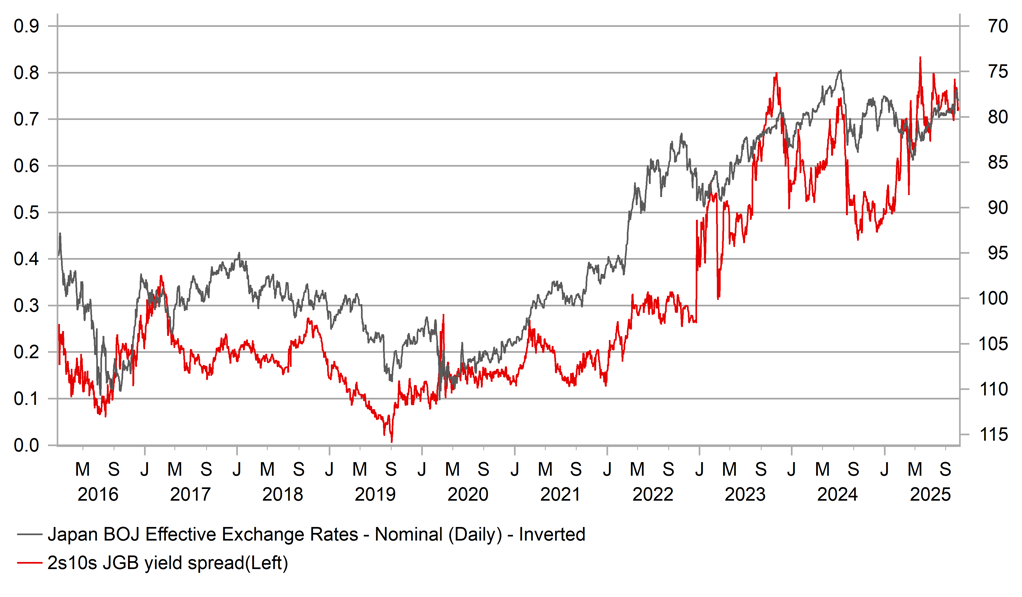

JGB stability bodes well for JPY

JPY: A sense of policy caution could curtail yen selling

The 30-year JGB yield remains nearly 25bps below the intra-day high set following Sanae Takaichi’s LDP leadership election victory and this stability at lower yields, while partly explained by international factors as well, does suggest the initial fears over Takaichi’s policies are receding. Following the coalition agreement with Ishin, a policy document including economic measures that will likely be included in an upcoming fiscal spending package was released. Abolishing the provisional gasoline tax rate and including subsidies on electricity and gas charges are set to be part of the initial fiscal steps taken to help reduce the cost of living burden on Japanese households. An exemption of the sales tax on food until March 2027 will also help lower inflation. These measures along with the review of a basic income tax reduction only “in accordance with the progress of inflation” suggest the focus will be targeted and on easing inflation. Straight cash transfers to households will be scrapped. Economic Policy & Revitalisation Minister Minori Kiuchi also spoke today on BoJ policy stating that growth and price stability were the goals and that the BoJ was expected to manage policy consistent with achieving the 2.0% policy goal. Takachi yesterday stated that the current cooperation agreement between the government and the BoJ does not need to be altered at this stage suggesting no shift in broad government policy on BoJ policy management.

So our sense at this stage is that there are greater signs of policy continuity than was originally feared and hence the ‘Takaichi trade’ of selling JGBs and the yen may be peaking. That’s not to say that the yen is about to rebound and take out the yen weakness in response to Takaichi’s victory but more that the policy approach being more balanced will deter further yen selling. The victory of Takaichi has had an impact on BoJ policy – a rate hike was much more likely in October prior and the timing has been pushed back to at least December or January.

The one risk to this view is that the new administration is only being cautious ahead of President Trump’s visit to Japan next week. PM Takaichi does not want a plunging yen to the backdrop of that visit and financial market stability is desirable. Furthermore, Trump is likely to pressure Takaichi to lift defence spending further. Japan spent just 1.4% of GDP on defence in 2024-25 with a commitment to spend 2% of GDP by March 2028. The US wants its allies to lift defence spending to 5% of GDP.

But overall, the political risk premium in the yen now looks appropriate (the yen is by far the worst performing G10 currency in October; -2.5%) and if risk-off conditions were to intensify and/or the US employment data (when it comes) was to signal the need for more Fed easing, it would likely help turn the USD/JPY momentum to the downside.

