Trade deal optimism lifts EUR ahead of ECB policy meeting

JPY: BoJ rate hike speculation is encouraging stronger yen

The yen has continued to strengthen during the Asian trading session resulting in USD/JPY falling to an intra-day low of 145.86 overnight. The stronger yen has been encouraged by building speculation that the BoJ will resume rate hikes sooner following the announcement of the trade deal between the US and Japan. The Japanese rate market has moved to price in around 8bps and 17bps of hikes by the September and October BoJ policy meetings. In comparison, the Japanese rate market was pricing in around 4bps and 11bps respectively at the end of last week. The hawkish repricing of BoJ rate hike expectations was encouraged by comments from BoJ Deputy Governor Uchida yesterday. He stated that “uncertainty has receded, and this of course means that the likelihood has risen” for the BoJ’s economic forecasts to be met. The BoJ continues to signal that it will tighten policy further if Japan’s economy evolves in line with their outlook. He described the trade deal between the US and Japan as a “big major breakthrough” that has lowered uncertainty over the outlook for Japan’s economy. However, he added some caution that “uncertainty remains” as other countries are still engaged in trade negotiation, and the actual economic impact from tariffs needs to be monitored. His comments have also supported expectations that the BoJ’s forecasts for inflation will be raised at next week’s policy meeting. He stated that “after the turn of this fiscal year, price hikes have spread from rice to other food products as well, and consumer prices have risen by more than what the Bank or market participants had expected.” He noted that “at least with regard to food prices, firms' price-setting behaviour has changed significantly compared to the past” and they “will monitor the extent of these developments”.

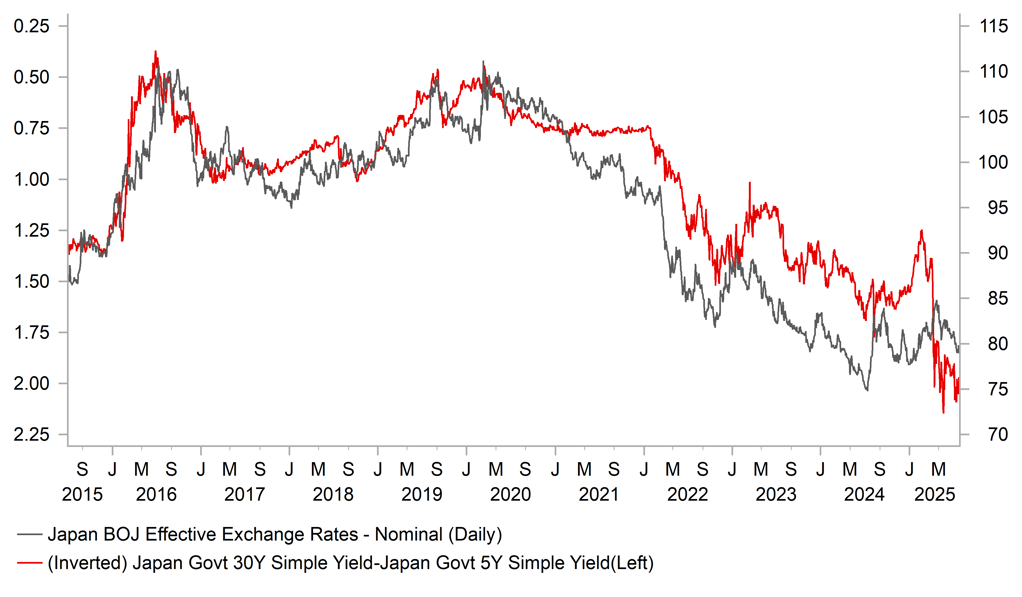

In light of these developments there is a higher risk that the BoJ will hike rates again by the end of this year although the timing of the next rate hike could still be disrupted by political uncertainty in Japan including the risk of another election. At the same time, the risk of looser fiscal policy after the Upper House election given the ruling coalition needs to compromise more with opposition parties to pass legislation has also been weighing on JGBs. The 10-year JGB yield has risen to fresh highs above 1.60%. The steeper Japanese yield curve as market participants price in more a fiscal risk premium in Japan could be curtailing yen strength on the back of BoJ rate hike expectations.

