Strong risk appetite & low vol will continue to work against US dollar

USD: Improving global optimism will limit further dollar gains

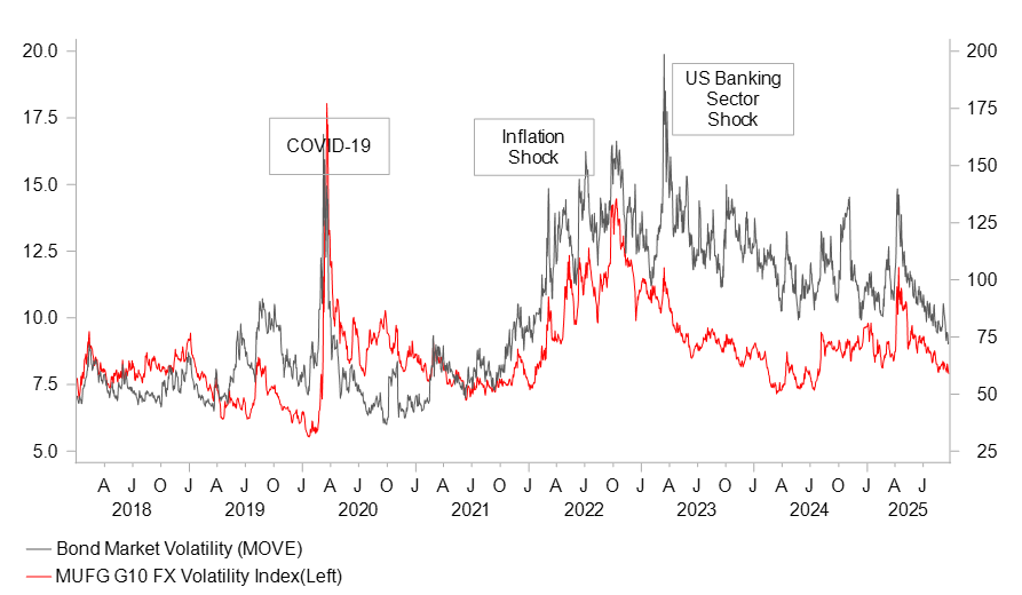

The rebound of the US dollar after the FOMC meeting last Wednesday looks to be losing steam already and the strength of the dollar always looked to be more a case of positioning in a market that had become a little over-extended on the Fed dovish side that means the FOMC communication was always likely to disappoint. Trading yesterday was relatively quiet and fixed income in particular with only marginal moves in yields. With close to two further rate cuts fully priced for the Fed the immediate outlook for risk remains positive. Declining volatility is fuelling renewed appetite for risk that is being helped by a macro backdrop that is improving. The TikTok deal and the positive news of a constructive call between Presidents Trump and Xi is easing concerns over any renewed escalation in trade tensions.

If global sentiment is improving that will make it difficult for the dollar to sustain this rebound from here. For sure, against the lowest yielding G10 currencies the dollar can outperform but against wider G10 and emerging market currencies gains will be difficult to maintain.

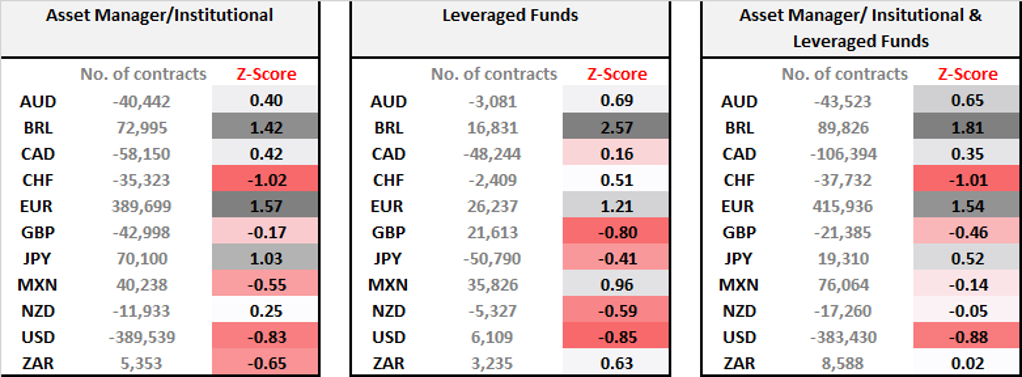

A look at positioning data released at the end of last week shows the strong appetite for carry. The positioning data measured by our own z-score metric indicates the most extreme positioning for the Brazilian real in the latest data relative to data over a two-year period, underlining the strong appetite for carry. The Mexican peso is also in demand although based on our z-score measure not as extreme as for the real. The carry attractiveness for the real in particular stands out. The key policy rate stands at 15.00% and last week the central bank left the key rate unchanged despite the latest inflation reading of 4.95% - implying a very attractive real policy rate of around 10%. BRL volatility continues to slide with the 3mth implied vol falling to below 12% to a level not seen since June last year.

Positioning is now entirely fuelled by carry of course and when Leveraged Funds and Asset Manager/Institutional Investor positions are combined, long positioning in euro is the next largest after the Brazilian real. That’s not yield driven and as is usually the case, the euro simply benefits as the ‘anti-dollar’ whenever US dollar sentiment is poor.

