All eyes on US debt ceiling talks as Fed rate hike expectations drop back

USD: Fed comments & US debt ceiling breakdown deliver setbacks

The US dollar has started the week trading at modestly weaker levels after the recent rebound was hit by a couple of setbacks at the end of last week. It has resulted in the dollar index falling back towards the 103.00-level after hitting an intra-day high last week at 103.62. The dollar still finished higher on the week for the second consecutive week for the first time since the send half of February. The first setback for the US dollar were relatively dovish comments from Fed Chair Powell on Friday when he was speaking at the Laubach conference. He stated that “until recently it has been relatively clear that further policy firming would be warranted” but now “we’ve come a long way in policy tightening and the stance of policy is restrictive. And we face uncertainties about the lagged effects of out tightening so far and about the extent of credit tightening from recent banking stresses…Having come so far we can afford to look at the data and evolving outlook to make careful assessments”. The risks of doing too much and doing too little has become “more balanced”. When asked between the disconnect between market pricing and the Fed’s outlook for policy, he did not push back that strongly against market expectations for multiple rate cuts by the end of this year. He said that the disconnect “does not seem to reflect a misunderstanding of our reaction function, and rather the market pricing is based on a different forecast as to the speed of disinflation and the likelihood of a significant downturn for the economy. He still believes that the incoming data supports the Fed’s own view that it will take longer for inflation to come down which is similar to the views expressed by surveys of market participants. Overall, the comments from Fed Cahir Powell refrained from giving a strong indication that the Fed is planning to raise rates further at their next policy meeting on 14th June. The US rate market has since pared back expectations for a hike in June and is now only pricing in around 2bps of hikes.

The second setback for the US dollar on Friday was the brief break down of US debt ceiling talks which also contributed to the paring back of June rate hike expectations. However, the breakdown in talks only proved short-lived. President Biden is scheduled to meet House speaker McCarthy today. It follows a call between President Biden and McCarthy yesterday when President Biden was on his way back from the G7 Summit in Japan, and further discussions between key negotiators yesterday. The pressing need to reach an agreement to raise the debt ceiling by the end of this month was highlighted by Treasury Secretary Yellen yesterday when she told NBC’s “Meet the Press” that some bills would have to go unpaid if the government breaches the 1st June deadline. The likelihood of the government being able to sustain operations and pay all bills until mid-June is “quite low”. It is likely that the progress of US debt ceiling negotiations will become increasingly important in driving financial markets and FX in the coming weeks.

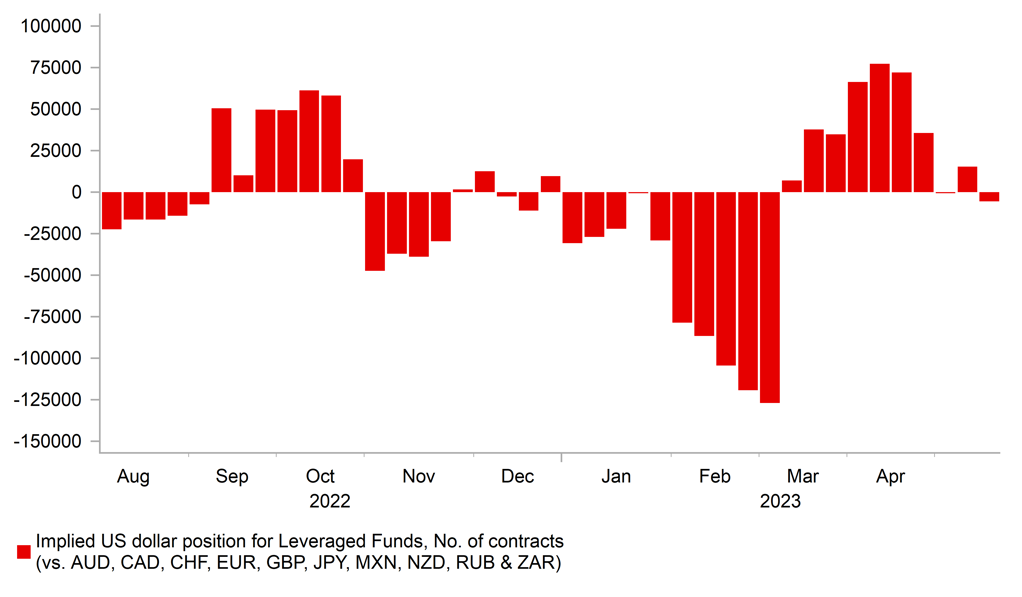

RECENT USD RALLY IS NOT LOVED

Source: Bloomberg, Macrobond & MUFG Research

GBP: UK inflation set to fall back sharply in week ahead

One other focus in the week ahead for market participants will be the release of the latest UK CPI report on Wednesday and US PCE deflator report on Friday. The UK CPI report is expected reveal a sharp drop in headline inflation. The current Bloomberg consensus is for headline inflation to fall to 8.2% in April from 10.1% in March. It will be mainly driven by disinflation in the energy price component. The 54% rise in the energy price cap for gas and electricity tariffs imposed in April 2022 will now drop out of the annual inflation calculation. Ofgem, the energy regulator, is scheduled to announce on Thursday the energy price cap for July to September. It is expected to fall closer to GBP2k from the current cap for April to June of GBP2.5k, and provide further evidence that the negative energy price shock to the UK economy continues to fade.

The UK economy has proven more resilient than expected to last year’s negative terms of trade shock which recently prompted the BoE to revise away their forecasts for recession in the UK. However, the CPI report is not expected to ease fears over underlying inflation pressures that have encouraged the BoE to keep raising rates given fears inflation could prove more persistent. The BoE also became less optimistic over how quickly food inflation will fall back this year in their latest QR projections this month. We are forecasting one final 25bps hike from the BoE in June, and the latest BoE inflation forecast have set a higher bar for upside inflation surprises in Q2 (click here). The recent rebound for the USD has resulted in cable falling back below the 1.25000-level after hitting an intra-day high earlier this month at 1.2680. The GBP has though held up better against the euro with EUR/GBP continuing to trade at close to recent lows at just below the 0.8700-level. If underlying inflation pressures keep alive expectations for the BoE to deliver multiple further hikes it will offer support for the pound in the week ahead. In contrast, the main downside risk for the pound would be if underlying and food price inflation ease alongside the expected sharp drop in energy price inflation.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SZ |

09:00 |

Total Sight Deposits CHF |

May-19 |

-- |

520.1b |

! |

|

EC |

09:45 |

ECB's Vujcic Speaks |

!! |

|||

|

EC |

10:00 |

Construction Output MoM |

Mar |

-- |

2.3% |

!! |

|

EC |

10:00 |

ECB Vice President Guindos Speaks |

!! |

|||

|

EC |

10:00 |

Construction Output YoY |

Mar |

-- |

2.3% |

!! |

|

EC |

12:30 |

ECB's Holzmann Speaks |

!! |

|||

|

EC |

15:00 |

Consumer Confidence |

May P |

- 16.8 |

- 17.5 |

!! |

|

EC |

15:15 |

ECB's Lane Speaks |

!!! |

|||

|

EC |

15:15 |

ECB's Villeroy speaks |

!!! |

|||

|

SP |

18:30 |

ECB's De Cos Speaks in Barcelona |

!! |

Source: Bloomberg