Fading geopolitical risks contributing to less volatile FX market?

EUR: Progress in peace talks offers support for European currencies

The major foreign exchange rates continue to trade in tight trading ranges at the start of this week. The main development overnight was the meeting between Presidents Trump and Zelenskiy alongside European leaders. President Trump has since posted that he has “called President Putin, and began the arrangements for a meeting, at a location to be determined, between Presidents Putin and Zlenskiy. After that meeting takes place, we will have a Trilat, which would be the two Presidents, plus myself. Again, this was a very good, early step”. President Trump’s optimism over steps to bring an end to the conflict in Ukraine has perhaps had more of an impact on the price of oil which has weakened modestly overnight and has fallen back towards recent lows closer to USD65/barrel for Brent. US Vice President JD Vance, Secretary of State Marco Rubio and special envoy Steve Witkoff has been set the task of coordinating the possible meeting. Ukrainian President Zelenskiy told reporters that a bilateral meeting should not carry any conditions and that it was Russia’s idea to have him meet with President Putin before bringing in President Trump. He did add though that he would be willing to discuss territorial issues with President Putin.

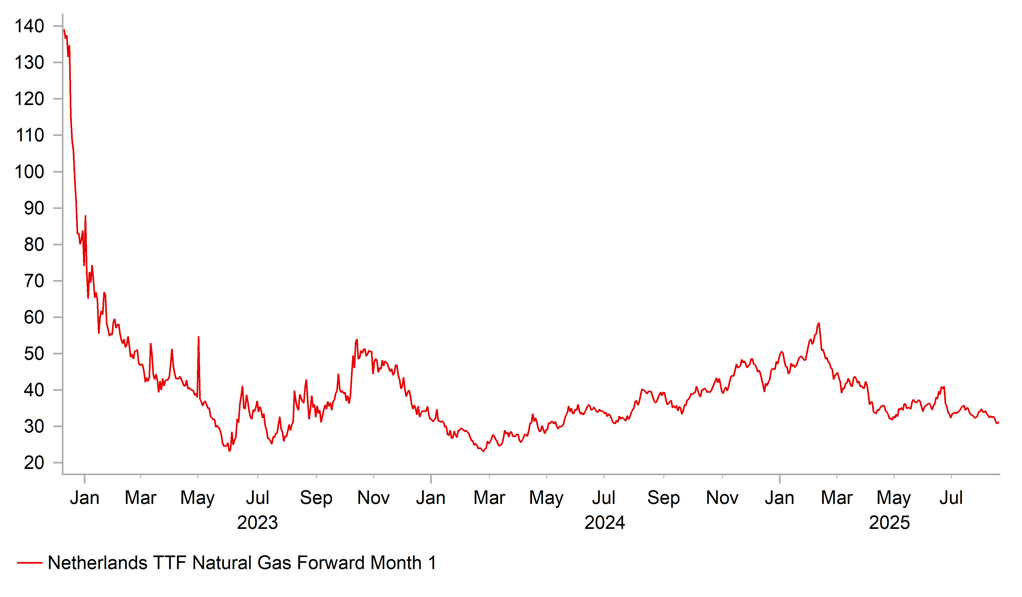

NATO Secretary General Mark Rutte stated that yesterday’s meeting was “really about security guarantees, the US getting more involved there, and all the details to be hammered out over the coming days”. President Zelenskiy is reportedly pleased that President Trump has agreed to participating in security guarantees as part of any peace deal and that he has reserved discussion of territorial exchanges for direct talks with President Putin. European officials expect to hold another virtual meeting with President Trump as soon as today to discuss the particulars of security guarantees. German President Friedrich Merz was optimistic that a direct meeting between Presidents Putin and Zelenskiy could be held within two weeks. So far there has been limited impact on the FX market from the latest geopolitical developments. If the talks prove successful in ending the conflict in Ukraine it could provide more support for European currencies that have already outperformed this year. The price of natural gas in Europe just fallen to its lowest level in over a year highlighting that the negative terms of trade shock continues to fade.

NATURAL GAS PRICES FALLING BACK TO LOWS IN EUROPE

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Hawkish repricing of BoE rate cut expectations continues

The pound weakened modestly yesterday even as the UK rate market continue to price in a more hawkish outlook for BoE policy. After rebounding in the first half of this month, the pound has recently lost upward momentum. EUR/GBP has bounced off support at the 0.8600-level while cable failed to extend its advance above the 1.3500-level. The pound derived support earlier this month from the hawkish reprciing of BoE rate cut expectations and recent run of stronger UK economic data releases that have helped to ease fears over the risk of a sharper slowdown for the UK economy. A development that will be supported as well by the announcement from the ONS today that the level of GDP at the end of 2023 was revised higher so that it was 2.2% above the pre-COVID level compared to the previously reported amount of 1.9%. The 2-year gilt yield has risen by almost 20bps from the low point at the start of this month. The UK rate market is now pricing in only around 7bps of cut by the November MPC meeting as market participants become less confident that further rate cuts will be required this year. The hawkish repricing has also helped to lift yields at the long end of the curve resulting the 30-year gilt yield rising to within touching distance of the cycle high from back in April at 5.66% which if broken may trigger some renewed concerns over the UK public finances heading into the autumn Budget. The 30-year gilt yield has risen by an even a larger 30bps form the low point at the start of this month.

The UK government’s plans for fiscal policy attracted market attention yesterday after the Guardian reported that the Chancellor Reeves has asked Treasury officials to consider potential replacements for stamp duty and council taxes. The Guardian added that the UK government are drawing on the findings of a report from centre-right thinktank Onward which was published a year ago (click here). The report proposes a dual approach of a national and local “proportional property tax” on property based on current valuations. The report does warn though that replacing stamp duty “will result in large revue losses for the government – approaching GBP10 billion a year, and running into billions a year, for several years”. A development which if not offset elsewhere could be create more concern over the public finances.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

Current Account |

Jun |

33.4B |

32.3B |

! |

|

US |

13:30 |

Housing Starts |

Jul |

1.290M |

1.321M |

!! |

|

CA |

13:30 |

CPI (YoY) |

Jul |

1.7% |

1.9% |

!!! |

|

US |

19:10 |

FOMC Member Bowman Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg & Investing.com