Surge in US yields fails to take USD higher

CNY: China data helps improve global growth sentiment

There has been a lot of bad news over recent months emanating from China that severely undermined investor sentiment that really intensified over the summer with the worsening of conditions in the property sector. Real GDP data released today in China will help to strengthen the belief that the economy can weather the negative drag from the real estate sector. Real GDP expanded by 4.9% YoY in Q3 and by 1.3% QoQ and was fuelled by a pick-up in consumer spending. The data strongly suggests that policy support measures are taking hold and that the 5.0% real GDP growth target for 2023 is achievable. Retail sales growth accelerated strongly from 4.6% YoY in August to 5.5% and will be a key source of offsetting the real estate weakness. Property investment worsened from -8.8% to -9.1% YoY.

The data did help USD/CNY to fall notably, from around 7.3120 to a low of 7.2980 but a lot of that initial response to the better data has now been reversed. China property stocks today have underperformed with the Country Garden issue unresolved and time ticking toward a probable formal default. A Bloomberg index of China property developer shares fell today to a level not seen since 2009. China stocks in general are lower today and pressure will persist for the authorities to do more to counter the likely further drag on growth from weakening real estate activity. At its peak, property-related activity accounted for between 25% and 30% of GDP growth. That has to be replaced and the ability of the consumer to replace the lost activity on a sustained basis remains questionable.

Still, for the financial markets over the short-term the perception that the economy is now stabilising or even strengthening modestly will be an important ingredient for curtailing further appreciation of the US dollar on weak global growth prospects. Small changes in the global macro backdrop can play an important role in shifting momentum, especially in circumstances like now when the dollar is so over-valued.

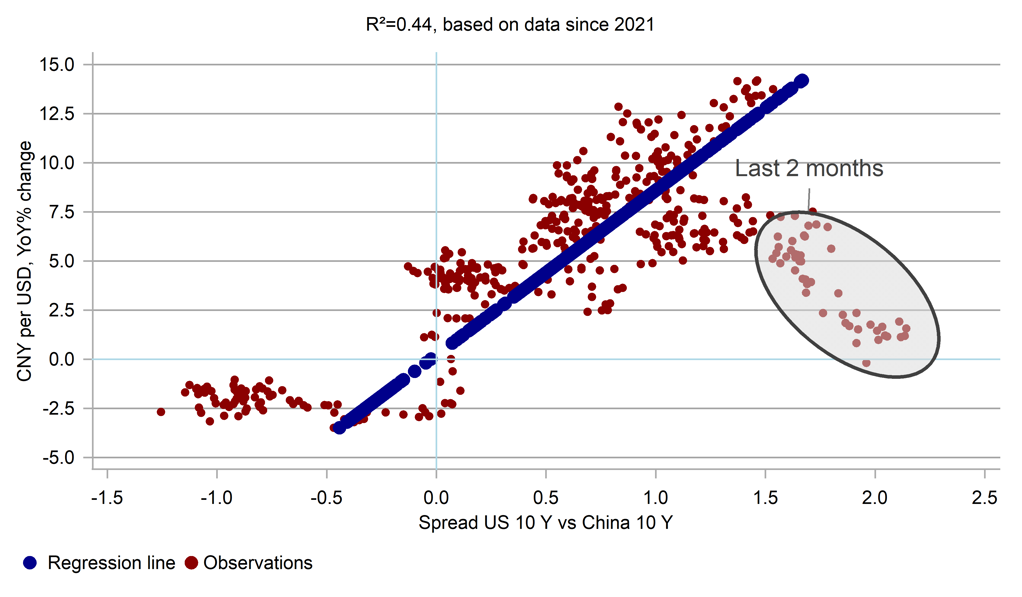

$/CNY CAP AROUND 7.3000 MEANS YIELD SPREAD CORRELATION WEAKER

Source: Bloomberg, Macrobond

ILS: Central bank confirms focus on stability

Many of our clients have exposure to ILS and after the terrible escalation of violence that began with the Hamas attack on Israel on 7th October, yesterday we released an ad hoc FX Focus piece (here) outlining the implications for the currency going forward. The release of our FX Focus piece coincided with some comments from the central bank that were consistent with our view – that the Israeli authorities will be first and foremost focused on stability and hence will avoid any policy that would undermine the stability of the shekel.

