Growth optimism lifts USD ahead of Jackson Hole

USD: Business confidence improves ahead of Jackson Hole

The US dollar has strengthened ahead of today’s keynote speech from Fed Chair Powell at the Jackson Hole Economic Symposium. It has resulted in EUR/USD dropping back below the 1.1600-level and lifted USD/JPY back up closer to the 149.00-level. The US dollar has been supported by the scaling back of Fed rate cut expectations triggered initially by the release of the FOMC minutes from the July FOMC meeting and then by the latest US PMI surveys for August. The US rate market is currently pricing in around 18bps of cuts by the September FOMC meeting and 49bps of cuts by the year end which compares to 21bps and 55bps respectively a week ago. While it is not a significant hawkish repricing it does highlight that market participants have become less confident that the Fed will resume rate cuts as soon as next month. It fits with our view that that we don’t expect Fed Chair Powell to commit today to a rate cut at the September FOMC meeting. It is more likely that he will acknowledge recent US labour market weakness indicating they are moving closer to cutting rates but leave optionality on the table to assess incoming data between now and the September FOMC meeting before deciding on whether to resume rate cuts. Another weak NFP report in early September would provide the green light to cut rates next month.

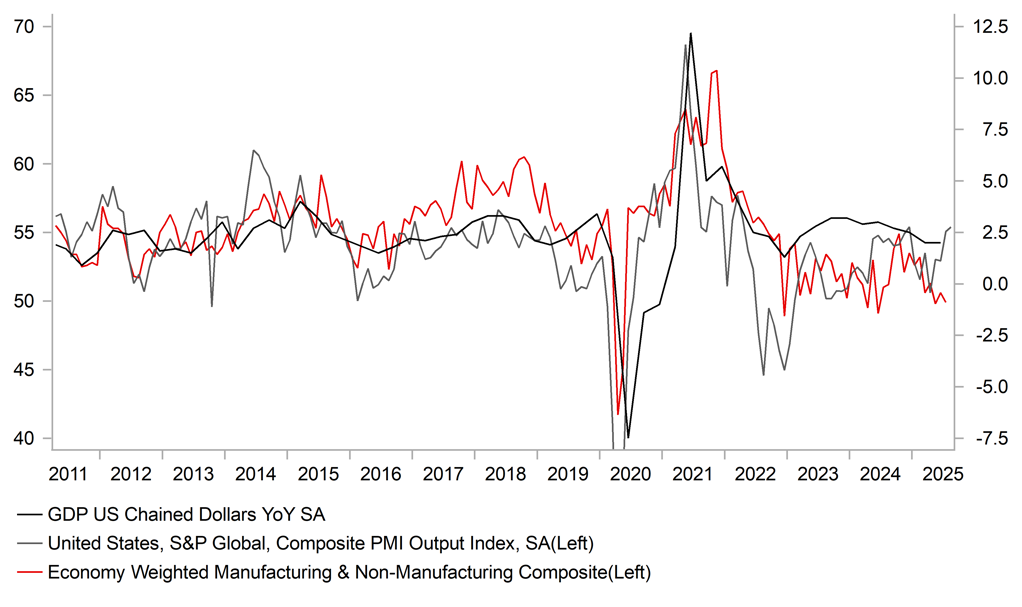

At the current juncture, Fed Chair Powell is likely to reiterate that the economic outlook remains uncertain and emphasise the need to remain data dependent. The latest economic data releases yesterday boosted investor optimism over the economic outlook. Business confidence in the US and Europe picked up more strongly than expected in August reflecting less concern over downside risk to growth from trade disruption and heightened policy uncertainty. As we saw during the 1H of this year soft economic data including business confidence and consumer confidence surveys declined sharply in response to the fears over downside risks to growth from higher tariffs. The composite US PMI survey averaged 52.4 during the first half of this year. Similarly in the euro-zone and UK the composite PMI surveys averaged 50.4 and 50.6 respectively. However, weakness in the PMI surveys was not fully consistent with the hard economic data as economic growth held up better than feared. Business confidence is now rebounding from overly pessimistic levels encouraged by recent trade deals and more resilient economic data. It is less clear though whether the surveys signal economic growth will strengthen going forward or more that risks of a sharper slowdown have eased. The downward revision this morning to economic growth in Germany in Q2 from -0.1% to -0.3% provides a timely reminder that growth could still disappoint despite rising investor optimism over the outlook.

BUSINESS CONFIDENCE & US GDP

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Japanese inflation in focus ahead of BoJ Governor Ueda panel discussion

The pick-up in global yields yesterday in response to the improvement in business confidence has weighed more heavily on the safe haven currencies of the yen and Swiss franc. Two-year government bonds yields in the US, euro-zone and UK all rose by around 4-5bps yesterday. A development which has helped to lift USD/JPY back closer to the 149.00-level overnight and USD/CHF back above the 0.8100-level. The release of the latest CPI report from Japan overnight did not disrupt the recent weakening trend for the yen.

The report revealed that headline inflation slowed in line with consensus expectations from 3.3% in June to 3.1% in July. It was mainly driven by lower utility rate and gasoline prices. Lower energy prices subtracted 0.26ppts from headline inflation. Bloomberg noted that a higher base from last year’s rollback of energy subsidies helped to soften the headline and core readings. However, the BoJ’s preferred measure of core inflation remained elevated at 3.4%. Services excluding rent which the BoJ has been focusing more on recently also held at 2.1%. Overall, the report continues to highlight that underlining inflation pressures remain sticky and will continue to encourage the BoJ to resume policy normalization now that heightened uncertainty over the economic outlook has eased. Japan’s economy held up better than expected during the 1H of this year and downside risks to the growth outlook have eased recently in response to the US-Japan trade deal. The BoJ will still be wary that higher tariffs will negatively impact growth. Real exports contracted sharply by -4.3% in July supporting the BoJ’s current cautious stance over resuming rate hikes. The Japanese rate market has moved to price in a higher probability of the BoJ resuming rate hikes as soon as October (round 15bps priced in). Comments from BoJ Governor Ueda, who is speaking on a panel at Jackson Hole tomorrow, will be scrutinized closely to see if they provide any encouragement that the BoJ is more seriously considering rate hikes again.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CA |

13:30 |

Retail Sales (MoM) |

Jun |

-- |

-1.1% |

!! |

|

US |

15:00 |

Fed Chair Powell Speaks |

-- |

-- |

-- |

!!! |

|

US |

17:00 |

U.S. President Trump Speaks |

-- |

-- |

-- |

!!! |

Source: Bloomberg & Investing.com