JGB yield plunge prompts renewed yen selling

JPY: JGB issuance plans could be altered

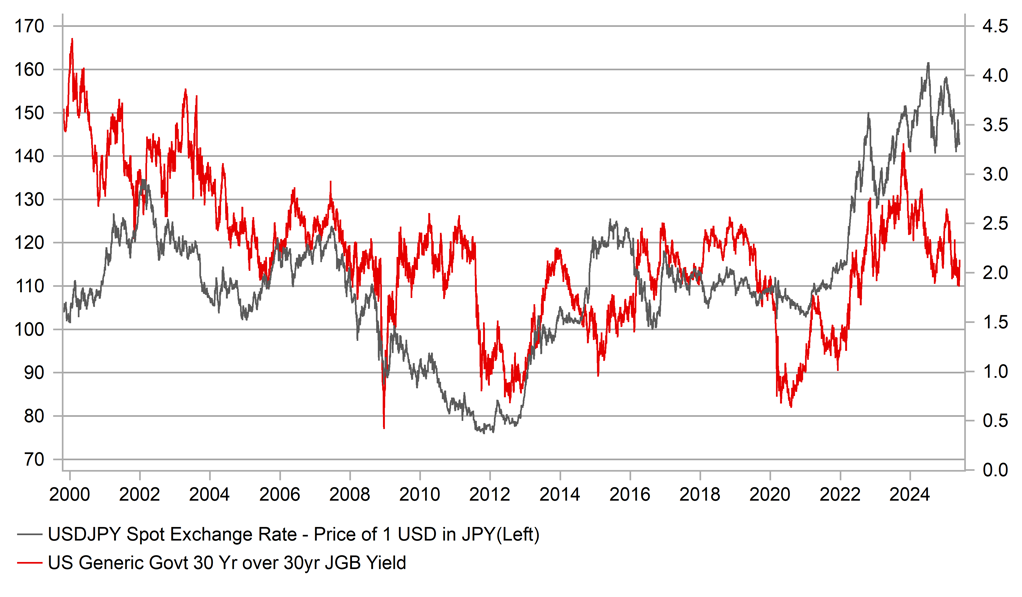

USD/JPY has jumped by over one big figure from the intra-day low earlier in Tokyo trading in response to a sharp plunge in super-long JGB yields following the news that the MoF was considering a change to its issuance plans in order to help support JGB prices at the long-end of the curve. From the closing low following the turmoil when the reciprocal tariff plans were announced in April, the 30-year JGB yield has jumped 90bps to a closing high of 3.18% last week. From that high the yield is now down 34bps following a 22bp drop today. The MoF today sent a questionnaire to JGB market participants relating to appropriate issuance amounts and general questions about the current market situation. Bloomberg is reporting that the questionnaire went to an unusually large number of market participants. The action may well reflect increased concerns over yields following the poor 20-year auction last week and ahead of a 40-year bond auction tomorrow. The Nikkei is also reporting that the MoF will hold a meeting with primary dealers on 20th June with the topic being the recent large jump in super-long yields and is set to cut issuance of super-longs to limit a repeat move.

While it is understandable to see the yen weaken given the scale of the JGB yield drop at the long-end of the curve, the sustainability of the FX move will depend on a number of factors, including the monetary stance of the BoJ, Fed policy expectations, broader financial market conditions and questions over confidence in US assets.

In the context of the BoJ, the comments today from Governor Ueda at a BoJ hosted conference are important. Ueda sounded a bit more confident in his communications that the BoJ would hike rates further given the BoJ continues to expect underlying inflation to move toward the 2% target in the second half of the outlook period. Maintaining the view that the inflation target will be achieved will ensure that rates pricing will remain skewed to tightening ahead. The OIS curve for BoJ policy expectations currently shows 16bps of tightening by year-end – that’s unique across the G10. Given overall US dollar sentiment is likely to remain negative, we doubt this JGB yield move will be the catalyst for any sustained yen selling. The move higher could well have further to run given the scale of JGB yield drop but we suspect yen buyers will return to the market at weaker levels given poor US dollar sentiment, Trump’s unpredictable trade policies and the prospect of Fed rate cuts later this year.

