Shifting policy expectations weigh on JPY & GBP

JPY: Japan fiscal policy plans & fresh US sanctions on Russia in focus

The major FX rates have remained relatively stable overnight with the yen continuing to underperform reflecting building expectations for looser fiscal and monetary policies to support growth under new Prime Minister Takaicihi. It has helped to lift USD/JPY up to a high of 152.65 overnight as the pair moves back closer to the high of 153.27 recorded on 10th October after Sanae Takaichi won the LDP leadership election. Yen selling has been encouraged by reports yesterday that the new prime minister is preparing an economic stimulus package that is likely to exceed last year’s supplementary budget which totalled JPY13.9 trillion according to government sources familiar with the plan. The exact scale of the package is reportedly still being finalised but could be announced as early as next month. The package will be built around three main pillars: i) measures to counter inflation, ii) investment in growth industries, and iii) national security. To provide inflation relief the government is expected to abolish the provisional gasoline tax rate, and will include investments in strategic growth sectors such as AI and semiconductors. The reports add that if additional spending needs exceed initial expectations, the government may need to issue deficit-covering bonds.

While the yen has weakened, the JGB market has remained more relaxed. The 30-year JGB yield even hit its lowest level since mid-August and currently stands almost 30bps lower than the high just after the LDP leadership election. The mixed price action indicates that yen weakness on the back of fiscal fears may be overdone. Downward pressure on long-term JGB yield does though also reflect spill-overs from the broader rally taking place in other major long-term bond markets.

The main development overnight has been the announcement from the Trump administration to step up sanctions on Russia’s biggest oil producers. The Treasury Department blacklisted state-run Rosneft PJSC and Lukoil PJSC because of “Russia’s lack of serious commitment to a peace process to end the war in Ukraine”. It quickly follows President Trump’s decision to cancel a second Summit meeting with President Putin in Budapest. Bloomberg has reported that it marks a radical change in Western policy around Russian oil, where previously efforts including the G7 cap on prices had sought to limit revenue for the Kremlin without impacting the flow of barrels. Rosneft and Lukoil jointly account for nearly half of the Russia’s oil exports. The report cautions though that the because the focus of the tariffs is on the oil companies and do not penalize third-parties that do business with them, many of the barrels are still likely to find their way to market but at a higher cost. It has prompted the price of Brent to jumped up towards USD65/barrel from closer to USD60/barrel earlier this week when it was trading closer to year to date lows. The oil-related G10 currencies CAD and NOK have benefitted from the oil price rebound this week.

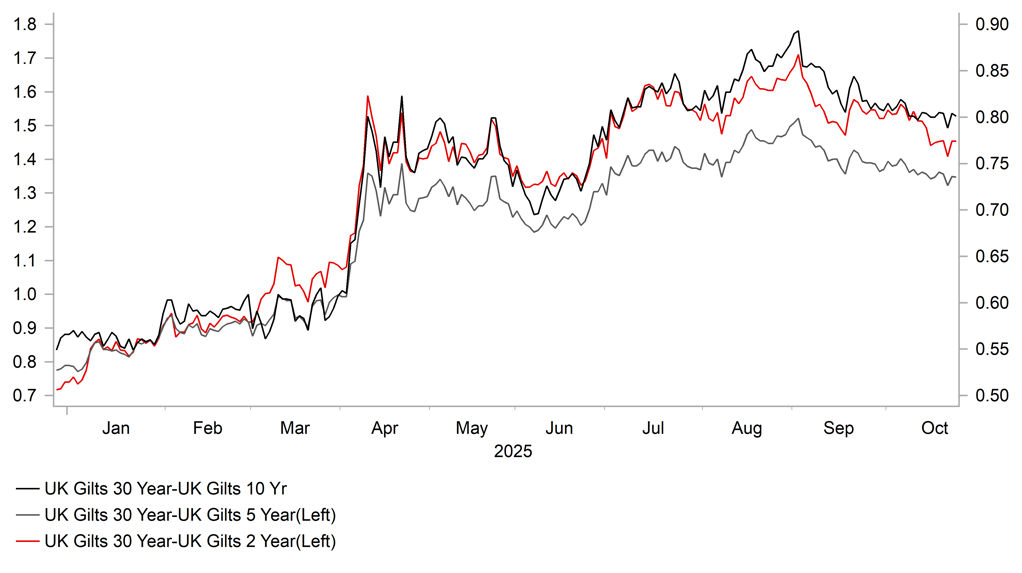

LONG-TERM GILTS OUTPERFORM AS FISCAL CONCERNS EASE?

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Opening the door for further BoE rate cuts while UK fiscal concerns ease

The pound weakened sharply yesterday initially after the release of the much weaker UK CPI report for September although a large part of the sell-off was quickly reversed. Cable initially dropped sharply from around 1.3385 and hit a low of 1.3311 before rebounding back towards 1.3350. The size of the initial cable sell-off was similar to the last time there was such a big downside inflation surprise back in December 2023 when on that occasion cable fell by -0.4% in the first 30 minutes after the CPI report was released. As our European economist highlighted yesterday (click here), the latest UK CPI for September revealed that inflation came in well below the BoE’s forecasts from the August Quarterly Inflation Report. The BoE was expecting headline inflation to peak at 4.0% but it came in at 3.8%. Services and food inflation also undershot their expectations by 0.3ppt and 0.5ppt point respectively. The weaker food inflation reading is important as the BoE had been emphasizing recently that they were concerned that higher food inflation was increasing the risk of more persistent inflation in the UK.

The report supports our decision to hold on to our call for the BoE to cut rates further this year in December. We had assumed that softer inflation and wage growth alongside fiscal tightening measures to be announced in the Autumn Statement would tip the balance in favour of a cut by the December MPC meeting. The UK rate market has now moved to price in higher probability of a December rate cut and is currently pricing in around 18bps up from 11bps at the start of this week. One can’t completely rule out the possibility the BoE performs a quick policy u-turn and sticks to the quarterly pace of rate cuts by lowering rates next month after communicating recently over the need to slowdown the pace of cuts. MPC member Dave Ramsden could join Swati Dhingra and Alan Taylor in voting for a cut next month. Governor Bailey could prove to be an important swing voter as Sarah Breeden has always voted the same way.

However, the sharp drop in UK yields this month has had only a modest negative impact on the pound. The two-year Gilt yield has dropped by around 25bps. The relative resilience of the pound could reflect support from an easing of UK fiscal concerns ahead of the Autumn Statement. The 30-year Gilt yield has dropped even more sharply by around 35bps and fully reversed the summer sell-off.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SZ |

08:25 |

SNB Monetary Policy Assessment |

-- |

-- |

-- |

!! |

|

UK |

09:30 |

BoE MPC Member Dhingra Speaks |

-- |

-- |

-- |

! |

|

UK |

11:00 |

CBI Industrial Trends Orders |

Oct |

-28 |

-27 |

!! |

|

US |

13:30 |

Chicago Fed National Activity |

Sep |

-- |

-0.12 |

! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

223K |

218K |

!!! |

|

CA |

13:30 |

Retail Sales (MoM) |

Aug |

-- |

-0.8% |

!! |

|

EC |

14:30 |

ECB's Lane Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

Existing Home Sales |

Sep |

4.06M |

4.00M |

!!! |

|

US |

15:00 |

FOMC Member Bowman Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg & Investing.com