Easing tensions as USD/Asia drifts lower

USD: Trump bides time helping push dollar lower

Brent crude oil is down 2.5% today in the clearest sign that fears over an imminent escalation in the Israel/Iran conflict have eased. President Trump’s decision to publicly state that he will make his mind up on involving the US in the conflict within the next two weeks has raised optimism that a deal can be done to avoid an escalation. Senior officials from the UK, Germany and France will meet Iranian officials in Geneva today and we are likely to go into the weekend with hope of diplomatic progress.

That has had a clear impact on the dollar as well with the DXY down 0.5% from the intra-day high yesterday. Much bigger moves have been seen in some Asian markets with USD/KRW around 1.0% lower. The US dollar was weaker versus nearly all Asian currencies and this no doubt reflected another PBoC USD/CNY fix that was notably lower than the market estimate. The fixing was set at 7.1695, more than a 100 pips below the estimate of 7.1826 – today was the third consecutive day of a lower fix vs the estimate of over 100 pips since mid-May. It was the lowest PBoC USD/CNY fix since 17th March. The fixings are a strong message that the Chinese authorities will not seek CNY depreciation as an offset to the ongoing trade uncertainties as we approach the key period when reciprocal tariffs are set to be reactivated.

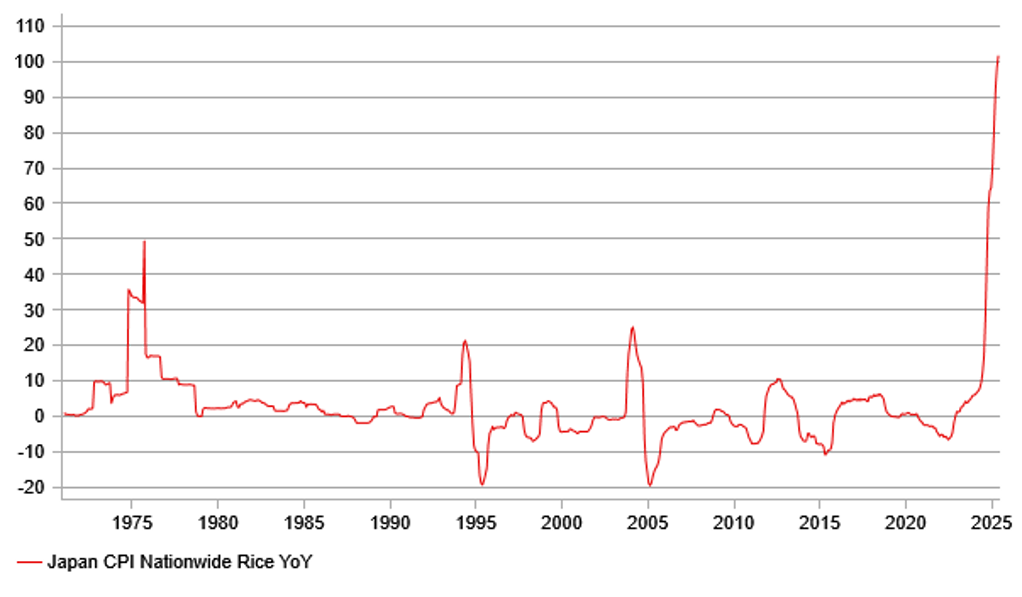

USD/JPY has not been a mover in Asia but could face downward pressure following the release of inflation data. Nationwide core CPI in YoY terms was stronger than expected, jumping 0.2ppt to 3.7%. The core-core rate was also stronger than expected, jumping 0.3ppt to 3.3%. Food price increases continue to drive overall inflation with rice prices up 102% YoY. Services inflation picked up from 1.3% to 1.4% in part on cost pressure in dining out, with restaurant services increasing 0.3ppt to 4.8%. Solid wage growth is allowing for these price increases and will certainly help reinforce confidence at the BoJ to raise rates again.

Further steps to help support the super-long JGB market look like being taken today by the MoF. It is holding a meeting with primary dealers at 4pm Tokyo time and according to Bloomberg will suggest cutting issuance of 20; 30; and 40-year JGB issuance by JPY 100bn at each auction through March 2026. As an offset, the MoF will increase issuance of 2-year JGBs. The JGB curve has flattened today as a result but the moves in JGB yields have been modest.

