Rate cuts push-back will remain USD supportive for now

USD: Risk-appetite related selling unsustainable

Yesterday saw the biggest trading range in EUR/USD since the US CPI data on 13th February with the euro initially rallying on strong risk appetite in global equity markets fuelled by the strong Nvidia earnings that helped lift global equity markets. The France PMI data triggered a EUR/USD bounce to the intra-day highs before weaker data from Germany prompted a quick reversal.

One observation we would make from the France PMI data is that it might be an indication of where the risks lie going forward. There has been a very long and sustained period of bad economic data releases from the euro-zone as Germany in particular struggles from declining competitiveness related to China and the huge energy price shock after the Ukraine invasion by Russia. Market participants are not used to good economic news from Europe and hence the big reaction after the France PMI data, which was much stronger than expected. We would hazard a guess that if the German data had been strong, EUR/USD probably would have held onto much of the gains from earlier yesterday. But this was not to be and quickly optimism faded as the data reverted more to type. Still, while German manufacturing remains in the doldrums, there is certainly some bright spots emerging with the services sector rebounding more than expected which bodes well for some pick-up in GDP growth in Q1 relative to the flat growth from Q4. It does in our view bode well for a more EUR-supportive economic backdrop emerging going forward. That makes sense from the perspective of a reversal of a far more damaging energy price shock in Europe should have a more notable impact on the data as it reverses.

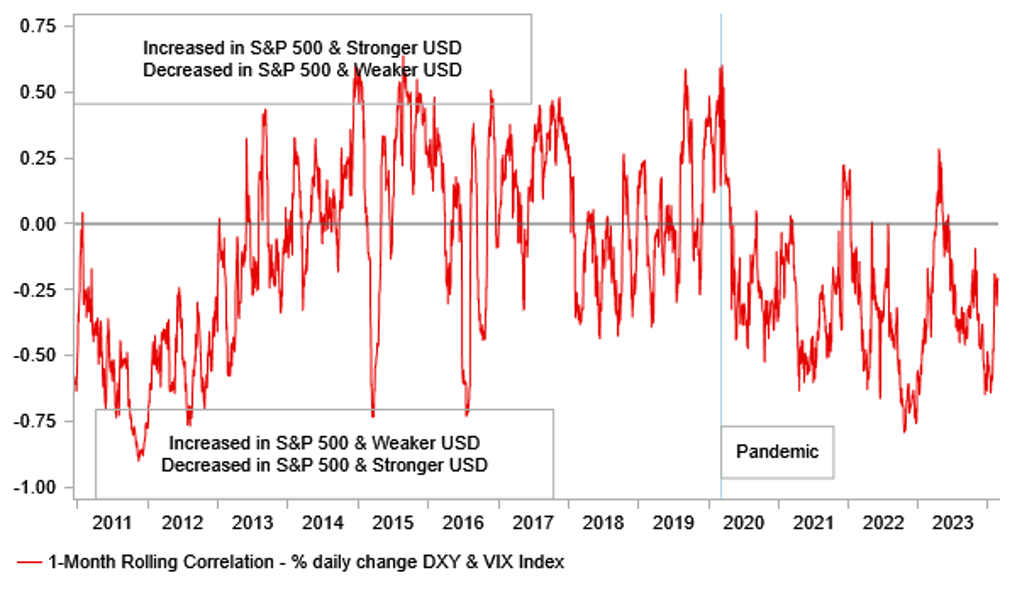

But the depreciation of the dollar that coincided with a strong performance for equities was always at risk given the move higher in US yields. Normal price action would suggest a weaker dollar coincides with increased risk appetite. But as can be seen above, there is still a negative correlation but that correlation has weakened. In fact when the daily correlation of percentage changes for risk and the dollar are compared to the correlation for the dollar and 2yr yields, the yield correlation is twice as strong. The 2yr UST yield is 50bps higher this month, slightly more than the move in Germany and with the equity market rally triggered by AI-related tech it makes it more questionable whether the dollar can weaken on the back of increased risk appetite.

Finally, the minutes from the ECB yesterday had limited impact on market pricing. The content was broadly in line with expectations and quite similar to the Fed’s on Wednesday with President Lagarde’s push-back on rate cuts at the press conference of that meeting obviously aligned with the content of the minutes. Of note to us though was the reference to the inflation forecast for 2024 likely being cut again. The latest forecasts show 2.7% CPI in 2024; 2.1% in 2025 and 1.9% in 2026. A cut to the 2024 level with the 2025-2026 levels on average at 2.0%, it is difficult to see why the ECB should not cut at the April meeting. While that small risk exists (8bps still priced) it will be hard for EUR to sustain any rallies.

USD / RISK CORRELATION REMAINS NEGATIVE BUT IS WEAKER

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Outlook brightens for pound

The UK data yesterday was also indicative of an improving outlook and the technical recession that took place in the second half of last year looks like it is probably over. The UK Composite PMI increased modestly further in the preliminary data for February from 52.9 to 53.3, the highest reading since May last year. S&P Global Market Intelligence stated that the PMI reading is signalling GDP expansion of 0.2% to 0.3% in Q1. The data also revealed some signs of upward pressure on prices again with the input price index increasing to the highest level since last August while output prices increased to the highest level since July. The data will only encourage the BoE to hold off and assess factors like shipping container traffic to assess whether supply constraints are returning and could impact inflation more notably than expected.

