Real yield plunge in Japan driving JPY weaker

JPY: Inflation expectations add to JPY selling

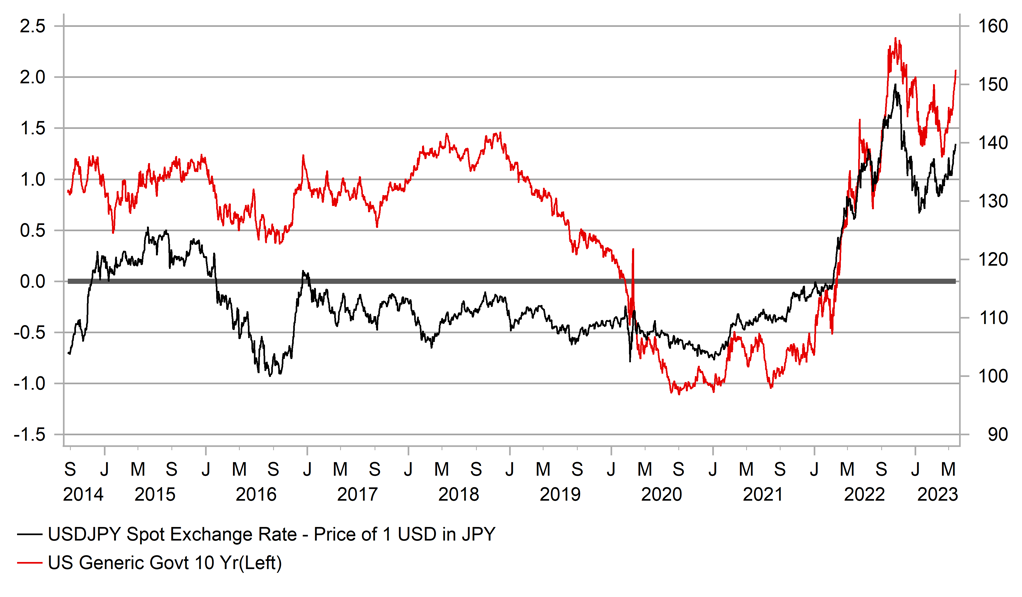

The rise in US yields (over 85bps from the low in early May) has been a key catalyst for the scale of rebound in USD/JPY this month. The move has caught us by surprise – we certainly didn’t expect such a rebound in short-term US rates. But there have been some surprises on the Japan side this month as well. Today, we had the release of the Tokyo CPI data and while there are signs of overall and core CPI topping out, the core-core CPI rate continues to advance higher. The Tokyo core-core CPI YoY rate accelerated from 3.8% to 3.9% in May, the highest level since 1982.

The data is further strengthening the expectations in Japan that there are some real fundamental changes taking place. Japan cross-border weekly flow data released yesterday revealed another large purchase of Japan equities by foreign investors – JPY 868bn worth last week after JPY 808bn of buying the week before. Incredibly, in the last seven weeks alone, foreign investors have purchased around JPY 7trn worth of Japan equities (USD 50bn), a record total over that period. This is creating a negative loop for the yen by driving real yields lower again. With the Topix Index at close to a 33yr high, the equity market surge is helping fuel a rebound in inflation expectations. The 10yr breakeven rate in Japan has rebounded and is approaching the cyclical high just over 1.00%. Japan land prices also recorded a gain in 2022 of 1.6%, the second consecutive year of increase and the biggest gain since before the Global Financial Crisis. 58% of locations in Japan saw price increases versus 44% the previous year underlining the broadening of price increases. More sustained asset price gains in Japan will certainly help to shift inflation expectations more meaningfully.

With US core CPI now falling on a sustained basis, the real 10yr government bond yield spread has rebounded sharply as can be seen in the chart above and this is certainly one key catalyst for the rebound in USD/JPY. It has been somewhat surprising that USD/JPY has not shown much in the way of responding to debt ceiling risks but the domestic developments in Japan help explain this.

Governor Ueda is now beginning to acknowledge these changes. In a Wall Street Journal article he stated that “there appear to be moves leading towards sustainable inflation”. But Ueda’s push-back on YCC at the April meeting is helping but ironically also could quickly provide the reasoning for abandoning the policy. We still believe it will be dictated by broader market conditions and wanting to abandon the policy when yields are under downward pressure globally, not upward pressure. So while there is a logic to the move in USD/JPY it also has its limits.

UEDA’S LOW-KEY CAUTIOUS APPROACH FUELS RENEWED JPY SELLING

Source: Bloomberg & Macrobond

USD: Advancing toward a deal

The sense of limbo in the markets as we await progress on the debt ceiling negotiations in Washington continues but Bloomberg is reporting from “sources” that we are now close to a deal. The deal would see federal spending capped over a two-year period with the effective cut to spending over that period still being negotiated. If true it is a considerably smaller deal than what the Republicans originally proposed which was a 10year deal that would reduce spending over that period by USD 4.8trn.

The S&P 500 advanced by just under 1% yesterday and there remains limited signs of increased distress in the markets as we get ever closer to the x-date. That sense of confidence that a deal will be done is understandable but could be tested if we do not get an announcement by the close of trading today. Monday is a bank holiday in the US so market participants will have to wait until Tuesday 30th May to trade positions again so there is a strong belief that Washington needs to make a deal happen today to avoid markets starting to become disorderly.

