Doubts over confidence in US assets returns after poor auction

USD: Yield spike after weak auction undermines confidence

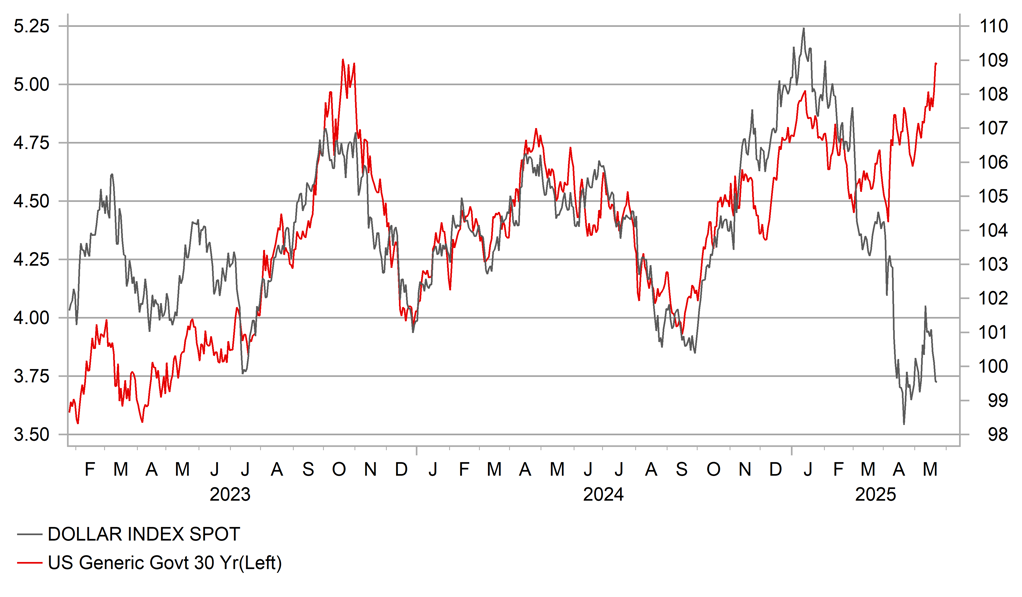

It’s the week for weak long-dated bond auctions and after the disappointing auction of 20-year paper in Japan earlier in the week, yesterday it was the turn of the US with the 20-year UST bond auction also disappointing the markets. The yield came in at 5.047%, a level that should have helped draw in demand but the bid-to-cover was 2.46, down from 2.63 at the last auction on 16th April. It was the lowest bid-to-cover since February although it was in line with the average over the last five auctions. The 10-year yield jumped by 7bps in response to the result. The 30-year yield also jumped and traded at 5.10% for the first time since October 2023. From the intra-day low following the reciprocal tariff announcement in early April, the 30-year yield has now jumped 80bps. Over the same period, the dollar has dropped by 2.5%.

Nearly all of the S&P’s drop yesterday (-1.6%) came in response to the auction and underlines the increasing sensitivity of investors risk appetite to bad news for US Treasuries and underlines the risks being taken by the Trump administration in relation to the ‘One Big Beautiful Bill Act’ that the Republicans in the House will vote on early today. Because of the Memorial Day bank holiday House Speaker Mike Johnson brought forward the vote. The details behind the bill lack credibility with White House Press Secretary Karoline Leavitt claiming the bill does not add to the debt and in fact will save USD 1.6trn through spending cuts. Every bipartisan or independent assessment concludes it will add significantly to the debt over a 10yr period.

The auction has basically resulted in another day of triple selling of US assets which will only reinforce the doubts over confidence in US assets. The G7 bilateral meetings have not created any further volatility in FX. The bilateral meeting between the US and Japan ended earlier with no discussion on FX levels specifically but both agreeing that FX rate should be determined by market forces and should reflect economic fundamentals. That provided some temporary relief and allowed for a brief pop higher in USD/JPY. But we see downward pressure on USD/JPY being maintained given doubts over US assets and economic policy mismanagement is set to persist.

30-YEAR UST BOND YIELD HITS HIGHEST LEVEL SINCE 2023 AS USD FALLS

Source: Bloomberg, Macrobond & MUFG GMR

EUR: Trump prompting more pro-active policy moves from EU

There are a number of factors that can help explain the change in the FX reaction to US tariffs – what was a dollar positive in Trump 1.0, turned to being a dollar negative in Trump 2.0. We have highlighted some of those in our research content this year but US dollar over-valuation, a different point in the US economic cycle (slowdown ahead) and obviously greater inflation risks and debt sustainability risks for the US are some examples. Another is the expectations that the key US trading partners have had ample time to prepare for the threat to trade with the US and have shifted efforts to supporting domestic demand to offset the negative hit to external demand. In that regard it was interesting to see a new imitative announced by the EU yesterday to support businesses in the EU.

No doubt linked to the Draghi report – The Future of European Competitiveness – the EU executive president in charge of industrial policy, Stephane Sejourne, outlined a new plan to reduce barriers to trading across the member states. The plan was in recognition that the approach of companies who “internationalise before they Europeanise” was no longer possible given the uncertain international business climate. The plan will break down the numerous different regulations that exist at a country-level in order to streamline rules across the region. The plan aims to create a new company category – “small mid-caps”, which have 250-750 employees with a certain turnover or asset size (the EU estimates there are 38,000 such companies). The plan will tackle the 10 most harmful barriers to doing business in the EU, like fragmented rules on packaging, labelling and waste. While these are not developments that will move the dial in terms of financial market moves now the plan is further evidence that over the medium-to-long-term, the EU could be better positioned to compete and supports our view that EUR can strengthen over the medium-to-long-term and possibly take advantage of the US-China chasm.

