JPY weakens initially after Japan Innovation Party set to join coalition

JPY: Sanae Takaichi moves closer to becoming prime minister

The yen initially weakened overnight resulting in USD/JPY rising to a high of 151.20 but has since quickly reversed most of those losses. The main trigger was the announcement that the LDP will sign a coalition deal with the Japan Innovation Party according to Japan Innovation Party co-leader Hirofumi Yoshimura. He stated that he had called new LDP Leader Sanae Takaichi this morning and told her “we would agree to a coalition and that I look forward to moving Japan forward together”. Together the LDP and Japan Innovation Party coalition would hold 231 seats in the Lower House just two seats short of a majority. It should mean that Sanae Takaichi now has sufficient support to be voted as Japan’s next prime minister tomorrow. The latest political developments have refuelled investor optimism that Sanae Takaichi will be able to implement looser fiscal and monetary policies in order to boost growth. The Nikkei 225 equity index has risen by around 3% overnight and hit a fresh record high, although the reaction in the FX market and JGB market has been more muted. In order to reach a coalition agreement, the LDP has agreed to reduce the number of parliamentary seats. Local media have also reported that the two sides have agreed to continue talks toward the ending of political donations from companies and groups by September 2027 when Takaichi’s term as LDP president ends. Market participants’ will now be watching closely to see what fiscal plans are put together by the new coalition government. Japan Innovation Party’s own fiscal plans have been described as “moderately expansionary” (click here). They have proposed raising the minimum taxable income threshold to JPY1.6 million for low-income earners, eliminating the consumption tax on food un March 2027 and support spending on education and social security although stressing the need for fiscal sustainability. We expect the yen to gradually rebound resulting in USD/JPY dropping back below the 150.00-level if policy stimulus disappoints under new LDP leader Takaichi.

Market participants will also be watching closely to see if the new political set-up in Japan has an impact on the outlook for BoJ policy. It has been speculated that the BoJ could come under more pressure from the government to pursue a slower pace of policy normalization which would undermine the yen. The Japanese rate market is currently pricing in around 6bps of hikes for the next BoJ meeting at the end of this month and around 16bps of hikes by the end of this year. Hawkish BoJ member Hajime Takata spoke overnight stating that “I believe that now is a prime opportunity to raise the policy interest rate”. He believes that “the once deeply entrenched norm has waned in Japan, that the price stability target has almost been achieved”. He also added that the yen’s failure to strengthen even after the Fed resumed rates cuts last month is another factor supporting a BoJ rate hike.

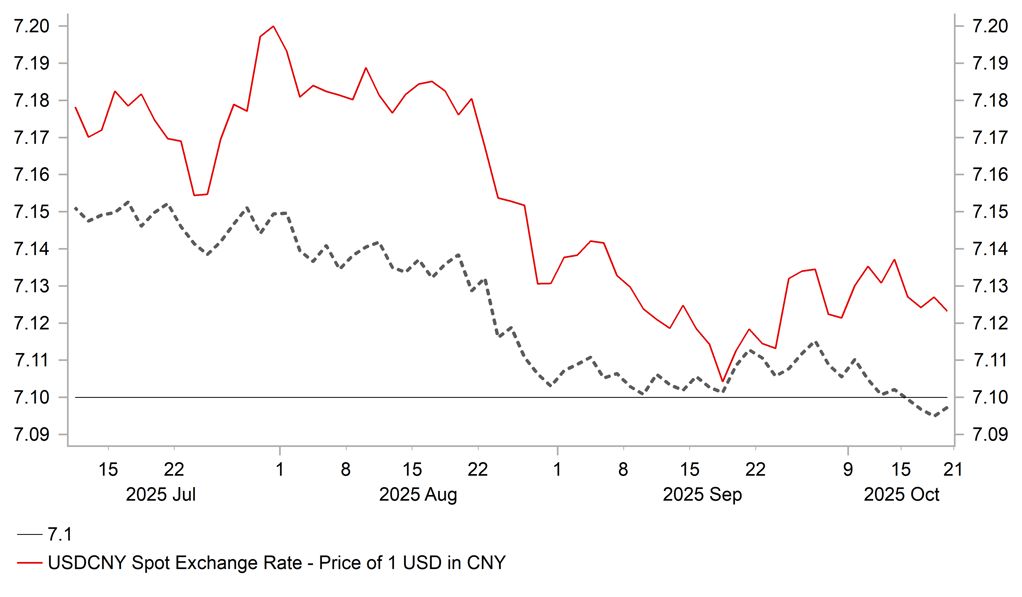

CHINA HAS BEEN SETTING DAILY FIX LOWER FOR USD/CNY

Source: Bloomberg, Macrobond & MUFG GMR

USD/CNY: Slower China growth amidst renewed US trade tensions

The other market focus at the start of this week is renewed trade tensions between China and the US which have increased downside risks to the near-term outlook for global trade and growth. Last week President Trump threatened to impose 100% tariffs on imports from China from 1st November marking a new phase of escalating trade tensions between China and the US. However, market participants remain cautiously optimistic that much higher tariffs are unlikely to remain in place for long and may not even be implemented at all helping to dampen the negative market reaction. Investor optimism has been encouraged by comments from President Trump over the weekend. He told Fox News yesterday that the 100% tariff was “not sustainable” though it “could stand”. Adding that the US will “be fine” with China. According to media reports, US Treasury Secretary Scott Bessent virtually met with Vice Premier He Lifeng on Friday and had a constructive exchange of views ahead of this week’s latest round of US-China trade talks taking place in Malaysia.

The release overnight of the latest economic activity data from China provided confirmation that growth slowed in Q3 after proving more resilient than expected during 1H of this year. The annual rate of GDP growth slowed to 4.8% in Q3 down from 5.2% in Q2. The National Bureau of Statistics noted though that the first three quarters have laid a “solid foundation” for achieving the government’s full-year growth target of around 5%. However, weakness evident in domestic demand both consumption and investment remains a concern. Bloomberg has calculated that fixed-asset investment has contracted for four consecutive months to September, and has fallen by an annual rate of -0.5% in the first three quarters of this year. Retail sales growth slowed further as well to an annual rate of 3.0% in September down from 3.4% in August. However, it was partially offset by an unexpected pick-up in industrial production which rose to an annual rate of 6.5% in September up from 5.2% in August. It comes at a time when China’s top leaders are meeting in Beijing at the so-called fourth plenum to put together development plans for the next five years. In the FX market, USD/CNY continues to trade between 7.1000 and 7.1500 although the PBoC has been setting the daily fix below 7.1000 over the past week.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

ECB Current Account SA |

Aug |

-- |

27.7b |

!! |

|

EC |

09:00 |

ECB's Schnabel Speaks in Frankfurt |

!! |

|||

|

EC |

10:00 |

Construction Output MoM |

Aug |

-- |

0.5% |

!! |

|

CA |

15:30 |

BoC Overall Business Outlook Survey |

3Q |

-- |

- 2.4 |

!! |

|

EC |

20:00 |

ECB's Nagel, Vujcic Speak in New York |

!! |

Source: Bloomberg & Investing.com