Will SNB policy meeting shake up range trading in G10 FX?

G10 FX: USD continues to rebound after failing to break lower last week

The US dollar has continued to trade at stronger levels during the Asian trading session after strengthening yesterday. It has resulted in the dollar index rising back closer to the 98.000-level where it has been trading since June. Last week’s FOMC policy update was not sufficient to trigger another leg lower for the US dollar and is extending the period of consolidation at lower levels. The US dollar benefitted yesterday from the release of softer economic data outside of the US. The latest German IFO survey surprisingly revealed that business confidence deteriorated in September. It was the first monthly decline in the IFO survey this year. The headline business climate measure had increased from a low of 84.8 at the end of last year to a high of 88.9 in August before dropping back to 87.7 in September. The breakdown revealed that both the current assessment and more forward leading expectations components declined by 0.7 points and 1.7 points respectively. Over the summer the expectations component had reached its highest level since in early 2022. Overall the survey has put a dampener on optimism over the outlook for Germany’s economy. After contracting by -0.3% in Q2, Bloomberg consensus forecasts are currently expecting a very gradual pick-up in growth during the 2H of this year before growth picks up more notably next year in response to the government’s plans for looser fiscal policy.

However, the softer IFO survey has not materially altered expectations for the ECB to leave rates on hold through the rest of this year. ECB Executive Board member Cipollone spoke yesterday and expressed confidence that the ECB is on track to meet their inflation goal. He stated “We think that the risks to inflation are very balanced. We are in a good place. I mean, we are right on target. We will be close to our target for the next two years. With the ECB set to leave rates on hold through the rest of this year while the Fed plans to deliver two more 25bps rate cuts, we continue to believe that the near-term policy divergence will encourage a stronger euro and lift EUR/USD up towards the 1.2000-level by year end.

