JPY continues to weaken as RBA delivers hawkish policy surprise

AUD: RBA still feels it has more work to do providing support for the Aussie

The Australian dollar has been the biggest mover overnight following the RBA’s latest policy update. It has resulted in the AUD/USD rate rising by around 1.0% back up to the 0.6700-level and the AUD/NZD rate has risen back above the 1.0800-level. It follows the hawkish policy surprise from the RBA overnight who decided to raise their key policy rate by a further 0.25 point up to 3.85%. In contrast, Australian rate market participants had been expecting the RBA to keep rates on hold for the second consecutive policy meeting which would have helped reinforce expectations that the RBA had reached the end of their hiking cycle. In the accompanying policy statement, the RBA acknowledged that inflation has now passed its peak in Australia but at 7% it was still considered too high and is expected to take a couple of years to fall back within the RBA’s target range. More specifically, the RBA remains concerned that services inflation is still very high and broadly based, and that unit labour costs are also rising briskly. The RBA believes that today’s hike will help further anchor medium-term inflation expectations. The RBA expects the cumulative impact of monetary tightening to date to result in the Australian economy growing below trend by 1.25% this year and around 2% over the year to mid-2025, but acknowledges that there is a high risk that the economy could slow more sharply if it overtightens policy. One key area of uncertainty remains the outlook for household consumption and how their spending reacts to higher rates, high inflation and the earlier decline in house prices.

Despite these concerns, the RBA still believes that it has work to do to bring inflation back down towards their target. It has continued to signal that “some further tightening” of monetary policy may be required that will depend upon how the economy and inflation evolve. Overall, the hawkish policy update has signalled that the RBA does not yet feel that rates are high enough. We now expect the RBA’s policy rate to peak at just over 4.00% after delivering one final 0.25 point hike. The sharp move higher in Australian rates overnight has provided some much needed support for the Australian dollar. The AUD/USD rate had recently fallen close to the year to date low at the end of last month at 0.6565. The sharp fall in the price of iron ore at the end of last month has been weighing down on the Aussie recently and casts doubt on the strength of the pick-up in demand from China so far this year. The outlook for China’ economy is still likely to prove more important for the Australian dollar’s performance this year than RBA policy in our view.

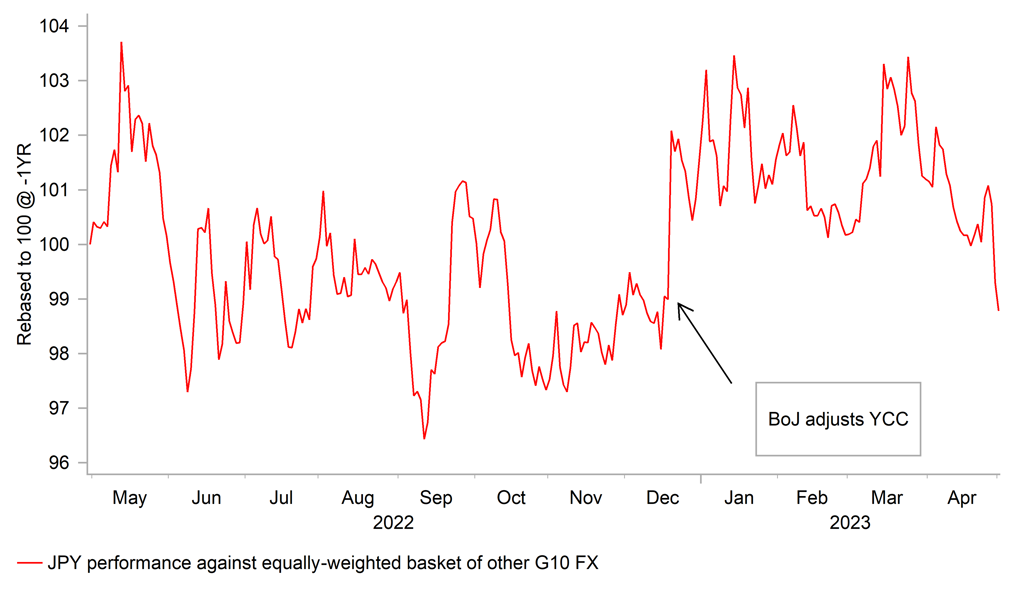

JPY GIVES BACK ALL GAINS SINCE DECEMBER YCC ADJUSTMENT

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Sharp BoJ induced sell-off continues

The yen has continued to weaken sharply at the start of this week following the BoJ’s dovish policy update on Friday. It has resulted in USD/JPY rising back above resistance from the 200-day moving average that comes in at around the 137.00-level to an intra-day high overnight at 137.77. It moves the pair back within touching distance of the high from 8th March at 137.91 which if broken would open the door to the move extending back towards the 140.00-level. The yen has weakened sharply across the board after the BoJ pushed back against expectations for a more imminent shift away from loose policy settings. Against our equally-weighted basket of other G10 currencies the yen has fallen back to the lowest level since mid-December and reversed all of the gains recorded after the BoJ last adjusted YCC. Weakness is most evident against the European currencies with EUR/JPY (highest since 2008), GBP/JPY (highest since 2016) and CHF/JPY (highest since 1979) all hitting new multi-year highs. The BoJ’s decision to leave policy settings unchanged and the long length of the planned policy review that is expected to take at least 12-18 months to complete has made market participants much more confident that the loose policy settings of Abenomics (YCC & negative rates) will remain in place this year. Even comments from Governor Ueda that policy settings can still be adjusted before the policy review is completed have failed to put a dampener on yen selling in the near-term.

The latest developments clearly pose downside risks to our outlook for the yen to strengthen from deeply undervalued levels in the year ahead. However, we still believe there is room for the BoJ to adjust/abandon YCC this year especially if global yields continue to fall in response to slowing global growth and falling inflation that opens the door for other major central banks to first pause and then consider reversing rate hikes later this year. If global yields are falling it creates a more favourable environment for the BoJ to abandon YCC by dampening the risk of a more disorderly move higher for Japanese yields. This week’s policy update for the Fed (click here) and latest NFP report will be important in determining if the Fed is close to the end of their own hiking cycle. At the same time, the BoJ is becoming more confident over stronger wage growth emerging in Japan that would support a shift away from loose policy settings. The BoJ’s latest quarter economic report released yesterday revealed that the BoJ thinks “it is highly likely that the growth rate of scheduled cash earnings will increase clearly this year” which would help the BoJ become more confident that inflation can be sustained at 2.0% in the future

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

M3 Money Supply (YoY) |

Mar |

2.4% |

2.9% |

! |

|

EC |

09:00 |

Manufacturing PMI |

Apr |

45.5 |

47.3 |

!! |

|

EC |

10:00 |

Core CPI (YoY) |

-- |

5.7% |

5.7% |

!! |

|

EC |

10:00 |

CPI (YoY) |

Apr |

7.0% |

6.9% |

!!! |

|

AU |

12:20 |

RBA Governor Lowe Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

Durables Excluding Defense (MoM) |

Mar |

-- |

3.5% |

! |

|

US |

15:00 |

JOLTs Job Openings |

Mar |

9.775M |

9.931M |

!!! |

Source: Bloomberg