JPY gains on back of trade deal offset by heightened political uncertainty

JPY: Speculation over Prime Minister Ishiba’s future intensifies after trade deal

It has been a volatile trading session for the yen overnight. The yen initially extended its rebound from the start of this week triggered by the announcement from President Trump overnight that the US has reached a trade deal with Japan. It resulted in USD/JPY falling to an intra-day low of 146.20. However, the yen has quickly given back those gains after it was reported by the Yomiuri/Mainaichi Shimbun newspapers that Prime Minister Ishiba is set to announce his intention to resign as soon as this month. According to the Yomiuri newspaper, Prime Minister Ishiba has made his decision known to those close to him. Now that there has been progress in reaching a trade deal with the US, Prime Minister Ishiba has reportedly decided he can now take responsibility for the election result. NHK then reported that Prime Minister Ishiba was holding a meeting with former prime minister Fumio Kishida, Vice President Yoshihide Suga and LDP Supreme Advisor Taro Aso at which he was expected to discuss his intentions to step down. The meeting has just concluded and Prime Minister Ishiba has stated that there is no truth in reports that he will be stepping down or discussed his fate as prime minster. Despite the official denial we expect speculation to continue over his future as prime minister. The LDP could just be playing for time before formally announcing that they will hold a leadership election in the autumn.

The yen has re-weakened in response to the heightened political uncertainty lifting USD/JPY back above the 147.00. Speculation is building over who could become the next leader of the LDP. Without a majority in the Lower House they would also need support from the opposition to become prime minister. It opens up the possibility of another general election late this year as well. As we have highlighted previously (click here), the worst outcome for the yen would be if Senae Takaichi became the next leader of the LDP. She is likely to be one of the initial favourites to replace Prime Minister Ishiba given that she got to the final run-off against Ishiba in the last LDP leadership election and was defeated narrowly by 215 to 194. She is strongly ideologically aligned to former Prime Minister Shinzo Abe and his Abenomics policies of maintaining loose fiscal and monetary policies. It could encourage speculation that the BoJ could come under more government pressure to delay policy normalization and thereby weaken the yen. Other potential candidates to become LDP leader that have been mentioned so far in the media include current Agriculture Minister Shinjiro Koizumi, former LDP Secretary General Toshimitsu Motegi, Chief Cabinet Minister Hayashi and current Finance Minister Katsunobu Kato.

The pick-up in political uncertainty quickly offset the initial boost to the yen from the trade deal announced between the US and Japan which came just before the 1st August deadline for “reciprocal” tariffs. As a result of the deal imports from Japan will now be subject to a 15% “reciprocal” tariff rate down from 25% as outlined in President Trump’s recent letter. In a further positive development for Japan, imports of autos & parts will be subjected to the same 15% tariff rate down from the 25% rate that has been imposed since April. Unlike the trade deal with the UK, Japan has secured a reduction in the tariff rate applied to autos & parts without setting a quota. Prime Minister Ishiba added that “we have secured a commitment that Japan will not be treated less favourably” than other countries in the event tariffs are imposed in the future on strategically important goods such as semiconductors and pharmaceuticals.

The trade deal also includes a USD550 billion investment pledge from Japan into the US. Bloomberg notes that the investment timeline is not certain, and it’s not clear whether President Trump would be able to allocate the full sum during his term. The investment sum would partly come in the form of loan guarantees according to Prime Minister Ishiba. It has been reported as well that Japan has agreed to return 90% of the profits made from the investment fund to the US. While the trade deal is heavily weighed in favour of the US, the reduction in tariff rates on imports of autos & parts is a positive development for Japan which will help to ease downside risks for Japan’s economy. On its own the trade deal would have encouraged market expectations that the BoJ could hike rates further later this year providing support for the yen. However, if the heightened political uncertainty in Japan continues to linger heading into the autumn then it will remain more challenging for the BoJ to resume rate hikes this year. In these circumstances, we are still not convinced yet that the stage is clear for a sustained yen rebound until domestic political uncertainty eases.

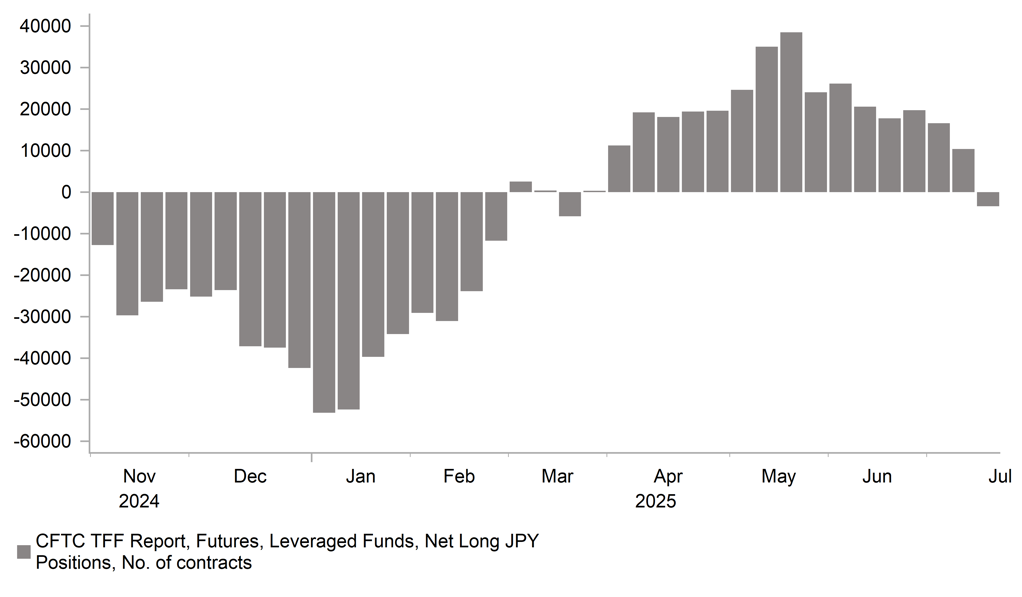

LEVERAGED FUNDS HAVE CUT BACK LONG JPY POSITIONS

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

US |

15:00 |

Existing Home Sales |

Jun |

4.00M |

4.03M |

!! |

|

EC |

15:00 |

Consumer Confidence |

Jul |

-15.0 |

-15.3 |

! |

Source: Bloomberg & Investing.com