30-YEAR US-JP SPREAD STILL POINTS TO NOTABLE USD/JPY DECLINE

Source: Bloomberg, Macrobond & MUFG GMR

EUR: President Trump delays higher tariffs on the EU again

The US dollar earlier today extended its sell-off at the start of this week resulting in the dollar index falling back below the 99.000-level, and moving closer to the year to date low of 97.921 recorded on 21st May. US dollar selling has been encouraged by further trade US policy uncertainty triggered by another u-turn from President Trump. On Friday he threatened to impose a 50% tariff on all imports from the EU effective from 1st June. However, President Trump has quickly agreed to delay the deadline for the EU until 9th July after a phone call with EU Commission President Ursula von der Leyen over the weekend. He referred to the call as a “very nice call”. EU commission President Ursula von der Leyen had earlier posted that “Europe is ready to advance talks swiftly and decisively” in the period to 9th July. It is the same date as the initial 90-day delay for higher 20% “reciprocal tariff” rate which was due to come to an end. In the interim, the US will continue to impose the lower 10% universal tariff rate on all imports from the EU in addition to the 25% tariffs on autos & parts, and on steel & aluminium. The EU and US will now continue to work towards some form of trade agreement before 9th July deadline to avoid the higher “reciprocal tariff” rate being put in place if no satisfactory deal is reached in time although it is unclear now whether a 20% or 50% tariff rate would be applied.

The EU sounds optimistic that it can avoid the higher tariff rate. Paula Pinho who is a spokesperson for the EU stated that “there’s now a new impetus for negotiations” and they have both “agreed to fast track the trade negotiations and stay in close contact”. Bloomberg has previously reported that the US last week rejected a proposal sent by the European Commission offering to jointly remove tariffs on industrial goods, to boost access or some American agricultural products and to co-develop AI data centres. US Deputy Treasury Secretary Michael Faulkender told Fox News that the US faces a “simultaneous challenge” of negotiating with the EU as a bloc on tariffs while also seeking to address most of these non-tariff barriers in talks with individual European countries creating a “negotiating problem”. In response the EU has largely refrained from retaliating against higher tariffs imposed by the US. So far the EU has only approved tariffs on EUR21 billion of US goods in response to US tariffs on steel & aluminium, but is also reportedly preparing an additional list of tariffs on EUR95 billion of US goods in response to “reciprocal tariffs” and on autos. The quick de-escalation of trade tensions over the weekend has provided encouragement that a more disruptive trade war can still be avoided between the EU and US.

Bloomberg have estimated that if the 50% tariff was implemented on the EU it could cut total EU exports to the US by more than half and increase the risk of sharper slowdown/recession for the euro-zone economy depending on how long the tariffs would remain in place. The EUR initially weakened after the tariff threat on Friday resulting in EUR/USD falling briefly back below the 1.1300-level but has since reversed all of those losses. The euro-zone rates market also moved initially to price in a higher probability of the ECB delivering three rather than two more rate cuts this year. The relative resilience of the EUR reflects a number of factors including optimism that President Trump will not fully follow through on threats to impose higher tariffs, and the loss of confidence in US policymaking that it is hurting the USD more broadly as we highlighted in our latest FX Weekly report (click here). Bloomberg also estimated that a 50% tariff on the EU could hit US GDP by close to 0.6% and lift inflation by 0.3%.

