Weighing up impact of Fed policy outlook on USD ahead of Jackson hole

USD: President Trump steps up attack on Fed ahead of Jackson Hole

It has been another quiet trading session overnight as the FX market remains in a holding pattern ahead of Fed Chair Powell’s keynote speech on Friday at the Jackson Hole Economic Symposium. The US rate market is currently pricing in around 20bps of cuts by the September FOMC meeting so market participants will be looking for a clear signal from Fed Chair Powell that the Fed is considering resuming rate cuts soon to justify current market pricing. The release overnight of the latest FOMC minutes from July provided more insight in the Fed’s current thinking on policy although they did not significantly alter market expectations for a September rate cut. Market expectations for a September rate cut rest heavily on the weakening US labour market. The minutes from the July FOMC minutes did not take into account any change in views amongst Fed officials since the release of the much weaker than expected NFP report for July including the significant downward revision to employment growth in May and June. Prior to the release of the July NFP report, some participants noted at the July FOMC meeting that slower employment growth “was not necessarily indicative of emerging economic slack as lower immigration was reducing the breakeven rate of payrolls”. It is less likely now that those participants will continue to hold that view since it has been revealed that nonfarm employment growth slowed more sharply to an average of 35k per month over the last three months to July. A much sharper slowdown in employment growth than Fed officials were aware of at the July FOMC meeting.

With regards to inflation, participants were uncertain over the inflation impact from tariffs with many participants noting that “it could take some time for the full effects of higher tariffs to be felt”. On balance, the “majority of participants judged the upside risk to inflation was the greater” risk to their dual mandate rather than downside risk to the full employment mandate. Only a couple saw “downside risk to employment the salient risk”. We expect that risk assessment to have changed in a more dovish direction since the July NFP report which is likely to be reflected in Fed Chair Powell’s speech on Friday.

Ahead of Fed Chair Powell’s speech on Friday President Trump has once again stepped up his attack on the Fed’s independence as he continues to apply pressure for lower rates. In the latest development, President Trump has called on Fed Governor Lisa Cook to resign after Federal Housing Finance Agency Director Bill Pulte urged Attorney General Pam Bondi to investigate Fed Governor Cook over potential mortgage fraud. President Trump posted that Fed Governor Cook “must resign now”. Federal Housing Finance Agency Director Bill Pulte alleges that Fed Governor Cook “appears to have acquired mortgages that do not meet certain lending requirements and could have received favourable loan terms under fraudulent circumstances”.

In response Fed Governor Cook has since replied that “I have not intention of being bullied to step down from my position because of some questions raised in a tweet. I do intend to take any questions about my financial history seriously as a member of the Federal Reserve and so I am gathering the accurate information to answer any legitimate questions and provide the facts”.

Fed Governor Cook was appointed to the Fed’s board of governors by former President Joe Biden and her current term as governor is not set to expire until 2038. If she was forced to step down it would further increase President Trump’s influence on setting Fed policy. His influence on policy setting is already set to increase in the year ahead when Jerome Powell’s term as Fed Chair comes to an end in May. If Chair Powell also steps down from the board of governors when his term as chair ends, President Trump will have the power to appoint another governor. He has already replaced former Governor Ariana Kugler after she decided to step down early before her term was due to end in January. She stated that she wanted to leave early to return to Georgetown University. President Trump has already chosen Stephen Miran, previously Chair of the Council of Economic Advisors, to serve out the remainder of Kugler’s term as Governor. It is not clear yet whether he will have been approved by the Senate in time to take part at the September FOMC meeting.

As a result of the appointment, three out of the seven Fed governors have now been appointed by President Trump including Governors Christopher Waller and Michelle Bowman who both dissented in favour of a rate cut at the July FOMC meeting. It is possible by this time next year that the majority of Fed governors will have been appointed by President Trump including the next Fed Chair giving him more influence on setting monetary policy. We continue to view threats to the Fed’s independence as a significant downside risk for the US dollar. President Trump’s desire for lower rates even if not justified by the Fed’s dual mandate poses upside risks to the US inflation outlook and could trigger a loss of confidence in the US dollar and long-term US Treasuries if implemented.

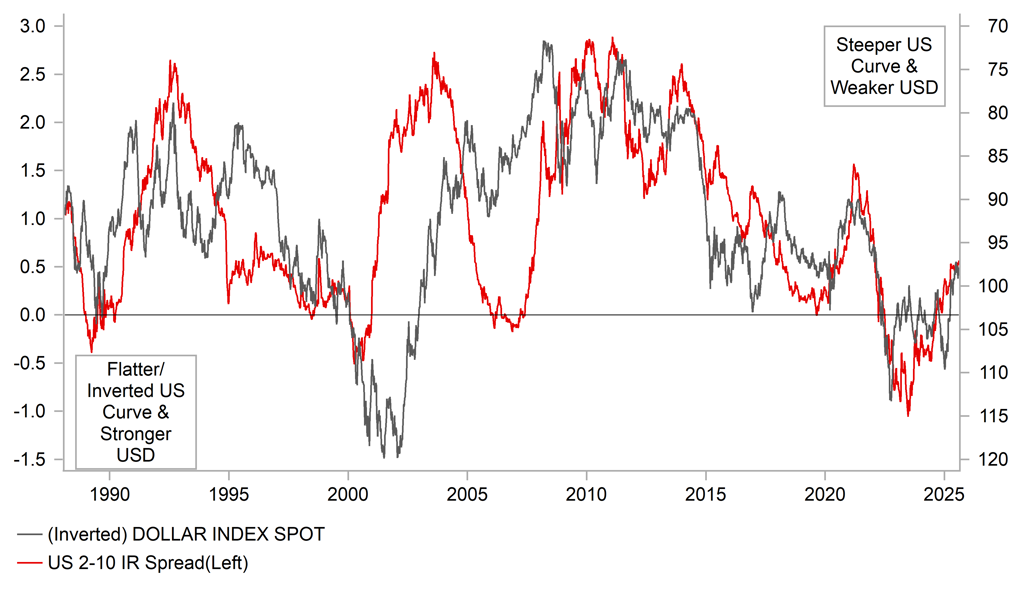

STEEPER US YIELD CURVE & WEAKER USD

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

Manufacturing PMI |

Aug |

49.5 |

49.8 |

!! |

|

EC |

09:00 |

Services PMI |

Aug |

50.8 |

51.0 |

!! |

|

UK |

09:30 |

Manufacturing PMI |

Aug |

48.2 |

48.0 |

!!! |

|

UK |

09:30 |

Services PMI |

Aug |

51.8 |

51.8 |

!!! |

|

US |

12:30 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

226K |

224K |

!!! |

|

US |

14:45 |

S&P Global Composite PMI |

Aug |

-- |

55.1 |

!! |

Source: Bloomberg & Investing.com