Powell message as before with limited market moves

USD: FX moves remain limited for now

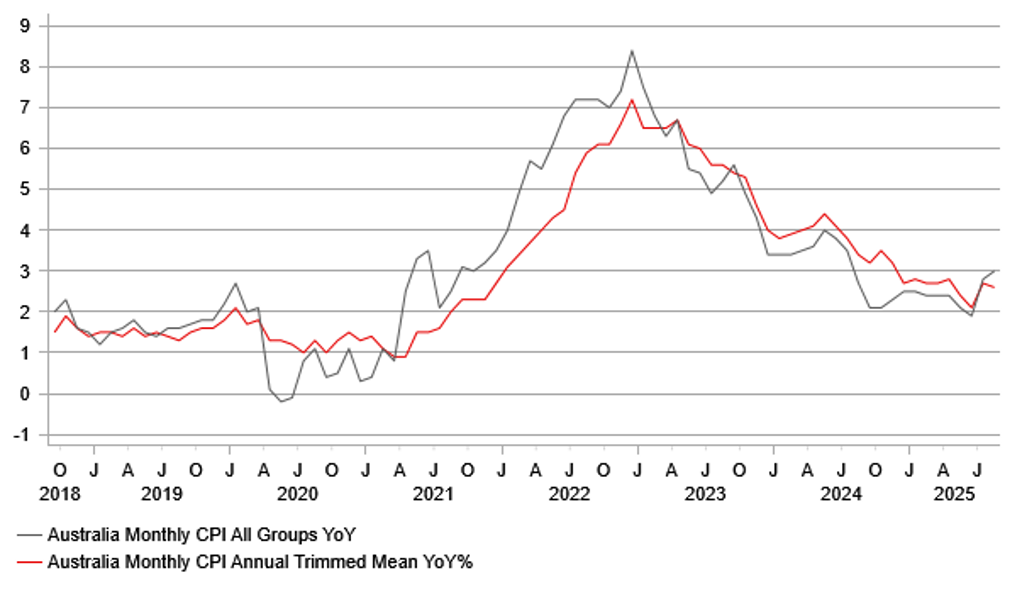

The US dollar remains in a narrow trading range with the DXY index remaining within a range of just 97.200-97.400 with all G10 currencies remaining broadly stable – bar the Australian dollar which is outperforming following a CPI print that was stronger than expected. The 2-year Australian government bond yield has jumped 7bps in response and expectations of RBA rate cuts have diminished. The RBA meets next week but there was already limited expectations of a cut next week. However, the probability of a rate cut at the November meeting has dropped, from about 75% to a little over 50%. The data was only marginally stronger (up from 2.8% to 3.0% vs 2.9% expected) while the trimmed mean slowed from 2.7% to 2.6%. Given the jobs data last week indicated weakening and the PMIs all declined, a rate cut is still a reasonable call.

The underperformer in G10 today is the yen (only 0.25% weaker vs USD) and we have had the scheduled debate amongst the five candidates to become leader of the LDP. The comments from Sanae Takaichi again suggest to us that the perceived gap in policy compared to Shinjiro Koizumi may now be less than before. Takaichi has again indicated greater caution in regard to fiscal policy stating that she would place “great importance of fiscal sustainability”. There has been some attention to Takaichi’s comment that the government is responsible for both fiscal and monetary policies. However, Takaichi did also add that the BoJ should decide the specifics of monetary policy. This we believe reflects the government shaping the broad goals of BoJ monetary policy with the BoJ then focused on achieving that goal. This is no different to now and to many other developed economies as well. The fact that Takaichi has stated that the BoJ would be left to decide the specifics of policy suggests to us less opposition from a Takaichi-led government on proceeding with further rate hikes.

Finally, the markets have little to trade off after Fed Chair Powell’s comments yesterday that indicated a finely balanced path ahead for decisions on monetary policy. Powell repeated that there was “no risk-free path” in monetary policy decisions given there was evidence of upside inflation risks and downside labour market risks. In that context the two key data releases – the NFP and CPI data – will remain crucial in determining policy decisions ahead. Assuming the labour market continues to show weakness and there are no nasty upside CPI surprises, there should be a path to two 25bp rate cuts in October and December. That will ensure the scope for further moderate dollar depreciation by year-end remains.

AUSTRALIA HEADLINE YOY CPI BACK AT TOP OF 2.0%-3.0% TARGET BAND

Source: Bloomberg, Macrobond & MUFG GMR

SEK: Riksbank cuts but provides hawkish guidance

One of two G10 central bank meetings took place yesterday and resulted in a surprise decision with the Riksbank cutting the key policy rate by another 25bps to 1.75%. OIS pricing before the meeting implied about a one-third chance of a cut so the decision certainly surprised most of the market. But as is often the case, the communication accompanying the surprise cut was more of the focus and the suggestion of this cut possibly being the last helped fuel SEK strength initially.

The key swing factor persuading the Riksbank to cut was likely the inflation data earlier this month. The CPIF ex-energy MoM 0.5% drop helped lower the annual rate to 2.9% with the headline rate at just 1.1%. The statement did cite inflation as still elevated so it was more the drop that encouraged the cut than the level. But the Riksbank cited evidence that this elevated inflation would be “transitory” – companies’ favourable pricing plans was the example given. The statement confirmed the view that the policy rate wold remain at the current level for “some time to come”. That was underlined by the forecasts from the Riksbank with the policy rate effectively unchanged in both 2026 and 2027. With rates unchanged the CPIF inflation measure is projected at just 1.0% in 2026, way down on the June forecast of 1.7% before then rising to 1.7% in 2027, below the June estimate of 2.0%.

That’s quite a divergence from the June projections and hence while the guidance suggests yesterday’s cut could be the last there could certainly be plausible scenarios in which we see further cuts from the Riksbank. It is certainly telling how the inflation backdrop appears so much more favourable in Europe than in the UK or the US. The SNB is under pressure to cut to negative rates this week due to annual inflation running just above zero at 0.2% while the ECB is currently in a “good place” with inflation roughly at around the target level of 2.0%.

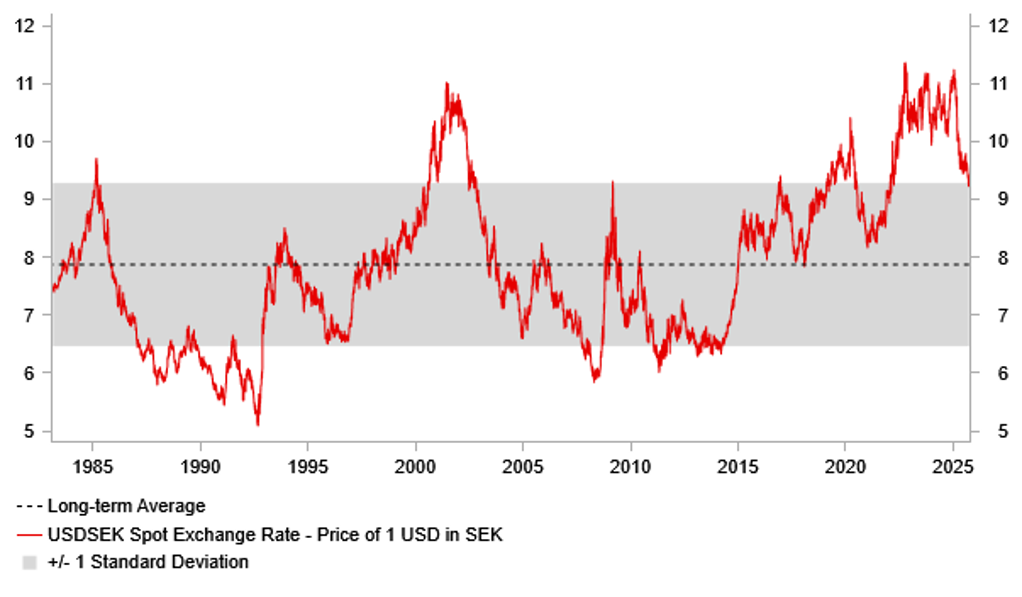

In a potential global backdrop of investors seeking safe-havens from inflation risks, SEK could certainly see some further outperformance if inflation falls as expected. SEK is the top performing G10 currency this year followed by NOK and then CHF. Part of this is a valuation story – SEK and NOK throughout the global inflation shock period were very often the worst performing currencies and the most under-valued. So this under-valuation is correcting and after an 18.5% gain for SEK this year and 15% gain for NOK, the upside momentum from an under-valuation perspective will fade from here. Still, given our US dollar bearish view and our target of 1.2500 for EUR/USD we see further gains for NOK and SEK mainly against the dollar by mid-2026 (6%-7%) and more modest gains versus the euro. (1%-2%).

USD/SEK CORRECTING FROM OVER-VALUED LEVELS

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

09:00 |

German Business Expectations |

Sep |

92.0 |

91.6 |

!! |

|

GE |

09:00 |

German Current Assessment |

Sep |

86.5 |

86.4 |

!! |

|

GE |

09:00 |

German Ifo Business Climate Index |

Sep |

89.3 |

89.0 |

!!! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

29.7% |

! |

|

US |

13:30 |

Building Permits (MoM) |

Aug |

-3.7% |

-2.2% |

! |

|

US |

13:30 |

Building Permits |

Aug |

1.312M |

1.362M |

! |

|

CA |

13:30 |

Manufacturing Sales (MoM) |

Aug |

-- |

2.5% |

! |

|

US |

15:00 |

New Home Sales |

Aug |

650K |

652K |

!! |

|

US |

15:00 |

New Home Sales (MoM) |

Aug |

-- |

-0.6% |

!! |

|

UK |

17:30 |

BoE's Greene speaks |

!!! |

|||

|

US |

21:10 |

FOMC Member Daly Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg & Investing.com