Japan inflation confirms scope for BoJ to extend pause

JPY: Inflation picks up as yen weakens further helped by Takaichi

USD/JPY is trading over the 153-level reflecting broader dollar strength and expectations that the BoJ will refrain from lifting rates over the coming meetings. Nationwide inflation data released today revealed an annual increase from 2.7% to 2.9% in September. Energy inflation jumped from -3.3% to +2.3% as bigger energy subsidies from a year earlier dropped out. The surge in rice prices also continued to fade. Core-core inflation slowed from 3.3% to 3.0% and services inflation slowed modestly as well. The data certainly won’t put any added pressure on the BoJ to hike. The OIS market pricing for a hike by December is now less than 50% although by January is at 85%. PM Takaichi also gave a key policy speech. The JGB market is stable but Takaichi spoke of “responsible, proactive fiscal policy” and that air of ‘Abenomics’ has helped reinforce further moderate yen weakness.

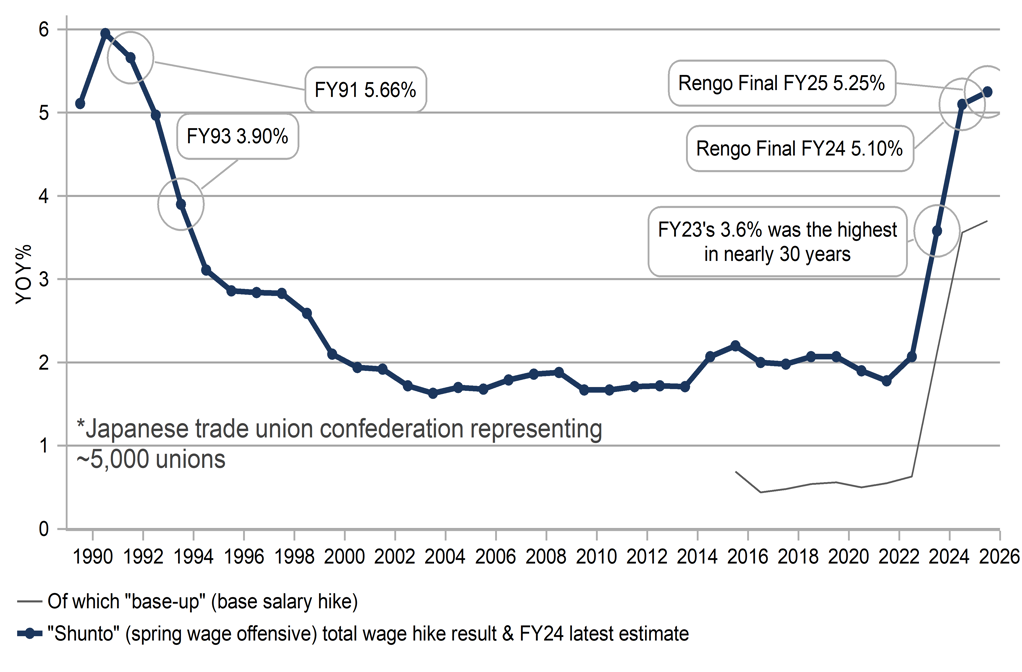

The inflation data released today follows the news yesterday that Rengo, the primary confederation of unions in Japan will seek a 5% pay increase for fiscal year 2026-27 that incorporates a base pay increase of 3.0%. Rengo represents around 7mn workers in Japan, so around 10% of the working age population and its power tends to mean its workers receive better wages than the average worker. Hence, the official monthly wage data does not show wage growth that high. Still, as a benchmark it does at least imply that wage growth, which has been consistent with the BoJ’s policy of gradual rate increases. The Rengo wage growth figure announced yesterday was the same as the initial estimate a year ago. Last year the final agreement was in fact higher, at 5.25%. That could well be the case again in negotiations that lie ahead. Food prices, which tend to be an important determinant in negotiations have been elevated. In October last year, nationwide food prices on an annual basis stood at 3.5% but by January had surged to 7.8% and the latest reading for August stands at 7.2%.

The yen continues to trade at weaker levels and the surge in crude oil prices has certainly helped to reinforce the near-term negative yen sentiment. Japan imports all its energy fossil fuels requirements and the 8% jump in crude oil prices has likely brought in USD-buying importer related flows, especially given there was a building consensus that oil prices were set to decline further. Furthermore, if the jump in crude oil extends further still, it lifts inflation expectations, which in turn drives real yields lower in Japan, thus reinforcing the BoJ ‘behind the curve’ trade of JGB yield curve steepening and yen selling.

The US CPI report today will be key for the US dollar in general. A stronger inflation print with clear evidence of tariff-related goods inflation could result in a near-term test of the 155-level. That would be unfortunate for the new government with President Trump in Tokyo next week and we will likely begin to hear vocal opposition to yen weakness but with the BoJ expected to hold next week, rhetoric is unlikely to hold much sway. We would still not expect USD/JPY to sustain a move above 155.00.

RENGO FINAL AGREED WAGE INCREASES SET TO REMAIN ELEVATED

Source: Bloomberg, Macrobond & MUFG GMR

USD: Trump suspends Canadian trade negotiations

The 100% tariff threat by President Trump on China leaves investors more focused on trade uncertainty and next week will be key with President Trump and President Xi meeting next Thursday at the Asia-Pacific Economic Cooperation. Markets participants are expecting some deal to be reached that will suspend this threat in order for more substantial negotiations to take place. That seems most likely at this stage with Trump himself admitting that 100% tariffs on top of existing tariffs would be “unsustainable”.

