JPY strengthens after release of CPI report from Japan

JPY: BoJ rate hike speculation continues to build after stronger CPI report

The major foreign exchange rates have continued to trade in tight ranges at the start of this week. After hitting a high yesterday at 150.84, USD/JPY has fallen back below 150.50 overnight following the release of the stronger than expected CPI report from Japan. The report revealed that both headline and core inflation measures slowed less than expected in January. Headline inflation slowed by 0.4 percentage point to 2.2%, and the Japanese style core inflation (excluding fresh food) by 0.3 percentage point to 2.0%. According to Bloomberg, the main reason for the upside surprise was a jump in prices of foreign tour packages (+62.9%Y/Y) which were compared with the level four years earlier rather than a year earlier. The Ministry of Internal Affairs and Communication explained that the base of comparison for prices was January 2020 after they had stopped surveying prices for the past three years due to difficulties in collecting stable price data during the COVID period. The one-off technical factor contributed to the higher inflation readings in January, and will dampen the BoJ’s hawkish reaction to the CPI report.

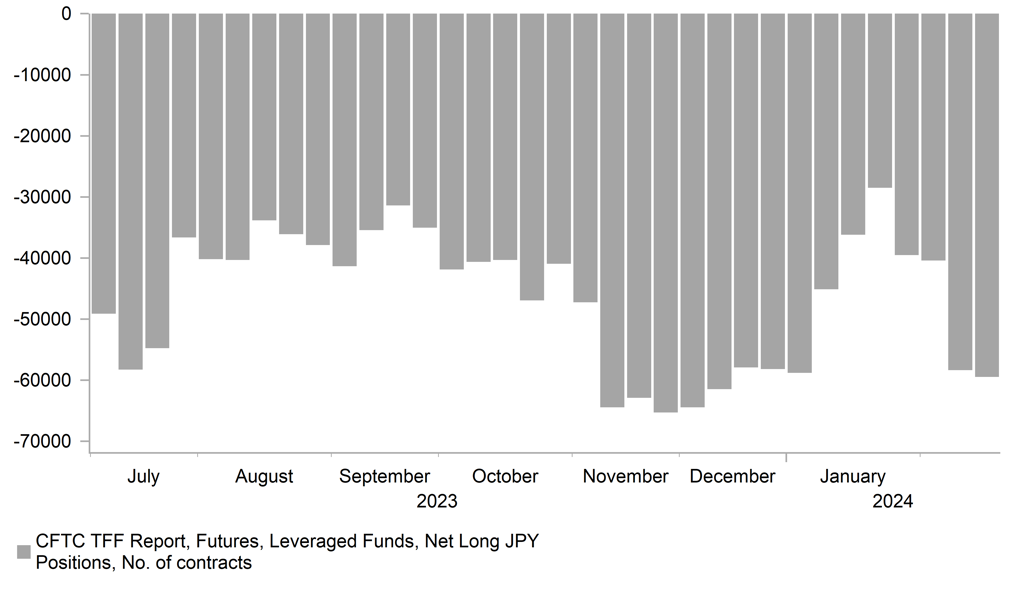

Nevertheless, we still believe that the BoJ is setting the stage for an exit from negative rates which could come as early as at the next policy meeting in March. Short-term interest rates in Japan have been moving higher driven by building speculation over BoJ rate hikes. The yield on the 2-year JGB has risen from a low at 0.0% in mid-January to a fresh high overnight at 0.18% which is the highest level since the middle of 2011. In our latest FX Weekly report (click here), we highlighted why we thought the BoJ would have more confidence in the prospects of achieving price stability. Last week Governor Ueda spoke in the Diet and provided a more upbeat and confident message stating that he believed the virtuous cycle of higher wages and inflation would strengthen. He added that “signs have been observed that businesses are becoming more active when deciding wages as labour demand tightens”. He stated that “companies in Japan will be more aggressive than ever”. Our sense is that the BoJ’s confidence in relation to wage increases is strengthening and if they are being swayed by their own incoming information they may well decide in March to hike. The weaker yen could also play a role in their decision. An earlier rate hike could help to reduce the risk of the yen weakening further in the current environment which is encouraging the establishment of yen-funded carry trades. The latest IMM report revealed that leveraged funds have sharply increased yen short positions this month.

SPECULATIVE YEN SELLING HAS PICKED UP AGAIN IN RECENT WEEKS

Source: Bloomberg, Macrobond & MUFG GMR

EUR: What is helping to provide more support for the euro?

The euro has continued to strengthen modestly against the US dollar at the start of this week resulting in the pair closing back above the 200-day moving average yesterday at around 1.0830 for the first time since the start of this month. After hitting a low of 1.0695 on 14th February, EUR/USD has been gradually grinding higher. The price action highlights that the euro is finding more support again now that it has fallen back into the middle of last year’s narrow trading range between 1.0500 and 1.1000.

We believe that the euro is deriving support from a number of favourable developments. Firstly, the euro-zone rate market has been pushing back the timing of the first ECB rate cut. The timing of the first ECB rate cut is now judged as more likely to be delivered in June rather than April (there is now only around 9bps of cuts priced in by then). At the same time, the total amount of ECB rate cuts priced in by year end has fallen back to around 88bps. The hawkish repricing of short-term euro-zone rates has been encouraged by recent comments from ECB officials indicating that they want to see further evidence that wage growth is continuing to slow at the start of this year before deciding to cut rates. While it does not rule out a rate cut as soon as April, it makes a June cut more likely as the ECB will have more inflation on wage developments in Q1 by that point in time. The developments are helping to ease downward pressure on the euro in the near-term.

Secondly, there have been some encouraging developments that are helping to ease concerns over the growth outlook in the euro-zone. The price of natural gas in Europe is continuing to fall, and has fallen back to its lowest level since the middle of 2021. It makes us more confident that the negative shock to the euro-zone economy will continue to ease in the year ahead which supports our expectations for a pick-up in growth in the 2H of this year as inflation continues to slow back to the ECB’s target. The latest PMI surveys from the euro-zone are already showing a pick-up in business confidence in the service sector. The February reading of 50.0 was the highest level since July of last year. At the same time, there is building optimism over the global inventory cycle that could be indicating a potential pick-up in global trade going forward which would be a supportive development for the euro-zone economy. Finally, the recent easing of investor pessimism over China’s economy has been lifted by fresh stimulus measures which is also helping to ease near-term selling pressure for the euro. The upcoming National People’s Congress in March is a potential positive catalyst should more stimulus measures be announced.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

M3 Money Supply (YoY) |

Jan |

0.3% |

0.1% |

! |

|

US |

13:30 |

Durable Goods Orders (MoM) |

Jan |

-4.7% |

0.0% |

!! |

|

UK |

13:40 |

MPC Member Ramsden Speaks |

-- |

-- |

-- |

!! |

|

US |

14:00 |

House Price Index (MoM) |

Dec |

0.3% |

0.3% |

! |

|

US |

15:00 |

CB Consumer Confidence |

Feb |

114.8 |

114.8 |

!!! |

Source: Bloomberg