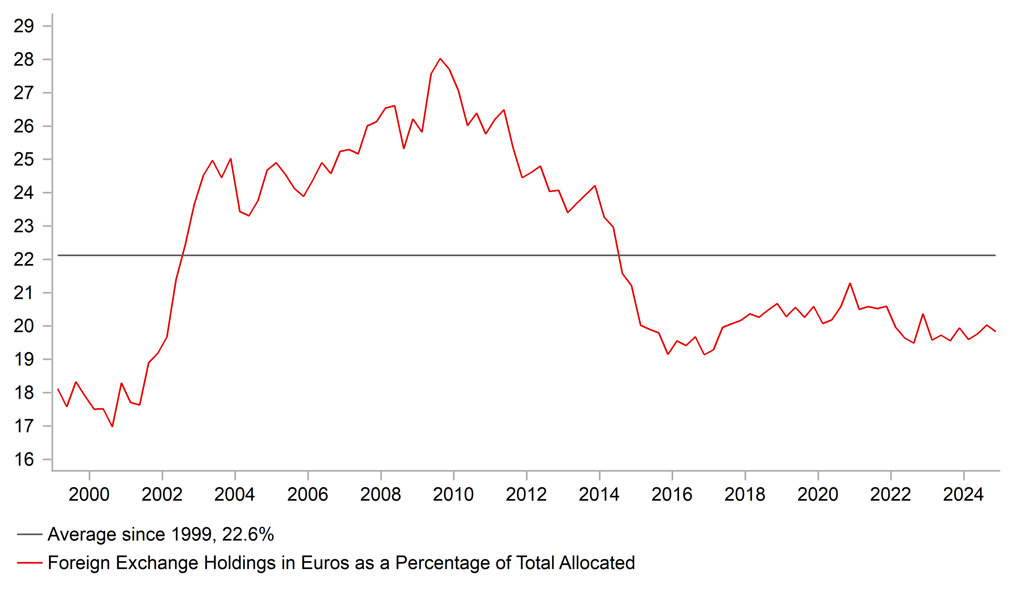

ECB President Lagarde gave a speech yesterday in Berlin and the focus was very much on the prospect of the euro increasing its global role as a reserve currency. Lagarde described President Trump’s erratic policies as a “prime opportunity” to strengthen the EUR’s international role and allow the euro-zone to enjoy more of the privileges reserved for the US including lower borrowing costs as well as protection from currency fluctuations and sanctions. She did stress though that the opening for a “global euro moment” will have to be earned. She urged a “a solid and credible geopolitical foundation by maintaining a steadfast commitment to open trade and underpinning with security capabilities. Secondly, she repeated calls to complete the single market, help start-ups, reduce regulation and build a savings and investment union where progress has been slow. Finally, she added that there should be more joint financing at the European level for measures including defence creating a deeper pool of liquid securities for international investors to tap into. Confidence in the EUR from reserve mangers was undermined by the euro-zone debt crisis and the ECB’s shift to negative rate policy which resulted in the EUR’s share of reserves falling from a peak of just over 28% in Q3 2009 to just under 20% according to the IMF. The EUR has been benefitting recently from the loss of confidence in the USD given it is the most liquid alternative.

EUR COMPOSITION IN GLOBAL FX RESERVES HAS BEEN STABLE BUT SCOPE THERE TO INCREASE BACK TO PRE-GFC HIGHS

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

US |

09:00 |

Fed's Kashkari speaks at BoJ Event |

!!! |

|||

|

EC |

10:00 |

Consumer Confidence |

May F |

-- |

-15.2 |

! |

|

EC |

10:00 |

Economic Confidence |

May |

94.1 |

93.6 |

! |

|

EC |

10:00 |

Industrial Confidence |

May |

-10.5 |

-11.2 |

! |

|

EC |

10:00 |

Services Confidence |

May |

1 |

1.4 |

! |

|

UK |

11:00 |

CBI Total Dist. Reported Sales |

May |

-- |

-26 |

!! |

|

UK |

11:00 |

CBI Retailing Reported Sales |

May |

-- |

-8 |

!! |

|

US |

13:30 |

Durable Goods Orders |

Apr P |

-7.80% |

9.20% |

!! |

|

US |

13:30 |

Durables Ex Transportation |

Apr P |

0.00% |

0.00% |

!! |

|

US |

13:30 |

Cap Goods Orders Nondef Ex Air |

Apr P |

-0.10% |

0.10% |

!!! |

|

US |

13:30 |

Cap Goods Ship Nondef Ex Air |

Apr P |

-0.10% |

0.20% |

!! |

|

US |

14:00 |

S&P CoreLogic CS 20-City MoM SA |

Mar |

0.20% |

0.40% |

! |

|

US |

14:00 |

S&P CoreLogic CS 20-City YoY NSA |

Mar |

4.50% |

4.50% |

! |

|

US |

14:30 |

Fed's Barkin speaks |

!! |

|||

|

US |

15:00 |

Conf. Board Consumer Confidence |

May |

87.1 |

86 |

!!! |

|

US |

15:00 |

Dallas Fed Manf. Activity |

May |

-23.1 |

-35.8 |

! |

|

EC |

17:00 |

ECB's Nagel speaks |

!! |

Source: Bloomberg & Investing.com