USD short position squeeze could have further to run

USD: Market is not positioned for stronger US data

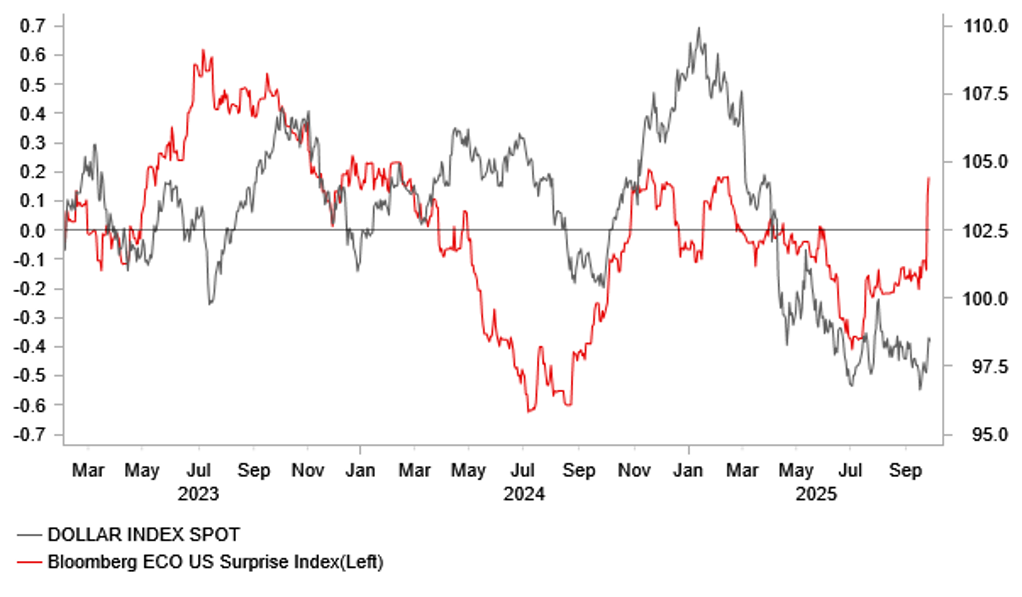

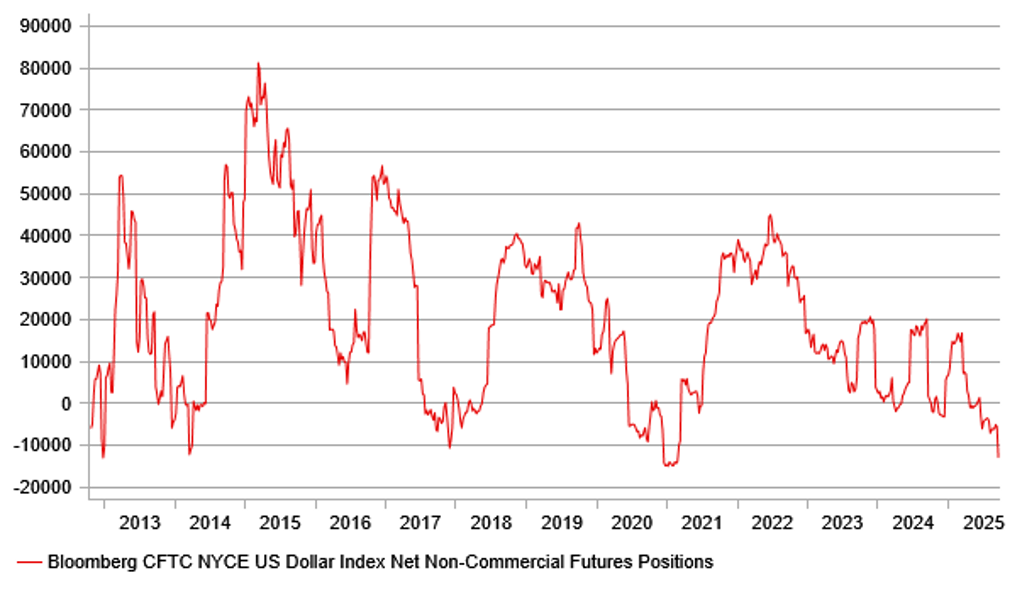

It’s been some time since US data has surprised to the upside and driven both yields and the US dollar higher but the data yesterday and on Wednesday certainly did surprise to the upside and given positioning has been so skewed of late toward weakening economic data in the US we have seen a notable rebound for the dollar just when volatility is hitting new lows in FX and bonds. The Bloomberg Economic Surprise Index below highlights the scale of upside surprise and the data certainly adds to the importance of the labour market data next week. Further strength in labour market data would add to the surprise and likely see a further position squeeze in FX. The second chart below shows the CFTC non-commercial US dollar positioning, which in the latest week revealed the biggest dollar short position since early 2021.

We would be surprised to see a sudden turnaround in the labour market and after the scale of weakness reported in recent weeks, including the near-1mn benchmark downward revision, it is unlikely we will see a turnaround when you consider that the monetary stance in the US remains restrictive. But from month to month of course it is difficult to predict NFP data and following the upside surprises this week any positive data next week would certainly reinforce the current positive momentum for the dollar. Short-term risks have certainly shifted following the data-driven rebound of the dollar with the dollar highs from the start of August in sight.

