USD is still staging relief rally after last week’s FOMC meeting

JPY: No relief after BoJ update as LDP leadership contest formally kicks off

The US dollar has continued to strengthen modestly at the start of this week building on gains following last week’s FOMC meeting. The dollar index has risen by around +1.6% from the year to date low recorded on 17th September. It has helped to lift USD/JPY back closer to resistance provided by the 200-day moving average at around 148.60. After hitting a low of 145.49 on 17th September, USD/JPY has risen even more sharply by around 1.9%. The yen has failed to derive support from the BoJ’s latest policy update (click here) on Friday which has encouraged market participants to price in more rate hikes. The yield on the 2-year JGB has risen to a fresh cyclical high overnight of 0.93%. The Japanese rate market has moved to price back in just over a 50:50 probability of the BoJ resuming rate hikes at the next policy meeting at the end of October. Market participants have been encouraged to bring forward the timing of the BoJ’s next rate hike after there were surprisingly two dissenters who voted in favour of hiking rates at last week’s policy meeting, and the BoJ outlined plans to start selling down its holdings of ETFs and JREITs albeit at a very modest pace. Governor Ueda did though maintain cautious guidance in the accompanying press conference indicating that they want to look at the data a “little more” while reiterating that the basic stance is “we will hike rates if the outlook is realized”. He noted that there was “little sign” of tariffs having an impact on Japan’s economy. Overall, last week’s BoJ policy update supports our view that a rate hike remains on the table next month

One uncertainty which is contributing to current BoJ caution over hiking rates further is political uncertainty in Japan. The ruling LDP party formally kicked off their leadership contest today ahead of the leadership election set to take place on 4th October. The five candidates who are competing to be the next LDP leader and likely prime minister of Japan are Sanae Takaichi, Shinjiro Koizumi, Yoshimasa Hayashi, Takayuki Kobayashi and Toshimitsu Motegi. Out of the five candidates, the two clear favourites are Sanae Takaichi and Shinjiro Koizumi. Another poll released by the Asahi newspaper over the weekend revealed that Shinjiro Koizumi remains the most popular candidate amongst LDP supporters to be the next leader. He secured 41% of their support compared to 24% for Tanae Takaichi while Yoshimasa Hayashi was the third most popular but trailed well behind securing just 10% of their votes. It fits with our view that Shinjiro Koizumi is the early favourite to become the next LDP leader. A Koizumi victory could then trigger some clearer communications from the BoJ over the prospect of a rate hike on 30th October, and encourage a stronger yen. Please see our latest FX Weekly for more details (click here).

EUR/CHF VS. SNB RATE SPECULATION

Source: Bloomberg, Macrobond & MUFG GMR

CHF: SNB to weigh up again whether to return to negative rates

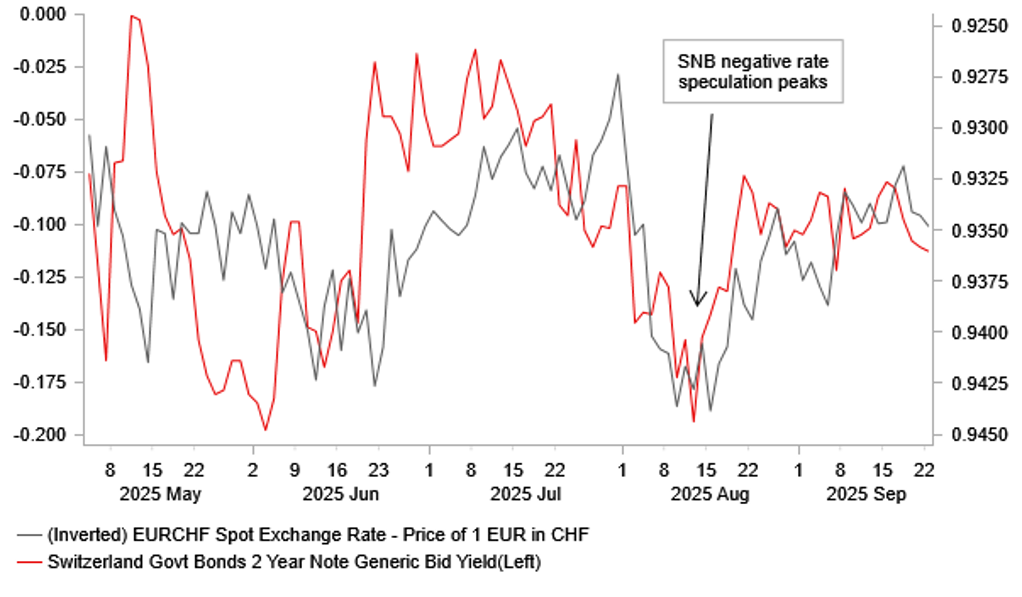

Unlike the yen, the Swiss franc has continued to perform relatively well over the past month even as global investor risk sentiment has continued to improve as evident by global equity markets hitting fresh record highs. USD/CHF briefly hit a new year to date low of 0.7829 on 17th September while EUR/CHF has fallen back towards the bottom of the recent tight trading range between 0.9300 and 0.9400. Swiss franc strength is continuing to prove persistent this year, and will likely remain a concern for the SNB given inflation in Switzerland is well below their 2.0% target.

The Swiss franc suffered a temporary setback in 1H August after President Trump announced the US would impose a 39% tariff on imports from Switzerland. EUR/CHF briefly rose to a high of 0.9457 on 18th August. Swiss franc selling was fuelled by initial speculation that the negative hit to Switzerland’s economy from the higher tariffs could encourage the SNB to more seriously consider re-implementing negative rates. However, market expectations for a return to negative rates in Switzerland have since eased back ahead of this week’s SNB policy meeting. SNB officials including President Schlegel have clearly indicated that there is a higher hurdle to reimpose negative rates given the undesirable side effects. There is also optimism after recent trade talks between the US and Switzerland that a deal will be done to lower the tariff rate. As a result, we are not expecting this week’s SNB meeting to weaken the Swiss franc.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

AU |

02:00 |

RBA's Bullock-Testimony |

!!! |

|||

|

CA |

13:30 |

Industrial Product Price MoM |

Aug |

0.1% |

0.1% |

!! |

|

US |

13:30 |

Chicago Fed Nat Activity Index |

Aug |

- 0.16 |

- 0.16 |

!! |

|

EC |

14:45 |

ECB's Lane Speaks |

!!! |

|||

|

EC |

15:00 |

Consumer Confidence |

Sep P |

- 15.0 |

- 15.0 |

!! |

|

EC |

17:00 |

ECB's Nagel Speak |

!! |

Source: Bloomberg & Investing.com