US jobs market will be key for the Fed and the dollar

USD: Claims data signals a turn

The dollar rebounded yesterday from the intra-day lows with EUR/USD failing to hold on to gains over the 1.1000-level. The BoE’s decision (here) to hike by 50bps and maintain its guidance of more hikes if inflation pressures persist helped reinforce expectations that the FOMC will deliver at least one of the two rate hikes that the FOMC believes will be necessary to bring inflation under control. Of course the BoE decision did also reinforce expectations that the ECB may need to hike beyond the July meeting so there was no notable change in yield spreads to back up the drop in EUR/USD and the selling looks in part technical to us based on the failure of EUR/USD to hold above the key 1.1000-level. Increased risk aversion today on fears over the impact of monetary tightening has also helped provide the dollar with some support.

But the decision on a hike from the FOMC will not be determined by the BoE or other external factors and will remain a decision primarily influenced by incoming economic data – in particular on the labour market and inflation. PCE inflation next week, ISM and NFP the following week and the CPI the week after will shape Fed thinking on the July meeting. Powell in communications to the Senate Banking Committee yesterday certainly made clear that in the FOMC’s view, the tightening cycle is not over.

But the primary piece of economic data that gives justification to the continued hawkish rhetoric from the Fed is the strength of the labour market. But evidence is building that we are close to a turn toward weaker employment data. It is already becoming clearer in the claims data. The initial claims yesterday came in at 264k which was the third consecutive week of claims over the 260k level for the first time since October 2021. Excluding the coivd period, it is the highest level since September 2017.

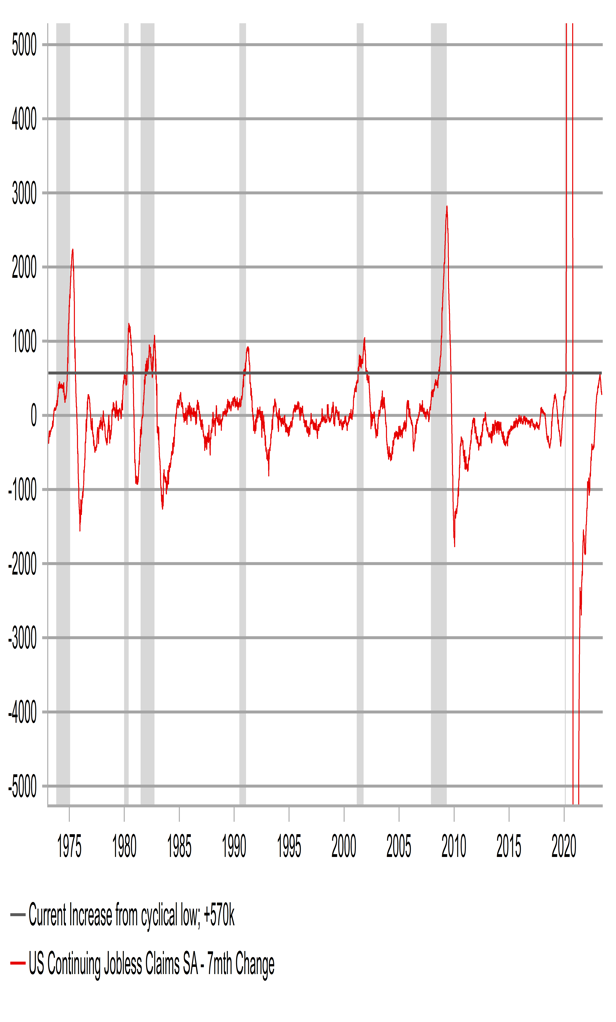

The continued claims data is also significant. The chart above highlights the change in claims over an 7-month period (this is the period since the cyclical low was hit last year to current high in April) and every time continued claims increases to the degree most recently (570k), the US labour market weakens notably and recession follows.

Other data backs up the weakening labour market view. The state-by-state nonfarm payrolls data for May revealed that only 5 states recorded notable increases in NFP versus April with 45 states roughly unchanged. That’s a big difference to the annual change which shows 42 states recorded increases and eight were roughly unchanged. Momentum is clearly turning more negative. A softer labour market is also more evident in the household survey as well with the unemployment rate up 0.3ppt, the biggest increase since November 2010.

Of course we can’t be sure these signs of weakness will become evident in the NFP in the July release for June data. And if the data holds up again then a hike by the FOMC in July is more likely. The data does though make us confident a turn will materialise over the coming two to three months and that leaves the dollar vulnerable to a further sell-off once the weakness is confirmed in NFP. Our current EUR/USD forecasts are 1.0900 in Q2 and 1.1300 in Q3 which reflects our view of a turn in the jobs data that intensifies once again recession fears and strengthens expectations of rate cuts at the back-end of this year and in 2024, which will help fuel renewed dollar selling.

