Japan inflation keeps BoJ rate hike action in play

JPY: Strong wage growth and inflation supports yen

The yen is stronger this morning versus the dollar but the FX move so far today looks more US dollar related with G10 currencies all stronger by a similar degree ahead of a long weekend for both the US and the UK. Data so far today has been supportive of a weaker dollar against the yen and pound with stronger than expected inflation from Japan and much stronger than expected retail sales in the UK. The inflation data has not had much impact and in particular, long-term JGB yields have dipped modestly after the big gains earlier this week. BoJ Governor Ueda made clear he would not comment on short-term moves in JGB yields but added he would watch moves closely. We believe this is consistent with a determination to stay away from long-term yields which was the message relayed by policy board member Asahi Noguchi yesterday who played down the move and added it wasn’t for the BoJ to step in to stop yield rises. It’s important to remember that a key objective of Governor Ueda since he started in the position is to normalise the BoJ’s monetary policy framework by returning to the targeting of short-term interest rates. Any step to influence long-term yields would be seen as a step back to the days of YCC. So we expect the BoJ to continue with a laissez-faire approach to JGB yields. Changes in the tenors of JGB buying by the BoJ is the only realistic action that the BoJ would be willing to take.

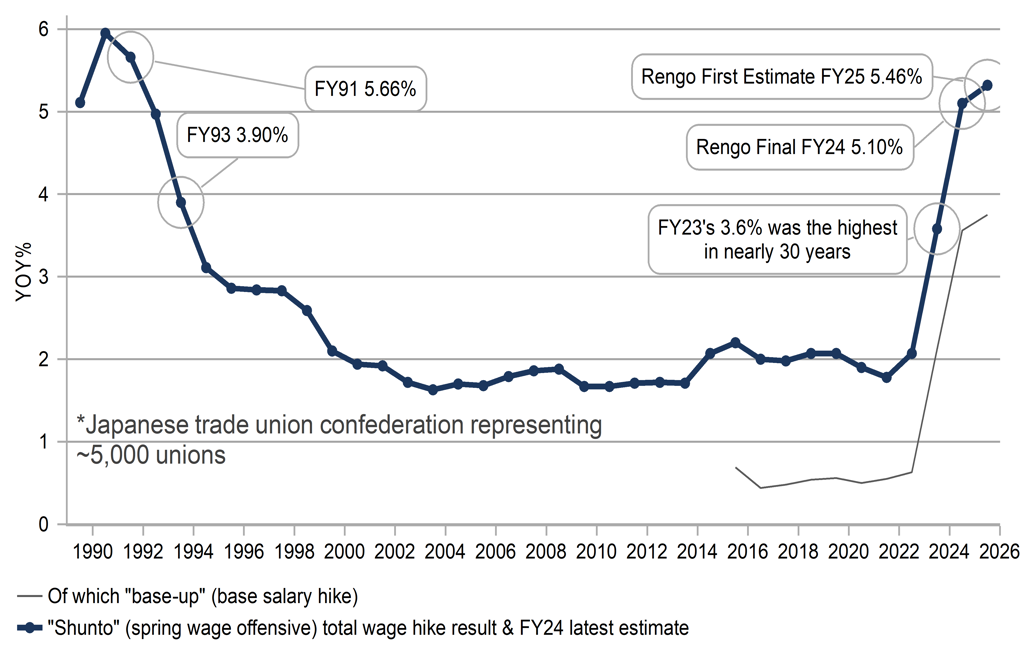

The CPI data today will certainly keep alive the prospect of a rate hike by the BoJ later this year. Risks are certainly balanced on whether broader global conditions will allow for a hike but stronger CPI and wages will strengthen the case for a move on domestic factors. Core nationwide YoY CPI increased from 3.2% to 3.5% while the core-core jumped from2.9% to 3.0%. Energy prices jumped 9.3% YoY up from 6.6% while food prices increased again – rice prices jumped 98%. Crucially, wage growth remains consistent with possible further BoJ action as well. The Japan Business Federation (Keidanren) comprising of 1,542 companies in Japan reported today an average wage increase of 5.38% in this year’s wage negotiations, only marginally below the 5.58% last year and well above the long-term average and at levels last seen in the early 1990s. Rengo in March announced a 5.46% wage increase in an initial estimate, consistent with the Keidanren announcement today.

The OIS curve indicates there remains 17bps of hikes priced for Japan by the end of the year. While that is modest, it is also unique across G10 and will act to keep USD/JPY under downward pressure especially as market participants become more convinced on the prospect of more Fed rate cuts later in the year. We also believe the Fed will deliver more cuts than the 50bps currently priced by year-end.

ANOTHER YEAR OF STRONG WAGE GROWTH KEEPS BOJ IN PLAY TO HIKE

Source: Bloomberg, Macrobond & MUFG GMR

EUR: ECB set to cut further with FX move a help

The minutes from the ECB meeting in April were released yesterday and in general the details were suggestive of further cuts to come going forward. The release has further reinforced the prospect of another 25bp cut at the next meeting on 5th June. The minutes revealed that some saw a cut in April as “front-loading a possible cut at the June meeting” which was aligned by the fact that some Council members were open to a 50bp cut at the April meeting. While we have seen a notable de-escalation in the US-China trade conflict since the ECB meeting on 16th-17th April, there was nothing in the minutes to suggest that the de-escalation would undermine the prospect of another cut in June. The cut in April was influenced by the actions by Trump on 2nd April with members who were considering a pause were encouraged to cut to provide “some insurance against negative outcomes.”

