March higher in yields beginning to bite

USD: Higher yields weighing on risk appetite

The relentless move higher in US yields continues but there are some signs now that the move is having a bigger impact on risk sentiment. That is not a surprise – the only uncertainty was when precisely that might happen. The S&P 500 closed down 1.5% yesterday, fuelled in large part by higher rates – the US 10-year UST bond yield hit another new high of 4.56% (but has corrected a little lower) taking the gain to 51bps from the intra-day low recorded on 1st September. The S&P 500 is now down 5.2% in September and is down 7.2% from the record intra-day high recorded on 27th July.

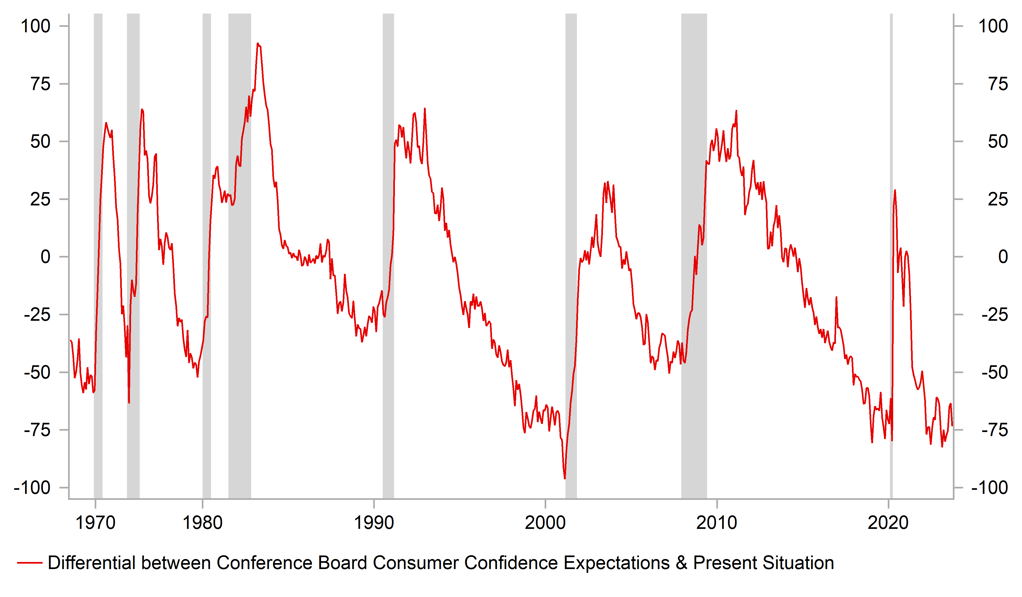

Two factors in addition to the ongoing climb in yields may have played a part in this equity market drop. Firstly, consumer sentiment deteriorated with a sharp drop in expectations. The drop in confidence (103.0 from 108.7) was less significant than the much larger drop in expectations. The present conditions index actually increased marginally. Expectations fell nearly 10pts (to 73.7) and when you compare the difference between the present conditions index and the expectations index, it is clear that the breakdown remains consistent with recessionary conditions. Further rises in gasoline prices and falls in equity markets would impact expectations further and begin to impact consumers’ appetite to spend. If yields continue to move higher, at some point relatively soon we will see even larger equity market declines and a hit to the main engine of the US economy – the consumer. We don’t know but possibly expectations could be dragged further lower as pandemic-related excess savings held by consumers dry up. The San Francisco Fed estimated a drop from over USD 2.0trn to as little as USD 190bn by June.

The second factor is the looming government shutdown. The 2018 government shutdown was the longest on record at 34 days and didn’t have much impact on the real economy or the markets. There were a host of global factors and Fed tightening that prompted a huge equity market plunge in December 2018 but the shutdown itself was not a significant factor. The dollar did drop by over 2.0% during that shutdown. A shutdown certainly doesn’t help sentiment and with 1mn government workers potentially impacted, it could start to impact if it drags on longer than in 2018. This shutdown is also expected to be more broad than in 2018. For now, the US dollar continues on its strengthening trend. It is very stretched though after the DXY recorded its tenth consecutive week of gains last week and perhaps a government shutdown that draws increasing attention might be the catalyst for at least a temporary correction. Still, an equity induced drop in yields seems a more plausible trigger for an FX reversal and the 10-year yield is now 5bps down from the high yesterday.

CONSUMER EXPECTATIONS DEPRESSED RELATIVE TO PRESENT CONDITIONS AND AT RECESSIONARY LEVELS

Source: Bloomberg, Macrobond & MUFG Research calculations

JPY & CNY: Opposition to currency weakness remains firm

Finance Minister Suzuki in Japan has again spoken on FX and confirmed that he’s monitoring FX “with a strong sense of urgency” after USD/JPY broke above the 149-level. The MoF are now speaking very frequently on yen moves and the words used are associated with a much higher risk of actual intervention. In our view, the primary impediment to action is the fact that the moves in FX are not “rapid” and certainly not “disorderly” and to intervene now would merely reinforce the impression of defending a level (150.00) rather than to fight against volatility.

