Spill-overs to FX market remain limited from escalating Middle East tensions

USD: Relatively muted initial market response to “targeted” US military strikes

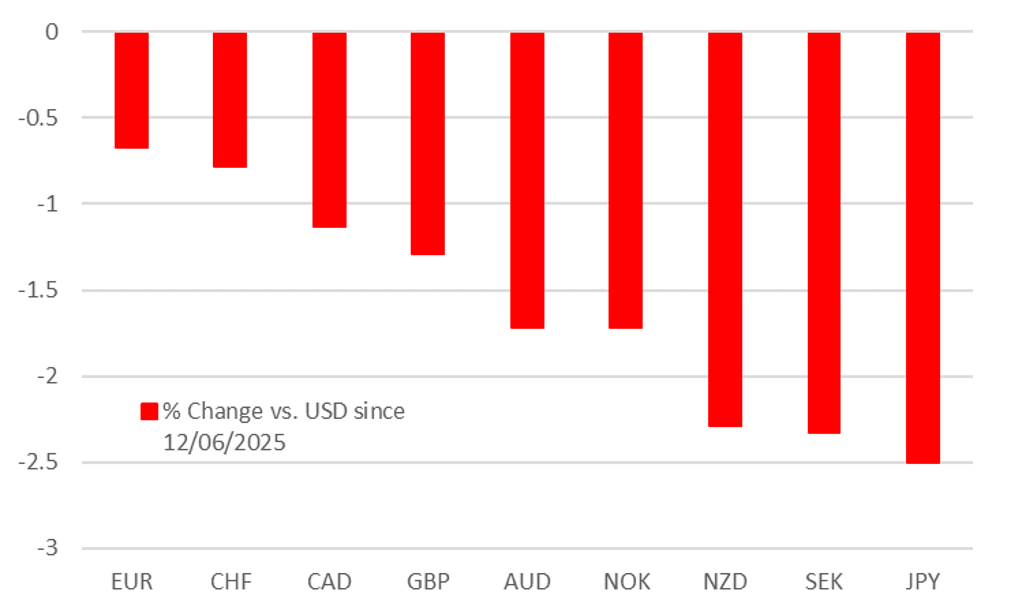

The US dollar has continued to strengthen modestly at the start of this week following a further escalation of geopolitical tensions in the Middle East over the weekend. It has helped to lift the dollar index back above the 99.000-level. However, the performance of other traditional safe haven currencies has been more mixed. The Swiss franc has strengthened modestly alongside the US dollar while the yen has weakened further resulting in USD/JPY rising back above the 147.00-level overnight. Yen weakness could initially reflect investor concerns that Japan’s economy would be hit harder by higher oil prices given its reliance on energy imports from the region, and the potential for inflationary fears to lift yields more outside of Japan. The flight to quality bid in response to US missile strikes on Iran has not been sufficient to reverse the yen weakening trend that has been in place recently which has been encouraged as well by BoJ caution over raising rates given elevated uncertainty related to trade policy and geopolitical risks in the Middle East. The high beta G10 commodity currencies of the Australian and New Zealand dollars have also underperformed alongside the yen.

Overall, the initial financial market reaction has been relatively muted in response to the US military strikes on Iran. The price of Brent crude oil did initially jump back above USD80/barrel but has since dropped back to closer to where it was trading at the end of last week at just above USD78/barrel. The initial muted market response could be a reflection that market participants are waiting to see how Iran will respond to the US military strikes to determine whether the conflict will prove more disruptive for the global economy and financial markets. At the United Nations on Sunday, Iranian Ambassador Amir Saeid Iravani told the emergency Security Council that the “timing, nature and scale” of their response “will be decided by its armed forces”. Foreign Minister Abbas Araghchi stated that the country reserves all options to respond. However, they are also aware that President Trump has threatened to meet any retaliation against the US with force “far greater” than the initial strikes that targeted nuclear sites over the weekend which should act as a significant deterrent to curtail retaliation from Iran.