The tone of the minutes also pointed to increased confidence in inflation returning to target, which if maintained, certainly points to the scope for the ECB to lower the policy rate into accommodative territory. The list of factors pushing inflation lower were growing – the negative demand shock due to the tariffs themselves, and then due to the uncertainty created, the decline in energy prices and the appreciation of the euro. The minutes outlined the market reactions to the tariffs and the unusual sell-off of equities and bonds but then highlighted the more usual performance of the German bund with yields declining and the OIS-Bund spread narrowing, which meant Bunds “had continued to perform their role as a safe-haven asset”. That solid safe-haven anchor also appears to have helped support other euro-zone bond markets as well. The BTP/Bund spread did initially widen but has surprisingly narrowed since peaking at 130bps on 9th April to around 100bps now. If that persists into the next meeting, the ECB will be even more encouraged about the resilience of the euro-zone markets.

The ECB also commented that the euro looked to be becoming a safe-haven currency and also cited an “intermediate scenario” of the euro becoming increasingly attractive and taking on a greater reserve currency role. This is something we believe is very plausible going forward. EUR composition in FX reserves currently stands at 20% and before the GFC stood at close to 28%. In a world of constant tension between the US and China and with Europe likely to take steps to further eliminate fragmentation in goods, services and financial markets, there is a strong chance now that with negative rates over that reserve managers will increasingly view the EUR more positively.

For now, the appreciation of the euro is certainly opening up the prospect of further monetary easing over the short-term. The EUR EER-41 index is now 1.8% lower than the peak set in April (around the time of the April ECB meeting), but remains 4.0% stronger than in the forecasts published in March and will help to ensure the price stability goal is maintained. Two more rate cuts seems likely and if global conditions worsen or EU-US trade conflicts emerge, three cuts would be very feasible.

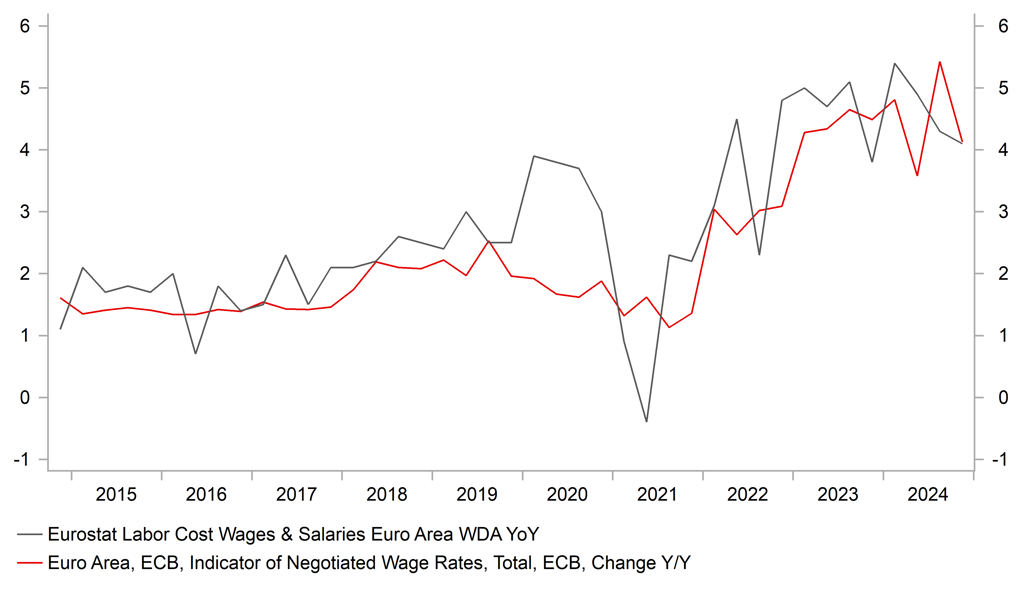

EZ NEGOTIATED WAGE GROWTH RATE SET TO SLOW FOLLOWING GERMAN SLOWDOWN (0.9% FROM 5.8% IN Q4)

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:30 |

ECB's Lane Speaks |

-- |

-- |

-- |

!! |

|

EC |

10:00 |

ECB Negotiated Wages |

Q1 |

4.1% |

!! |

|

|

US |

13:30 |

Building Permits |

Apr |

1.412M |

1.467M |

!! |

|

US |

13:30 |

Building Permits (MoM) |

Apr |

-4.7% |

0.5% |

! |

|

CA |

13:30 |

Core Retail Sales (MoM) |

Mar |

0.2% |

0.5% |

!!! |

|

CA |

13:30 |

Corporate Profits (QoQ) |

-- |

-- |

-2.5% |

! |

|

CA |

13:30 |

Retail Sales (MoM) |

Mar |

-0.3% |

-0.4% |

!! |

|

CA |

13:30 |

Retail Sales (MoM) |

Mar |

-- |

-0.4% |

!! |

|

US |

14:35 |

Fed Schmid Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

New Home Sales |

Apr |

694K |

724K |

!!! |

|

US |

15:00 |

New Home Sales (MoM) |

Apr |

-- |

7.4% |

!! |

|

US |

17:00 |

Fed Governor Cook Speaks |

-- |

-- |

-- |

!! |

|

EC |

17:00 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

!!! |

Source: Bloomberg & Investing.com