JPY remains on defensive ahead of BoJ policy update

USD/JPY: Trading at close to year to date highs ahead of BoJ meeting

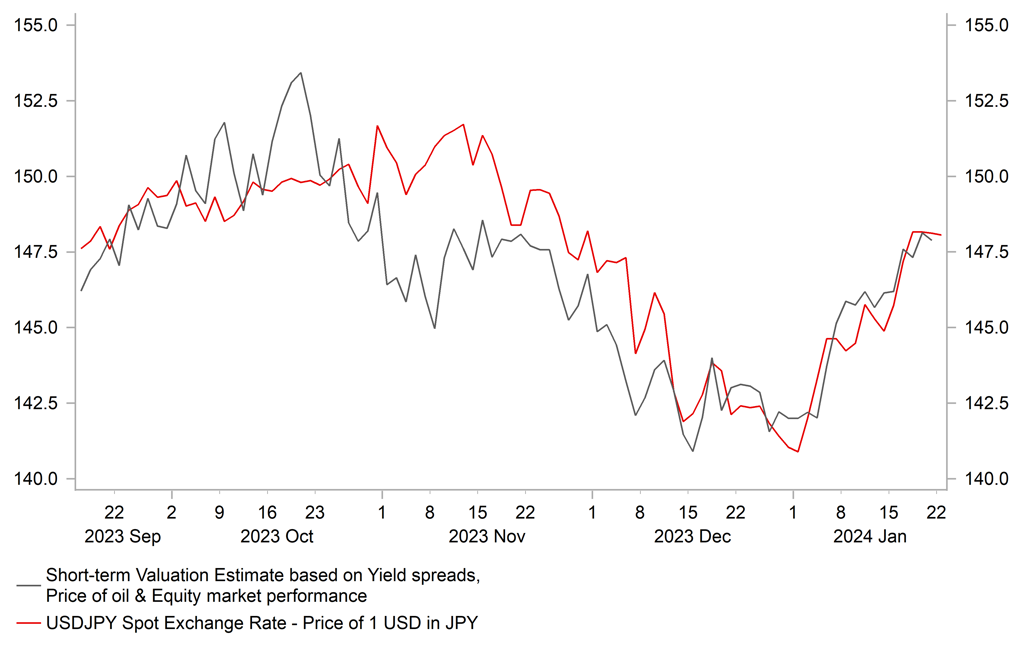

The yen has continued to trade at weaker levels ahead of tomorrow’s BoJ policy update. USD/JPY remains close to the year to date high recorded on Friday at 148.80. So far this month the yen has been the worst performing G10 currency. It has weakened by almost 5.0% against the US dollar. The sharp adjustment higher for USD/JPY at the start of this year has been driven by two main fundamental drivers. Firstly, the US dollar has rebounded across the board supported by a pickup in US yields. The 10-year US Treasury yield hit a year to date high on Friday of 4.20% as it moved further above the low from the end of last year of 3.78%. The resilience of the US economy at the end of last year has cast some doubt on how soon the Fed is likely to begin cutting rates this year. The probability of the first rate cut being delivered as soon as in March has fallen below 50% (there are currently 12bps of cuts priced in). Building optimism over a softer landing for the US economy has helped to propel the US equity market to a new record high at the end of last week. On Friday the S&P500 index broke above the previous record high of 4,818 from January of last year.

While there are doubts over the timing of the first rate cut, market participants are still confident that the Fed will make their policy rate less restrictive in response to slowing US inflation. The release of the latest US PCE deflator report for December on Friday is expected to confirm that inflation pressures slowed sharply in 2H of last year. The Bloomberg consensus forecast is for the core PCE deflator to increase by 0.2%M/M. If confirmed that would mean that the Fed’s preferred measure of underlying inflation pressure slowed to an annualized rate of 1.9% in 2H of last year. A reading that should give the Fed more confidence that inflation is falling back towards their 2.0% target, and open the door to making rates less restrictive.

The second fundamental driver behind the sharp adjustment higher for USD/JPY at the start of this year has been that market participants have pushed back expectations for the BoJ to exit negative rate policy. It appears highly unlikely now that the BoJ will raise rates and/or adjust YCC policy settings again as soon as at tomorrow’s policy meeting. The outcome from the recent BoJ branch managers’ meeting (click here) was not optimistic enough to justify the BoJ raising rates as soon as tomorrow. Furthermore, the recent earthquake in Japan has created additional uncertainty which makes it even less likely that the cautious BoJ will make such an important decision to exit negative rates until they have more clarity over the impact on the economy. With market participants now expecting no change in BoJ policy tomorrow, the performance of the yen will be driven by the updated guidance from the BoJ. The yen could weaken further if the BoJ does not provide a stronger signal that rates could be raised at either the March or April meetings. One potential bearish trigger for the yen would be if the BoJ lowers the core-core CPI projections although that is not our base case scenario.

USD/JPY’S ADJUSTMENT HIGHER IS BACKED BY FUNDAMENTAL DRIVERS

Source: Bloomberg, Macrobond & MUFG GMR

EUR: ECB policy meeting is key risk event in week ahead

In contrast to the yen, the euro has held up better at the start of this year. It has been the third best performing G10 currency so far this year. It has resulted in the euro weakening only modestly against the US dollar by around -1.3% YTD. After hitting a high at the end of last year at 1.1139, EUR/USD has fallen back to support from the 200-day moving average at just below 1.0850. The main event risk for the pair in the week ahead will be the ECB’s latest policy meeting. However, we are not expecting the policy meeting to a big market mover. ECB policymakers have been very busy at the start of this year outlining their views on monetary policy so there is unlikely to be major policy surprises at this week’s meeting.

Recently ECB policymakers have presented a unified policy message pushing back against premature expectations for ECB rate cuts. The euro-zone rate market is currently pricing in 20bps of ECB rate cuts by the April policy meeting and 41bps by June. The pricing is still not fully consistent with the recent messaging from ECB policymakers. President Lagarde sent a strong signal last week over the timing of the first ECB rate cut when she stated that they are likely to cut rates in the summer. It suggests that June is likely to be earliest point that the ECB is planning to begin cutting rates although more hawkish ECB policymakers have even suggested that a rate cut in 1H of this year is unlikely. Overall, we expect the ECB to continue presenting a relatively hawkish message at this week’s policy meeting which has been helping to support the euro at the start of this year. The euro-zone rate market has already taken out around 40bps of expected cuts by the end of this year.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

14:00 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

US Leading Index (MoM) |

Dec |

-0.3% |

-0.5% |

!! |

Source: Bloomberg