Short-term direction in FX will continue to be influenced by developments in the Israel/Iran conflict and escalation versus de-escalation risks. But the strong inflation readings in Japan are becoming more common and the risks are rising that the BoJ will have to up its hawkish rhetoric on the potential for a rate hike. If a trade deal is done between Japan and the US before 9th July, that will likely prompt a shift from the BoJ that would once more increase downside risks in USD/JPY.

JAPAN RICE PRICES HELP LIFT OVERALL CPI IN NATIONWIDE DATA

Source: Bloomberg, Macrobond & MUFG GMR

CHF: SNB offers limited resistance to FX strength

We had three separate monetary policy decisions yesterday (BoE reaction piece here) and while the BoE left its monetary stance unchanged as expected, Norges Bank and the SNB both cut their key policy rates by 25bps. The market was priced for some risk that the SNB could cut by a larger 50bps but the SNB kept to a more cautious path despite the fact that the SNB has by some distance under-estimated the speed in which inflation has fallen. In its first Monetary Policy Assessment last year, the SNB predicted annual inflation in 2025 to be 1.2% and in June 2024 1.1%. Yesterday, the SNB’s latest forecast for this year was just 0.2%. Given the Swiss franc’s role as a safe-haven and given the current global circumstances with elevated geopolitical risks, rates in Switzerland need to be a lot lower in order to deter investors from buying the franc. Indeed, in real terms, with modest deflation, the policy rate is modestly positive now with many other G10 central banks now running negative policy rates in real terms. In that regard it was somewhat surprising that the SNB emphasised the “undesirable side-effects of negative rates that “present challenges for many economic agents”. That certainly gave an initial impression of a reluctance to move the policy rate into negative territory. Investors certainly didn’t embrace the decision with Swiss equities closing down 0.7%, although European stocks fell widely as geopolitical risks related to the Middle East remained elevated. The cut to zero percent does in reality bring negative rates back as a potential reality given the SNB since 2022 penalises banks that hold excess reserves over 18 times its minimum reserves by only paying 25bps less than the policy rate, which will now mean banks are charged. The SNB put the framework in place to encourage lending and maintain liquidity in money markets.

With the SNB forecasting inflation of just 0.2% this year and 0.4% next year, it seems highly likely that the SNB will have to cut again and indeed will likely have to become more active in FX intervention. Given the zero-bound problem, the SNB is at the mercy of foreign developments. Worsening global conditions will for example see more active rate cuts than currently expected with the SNB potentially having difficulties matching global monetary easing from here that leads to further upward pressure on the franc.

If the reluctance to turn to negative rates is strong, then the only alternative will be to turn to FX intervention. Intra-day high-to-low from May to November last year, EUR/CHF fell 7.5% with limited FX intervention activity and that stance will likely have to change. Still, with trade negotiations between the US and Switzerland ongoing, the scope for FX intervention may be limited especially after the US put Switzerland on its “watch List” for currency manipulation. CHF upside risks will likely persist despite the SNB’s cut to zero percent.

CHF REER CLOSE TO RETESTING RECENT HIGHS

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

ECB Economic Bulletin |

-- |

-- |

-- |

! |

|

EC |

09:00 |

M3 Money Supply (YoY) |

-- |

4.0% |

3.9% |

! |

|

EC |

09:00 |

Private Sector Loans (YoY) |

-- |

2.0% |

1.9% |

! |

|

US |

13:30 |

Philadelphia Fed Manufacturing Index |

Jun |

-1.7 |

-4.0 |

!!! |

|

US |

13:30 |

Philly Fed Business Conditions |

Jun |

-- |

47.2 |

! |

|

US |

13:30 |

Philly Fed Employment |

Jun |

-- |

16.5 |

! |

|

US |

13:30 |

Philly Fed New Orders |

Jun |

-- |

7.5 |

! |

|

CA |

13:30 |

Core Retail Sales (MoM) |

Apr |

-0.2% |

-0.7% |

!!! |

|

CA |

13:30 |

IPPI (MoM) |

May |

0.0% |

-0.8% |

! |

|

CA |

13:30 |

New Housing Price Index (MoM) |

May |

-0.2% |

-0.4% |

! |

|

CA |

13:30 |

Retail Sales (MoM) |

Apr |

0.4% |

0.8% |

!! |

|

CA |

13:30 |

RMPI (MoM) |

May |

-0.8% |

-3.0% |

! |

|

US |

15:00 |

US Leading Index (MoM) |

May |

-0.1% |

-1.0% |

!! |

|

EC |

15:00 |

Consumer Confidence |

Jun |

-15.0 |

-15.2 |

! |

Source: Bloomberg & Investing.com