STEEPER JAPANESE YIELD CURVE & WEAKER JPY

Source: Bloomberg, Macrobond & MUFG GMR

EUR: Trade deal optimism provides boost ahead of ECB policy meeting

The euro has strengthened against the US dollar this week rising back up towards the year to date high from the start of his month at 1.1829. The rebound for the euro this week was reinforced by reports yesterday that the EU is moving closer to a trade deal with the US before the upcoming deadline on 1st August. The FT reported that a trade deal for the EU could be similar to the Japan deal. It was reported that the deal could involve setting a 15% tariff on imports from the EU including for autos & parts. There could be limited exemptions from the 15% tariff rate linked to aviation, some medical devices and general medicines, several spirits, and a specific set of manufacturing equipment that the US needs. The current tariff rate for autos is set at 27.5% and President Trump has threatened to put in place a higher “reciprocal” tariff of 30% if a timely trade deal is not agreed. In this regard, if the potential trade is finalized as reported it would help to dampen downside risks for European economies. According to a US official, negotiations remain fluid and a deal may not be announced imminently.

It is not clear if a trade deal will be officially announced ahead of today’s ECB policy meeting. However, it should not have a significant impact on the ECB’s immediate policy decision as they were already expected to leave rates on hold even before the latest trade news. At the last policy meeting, President Lagarde had indicated that the ECB was nearing the end of their easing cycle now that the policy rate has returned to neutral territory. Economic data releases since the last June policy meeting have not provided justification for the ECB to deliver another back-to-back rate cut today. President Lagarde is likely to be asked about a potential trade deal between the EU and US in the press conference. We would expect her to express cautious optimism over a potential trade deal that would help to ease downside risk for the euro-zone economy. A trade deal will dampen expectations for further ECB rate cuts this year. The euro-zone rate market is currently priced for just one more 25bps rate cut by year end. The ECB would have to become more concerned over the risk of an inflation undershoot to cut rates much further below 2.00%. Disinflation pressures in the euro-zone are being reinforced by the stronger euro. We are expecting the ECB to repeat the message from the June policy meeting (click here) that that the stronger euro continues to pose downside risks to growth alongside higher tariffs via their negative impact on exports, while posing downside risks to the inflation outlook as well. The ECB is unlikely to push back strongly against euro strength at the current juncture.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

08:30 |

HCOB Germany Manufacturing PMI |

Jul |

49.4 |

49.0 |

!! |

|

GE |

08:30 |

HCOB Germany Services PMI |

Jul |

50.0 |

49.7 |

!! |

|

EC |

09:00 |

HCOB Eurozone Manufacturing PMI |

Jul |

49.7 |

49.5 |

!! |

|

EC |

09:00 |

HCOB Eurozone Services PMI |

Jul |

50.6 |

50.5 |

!! |

|

UK |

09:30 |

S&P Global Manufacturing PMI |

Jul |

47.9 |

47.7 |

!! |

|

UK |

09:30 |

S&P Global Services PMI |

Jul |

52.8 |

52.8 |

!! |

|

EC |

13:15 |

Deposit Facility Rate |

Jul |

2.00% |

2.00% |

!!! |

|

US |

13:30 |

Building Permits |

Jun |

1.397M |

1.394M |

!! |

|

US |

13:30 |

Continuing Jobless Claims |

-- |

1,960K |

1,956K |

!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

227K |

221K |

!!! |

|

CA |

13:30 |

Retail Sales (MoM) |

May |

-0.9% |

0.3% |

!! |

|

EC |

13:45 |

ECB Press Conference |

-- |

-- |

-- |

!!! |

|

US |

14:45 |

S&P Global Manufacturing PMI |

Jul |

52.7 |

52.9 |

!!! |

|

US |

14:45 |

S&P Global Services PMI |

Jul |

53.0 |

52.9 |

!!! |

|

US |

15:00 |

New Home Sales |

Jun |

649K |

623K |

!!! |

|

EC |

15:15 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg & Investing.com