USD gives back gains as Middle East tensions ease

USD: De-escalation of Middle East tensions triggers correction lower for USD

The US dollar has corrected sharply lower overnight falling back closer towards the year to date lows recorded prior to the start of the conflict between Israel and Iran. It follows clear steps towards de-escalation in the conflict overnight. Firstly, Iran’s retaliation against US military strikes on nuclear facilities over the weekend proved to be largely symbolic. According to reports, Iran fired 14 missiles at a US military base in Qatar of which 13 were intercepted and 1 was allowed to pass as it posed no threat. President Trump described the attacks as “very weak” and was happy to report that no Americans were harmed. He even went on to “thank Iran for giving us early notice, which made it possible for no lives to be lost, and nobody to be injured”, and expressed optimism that “perhaps Iran can now proceed to Peace and Harmony in the Region” while encouraging Israel to do the same.

Secondly, President Trump has since gone further by announcing a “Complete and Total CEASEFIRE” between Israel and Iran has taken effect although it has not been officially confirmed by all parties. Iranian Foreign Minister Abbas Araghchi posted that Iran would stop firing so long as Israel does and “the final decision on the cessation of our military operations will be made later”. Similarly, it was been reported that Israel has agreed to a ceasefire as long as Iran does not launch further attacks. It follows reports that President Trump brokered the ceasefire in a direct conversation with Israeli Prime Minister Netanyahu overnight while Vice President JD Vance, Secretary of State Marco Rubio and special Envoy Steve Witkoff spoke with the Iranians through direct and indirect channels, and that the Qataris were key in brokering the deal. Comments from Israeli officials at the start of this week had already indicated that they were close to reaching their objectives to disrupt Iran’s nuclear operations and ballistic missiles.

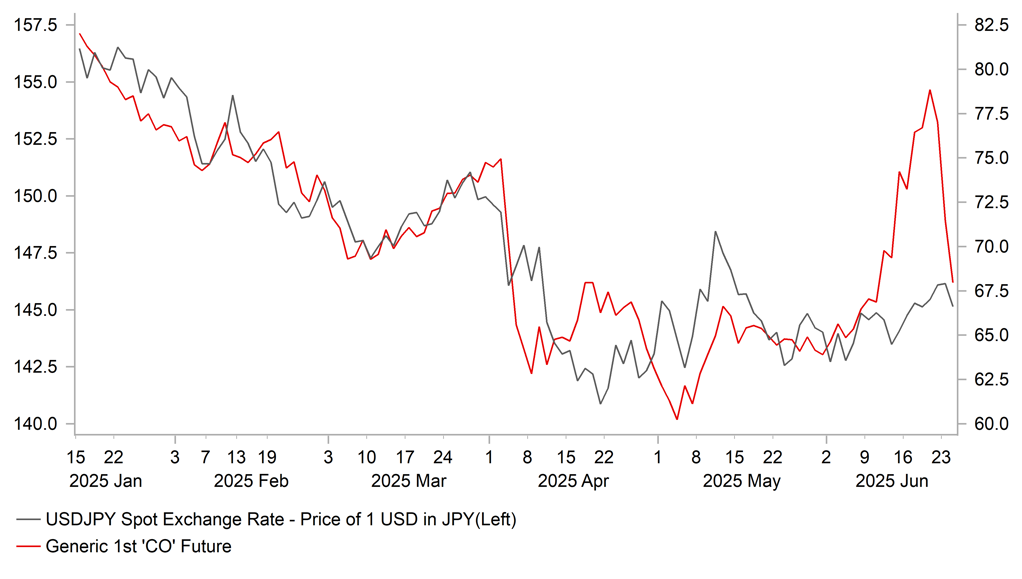

A potential end to the conflict has been welcomed by market participants. The price of Brent crude oil has dropped back sharply back towards USD68/barrel after hitting a peak at the start of this week at USD81.40/barrel. It has now almost fully reversed all of the gains since the conflict started. In the FX market a similar reversal is underway with the US dollar giving back recent gains. If Middle East risks now fade into the background as a market driver, it is more likely that the US dollar weakening trend will resume. On the other hand, the yen, Swedish krona, Norwegian krone and New Zealand dollar, which were hit the hardest by the recent pick-up in geopolitical risks, have some scope to rebound further in the near-term if the ceasefire holds.

USD/JPY VS. PRICE OF OIL

Source: Bloomberg, Macrobond & MUFG GMR

USD: Dovish Fed comments reinforce USD sell-off before Powell’s testimony

The US dollar had already started to weaken yesterday prior to the de-escalation in Middle East tensions reflecting building market expectations for looser Fed policy. Those expectations have been encouraged by dovish comments from Fed Governors Waller and Bowman who indicated that they are open to voting for a rate cut as soon as next month’s FOMC meeting. Michelle Bowman, the Fed’s vice chair for supervision stated yesterday that “should inflation pressures remain contained…I would support lowering the policy rate as soon as our next policy meeting in order to bring it closer to its neutral setting and to sustain a healthy labour market”. Fed Governor Waller had made similar comments on Friday when he stated that policymakers should not wait for the labour market to weaken before lowering borrowing costs.

The comments will be music to the ears of President Trump who has again called on Chair Powell to lower rates ahead of today’s semi-annual testimony on monetary policy before Congress. He posted that rates should be two to three percentage points lower which he believes would save the US government USD800 billion/year. He even called on Congress to “really work this very dumb, hardheaded person, over”, and then called on the Fed board to “ACTIVATE”. The dovish comments from the Fed governors have helped to put downward pressure on US rates alongside the easing of upside inflation risks from the short-lived spike in the price of oil. After failing to break above the 200-day moving average at just above 4.00%, the 2-year US Treasury yield has dropped back towards 3.80%. Nevertheless, the US rate market is still only pricing in around 6bps of cuts by the July FOMC meeting compared to 24bps by the September FOMC meeting.

Last week’s FOMC meeting showed that FOMC was highly divided on the outlook for policy with 7 participants calling for no cuts this year, 2 participants in favour of one 25bps cut, 8 in favour of two 25bps cuts and 2 in favour of three 25bps cuts. Even with the announcement of ceasefire deal between Israel and Iran, it is unlikely that Chair Powell will deliver a more dovish policy update at today’s semi-annual testimony. He is more likely to repeat the message from last week that the Fed is not in a rush to resume rate cuts and will wait for policy uncertainty to ease further over the summer which should open the door for a cut from September. The potential dovish repricing of Fed rate cut expectations is one reason why we expect the US dollar to weaken further as outlined in our latest FX Focus: What’s next for the USD? (click here).

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:00 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!! |

|

GE |

09:00 |

German Ifo Business Climate Index |

Jun |

88.1 |

87.5 |

!! |

|

US |

13:30 |

Current Account |

Q1 |

-448.0B |

-303.9B |

!! |

|

CA |

13:30 |

CPI (YoY) |

May |

1.7% |

1.7% |

! |

|

US |

14:00 |

S&P/CS HPI Composite - 20 s.a. (MoM) |

Apr |

-- |

-0.1% |

! |

|

EC |

14:00 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

UK |

14:35 |

MPC Member Ramsden Speaks |

-- |

-- |

-- |

!! |

|

EC |

14:55 |

ECB's Lane Speaks |

-- |

-- |

-- |

!! |

|

UK |

15:00 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

Fed Chair Powell Testifies |

-- |

-- |

-- |

!!! |

|

UK |

16:40 |

BoE MPC Member Pill Speaks |

-- |

-- |

-- |

!! |

|

UK |

16:50 |

BoE Breeden Speaks |

-- |

-- |

-- |

! |

|

US |

17:30 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!! |

|

US |

18:00 |

M2 Money Supply (MoM) |

May |

-- |

21.86T |

! |

Source: Bloomberg & Investing.com