No let up for USD selling over holiday period

USD: Weakening trend extends into year end

The US dollar has continued to weaken over the holiday period with the dollar index closing lower for the fourth consecutive trading day and moving back closer to the year to date low from July at 99.578. In the absence of important economic data releases and/or central bank speakers, there is unlikely to be a fundamental trigger to reverse the US dollar’s weakening trend heading into year end. The US dollar weakening trend has been encouraged by building speculation that the Fed will be the first major central bank to begin cutting rates early next year. The US rate market is fully priced for the first 25bps Fed rate cut to be delivered at 20th March FOMC meeting. In comparison, the ECB and BoE are expected to wait until their policy meetings on 11th April and 9th May respectively before beginning to cut rates.

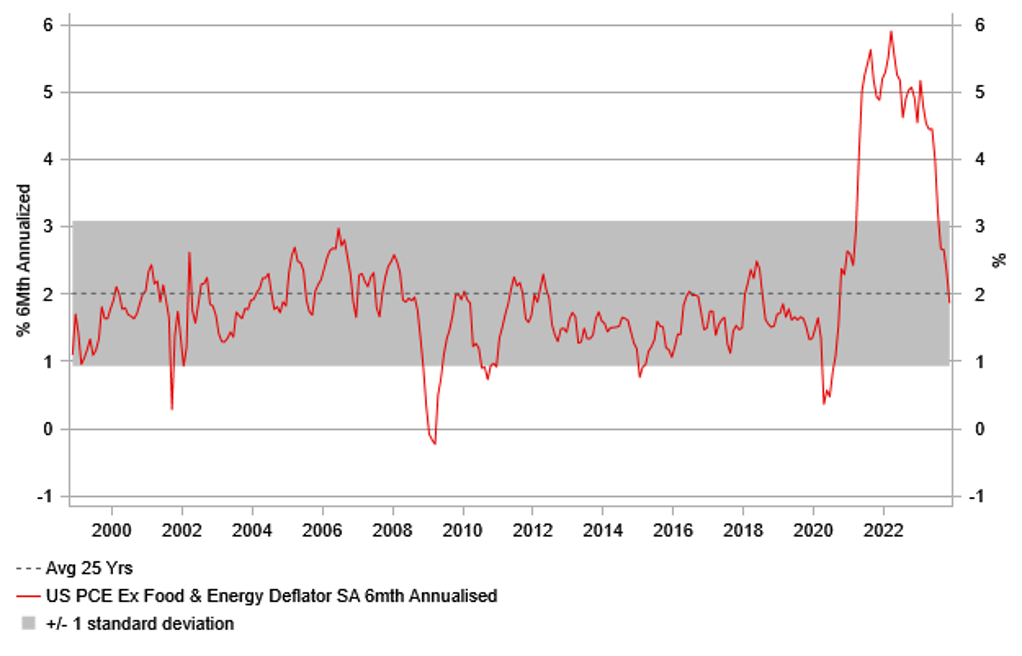

Recent comments from Fed officials that have attempted to pushback against rate cut speculation as soon as at the March FOMC meeting have had limited impact so far on market expectations. It has been hard for the Fed to pushback against expectations for earlier and deeper rate cuts next year when evidence continues to build that US inflation is slowing more quickly than expected even as economic growth has proven resilient. Investor optimism over a softer landing for the US economy was boosted further ahead of the holiday period by the release of the US PCE deflator report for November. The report provided further evidence that underlying inflation pressures continue to slow, and should give the Fed more confidence that inflation will return to their 2.0%. Over the last six months, the core PCE deflator which is the Fed’s preferred inflation gauge has increased by an annualized rate of just 1.9%. It marks a sharp slowdown from in the previous six months to the end of May when it had increased by an annualized rate of 4.5%. If inflation continues to slow at the start of next year, it will become harder for the Fed to justify keeping the policy at current restrictive levels.

SLOWING US INFLATION IS ENCOURAGING A WEAKER USD

Source: Macrobond

JPY: BoJ on course to exit negative rates but exact timing of 1st hike uncertain

The biggest mover in the FX market overnight has been the yen which has strengthened by around 0.5% against the US dollar. The next important support level for USD/JPY is provided by the low from 14th December at 140.97. It follows comments from BoJ Governor Ueda at the start of this week which Bloomberg has described as “preparing the ground for a rate hike” next year. Governor Ueda spoke with public broadcaster NHK yesterday and in those comments he indicated that “it is possible [for the BoJ] to make some decisions even if the bank doesn’t have the full results of the spring wage negotiations from small and middle-sized businesses”. It suggests that the BoJ may be less likely to wait until July to begin raising rates when more complete pay deal data is compiled by Rengo, Japan’s largest union federation. On the other hand, he also indicated that the BoJ is unlikely to be in a position to begin raising rates as soon as at the next policy meeting on 23rd January. He stated that the chances of having enough information to support a policy change in January were “not so high”, but refused to completely rule it out as a possibility.

The comments appear more consistent with the consensus view amongst Japanese economists for the BoJ to begin raising rates in April. A view shared by around two thirds of respondents in the latest Bloomberg poll. The likelihood of the BoJ raising rates as soon as in January in line with out own view has diminished recently. An earlier hike than April still can’t be ruled out though as Bloomberg notes, Rengo will release the initial results of annual spring pay negotiations known as shunto the week before the BoJ meets on 19th March. Last year Rengo announced on 17th March that 805 unions had secured a record 3.8% wage increase. The results from smaller firms were then subsequently incorporated into the final results in the following month which are scheduled to be unveiled this year on 4th April. When speaking to NHK yesterday, Governor Ueda stated that it was desirable to see wage gains that are “the same as this year or a little larger”. While the exact timing of the first rate hike remains uncertain, the direction of travel is clear. We continue to expect the BoJ to exit negative rate policy in the 1H of next year helping to reinforce the yen’s rebound from deeply undervalued levels. So far the recent rebound for the yen has been mainly driven by expectations that major central banks outside of Japan including the Fed will begin to cuts rates earlier and deeper next year helping to narrow policy divergences with the BoJ.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

US |

13:30 |

Goods Trade Balance |

Nov |

-88.40B |

-89.56B |

!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

210K |

205K |

!!! |

|

US |

15:00 |

Pending Home Sales (MoM) |

Nov |

1.0% |

-1.5% |

!!! |

Source: Bloomberg