CLAIMS 570K FROM CYCLICAL LOW IN 7MTHS – A SIGNAL OF RECESSION IN PREVIOUS RECESSIONS BACK TO THE 1970S

Source: Bloomberg & Macrobond

TRY: Policy shift continues as CBRT disappoints expectations for bigger hike

The Turkish lira has continued to adjust sharply lower following yesterday’s CBRT policy meeting. It has resulted in USD/TRY hitting a new record high of 25.480 overnight which is up from around 23.550 where it was trading prior to yesterday’s CBRT policy meeting. The CBRT under the new leadership of new Governor Erkan raised their key policy rate by 6.5 percentage points to 15.0%. While it was a step in right direction back towards more orthodox monetary policy settings, the size of the adjustment disappointed market expectations and triggered a fresh sell-off in Turkish assets and the lira. The Bloomberg consensus forecast prior to yesterday’s policy meeting was expecting the CBRT to raise the policy rate to 20.00% although there was a wide range of views. The CBRT indicated that “monetary tightening will be further strengthened as much as needed in a timely and gradual manner until a significant improvement in the inflation outlook is achieved”. The Committee also stated that they “will simplify and improve the existing micro and macroprudential framework”. The guidance suggests that the CBRT is likely to follow up yesterday’s rate hike with similar sized adjustments at upcoming meetings in July and August and lift the policy rate closer to 25-30% as it attempts to regain inflation fighting credibility.

In a tweet after yesterday’s CBRT policy update, new Treasury and Finance Minister Simsek stated that a “policy framework based on the principles of market economy, free foreign exchange regime and open economy will ensure significant capital inflow to Turkey”, and that the central bank rate decision should be viewed in this context. He emphasized that the “stability and security of our currency is the most effective solution to get rid of dollarization problem”. In the near-term, the shift back to more orthodox policy settings including allowing the lira to float more freely is allowing it to find a new lower equilibrium which helps restore external competitiveness and rebalance Turkey’s economy. By delivering more gradual hikes, the lira is playing a greater role in the policy shift. It is resulting in more front-loaded lira weakness than we had been forecasting (click here). We believe it is still too early in the adjustment to expect a significant pick-up in capital flows into Turkey resulting from the policy shift that would help to provide more support for the lira at weaker levels. As a result risks remain heavily titled to the downside for the lira.

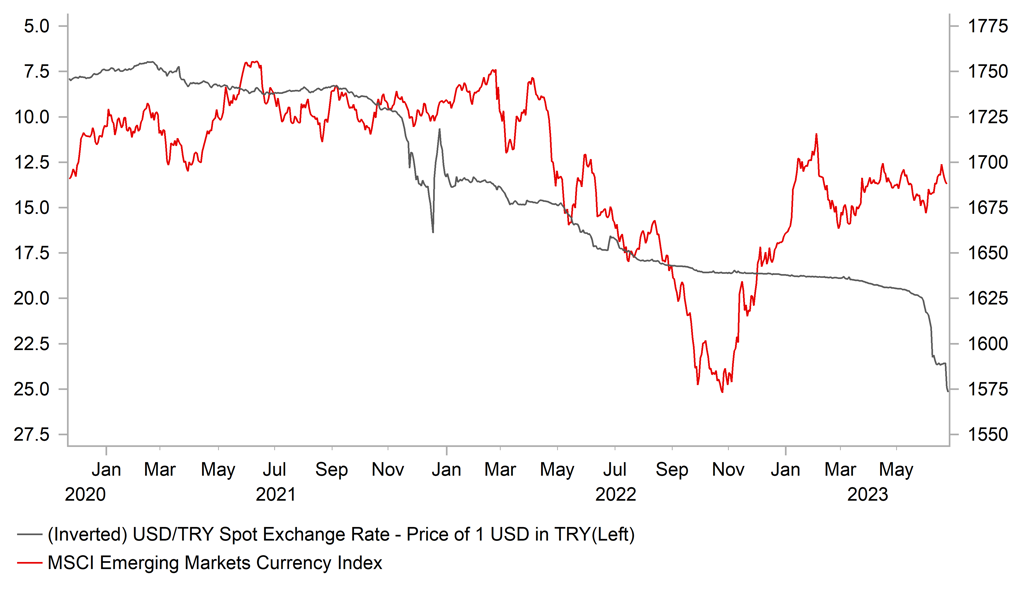

SHARP TRY DEPRECIATION IN THE MIDST OF EM FX STABILITY

Source: Macrobond

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

Manufacturing PMI |

Jun |

44.8 |

44.8 |

!! |

|

EC |

09:00 |

Services PMI |

Jun |

54.5 |

55.1 |

!! |

|

UK |

09:30 |

Manufacturing PMI |

-- |

46.8 |

47.1 |

!!! |

|

UK |

09:30 |

Services PMI |

-- |

54.8 |

55.2 |

!!! |

|

US |

10:15 |

FOMC Member Bullard Speaks |

-- |

-- |

-- |

!! |

|

US |

13:00 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

|

EC |

13:45 |

ECB's Panetta Speaks |

-- |

-- |

-- |

!! |

|

US |

14:45 |

S&P Global Composite PMI |

Jun |

-- |

54.3 |

!! |

|

US |

18:40 |

FOMC Member Mester Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg