Yen rebounds after Upper House election but will gains be sustained?

JPY: Ruling coalition loses Upper House majority creating more uncertainty

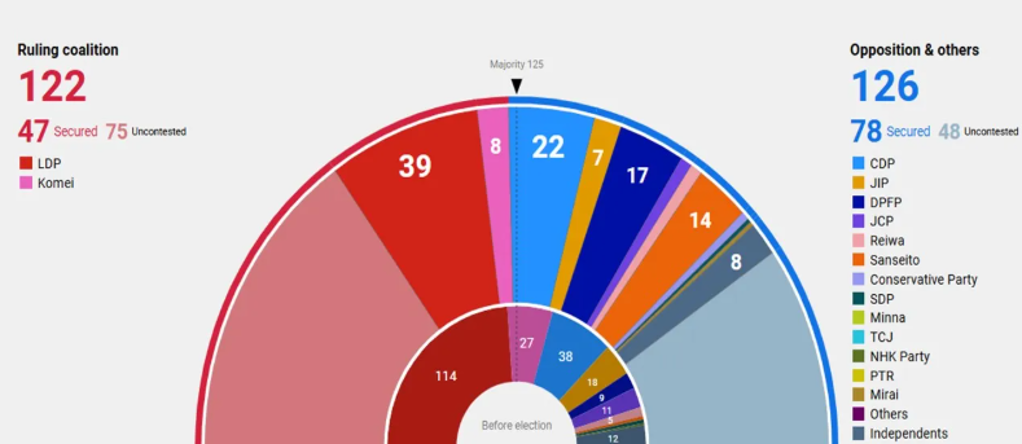

The yen has strengthened following the Upper House elections in Japan over the weekend resulting in USD/JPY dropping back below the 148.00-level. According to public broadcaster NHK, the ruling coalition government narrowly failed to hold on to their majority winning 47 seats which was just short of the 50 seats required. The main opposition party the Constitution Democratic Party came in second place winning 22 seats, the Democratic Party for the People finished third winning 19 seats followed by the right-wing Sanseito party winning 14 seats.

In response to the disappointing election results for the ruling coalition government who have now lost their majority in both houses of parliament, Prime Minister Ishida has indicated that he is not immediately planning to step down. When asked repeatedly is he intended to stay on, he answered with a simple “that’s right”. He added that “I continue to have a number of duties I must fulfil for the nation, including achieving wage growth that exceeds inflation, achieving gross domestic product of a quadrillion yen, and responding to an increasingly tense security environment”. As highlighted by Bloomberg it remains to be seen how long he will be able to continue on as prime minister given that the last three LDP prime ministers who lost an Upper House majority have stepped down within two months.

The loss of the ruling coalition government’s majority in the Upper House will further complicate policymaking which will make the government even more reliant on reaching compromises with other political parties to pass legislation. The less powerful Upper House can delay or block other legislation but can’t appoint a prime minister, hold a no-confidence vote or stop the passage of the budget. Japan’s main opposition leader, Yoshihiko Noda of the CDP has said he’s considering whether to submit a vote of no confidence motion in the Lower House after hearing what Prime Minister Ishiba says in a press conference today. In the press conference that has just taken place, Prime Minister Ishiba has confirmed that the coalition with Komeito will continue and going forward he will seek common ground with parties other than Komeito. He is not considering an expansion of the coalition or personnel changes at this point. The comments indicate that the ruling coalition plans to carry on ruling as a minority government in both houses of parliament.

Prime Minister Ishiba is also likely to face internal pressure to step down as prime minister. Former prime minister and current LDP Vice President Taro Aso has reportedly told allies that he won’t accept Ishiba’s continued leadership. The immediate policy focus for the government in the aftermath of the Upper House elections will be to secure a trade deal with the US ahead of the upcoming “reciprocal” tariff deadline scheduled for 1st August. The pick-up in political uncertainty in Japan could complicate reaching a timely trade deal with the US posing downside risks for Japan’s economy and the yen. In light of these developments we are not convinced that the initial rebound for the yen will be sustained. The initial relief for the yen that the ruling coalition did not lose even more seats and that Prime Minster Ishida plans to hang on to power is likely to prove short-lived. The BoJ has stated clearly that heightened uncertainty is the main reason that they have become more cautious over tightening policy further in the near-term. A timely trade deal with the US would be more important in providing more lasting support for the yen.

RULING COALITION LOSE MAJORITY IN UPPER HOUSE

Source: NHK

EUR: ECB to weigh up risks from stronger EUR but leave rates on hold

The other main macro event in the week ahead will be the ECB’s upcoming policy meeting on Thursday. Ahead of this week’s ECB meeting, the euro has lost some upward momentum after strong gains recorded between March and June. The ECB’s trade-weighted exchange rate (EEREE41) strengthened sharply by around 7.0% over that period. Over the last twenty years there have been only three other occasions when the trade-weighted euro has increased by 7% or more over a four month period.

The sharp strengthening of the euro has drawn more concern from ECB policymakers (click here) over the past month. In the minutes from the last ECB policy meeting in June, policymakers noted that the “recent appreciation of the euro should weigh on exports” and that “downward pressure on inflation could be amplified if…the euro appreciates more strongly”. Comments from ECB policymakers on the euro reached a crescendo around the ECB’s Central Bank Forum held in Sintra between 30th June and 2nd July. Governing Council member Villeroy de Galhau stated that “the ECB is closely watching exchange rate volatility. Euro appreciation has a clear disinflationary effect”. ECB Vice President Luis de Guindos even mention specific levels for EUR/USD when he stated “I think 1.1700. even 1.2000, is not something. We can overlook it a bit. Something beyond that would be much more complicated…the pace of the euro’s appreciation is a bigger concern than where it is right now”. After trading at much lower levels in recent years EUR/USD has quickly moved back closer to the average level over the last thirty years of around 1.1850.

The impact of the stronger euro for the economic outlook in the euro-zone is likely to be one important focus amongst market participants at this week’s ECB policy meeting. We are expecting the ECB to repeat the message from the June policy meeting that that the stronger EUR continues to pose downside risks to growth alongside higher tariffs via their negative impact on exports, while posing downside risks to the inflation outlook as well. In the Q&A following the last policy meeting in June, President Lagarde did not sound too concerned over euro strength indicating that it was partly a reflection of increased investor confidence in the growth outlook in the euro-zone attracting more capital inflows, and not just as a result of a loss of confidence in the USD. We see no clear reason for the ECB to change that assessment even though the euro has continued to strengthen further since the June meeting.

At best any comments from the ECB displaying more unease over the recent sharp strengthening of the euro at this week’s policy meeting may have a dampening impact on the euro’s upward momentum, but are unlikely to trigger a sustained reversal of the current strengthening trend. It is a view shared by market participants who have become less confident that the ECB will cut rates further this year despite the downside risks to inflation from the stronger EUR. There are currently only around 12bps of cuts priced in for the following ECB policy meeting in September and 26bps by year end. Even the threat from President Trump to raise tariffs to 30% on EU imports from 1st August has failed to trigger a dovish repricing of ECB rate cut expectations.

Market participants remain optimistic that a trade deal will be reached in time to prevent the current 10% tariff rate being raised all the way up to 30%. If a deal is reached that keeps the current 10% tariff rate in place, we would scale back our forecast for two further 25bps ECB cuts this year. Whereas the implementation of a higher tariff rate of say 20-30% would leave the door more ajar for further rate cuts. At this week’s policy meeting, the ECB can only really continue to acknowledge the ongoing uncertainty related to US trade policy and downside risks posed to the economic outlook. As a result, the ECB is expected to leave rates on hold this week. Officials have indicated that there’s a higher hurdle for further cuts after the policy rate returned to neutral levels. Please see our latest FX Weekly for more details (click here).

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

US |

15:00 |

US Leading Index (MoM) |

Jun |

-0.2% |

-0.1% |

!! |

|

CA |

15:30 |

BoC Business Outlook Survey |

-- |

-- |

-- |

!! |

|

NZ |

23:45 |

Trade Balance (MoM) |

Jun |

1,020M |

1,235M |

! |

Source: Bloomberg & Investing.com