Reciprocal tariff risks receding

USD: Risks of volatile summer could be receding

Fed speculation on monetary easing and mixed US data hit the dollar yesterday (see below) but there has been limited follow-through of US dollar selling today with the FX markets broadly stable. The US dollar has recouped some of yesterday’s losses and one key development at about 10pm BST last night was a Bloomberg TV interview with Commerce Secretary Howard Lutnick in which he made clear that notable progress was being made in reaching trade deals with other countries. The US has signed an agreement with China based on the outline agreed in Geneva while the administration is working on finalising deals with 10 trading partners. This was always going to be the most plausible way for the reciprocal tariffs scheduled for 9th July to be watered down in terms of global impact and we feel 10 deals is beyond what the markets were anticipating.

At this stage these deals are unlikely to be comprehensive but that is irrelevant for now – the key for the markets is that a scenario of full implementation of the tariffs announced on ‘Liberation Day’ is avoided. There was even good news in relation to the EU with Lutnick stating he was more optimistic and that Europe had done “an excellent job” in negotiations. A deal with India was also mentioned as being close.

There was also good news in relation to Section 899 with the Treasury announcing a deal with G-7 partners to remove OECD Pillar Two taxes in exchange for dropping Section 899 from the One Big Beautiful Bill.

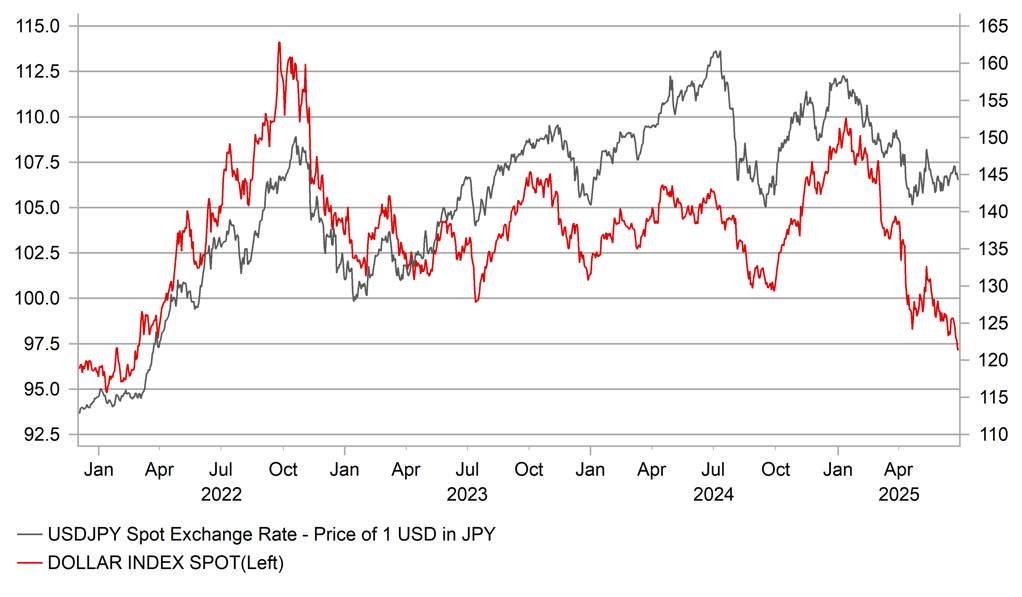

So what does this all mean for the dollar? Well based on the selling of the dollar earlier on reciprocal tariffs and the hit to confidence due to Section 899, these developments could be viewed as dollar positive. But the rebound for the dollar has been marginal. Market participants may want to see more of these deals formalised first and in any case nobody doubts the ideological views of the administration – to shrink the record trade deficit, and tariffs and dollar depreciation help. Part of the sell-off of the dollar is due to the unpredictability of policy from Washington and that is unlikely to change. In addition, the global outlook is a little better today and that will curtail the selling of non-dollar currencies. Expectations of a slowing US economy and Fed rate cuts will also curtail dollar buying. If Japan is included in these 10 deals it leaves the BoJ in a much better position to hike rates this year, which is not priced (just 3bps for September) and even following today’s weaker CPI data, the BoJ is likely to hike if international conditions permit. The DXY is back at March 2022 levels but USD/JPY remains considerably above March 2022 levels (116.00/117.00) underlining scope for some catch-up. Receding reciprocal tariff risks is a positive development, but policy uncertainties from Washington and expectations of a more active Fed in cutting rates will limit the scope of the dollar rebound.