But the constant uncertainty over trade policy cannot be a positive for US business planning and prospects of a deal between the US and Canada took a knock when President Trump announced that trade negotiations were off following anti-tariff adds were aired in the US that were launched by the province of Ontario. The US continues to hit Canada imports not covered under the USMCA deal with a 35% tariff while certain sector-specific tariffs, like on steel and aluminium, are hit with a 50% tariff. Despite the 8% gain in crude oil prices in the last two days, the Canadian dollar is underperforming and is close to unchanged versus the US dollar this week.

CAD is being held back by the trade tariff uncertainty and the more aggressive monetary easing by the Bank of Canada. The BoC looks set to cut the key policy rate again next week although a strong jobs report and higher than expected inflation leaves the decision a close call and if a cut is delivered it may well be accompanied with a signal of a pause.

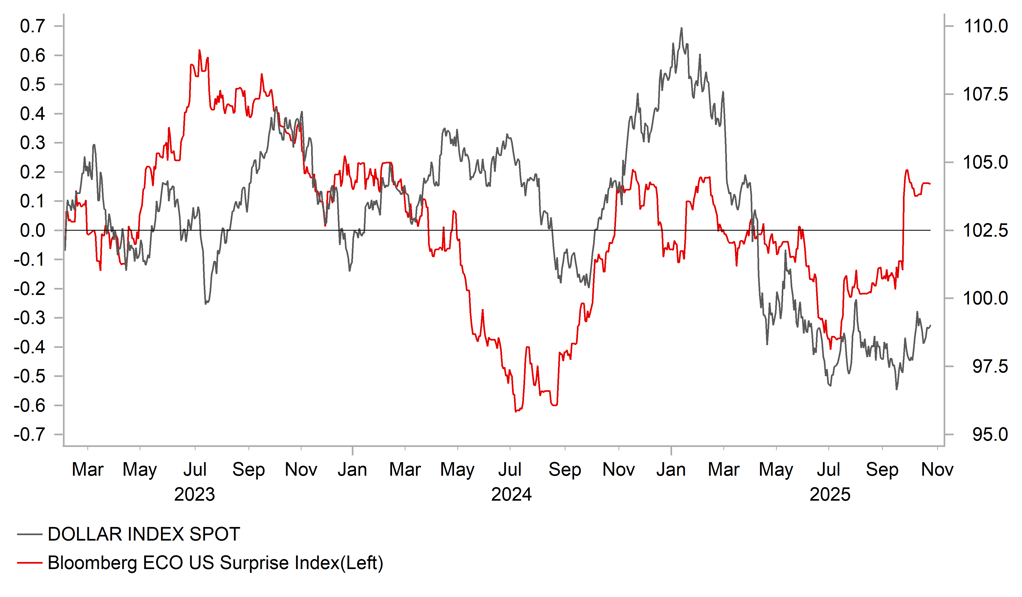

Whether the US dollar advances into the end of the week will very much depend on the details of today’s CPI release. Assuming the consensus readings are met of a 0.4% m/m headline increase and 0.3% for the core, the Fed will very likely follow through with the 25bp cut that is fully priced, meaning rates and FX moves should be limited. The overall CPI increases will likely be down to tariff-related goods inflation picking up but being curtailed by the disinflation in services due to rents.

Given the market is fully priced for two cuts by year-end, the risk appears more skewed toward a bigger rates higher move than lower and a stronger dollar. That said, a higher rates move stronger dollar will to some degree be restrained by the lack of jobs data that could be indicating further weakness of the economy. From an FX perspective, the DXY remains in the 100-96.00 range but is at risk of breaking to the upside. A break of the 100-level and more specifically the August intra-day high of 100.257 would be significant and would signal increased risks to our dollar bearish levels we have for year-end. Our year-end DXY forecast of 95.710 would look a lot more difficult to achieve.

US DATA HAS BEEN COMING IN STRONGER THAN EXPECTED – HELPING PROVIDE SUPPORT FOR THE DOLLAR

Source: Bloomberg & Macrobond

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

Manufacturing PMI |

Oct (P) |

49.8 |

49.8 |

!! |

|

EC |

09:00 |

Services PMI |

Oct (P) |

51.2 |

51.3 |

!! |

|

UK |

09:30 |

Composite PMI |

Oct (P) |

50.6 |

50.1 |

!!! |

|

UK |

09:30 |

Manufacturing PMI |

Oct (P) |

46.6 |

46.2 |

!!! |

|

UK |

09:30 |

Services PMI |

Oct (P) |

51.0 |

50.8 |

!!! |

|

US |

13:30 |

Building Permits |

Sep |

-- |

1.330M |

!! |

|

US |

13:30 |

Core CPI (MoM) |

Sep |

0.3% |

0.3% |

!!!!! |

|

US |

13:30 |

Core CPI (YoY) |

Sep |

3.1% |

3.1% |

!!! |

|

US |

13:30 |

CPI (YoY) |

Sep |

3.1% |

2.9% |

!!! |

|

US |

13:30 |

CPI (MoM) |

Sep |

0.4% |

0.4% |

!!!! |

|

GE |

13:45 |

ECB's Nagel Speaks |

-- |

-- |

-- |

!! |

|

US |

14:45 |

Manufacturing PMI |

Oct (P) |

51.9 |

52.0 |

!!! |

|

US |

14:45 |

Services PMI |

Oct (P) |

53.5 |

54.2 |

!!! |

|

US |

15:00 |

Michigan 1-Year Inflation Expectations |

Oct |

4.6% |

4.7% |

!! |

|

US |

15:00 |

Michigan 5-Year Inflation Expectations |

Oct |

3.7% |

3.7% |

!! |

|

US |

15:00 |

Michigan Consumer Sentiment |

Oct |

55.0 |

55.1 |

!! |

|

US |

15:00 |

New Home Sales |

Sep |

710K |

800K |

!!! |

Source: Bloomberg & Investing.com