In the near-term though, Bloomberg reported yesterday that the EU has prepared and is expected to share a revised trade proposal with the US. The proposal covers a wide array of economic issues but does include a plan for a gradual reduction in tariffs to zero for industrial goods and non-sensitive agricultural goods. We currently assume the 20% reciprocal tariff will go live in July which will result in retaliation from the EU so it would be a positive surprise if an agreement was reached with the EU. Trump’s comments on the EU suggests a deal is unlikely.

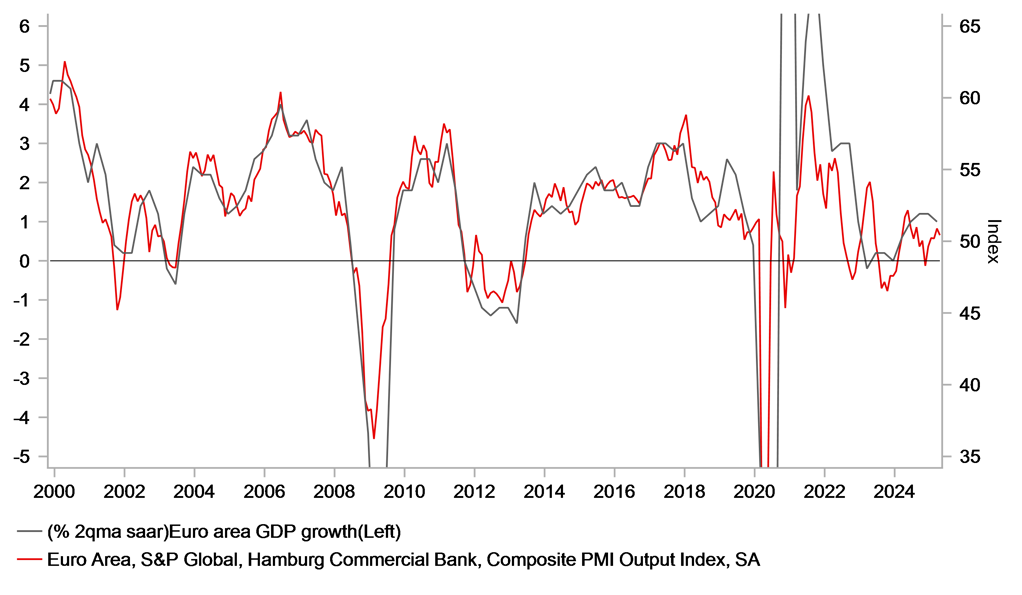

Today we will also see the release of the advance PMIs that should show some improved confidence. The survey period for the advance reports usually covers a period from around 7th of the month through to the day before the release. That implies the survey period will cover the majority of the period since US-China de-escalation was announced on 12th May. A bigger bounce in sentiment would certainly help the positive EUR/USD momentum that is emerging once again.

EURO-ZONE COMPOSITE PMI VERSUS EURO-ZONE REAL GDP SAAR AVERAGED OVER 2QTRS

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

08:30 |

German Composite PMI |

May |

50.4 |

50.1 |

!!! |

|

GE |

09:00 |

German Ifo Business Climate Index |

May |

87.4 |

86.9 |

!! |

|

EC |

09:00 |

Manufacturing PMI |

May |

49.2 |

49.0 |

!!! |

|

EC |

09:00 |

S&P Global Composite PMI |

May |

50.7 |

50.4 |

!!! |

|

EC |

09:00 |

Services PMI |

May |

50.4 |

50.1 |

!!! |

|

UK |

09:30 |

Composite PMI |

May |

49.3 |

48.5 |

!!! |

|

UK |

09:30 |

Manufacturing PMI |

May |

46.2 |

45.4 |

!!! |

|

UK |

09:30 |

Services PMI |

May |

50.0 |

49.0 |

!!! |

|

UK |

11:00 |

CBI Industrial Trends Orders |

May |

-24 |

-26 |

! |

|

UK |

11:50 |

BoE Breeden Speaks |

-- |

-- |

-- |

!! |

|

EC |

12:30 |

ECB Publishes of Monetary Policy Meeting |

-- |

-- |

-- |

!!! |

|

UK |

13:00 |

BoE MPC Member Dhingra Speaks |

-- |

-- |

-- |

!! |

|

UK |

13:30 |

BoE MPC Member Pill Speaks |

-- |

-- |

-- |

! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

230K |

229K |

!!! |

|

US |

14:45 |

Manufacturing PMI |

May |

49.9 |

50.2 |

!!! |

|

US |

14:45 |

Services PMI |

May |

51.0 |

50.8 |

!!! |

|

US |

15:00 |

Existing Home Sales |

Apr |

4.15M |

4.02M |

!! |

|

EC |

16:35 |

ECB's De Guindos Speaks |

-- |

-- |

-- |

! |

|

US |

19:00 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!!! |

|

CA |

20:15 |

BoC Deputy Governor Gravelle Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg & Investing.com