USD/JPY / DXY DIVERGENCE RELATIVE TO MARCH 2022

Source: Bloomberg, Macrobond & MUFG GMR

USD: Softer US data keeps dollar negative momentum going

The Wall Street Journal article reporting President Trump was considering an early announcement of his replacement of Fed Chair Powell (has since been denied), who doesn’t leave his post until May next year, got the dollar off to a bad start yesterday and the data released from the US certainly helped to reinforce that negative momentum. Speculation of the Fed easing sooner or ultimately by more had begun to influence rates and FX before the WSJ article and this really is the root of the leg lower for the dollar. Fed Governors Waller and Bowman explicitly mentioned the possibility of cutting in July while Fed President Goolsbee suggested “burden sharing” of the tariff hit could see the CPI impact being less than expected. Powell in testimony spoke of cutting “sooner rather than later” if inflation is contained and the labour market weakens. The response in the US rates market has been to see rates come down more notably in 2026 with the end-2026 fed funds level now back close to 3.00% - from 6th June, the Dec 2026 fed funds future has seen the implied fed funds drop 35bps. Over the same period, the July 2025 fed funds future has barely moved. July could still be in play, but the real impact of the comments from Fed officials has been further out. That has helped reinforce dollar selling.

The data yesterday certainly was consistent with the move in rates and FX. The GDP data is of course backward looking but the weakness in consumer spending does change the perception of resilience in consumption. That weaker gain in Q1 of just 0.5% Q/Q SAAR versus a previous estimate of 1.2% could have forward-looking implications depending on the monthly pattern, more of which we will know today when we get the June real spending data. If the weakness reflected in GDP is more pronounced in June it leads to a negative follow-through effect heading into Q3 (the Q2 average is higher than the July starting point).

The potential cracks appearing in the labour market was also evident in the continued claims print yesterday. Initial claims did drop by 10k to 236k but continued claims increased again indicating those laid off are taking longer to find new employment. The increase was 37k to 1.974mn. Continued claims are approaching the 2mn mark, a level not seen since November 2021.

It won’t take much for the market pricing for Fed easing to shift more convincingly to price a July cut. The payrolls report, next Thursday, if weaker than expected would be one requirement met for that and then a weak CPI report on 15th July would be the other. The OIS market is now priced at 60% that the Fed will cut by 25bps three times this year – that pricing could continue to drift higher without a July cut and would help keep the dollar momentum negative.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Business Confidence |

Jun |

87.0 |

86.5 |

! |

|

IT |

09:00 |

Italian Consumer Confidence |

Jun |

97.0 |

96.5 |

! |

|

EC |

10:00 |

Business and Consumer Survey |

Jun |

95.1 |

94.8 |

! |

|

EC |

10:00 |

Consumer Confidence |

Jun |

-15.3 |

-15.1 |

! |

|

EC |

10:00 |

Services Sentiment |

Jun |

1.6 |

1.5 |

! |

|

EC |

10:00 |

Industrial Sentiment |

Jun |

-9.9 |

-10.3 |

! |

|

US |

12:30 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!!! |

|

US |

13:30 |

PCE Price index (YoY) |

May |

2.3% |

2.1% |

!! |

|

US |

13:30 |

PCE price index (MoM) |

May |

0.1% |

0.1% |

!! |

|

US |

13:30 |

Core PCE Price Index (YoY) |

May |

2.6% |

2.5% |

!!!! |

|

US |

13:30 |

Core PCE Price Index (MoM) |

May |

0.1% |

0.1% |

!!!!! |

|

US |

13:30 |

Personal Income (MoM) |

May |

0.3% |

0.8% |

! |

|

US |

13:30 |

Personal Spending (MoM) |

May |

0.1% |

0.2% |

!! |

|

US |

13:30 |

Real Personal Consumption (MoM) |

May |

-- |

0.1% |

!!! |

|

CA |

13:30 |

GDP (MoM) |

Apr |

0.0% |

0.1% |

!! |

|

US |

14:15 |

Fed Governor Cook Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

Michigan 1-Year Inflation Expectations |

Jun |

5.1% |

6.6% |

!!! |

|

US |

15:00 |

Michigan 5-Year Inflation Expectations |

Jun |

4.1% |

4.2% |

!!! |

|

US |

15:00 |

Michigan Consumer Sentiment |

Jun |

60.5 |

52.2 |

!! |

Source: Bloomberg & Investing.com