EASING POLITICAL RISKS SHOULD CURTAIL JGB CURVE STEEPENING

Source: Bloomberg, Macrobond & MUFG GMR

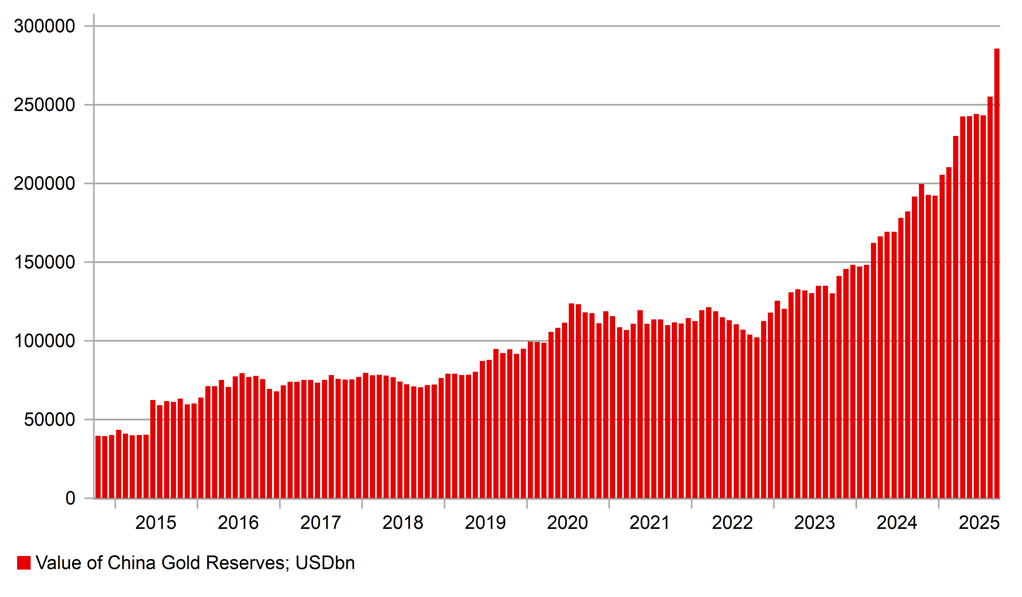

USD: Gold takes a dip

Toward the end of London trading yesterday, Gold was down over 6.0% and at the same time the S&P 500 was close to unchanged while UST bond yields were down across the curve by about 2bps. The US dollar was stronger by about 0.3%. Gold took a further dive in Asia trading today, dropping a further 3% before recouping all these losses. There were a number of questions in regard to why gold had dropped, or more specifically why now?

What had become clear prior to this dip was that the surge looked way overdone. A tell-tale sign of an overdone price move or bubble is when the fundamental narrative to why the move is taking place keeps changing. Initially it was an inflation-hedge but then UST bond yields drifted lower and breakeven inflation fell and then the gold advance was put down to Trump trade tariff uncertainty. Then optimism about trade tariffs and a US-China deal lifted other markets (Australian shares at a record high for example) and the narrative changes to a geopolitical risk trade. Then the gold move is put down to the debasement trade and sovereign risk concerns.

Of course there are elements of truth to all these fundamental drivers but we are getting the sense that certainly the last leg of the move was more about FOMO than anything else given gold is the top performing asset on a year-to-date basis. Positioning clearly looks to have become excessive. In general if it’s a crowded trade then we must class it as a risk-on trade given the performance of US equities and hence the credit strains we have witnessed in regard to Tricolor and First Brands and the general concern over what lurks in the non-bank lending space (“cockroaches”) mean this gold correction looks like a reflection of some profit-taking on a very profitable trade given recent developments and increased uncertainties in the credit space.

But there have also been active buying by central banks and getting timely information on when that buying may possibly stop is of course difficult. China’s central bank data has China’s holdings at 74.06mn fine troy ounces as of September, with a current value approaching USD 300bn. The volume of gold held is close to 20% higher than two years ago underlining the demand just from China. We know other central banks have been actively buying. If that buying is drying up it could easily be the catalyst for a retracement lower in price. Given the doubling in the price of gold since the start of 2024, this initial correction could have further to run based on previous price action episodes. From the end of 2005 to early 2008, gold advanced by 88% and then corrected by 25% lower into the GFC while from September 2018 to mid-2020, gold advanced by 65% and then corrected close to 20% by October 2022. In the GFC example, the gold correction lower coincided with a surge of the US dollar (20% & 5% further for yen vs USD). In the 2020-22 gold correction lower the dollar surged also by 20% but the yen underperformed massively (USD/JPY +40%). These examples were extreme risk-off events but given the scale of the gains on this occasion a further correction could still be notable.

THE VALUE OF CHINA’S GOLD HOLDINGS HAVE SURGED TO CLOSE TO USD 300BN AFTER 20% INCREASE IN VOLUME SINCE START OF 2024

Source: Bloomberg & Macrobond, People’s Bank of China; as of Sept 2025

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:30 |

House Price Index (YoY) |

-- |

2.5% |

2.8% |

! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

-1.8% |

! |

|

EC |

12:00 |

ECB's De Guindos Speaks |

-- |

-- |

-- |

!! |

|

EC |

13:25 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!!! |

|

US |

18:00 |

20-Year Bond Auction |

-- |

-- |

4.613% |

!! |

|

US |

21:00 |

Fed Vice Chair for Supervision Barr Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg & Investing.com