USD policy uncertainty in focus as G7 meets

USD: G7 finance ministers’ meeting in focus

G7 finance ministers have gathered in Alberta, Canada with Canada’s finance minister stating that the goal was to restore stability and growth. The focus will be very much on US Treasury Secretary Scott Bessent and the aim of bridging gaps with the US on the main two issues – trade and Ukraine. Bessent is expected to hold bilateral meetings with each of the other finance ministers which is likely to very much focus on trade relations. There are also reports that the other G7 countries are considering following the US lead on placing tariffs on small value goods (removing the de minimis exemption) shipped from China. The fear here is that due to the US tariff more of those goods will end up elsewhere and the other G7 countries will want to avoid that. This of course risks a further escalation if China felt it needed to retaliate if action is taken.

There are other factors at play too that are reinforcing dollar selling pressure. Investors remain concerned over the fiscal outlook in the US with the Wall Street Journal reporting that a deal on the SALT cap to unify the Republicans has been reached to get the tax cutting bill moving through Congress. A higher cap of USD 40k may have helped break the deadlock but other changes may now need to be made to cover the higher cost of a higher cap. Still, the IMF has also weighed in calling on the US to tackle the “ever-increasing” debt burden.

The Swiss franc and the yen are outperforming today on news that Israel is about to launch an attack on Iran’s nuclear facilities. Crude oil prices have jumped about 1.0% on the news. The yen is being further supported by the continued upward pressure on long-term yields in the JGB market. The BoJ is gathering information from JGB market participants ahead of the BoJ policy meeting in June when an update on balance sheet policy is expected. Pressure is building that it may need to curtail maturities of ultra-long JGBs to help improve the supply-demand imbalance.

The dollar on a DXY basis is fast retracing back toward the low in April and while market participants do not expect any explicit comment from Bessent on a shift in Washington policy on the dollar, any sign of pushing trading partners in Asia (Japan this week) to conducting less or stopping US dollar buying intervention would likely trigger further big moves weaker for the dollar. For Japan, Bessent’s complaint has been more related to inappropriately loose monetary policy. USD/Asia is notably weaker today underlining market sensitivities to news/comments from the G7 in Canada over the coming days.

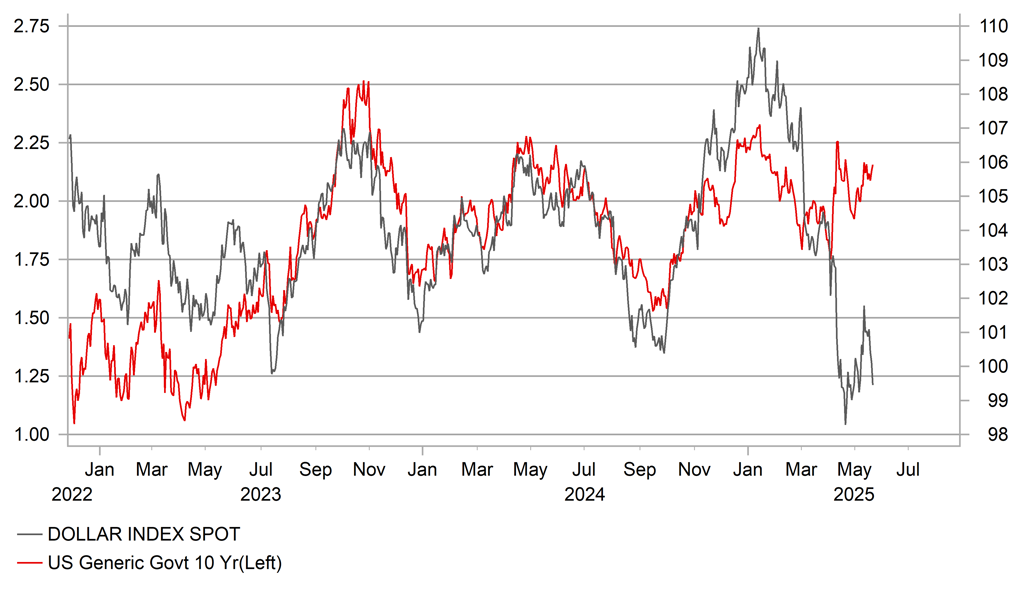

US DOLLAR IS RENEWING ITS DECLINE AS YIELDS REMAIN ELEVATED

Source: Bloomberg, Macrobond & MUFG GMR

EUR: BoP data underline euro-zone external surplus

The ECB yesterday released its monthly balance of payments statistics for the month of March and the data again highlighted the growing external surplus on the current account that can help provide the euro with greater support and act to enhance the euro’s safe haven credentials. If the US dollar is losing its appeal as a safe haven currency (of course in a severe risk-off event, the dollar would still likely strengthen but the euro could well outperform within G10) the euro could increasingly benefit now that the euro-zone has exited negative rates and Germany has at least loosened the constraints its economy was managed under the constitutional debt break that was established in 2009.

