US jobs data in focus but FOMC set to pause

USD: Strong jobs report required now to shift Fed thinking

The US dollar weakened notably yesterday and has remained at weaker levels today with further Fed comments that underline the prospect of a pause at the next FOMC meeting in under two weeks. Fed President Harker, who votes at the FOMC this year, was very clear in a speech last night as to where he stands – he is happy to skip voting for a rate increase given he believes the Fed have taken rates to the point where monetary policy can “do its work to bring inflation back to target”. Even uber-hawk James Bullard has changed his tune somewhat stating that the current policy rate was at the “low-end” of a restrictive stance and that disinflation was set to continue with inflation expectations now back at the 2% target level. Bullard doesn’t vote this year but has led the way calling for aggressive rate hikes.

As a result of Fed communications this week, the 2yr UST note yield has dropped by over 20bps as we approach the key macro event of the week – the nonfarm payrolls report later today. The ADP employment report yesterday was strong with 278k new jobs reported following 291k the previous month. The predictive power of the ADP report month-to-month is questionable though and has been over-estimating NFP. The ISM Manufacturing report yesterday was certainly weak especially given the sharp declines in Prices Paid and New Orders. But the Employment index was firm increasing from 50.2 to 51.4. Initial claims data doesn’t suggest weakness and the JOLTS report was stronger than expected. However, the Challenger Job Cuts report yesterday did show a higher level of layoffs continues. Taking all the information it doesn’t feel like we will get an NFP print that is particularly weak – the consensus is +195k.

But the communications from the Fed have definitely altered the balance of risks in terms of market reaction. At the start of the week it felt like we needed a weaker jobs report to allow the Fed to pause (given the strong PCE inflation data last week for example) but now after this week’s Fed communications it feels more like we need a much stronger report to bring the Fed into play for this month. AHE are expected to slow while the unemployment rate is expected to rise by 0.1ppt. The ADP wage data yesterday confirmed a continued slowdown in wage growth. We maintain our view that the Fed will pause this month and that the tightening cycle is likely over.

A consensus print today will likely remove the lingering pricing for a rate hike this month (OIS implies about 7bps) and propel the dollar further weaker into the weekend. That could mean the 100-day moving average for DXY (102.91) comes into play and is tested this afternoon.

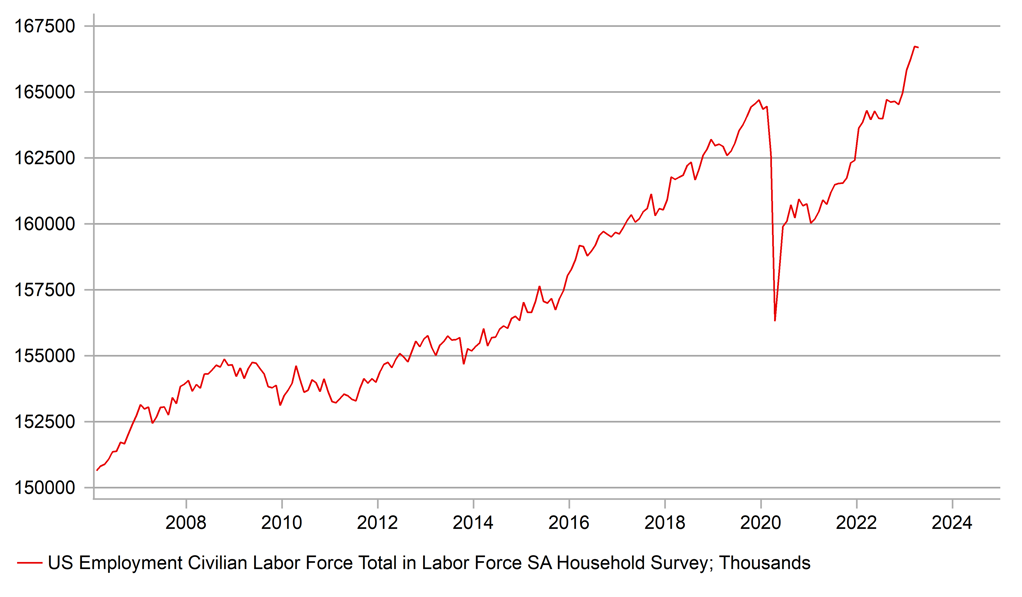

US LABOUR FORCE GROWTH SHOULD HELP CONTAIN WAGE GROWTH

Source: Bloomberg & MUFG Research calculations

EUR: Lower inflation but ECB minutes point to two more hikes

As mentioned above, EUR/USD managed to rebound yesterday in part due to Fed speak and in part due to the US-inflation specific aspects of yesterday’s US data pointing to the scope for the Fed to pause in May. There were also reason for increased conviction that the ECB would continue tightening for at least the next two meetings. The slide in EUR prior to yesterday reflected some building doubt over whether the ECB would follow through with two more hikes. The 2yr EU-US swap spread moved yesterday in favour of EUR for the first time since 10th May following the fall in euro-zone inflation for May being a little less than expected given the sharp declines recorded in Germany, France and Spain. The support for front-end rates also came from a speech from ECB President Lagarde who stated yesterday that there was “no clear evidence” that underlying inflation had peaked. Expect that rhetoric to be repeated when President Lagarde speaks in the policy press conference on 14th June after a likely hike of 25bps.