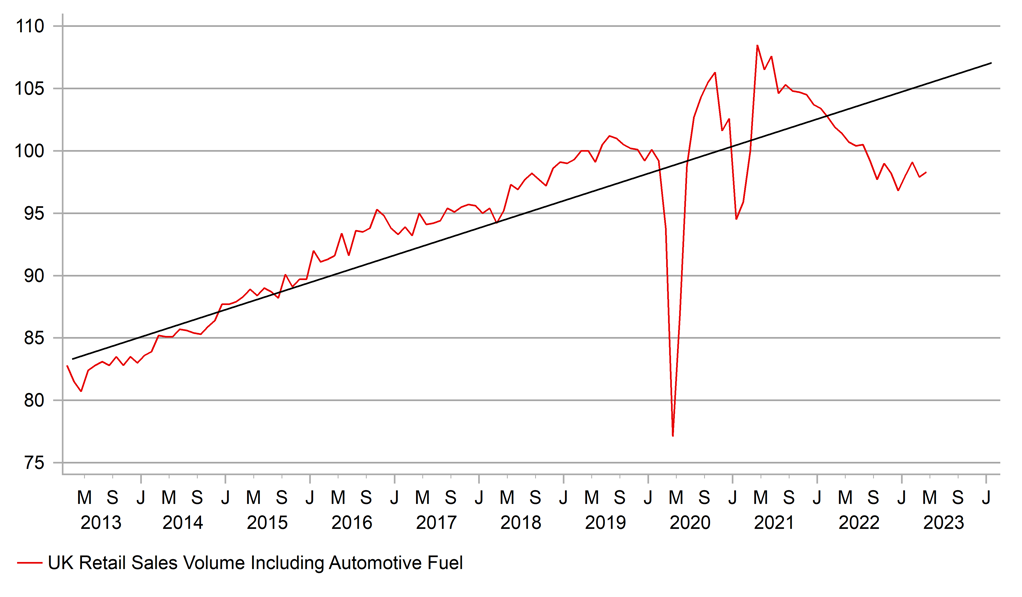

GBP: Retail sales rebounds in April

UK retail sales data for April has just been released and after a very weak print in March, sales rebounded with a MoM gain of 0.5% and 0.8% excluding fuel. The breakdown saw gains across all the main categories apart from Household Goods Stores and the Predominantly Auto Fuel category. The data was stronger than the consensus but the March declines were revised lower so net of those revisions the data was broadly in line with market consensus. On a three-month vs previous three-month basis, retail sales jumped 0.8% which was the strongest since August 2021.

That’s good news although the April gain was certainly helped by the 10.1% increase in welfare benefits for 19.2mn families across the UK. That along with emerging energy price declines have helped lift consumer confidence. The GfK Consumer Confidence to -27, the highest level since February 2022.

However, it is too soon to conclude UK consumers are set to bounce back notably. The CBI Distributive Sales report this week painted a gloomy picture with the sales-for-the-time-of-the-year balance falling to -18 in May, from +21 in April and the lowest level in eleven months. With the bulk of the BoE’s monetary tightening yet to hit the mortgage market consumer spending is likely to remain weak. Governor Bailey this week estimated that about one-third of rate hikes have fed into the economy. We have become more neutral on the outlook for GBP after being bullish since the start of the year. Rate hike expectations are supportive but that could give way at some stage if UK inflation is viewed as more problematic and growth expectations worsen.

UK RETAIL SALES REMAIN 0.8% BELOW PRE-COVID LEVEL (FEB 2020)

Source: Macrobond

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Consumer Confidence Index |

May |

105.0 |

105.5 |

! |

|

IT |

09:00 |

Manufacturing Confidence |

May |

102.5 |

103.0 |

! |

|

US |

13:30 |

Real Personal Spending |

Apr |

0.3% |

0.0% |

!!! |

|

US |

13:30 |

PCE Deflator MoM |

Apr |

0.3% |

0.1% |

!! |

|

US |

13:30 |

PCE Deflator YoY |

Apr |

4.3% |

4.2% |

!! |

|

US |

13:30 |

PCE Core Deflator MoM |

Apr |

0.3% |

0.3% |

!!!! |

|

US |

13:30 |

PCE Core Deflator YoY |

Apr |

4.6% |

4.6% |

!!!! |

|

US |

13:30 |

Advance Goods Trade Balance |

Apr |

-$85.9b |

-$84.6b |

!! |

|

US |

13:30 |

Retail Inventories MoM |

Apr |

0.20% |

0.70% |

! |

|

US |

13:30 |

Durable Goods Orders |

Apr P |

-1.00% |

3.20% |

!! |

|

US |

13:30 |

Durables Ex Transportation |

Apr P |

-0.10% |

0.20% |

!! |

|

US |

13:30 |

Cap Goods Orders Nondef Ex Air |

Apr P |

-0.10% |

-0.60% |

!!! |

|

US |

13:30 |

Cap Goods Ship Nondef Ex Air |

Apr P |

0.10% |

-0.50% |

!! |

|

US |

15:00 |

U. of Mich. Sentiment |

May F |

58 |

57.7 |

!! |

|

US |

15:00 |

U. of Mich. 1 Yr Inflation |

May F |

4.50% |

4.50% |

!!! |

|

US |

15:00 |

U. of Mich. 5-10 Yr Inflation |

May F |

3.10% |

3.20% |

!!! |

Source: Bloomberg