Fed rate cut caution provides support for USD alongside Middle East risks

USD: Fed remains reluctant to resume cuts amidst elevated uncertainty

The US dollar has continued to trade at stronger levels overnight after strengthening in response to the latest FOMC meeting. It has helped to lift USD/JPY back above the 145.00-level as it moves closer this month’s highs at around 145.40. The stronger US dollar has been encouraged by the updated policy signal from the Fed that they remain comfortable to leave rates on hold in the near-term despite the recent run of softer US inflation and labour market data. Fed Chair Powell described both the economy and the labour market as “solid”. He emphasized that Fed policy is well positioned to wait to learn more about how the US economy is adjusting to changes in trade and fiscal policies whose impact remains uncertain. In the accompanying policy statement, he Fed did acknowledge that uncertainty over the economic outlook has “diminished but remain elevated”. Chair Powell still expects tariff hikes to feed through to a pick-up in inflation and remains wary that the inflation impact could be more persistent. He noted that many companies expect to pass on tariff costs and that it takes time for tariffs to work through to the end consumer. Alongside ongoing caution over upside risks to inflation from tariffs, Chair Powell acknowledged that the US labour market is slowly cooling but downplayed the slowdown so far saying it is “nothing concerning”. The comments indicate that the Fed is not in a rush to resume rate cuts as soon at the next policy meeting in July. He did note though that they are likely to get to a place where resuming rate cuts is appropriate but that it is hard to know how to react until tariff effects are known. He expects to learn more about tariffs over the summer and their impact which could open the door for a rate cut as early as at the September FOMC meeting. Finally, he highlighted that the elevated level of uncertainty is resulting in a healthy diversity of views on the FOMC and downplayed the importance of focusing too much on the updated dot plots by stating that “no one holds these rate paths with great conviction”.

The Fed’s updated projections revealed that the median projection amongst FOMC participants still showed that they favoured cutting rates two more times by the end of this year by 50bps in total. However, the vote split was more divided with two participants favouring just one rate cut and seven favouring no rate cuts compared to eight who favoured two rate cuts. It indicates that the FOMC appears to be weighing up whether to stick to two rate cuts or deliver no rates cuts at all this year which will ultimately depend on how the economy evolves as elevated uncertainty continues to ease. We continue to expect the Fed to cut rates in the 2H of this year as more evidence emerges of the labour market loosening and the inflation impact from tariffs proving less than feared. One risk to that view would be a wider and more disruptive conflict in the Middle East that triggers a more sustained increase in energy prices. Chair Powell noted that it’s possible we’ll see higher energy prices from Middle East risks but noted that energy shocks don’t tend to have lasting inflation effects.

“Stagflationary” risks for the US economy were evident in the updated economic projections. The median projections for growth were revised lower to 1.4% and 1.6% for this year and next while core inflation forecasts were revised higher to 3.1% and 2.4% respectively. The unemployment rate is expected to rise but only modestly to 4.5% which sets a relatively low hurdle for the Fed to resume rate cuts if the labour market proves weaker than expected. The unfavourable mix of weaker growth and higher inflation in the US remains a headwind for the US dollar and should help to dampen further US dollar upside on the back of the Fed’s reluctance to resume rate cuts in the near-term. The US dollar is also deriving some support from reports overnight that US officials are preparing for a possible military strike on Iran in the coming days.

