility risks

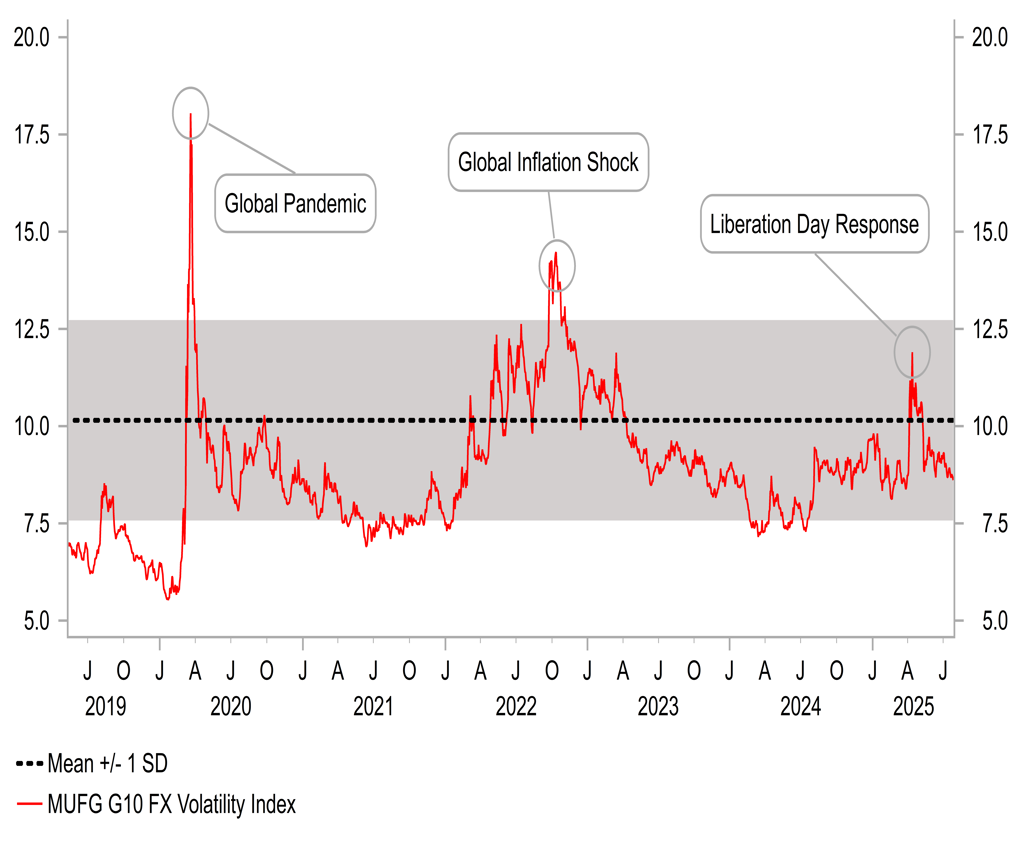

This week starts relatively quietly with a light data calendar but the main event risks will be from Wednesday with the FOMC, followed by the BoJ meeting on Thursday and then the payrolls report and the date in which President Trump’s new tariff rates will be effective from. So the risk of a pick-up in FX volatility will certainly increase as the week unfolds. In our FX Weekly, published on Friday (here), we explain why the central bank meetings are unlikely to trigger any notable pick-up in volatility and that the backdrop for now looks supportive for FX carry strategies to continue to perform well. We include USD/JPY in that and the weakness of the yen that coincided with a pick-up in hawkish BoJ expectations was telling. The market price action suggests positioning reflects anticipation of a more hawkish message which no doubt was helped last week by a speech by Deputy Governor Uchida and a Bloomberg report on Friday from “people familiar with the matter” suggesting the BoJ now see greater potential for a rate hike this year. The Bloomberg story aligns with the speech from Uchida and we see no reason why Governor Ueda will shift away from the message from Uchida – that the US-Japan trade deal has reduced economic uncertainty and therefore the BoJ is more confident that its forecasts will be realised and therefore raise the policy rate again.

The probability of a BoJ rate hike by year-end is around 80% now, and for a hike in October (more likely in our view) is now priced as nearly a 70% probability. With three months to that end-October meeting it seems highly unlikely that Governor Ueda would speak hawkishly enough to move the probability much further at this stage.

If you then make the reasonable assumption that the messaging from Fed Chair Powell is broadly the same – that they will take time to assess the inflation impact of incoming trade tariff increases – then the dollar should remain broadly stable with the potential for further gains. Will Powell be dovish enough to lift the current near-70% probability of a cut in September? That seems unlikely right now with another round of tariff increases about to go live and the last CPI report indicating clear signs of goods inflation due to tariffs.

The biggest risk therefore of market volatility that could undermine the positive FX carry momentum will come at the end of the week – with the release of the non-farm payrolls report. Other data like initial claims does not suggest any dramatic change in labour market conditions although there will be other data this week that will help shape market expectations into the NFP print. Economic resilience in the face of tariffs looks like a theme that can run further which should be supportive of USD/JPY grinding back higher again

G10 FX VOLATILITY CONTINUES TO GRIND LOWER – REDUCED TRADE TARIFF RISKS COULD SEE THAT CONTINUE

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

11:00 |

CBI Distributive Trades Survey |

Jul |

-28 |

-46 |

! |

|

CA |

13:30 |

Wholesale Sales (MoM) |

Jun |

-- |

0.1% |

!! |

|

FR |

14:00 |

French 12-Month BTF Auction |

-- |

-- |

1.9% |

! |

|

FR |

14:00 |

French 3-Month BTF Auction |

-- |

-- |

1.9% |

! |

|

FR |

14:00 |

French 6-Month BTF Auction |

-- |

-- |

1.9% |

! |

|

US |

15:30 |

Dallas Fed Mfg Business Index |

Jul |

-- |

-12.7 |

! |

|

US |

16:30 |

3-Month Bill Auction |

-- |

-- |

4.2% |

! |

|

US |

16:30 |

6-Month Bill Auction |

-- |

-- |

4.1% |

! |

|

US |

17:00 |

2-Year Note Auction |

-- |

-- |

3.8% |

!! |

|

US |

17:00 |

5-Year Note Auction |

-- |

-- |

3.9% |

!! |

Source: Bloomberg & Investing.com