BoE MPC member Megan Greene spoke yesterday and stated that she was not in a position to vote for a rate cut and needed to see evidence that inflation was not entrenched. Greene only at the last meeting this month stopped voting for a hike so it’s no surprise that she remains cautious over cutting.

The upturn in risk sentiment globally will certainly allow the BoE to remain patient, similar to other central banks. But good news is still coming and the prospects of inflation hitting the 2% target in April remains plausible. OFGEM this morning confirmed that the energy bill price cap will drop 12% in April, to GBP 1,690. Still, as Greene stated yesterday, wage growth “remains a lot higher” in the UK than in the US or in Europe. If the Fed and ECB are delaying the timing of the first rate cut, the BoE will be too. The first cut is fully priced for August in the UK.

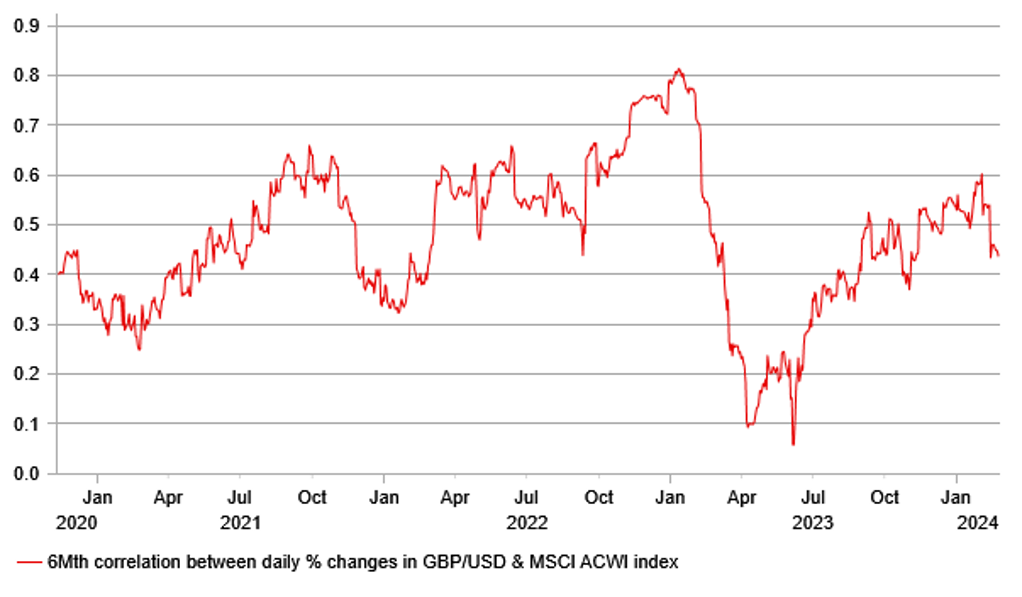

The better UK data and the strong risk appetite should be benefitting the pound more than what we are seeing to date. However, concerns over growth seem to be lingering and possibly holding GBP back. GfK Consumer Confidence this morning fell due to concerns over the outlook for the economy. Mortgage rates have turned moderately higher again possibly adding to concerns. The GBP correlation with global equities has started to weaken but remains stronger than the USD / risk correlation and may prompt some GBP strengthening if this risk appetite persists.

GBP & MSCI DAILY % CHANGE CORRELATION OVER 3MTH ROLLING WINDOW

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SZ |

08:30 |

SNB Vice Chairman Schlegel Speaks |

-- |

-- |

-- |

! |

|

GE |

09:00 |

German Business Expectations |

Feb |

84 |

83.5 |

!! |

|

GE |

09:00 |

German Current Assessment |

Feb |

86.7 |

87 |

!! |

|

GE |

09:00 |

German Ifo Business Climate Index |

Feb |

85.5 |

85.2 |

!! |

|

EC |

09:20 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

!! |

|

EC |

09:30 |

ECB's Supervisor Brd Member Jochnick Speaks |

-- |

-- |

-- |

!! |

|

GE |

10:00 |

German Buba Mauderer Speaks |

-- |

-- |

-- |

!! |

|

GE |

10:00 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

EC |

10:00 |

ECOFIN Meetings |

-- |

-- |

-- |

! |

|

EC |

10:00 |

Eurogroup Meetings |

-- |

-- |

-- |

!! |

|

IT |

10:30 |

Italian 2-Year CTZ Auction |

-- |

-- |

3.97% |

! |

|

EC |

13:00 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

!! |

|

CA |

13:30 |

Corporate Profits (QoQ) |

-- |

-- |

4.70% |

! |

|

CA |

16:00 |

Budget Balance |

Dec |

-- |

-4.01B |

! |

|

CA |

16:00 |

Budget Balance (YoY) |

Dec |

-- |

-19.14B |

! |

Source: Bloomberg