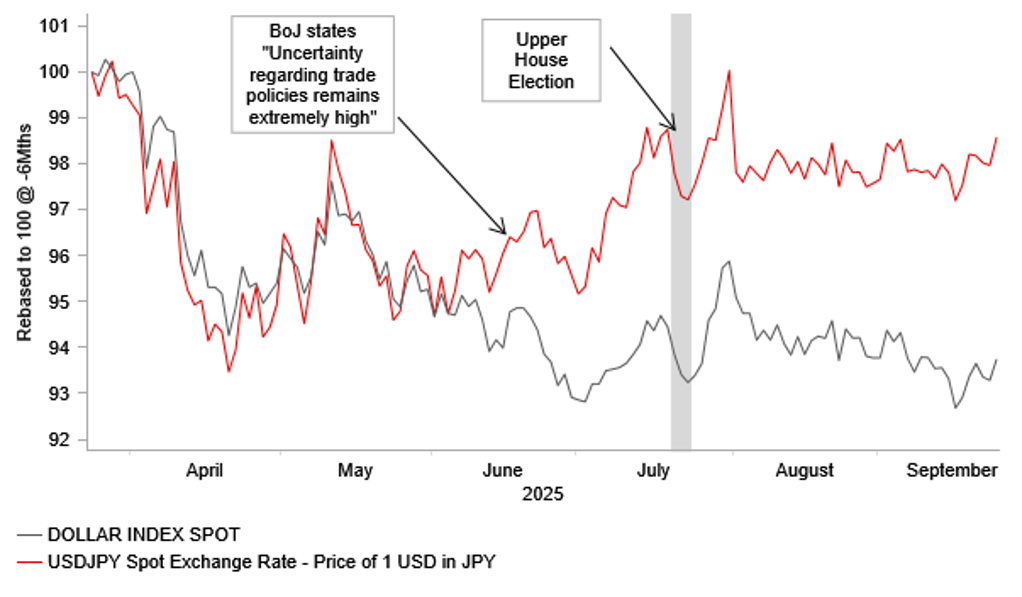

The rebound for the US dollar since last week’s FOMC meeting has been broad-based. The New Zealand dollar has weakened the most (-2.8%) against the US dollar since 16th September followed by the Scandi currencies of the Swedish krona (-1.9%) and Norwegian krone (-1.8%), and the yen (-1.6%). The yen has weakened even as the Japanese rate market has brought forward expectations for the next BoJ rate hike after last week’s BoJ policy update. There are currently around 14bps of BoJ rate hikes priced in by the end of October policy meeting and 20bps of hikes by the end of this year. It follows 2 dissents from BoJ members at last week’s meeting in favour of resuming rate hikes. The release overnight of minutes from the BoJ’s previous policy meeting in late July while dated supported building expectations for a rate hike. The minutes revealed one member thought it may be possible to end the BoJ’s wait-and-see mode by the end of this year. One member thought it would take at elast two to three months to examine the impact of US tariffs. One member thought it was important for the BoJ to raise rates in a timely manner. Heightened political uncertainty in Japan could be preventing the yen from strengthening on back of BoJ rate hike expectations.

JPY HAS UNDERPERFORMED AMIDST BROAD-BASED USD WEAKNESS

Source: Bloomberg, Macrobond & MUFG GMR

CHF: Weighing up downside risks for the CHF from today’s SNB meeting

The main event risk today is the SNB’s latest policy meeting. The SNB are widely expected to leave rates on hold after lowering the policy rate back to the zero bound at their last meeting in June. Looking back at currency performance since the SNB lowered their policy rate to 0.00%, it has not put a significant dampener on Swiss franc performance. In fact the Swiss franc has been the best performing (+3.0%) G10 currency since 16th June just before the SNB last policy meeting on 17th June.

The Swiss franc did briefly weaken during the 1H August after President Trump announced he would impose a higher than expected tariff of 39% on imports from Switzerland. The decision encouraged speculation that the SNB would more seriously consider re-imposing negative rates in Switzerland to provide more support for growth and inflation and provide an offset to the negative impact from the higher tariff.

However, market expectations for the SNB to reimpose negative rates as soon as at today’s policy meeting have since faded allowing the Swiss franc to rebound. Recent comments from SNB officials including President Schlegel have sent a clear signal that there is a much higher hurdle for the SNB to lower rates back into negative territory given the unwanted side effects. It supports our view that downside risks to the SNB’s inflation target will likely have to intensify further before the SNB is willing to reimpose negative rates. As a result, we believe it could be more of a story for next year rather posing immediate downside risks for the Swiss franc. Market participants will be watching closely today to see if SNB provides any further encouragement for negative rate expectations. We also expect the SNB to reiterate that it remains willing to be active in the foreign exchange market as necessary. However, intervention remains unlikely while trade talks are ongoing with the US to lower the tariffs rate on imports from Switzerland.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SZ |

08:30 |

SNB Interest Rate Decision |

Q3 |

0.00% |

0.00% |

!!! |

|

SZ |

09:00 |

SNB Press Conference |

-- |

-- |

-- |

!!! |

|

EC |

09:00 |

ECB Economic Bulletin |

-- |

-- |

-- |

!! |

|

EC |

09:00 |

M3 Money Supply (YoY) |

Aug |

3.3% |

3.4% |

! |

|

US |

13:20 |

Fed Goolsbee Speaks |

-- |

-- |

-- |

! |

|

US |

13:30 |

Durable Goods Orders (MoM) |

Aug |

-0.3% |

-2.8% |

!! |

|

US |

13:30 |

GDP (QoQ) |

Q2 |

3.3% |

-0.5% |

!!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

233K |

231K |

!!! |

|

US |

14:00 |

Fed Schmid Speaks |

-- |

-- |

-- |

! |

|

US |

14:00 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

Existing Home Sales (MoM) |

Aug |

-- |

2.0% |

!! |

|

US |

15:00 |

FOMC Member Bowman Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg & Investing.com