There is limited signs of speculation as well. Certainly the weekly data from IMM does not reveal any increased appetite for selling JPY at these levels. In addition, while the yen is underperforming, the move in the BoJ NEER has seen only modest weakness and is down just 0.6% so far in September. We continue to see a high chance of intervention but only after a break above the 150-level when there is a higher chance of stops fuelling volatility and “disorderly” price action that would provide the justification for the MoF to intervene.

The authorities in China have also upped their rhetoric opposing CNY weakness as well. Actions to curtail upside moves in USD/CNY would certainly help Tokyo in their battle to limit JPY weakness. The PBoC released a statement today underlining its commitment to keep the FX rate “basically stable” and would “resolutely correct one-sided and pro-cyclical behaviours”. Bloomberg also cited traders in the onshore FX market as seeing heavy US dollar selling by China state banks while state banks’ overseas branches have been curtailing CNH lending to tighten liquidity and support the currency offshore. There appears to be no let-up in CNY support measures despite the further broad strengthening of the dollar.

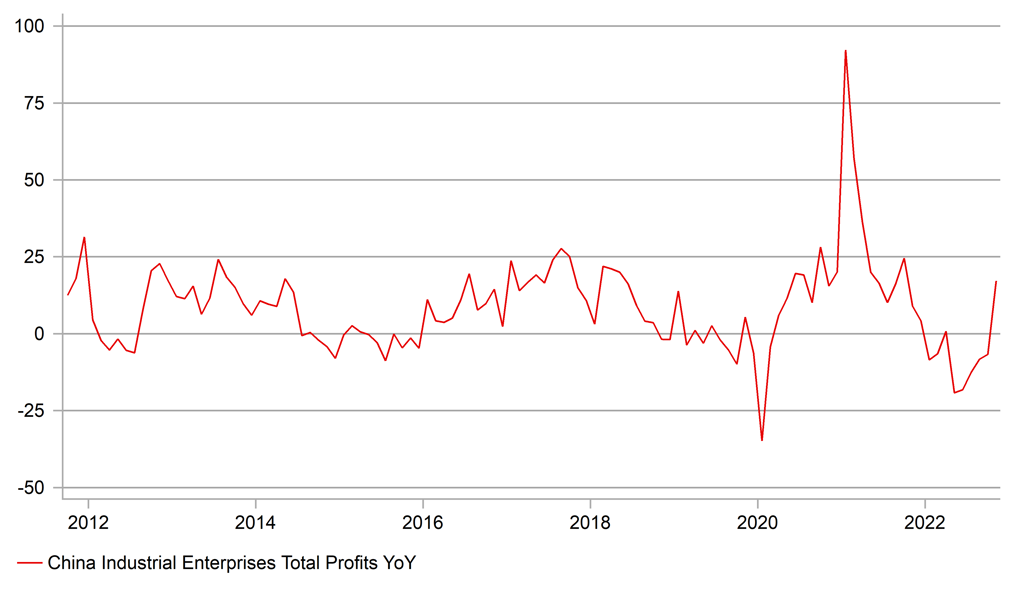

These efforts would have been helped by the release today of some positive economic data. Chinese industrial profits increased 17.2% on an annual basis in August – the first positive annual reading in over a year and a sign that economic activity may be stabilising. Industrial production also picked up in August adding to the possibility that policy support measures may be helping to support growth. We see the risks still skewed to the upside for both USD/JPY and USD/CNY given the US dollar momentum but opposition to currency weakness in Tokyo and Beijing remains firm.

CHINA INDUSTRIAL PROFITS REBOUND

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SZ |

09:00 |

ZEW Expectations |

Sep |

-- |

-38.6 |

! |

|

EC |

09:00 |

M3 Money Supply (YoY) |

Aug |

-1.0% |

-0.4% |

! |

|

EC |

09:00 |

Loans to Non Financial Corporations |

Aug |

-- |

2.2% |

! |

|

EC |

09:00 |

Private Sector Loans (YoY) |

-- |

1.2% |

1.3% |

! |

|

IT |

10:10 |

Italian 6-Month BOT Auction |

-- |

-- |

3.829% |

! |

|

GE |

10:30 |

German 10-Year Bund Auction |

-- |

-- |

2.630% |

!! |

|

FR |

11:00 |

France Jobseekers Total |

-- |

-- |

2,816.6K |

! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

5.4% |

! |

|

EC |

13:00 |

ECB's Enria Speaks |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Core Durable Goods Orders (MoM) |

Aug |

0.1% |

0.5% |

!!! |

|

US |

13:30 |

Durable Goods Orders (MoM) |

Aug |

-0.5% |

-5.2% |

!! |

|

US |

13:30 |

Durables Excluding Defense (MoM) |

Aug |

-- |

-5.5% |

! |

|

US |

13:30 |

Goods Orders Non Defense Ex Air (MoM) |

Aug |

0.0% |

0.1% |

!!! |

|

SZ |

14:00 |

SNB Quarterly Bulletin |

-- |

-- |

-- |

! |

|

SZ |

17:45 |

SNB Chairman Thomas Jordan speaks |

-- |

-- |

-- |

!!! |

|

US |

18:00 |

5-Year Note Auction |

-- |

-- |

4.400% |

!! |

Source: Bloomberg