The minutes (known as the accounts) from the ECB meeting on 4th May were released yesterday and again the take-away here also reinforces the prospect of at least two more rate hikes by the ECB. The minutes outlined the fact that data and inflation had generally been stronger but noted that rate hike expectations had been pared back. Suggestions were discussed as to why this took place with tighter financial conditions and the impact of credit contraction due to banking sector uncertainties one possibility put forward. Another was that inflation concerns had receded.

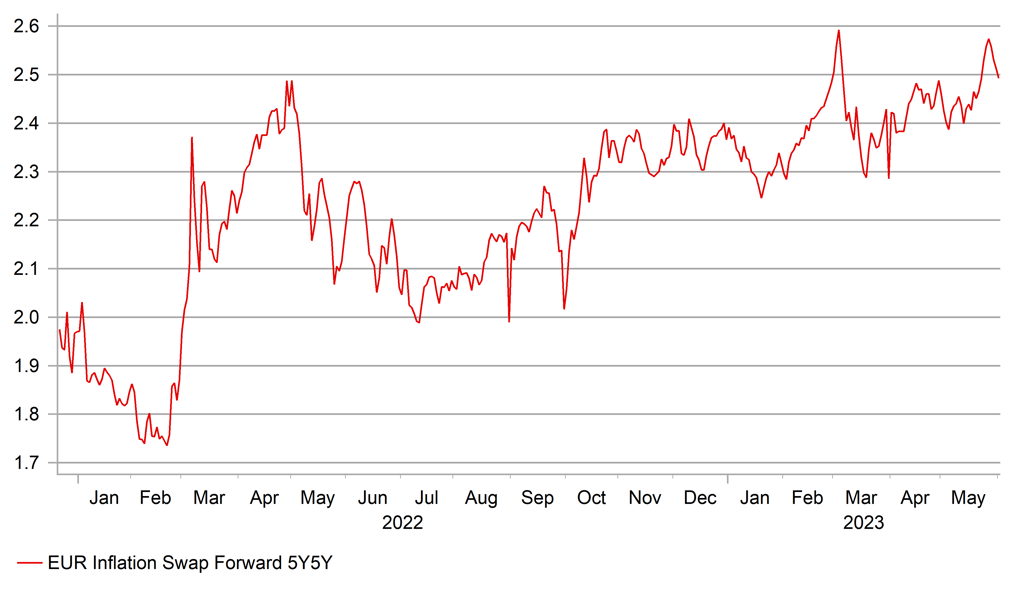

However, the ECB seemed to dismiss the inflation argument given the fact that inflation expectations had remained stubbornly high. The 5yr5yr forward inflation rate then had remained above 2.4%. If we fast forward to today that same rate recently jumped to close to 2.60% but has since eased a touch after the weak inflation. At these levels the ECB at the June meeting would remain as concerned as in May.

The ECB minutes, the comments from Lagarde and the fact that services inflation could well drift higher over the summer on tourism-related inflationary pressures, we see limited scope for lower yields at the front-end in the euro-zone which will provide EUR with support at these lower levels.

ECB AT MAY MEETING REFERENCED 5Y5Y INFLATION “STUBBORNLY ABOVE 2.4%” WHICH REMAINS THE CASE STILL TODAY

Source: Macrobond

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

NO |

09:00 |

Unemployment Change |

May |

60.52K |

61.64K |

! |

|

NO |

09:00 |

Unemployment Rate n.s.a. |

May |

1.80% |

1.80% |

! |

|

US |

13:30 |

Average Hourly Earnings (YoY) (YoY) |

May |

4.3% |

4.4% |

!! |

|

US |

13:30 |

Average Hourly Earnings (MoM) |

May |

0.4% |

0.5% |

!!!! |

|

US |

13:30 |

Average Weekly Hours |

May |

34.4 |

34.4 |

! |

|

US |

13:30 |

Manufacturing Payrolls |

May |

8K |

11K |

! |

|

US |

13:30 |

Nonfarm Payrolls |

May |

180K |

253K |

!!!! |

|

US |

13:30 |

Private Nonfarm Payrolls |

May |

160K |

230K |

!!! |

|

US |

13:30 |

Participation Rate |

May |

62.5% |

62.6% |

!!! |

|

US |

13:30 |

U6 Unemployment Rate |

May |

6.6% |

6.6% |

! |

|

US |

13:30 |

Unemployment Rate |

May |

3.5% |

3.4% |

!!!! |

Source: Bloomberg