Without retaliation the Trump administration has initially indicated that the military strikes over the weekend are likely to be a one-off to damage Iran’s nuclear capabilities rather than the start of broader conflict. Vice President JD Vance stated that the US was “not at war with Iran, we’re at war with Iran’s nuclear programme” and Secretary of State Marco Rubio stated that the US “was not looking for war in Iran”. After the US strikes, Israeli Prime Minister Netanyahu has stated that Israel is “very close” to completing its objectives after inflicting major damage to Iran’s nuclear facilities and missile programmes. The comments indicate that there appears to be a path for the conflict to de-escalate going forward. However, President Trump has brought up the subject of regime change in Iran which could trigger a potentially more disruptive outcome. He posted on Truth Social “It’s not politically correct to use the term, “Regime Change”, but if the current Iranian Regime is unable to MAKE IRAN GREAT AGAIN, why wouldn’t there be a Regime change??? MIGA!!!”. The higher level of geopolitical uncertainty and the risk of triggering another energy price shock is providing more support for the US dollar in the near-term alongside the Fed’s reluctance to resume rate cuts (click here).

JPY HAS BEEN WORST PERFORMER SINCE MIDDLE EAST RISKS INCREASED

Source: Bloomberg, Macrobond & MUFG GMR

USD: Fed Chair Powell’s semi-annual testimony another focus in week ahead

The latest developments in the Middle East will understandably dictate price action in financial markets at the start of this week. It follows a heavy schedule of central bank updates last week. The Scandi central banks of the Norges Bank were more active than expected contributing to weaker local currencies alongside the broader the deterioration in global investor risk sentiment. The Riksbank cut rates but a further 25bps after temporarily paused their easing cycle earlier this year, and left the door open to another cut before year end which would lower the policy rate to 1.75%. More surprising was the Norges Bank’s decision to start their easing cycle a little earlier than expected and they signalled that they plan to cut rates potentially two more times by the end of this year. The Riksbank acknowledged that the economic recovery in Sweden is proceeding more slowly than expected and they expect the “substantial” uncertainty to hamper the recovery in the near-term. The Norges Bank’s decision to start rate cuts sooner was driven more by evidence of softer underlying inflation than expected in Norway. The dovish policy updates leave the NOK and SEK vulnerable to further weakness in the near-term.

The Fed’s outlook for monetary policy will be in focus again in the week ahead when Chair Powell will deliver the semi-annual update on monetary policy to Congress on Tuesday and Wednesday. We expect a similar message to be delivered to at last week’s FOMC meeting indicating that the Fed is not in a rush to resume rate cut rates until they have more clarity over the economic outlook. One FOMC participant who has become more dovish recently is Governor Waller who has been mentioned as a potential candidate to be next Fed Chair. He stated that the Fed should cut rates as soon as next month having previously called for the Fed to wait until later this year. He believes that “we’ve got room to bring it down, and then we can kind of see what happens with inflation”. The comments would be viewed more favourably by President Trump who has recently been calling on the Fed to cut rates by 2-2.5 percentage points. It highlights that US dollar strength on the back of Middle East tensions and the Fed’s reluctance to cut rates are built on shaky foundations.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

FR |

08:15 |

HCOB France Manufacturing PMI |

Jun |

49.8 |

49.8 |

!! |

|

FR |

08:15 |

HCOB France Services PMI |

Jun |

49.2 |

48.9 |

!! |

|

GE |

08:30 |

HCOB Germany Manufacturing PMI |

Jun |

48.9 |

48.3 |

!! |

|

GE |

08:30 |

HCOB Germany Services PMI |

Jun |

47.8 |

47.1 |

!! |

|

EC |

09:00 |

HCOB Eurozone Manufacturing PMI |

Jun |

49.6 |

49.4 |

!! |

|

EC |

09:00 |

HCOB Eurozone Services PMI |

Jun |

50.0 |

49.7 |

!! |

|

UK |

09:30 |

S&P Global Manufacturing PMI |

Jun |

46.9 |

46.4 |

!! |

|

UK |

09:30 |

S&P Global Services PMI |

Jun |

51.2 |

50.9 |

!! |

|

EC |

14:00 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

US |

14:45 |

S&P Global Manufacturing PMI |

Jun |

51.1 |

52.0 |

!!! |

|

US |

14:45 |

S&P Global Services PMI |

Jun |

52.9 |

53.7 |

!!! |

|

US |

15:00 |

Existing Home Sales (MoM) |

May |

-1.3% |

-0.5% |

!! |

|

US |

15:00 |

FOMC Member Bowman Speaks |

-- |

-- |

-- |

!! |

|

GE |

16:00 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

US |

18:10 |

Fed Goolsbee Speaks |

-- |

-- |

-- |

! |

|

US |

19:30 |

FOMC Member Kugler Speaks |

-- |

-- |

-- |

! |

|

US |

19:30 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg & Investing.com