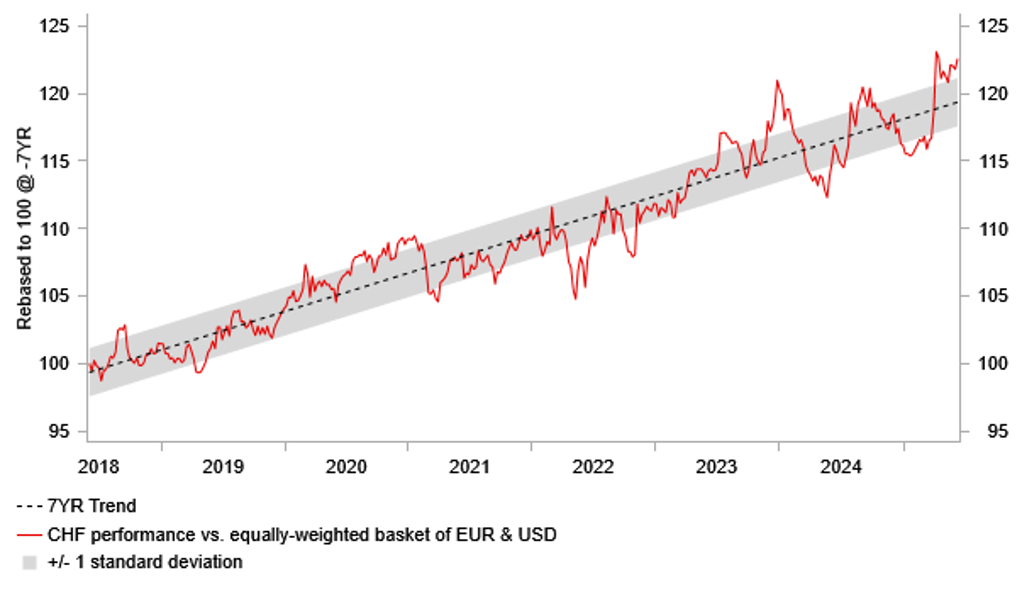

CHF REMAINS STRONG HEADING INTO TODAY’S SNB MEETING

Source: Bloomberg, Macrobond & MUFG GMR

GBP/CHF: Dovish policy updates expected from BoE & SNB

Market attention will now turn to the upcoming policy meetings today from the SNB and BoE. We released a preview for today’s MPC meeting earlier this week (click here). The ONS has since released the latest UK CPI report for May revealing that headline and core inflation slowed to 3.4% and 3.5% respectively. The data was broadly in line with the forecasts from the May MPR so should not significantly alter views held by participants at today’s MPC meeting. We continue to hold the view that the recent UK domestic data flow certainly opens the door to some subtle dovish shifts in messaging after a somewhat hawkish tone last time out. The vote split may also reflect greater confidence in the underlying disinflation process. We have pencilled in a 6-3 vote in favour of a hold. That would be a shift from the 8-1 split at the last ‘pause’ meeting in March and bolster expectations that the BoE will extend its quarterly easing cycle through the rest of the year.

The pound has been trading on a softer footing heading into this week’s MPC meeting. EUR/GBP has risen for seven consecutive trading days while cable’s upward momentum has stalled just below the 1.3600-level. We expect the pound to weaken further if the there are three dissenters in favour of a rate cut at today’s MPC meeting. However, the scale of the pound sell-off would be curtailed if there is no significant change in tone or guidance indicating that the BoE remains comfortable to maintain the current quarterly pace of rate cuts. The UK rate market is already almost fully priced for two further 25bps cuts by year end. It would still leave rates in the UK amongst the highest on offer amongst G10 currencies. FX volatility has also eased over the last couple of months providing a more supportive backdrop to rebuild carry trades and providing support for the pound. The main risk for a bigger pound sell-off in the near-term would be a more disruptive outcome for financial markets and the global economy from escalating tensions in the Middle East.

In contrast, we expect the SNB to take action today to loosen monetary policy further after inflation fell back into negative territory in May. The SNB is expected to lower the policy rate by 25bps to 0.00%. Market participants will be listening closely to any guidance from the SNB over the likelihood of a return to negative rates and/or use of FX intervention to dampen Swiss franc strength. The SNB have previously stated that negative rate policy was effective when used previously and they would be willing to use again if required. Building expectations for a return to negative rate policy and the improvement in global investor risk sentiment since April have been contributing to a gradual weakening of the Swiss franc helping to lift EUR/CHF back up towards its 200-day moving average at around 0.9400 after hitting a low of 0.9206 in April. Swiss franc strength could become an even bigger problem for the SNB if tensions in the Middle East continue to escalate triggering a bigger flight to quality.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SZ |

08:30 |

SNB Interest Rate Decision |

Q2 |

0.00% |

0.25% |

!!! |

|

EC |

08:30 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

SZ |

09:00 |

SNB Press Conference |

-- |

-- |

-- |

!! |

|

GE |

10:00 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

EC |

10:00 |

Construction Output (MoM) |

Apr |

-- |

0.10% |

! |

|

UK |

12:00 |

BoE MPC vote cut |

Jun |

2 |

7 |

!! |

|

UK |

12:00 |

BoE Interest Rate Decision |

Jun |

4.25% |

4.25% |

!!! |

|

UK |

12:00 |

BoE MPC Meeting Minutes |

-- |

-- |

-- |

!! |

Source: Bloomberg & Investing.com