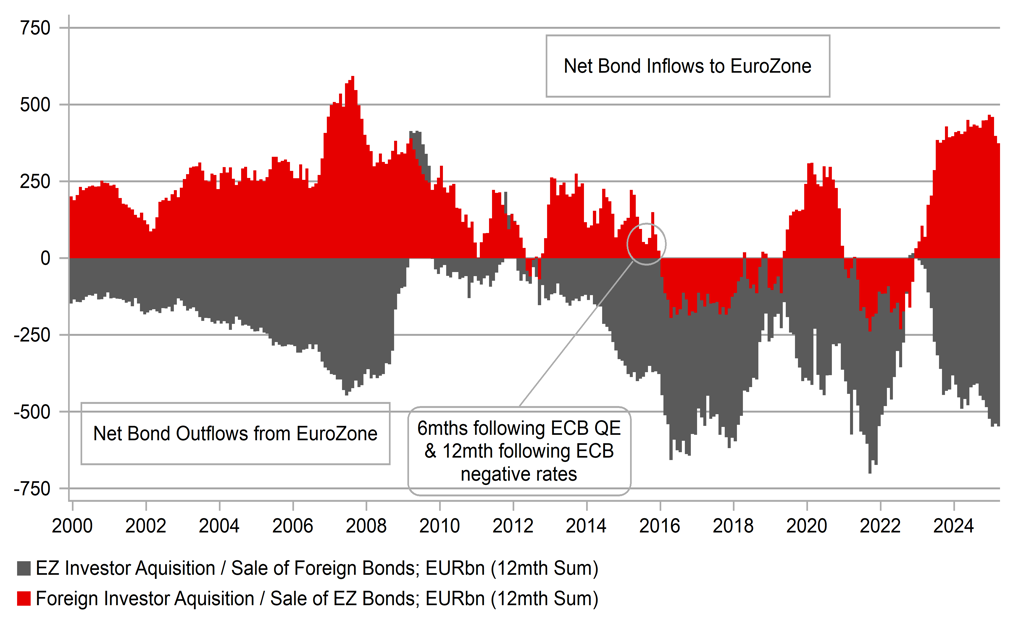

Yesterday’s current account balance for March was confirmed at EUR 50.9bn, the second largest one-month surplus on record, only surpassed in June last year. On a 12mth basis, the current account surplus hit a new record of EUR 438.5bn, a huge 40.6% increase from March 2024. What has also become clear from the flow data on the financial account side of the balance of payments is that the end of negative rates in core Europe has helped to draw in demand for euro-zone fixed income from abroad. In the 12mth period to March, foreign investors bought EUR 374bn worth of euro-zone debt securities. That’s down from the peak buying last year but the post-inflation shock period of foreign investor buying of euro-zone debt is the most substantial in the history of the data series. However, as the chart highlights, euro-zone investors have remained active buyers of foreign bonds with a 12mth total of EUR 548bn. So there was still a net bond outflow of EUR 174bn. That net bond outflow was however offset by a net equity inflow. In the 12mths to March foreign investors bought EUR 408bn worth of euro-zone equities while euro-zone investors bought EUR 150bn of foreign equities resulting in a net inflow of EUR 258bn. Overall there was a combined bond and equity inflow of EUR 85bn.

Hedging behaviour will play an important role in the overall FX impact. For a USD-based investor you currently get paid to hedge (over a 3mth period for example) EUR exposure and hence that flow could be more hedged than the opposite flow where a EZ investor has its fixed income return eroded by USD-hedging related selling. Hence, there could well be a larger EUR-negative impact given foreign bond buying (into the US anyway) gets hedged less. But the net equity inflow would be more EUR-supportive with a tendency for equity purchases to be hedged less. Still, what the data does indicate in general is that foreign investors, both equity and fixed income, have returned to the euro-zone markets.

SUBSTANTIAL EZ BOND BUYING BY FOREIGN INVESTORS BUT OFFSET BY SUBSTANTIAL FOREIGN BOND BUYING BY EZ INVESTORS

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

ECB Financial Stability Review |

-- |

-- |

-- |

!! |

|

UK |

09:30 |

House Price Index (YoY) |

-- |

5.2% |

5.4% |

! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

1.1% |

! |

|

CA |

13:30 |

New Housing Price Index (MoM) |

Apr |

0.1% |

0.0% |

!! |

|

US |

17:00 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

!! |

|

EC |

17:00 |

ECB's Lane Speaks |

-- |

-- |

-- |

!!! |

|

US |

17:15 |

FOMC Member Bowman Speaks |

-- |

-- |

-- |

!!! |

|

US |

18:00 |

20-Year Bond Auction |

-- |

-- |

4.810% |

!!! |

Source: Bloomberg & Investing.com