While an argument can be made that the revised GDP data relates to backward looking performance as far back as Q2, the initial claims data is more telling in that it points to evidence that the labour market is not deteriorating markedly and while labour demand has clearly weakened, there remains limited evidence of a pick-up in firing. A jump in Texas claims due to fraud that previously lifted claims reversed but still only accounted for half the drop. Initial claims now are at the lowest level in two months. The durable goods orders data also points to activity holding up, possibly helped by easing uncertainty related to trade.

If the labour market data was to prove better than expected next week, it would certainly undermine the primary argument put forward by Fed Chair Powell to cut rates further and force the Fed to give more weight to the upside inflation risks. We should now expect FX and rates to be much more sensitive to incoming labour market data next week. Market pricing now implies an 80% probability of a cut in October and 80% probability of two cuts this year. Stephen Miran yesterday again called for faster rate cuts given policy is “excessively restrictive” but he could be further isolated if we see more data like we saw yesterday and Wednesday (new home sales +20% MoM). If the market was to remove one of the two cuts for this year from market pricing, we could well see EUR/USD drift further lower to 1.15-1.16 area (based on an assumed EU-US spread move). Still, a sustained rebound in activity still seems unlikely to us and hence we see limited scope for dollar gains to extend beyond a further 1%-2% from here.

US ECONOMIC SURPRISE INDEX HAS SURGED – WILL USD FOLLOW

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Inflation drop won’t necessarily deter BoJ from hiking

The Tokyo CPI data for September was released earlier today and certainly based on the headline readings point to stronger disinflationary forces that could allow the BoJ to continue pushing back the timing of the next rate hike. The headline rate was expected to jump from 2.5% to 2.8% but instead remained unchanged at 2.5%. However, there is an important technical factor that will likely diminish the significance of this weaker data. The Tokyo metropolitan government’s scrapping of childcare fees for first-born children shaved 0.28ppt off the headline rate was the primary factor in the drop. That policy step saw services CPI from 2.0% to 1.5%. Food inflation remained elevated but did slow from 7.4% to 6.9%, still high enough to continue to be a source of anger amongst voters.

Does this data alter the prospects of a rate hike by the BoJ being realised before the end of the year? Given the technical factor, probably not. Furthermore, we believe FX could start to play an increasing role in the near-term decision-making by the BoJ. The USD/JPY rate is now around the key 150-level and for the yen to weaken further through that 150-level would be seen in Japan as increasing the prospects of the cost of living crisis extending further. Let’s not forget, the LDP has done poorly in the last two elections because of inflation. The dollar is currently stronger due to signs of resilience of the US economy and global equities remain close to record highs so the argument for caution by the BoJ is certainly weaker. USD/JPY trading over the 150-level as a new LDP leader becomes prime minister would intensify pressure on the BoJ to act. As was highlighted by a BoJ policy board member in the minutes of the BoJ meeting in July, there is a risk of being too cautious and missing the opportunity to raise the key policy rate.

The minutes of the meeting we believe didn’t get the attention deserved and our take is that the minutes revealed a policy board that is moving toward a rate hike. The section discussing monetary policy revealed, by our count, as many as five who expressed increased support in considering a rate increase. Two of those (Takata & Tamura) went on to vote for a hike this month but three others shifted in that direction in July. If Governor Ueda considers a rate hike as appropriate in October, the July minutes point to there being wider support for that. Today’s inflation is unlikely to alter that but the move weaker for the yen will only reinforce the signs of building support for a rate hike.

SHORT USD POSITIONING REACHING EXTREME

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Business Confidence |

Sep |

87.5 |

87.4 |

! |

|

IT |

09:00 |

Italian Consumer Confidence |

Sep |

-- |

96.2 |

! |

|

EC |

10:30 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!!! |

|

US |

13:30 |

PCE Price index (YoY) |

Aug |

2.7% |

2.6% |

!!! |

|

US |

13:30 |

PCE price index (MoM) |

Aug |

0.3% |

0.2% |

!!! |

|

US |

13:30 |

Core PCE Price Index (MoM) |

Aug |

0.2% |

0.3% |

!!!! |

|

US |

13:30 |

Core PCE Price Index (YoY) |

Aug |

2.9% |

2.9% |

!!! |

|

US |

13:30 |

Personal Income (MoM) |

Aug |

0.3% |

0.4% |

! |

|

US |

13:30 |

Personal Spending (MoM) |

Aug |

0.5% |

0.5% |

!! |

|

US |

13:30 |

Real Personal Consumption (MoM) |

Aug |

-- |

0.3% |

!! |

|

CA |

13:30 |

GDP (MoM) |

Jul |

-- |

-0.1% |

!! |

|

CA |

13:30 |

GDP (MoM) |

Jul |

0.1% |

-0.1% |

!! |

|

CA |

13:30 |

Wholesale Sales (MoM) |

Aug |

-- |

1.2% |

! |

|

US |

14:00 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

Michigan 1-Year Inflation Expectations |

Sep |

4.8% |

4.8% |

!! |

|

US |

15:00 |

Michigan 5-Year Inflation Expectations |

Sep |

3.9% |

3.5% |

!! |

|

US |

15:00 |

Michigan Consumer Sentiment |

Sep |

55.4 |

58.2 |

!! |

|

US |

18:00 |

FOMC Member Bowman Speaks |

-- |

-- |

-- |

!! |

|

US |

23:00 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg & Investing.com