Growth optimism did certainly help the euro earlier in its rally after Germany announced its EUR 1 trillion defence and infrastructure spending plans and Bund yields surged. In that context today’s advance PMIs will be important for the euro. The euro-zone composite PMI, currently at 51.0, is the highest since August 2024 underlining improved business sentiment helped in part by a better outlook in Germany and some reduced concerns over the impact of US tariffs. Still, the tariff relief could well prove temporary and with French politics an added uncertainty we may well see some modest retracement in sentiment. EUR/USD clearly rejected the upside levels visited after the FOMC last week and that could well curtail EUR buying appetite ensuring relatively narrow trading ranges until there is clear direction from the US or some disruption to the low-vol positive risk trading environment.

CFTC IMM WEEKLY POSITIONING DATA HIGHLIGHTS STRONG BRL & MXN BUYING BY LEVERAGED FUNDS

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Takaichi signals JGB issuance caution

The yen remains one of only three G10 currencies that has weakened against the US dollar in September (CAD & NZD the others) with political uncertainty cited as a factor explaining the underperformance. Campaigning for the leadership election has now begun and today a joint press conference was held ahead of a debate tomorrow.

What is becoming clear in recent days is that one of the leading contenders – Sanae Takachi – has toned down some of her key policy stances. In today’s press conference Takaichi again hinted at a shift in her previous view that the consumption tax should be cut. Today she stated that she was “positive about this previously” but now believes “it’s important to revisit it within the party”.

Takaichi also made clear today that her views on fiscal expansion have become more cautious stating that Japan would need to rely on excess tax revenue to implement measures to support Japanese households. Now her view on JGB issuance is only that “it could become unavoidable if the situation calls for it”. This is a clear shift in rhetoric from Takaichi which suggests that the policy gap between herself and Koizumi is not as large as previously assumed. In the leadership election last year Takaichi was promoting her stance of “strategic fiscal stimulus” but there has been no repeat of this so far in campaigning this year.

Furthermore, on BoJ monetary policy Takaichi so far has been quiet. A year ago she stated that the BoJ would be “stupid” to raise rates but to date has steered clear on monetary policy comments. Tomorrow’s debate could well see her questioned on this. A shift in stance away from ‘Abenomics’-like policies makes sense. Abenomics was very geared toward lifting inflation after three decades of mild deflation but now the anger of voters is over inflation being too high. Takaichi could well continue to highlight a shift in stance to something more aligned with the economic challenges today.

If this shift continues to be evident it would argue against the need for as much political risk premium. Takaichi has been viewed as being negative for the yen and Koizumi more positive for the yen with JGB market participants preferring Koizumi’s more conservative fiscal policies. But if the perceived differences continue to narrow it could help provide support for the yen as fears over yen-negative policies diminish. It’s too soon to conclude yet and views on BoJ policy will be important to hear but the policy gap may not be as large as previously assumed.

EQUITY & BOND MARKET VOLATILITY CONTINUE TO SLIDE

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

FR |

08:15 |

French S&P Global Composite PMI |

Sep |

49.9 |

49.8 |

! |

|

GE |

08:30 |

German Composite PMI |

Sep |

50.5 |

50.5 |

!! |

|

GE |

08:30 |

German Manufacturing PMI |

Sep |

50.0 |

49.8 |

!! |

|

GE |

08:30 |

German Services PMI |

Sep |

49.5 |

49.3 |

!! |

|

EC |

09:00 |

Manufacturing PMI |

Sep |

50.7 |

50.7 |

!! |

|

EC |

09:00 |

S&P Global Composite PMI |

Sep |

51.1 |

51.0 |

!! |

|

EC |

09:00 |

Services PMI |

Sep |

50.6 |

50.5 |

!! |

|

UK |

09:30 |

Composite PMI |

Sep |

52.7 |

53.5 |

!!! |

|

UK |

09:30 |

Manufacturing PMI |

Sep |

47.1 |

47.0 |

!!! |

|

UK |

09:30 |

Services PMI |

Sep |

53.4 |

54.2 |

!!! |

|

UK |

10:00 |

BoE MPC Member Pill Speaks |

-- |

-- |

-- |

!! |

|

UK |

11:00 |

CBI Industrial Trends Orders |

Sep |

-30 |

-33 |

!! |

|

US |

13:30 |

Current Account |

Q2 |

-259.0B |

-450.2B |

!! |

|

US |

13:30 |

Fed Goolsbee Speaks |

-- |

-- |

-- |

! |

|

US |

14:00 |

FOMC Member Bowman Speaks |

-- |

-- |

-- |

!!! |

|

US |

14:45 |

S&P Global Composite PMI |

Sep |

54.6 |

54.6 |

!! |

|

US |

15:00 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

|

US |

17:35 |

Fed Chair Powell Speaks |

-- |

-- |

-- |

!!!! |

|

US |

18:00 |

2-Year Note Auction |

-- |

-- |

3.641% |

!! |

|

CA |

19:15 |

BoC Gov Macklem Speaks |

-- |

-- |

-- |

!! |

|

US |

20:30 |

Fed Goolsbee Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg & Investing.com