This is not a huge surprise. To announce an intervention program committing to selling up to USD 30bn and then also act by cutting interest rates would not be conducive to restoring stability and reducing the current high level of uncertainty. The commitment yesterday to focusing on FX stability rather than monetary easing helped fuel some recovery of the shekel. USD/ILS jumped from below 3.8500 before the Hamas attack to a high yesterday of 4.0329 before recovering on the back of Deputy Governor Andrew Abir’s comments. USD/ILS risks remain skewed to the upside over the short-term. The broader demand for the US dollar adds to those risks and how the initial phase of any pending ground invasion of Gaza unfolds will also be important. The primary risk of further upside stems from the risk of a broader escalation of the conflict that would fuel speculation of a more drawn out and complicated conflict. But the central bank’s stance will help diminish those risks somewhat.

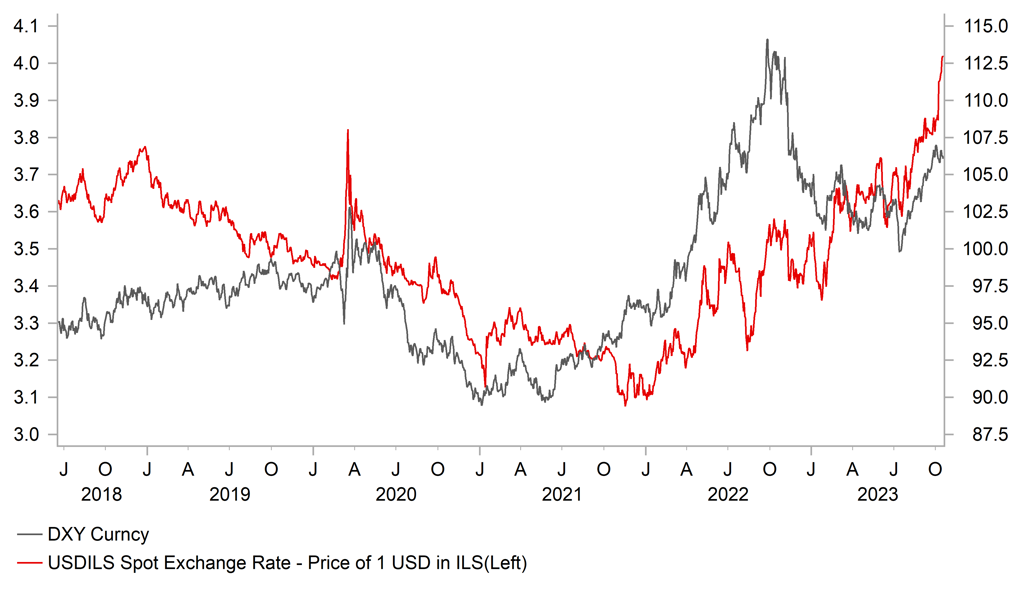

USD/ILS OUTPERFORMS BROADER USD MOVES OF LATE

Source: Macrobond & Bloomberg

EUR: Resilience in the face of surging US yields

The price action in the foreign exchange market yesterday and into today is certainly notable. We had a very strong US retail sales report and another surge in US yields but the US dollar weakened in response. The 2-year UST bond yield surged 14bps yesterday to a new cyclical high of 5.24%, a scenario that would have usually prompted some degree of dollar strength. Instead, the DXY index from the very initial bounce immediately after the retail sales data declined 0.5% and was weaker by 0.2% from yesterday’s open. That’s also telling given the hospital bombing in Gaza last night that has raised tensions further and lifted crude oil prices today.

There is nothing specific or obvious to explain this lack of follow-through for the dollar. There may have been some position liquidation ahead of the deluge of China data today with some anticipation that the data could be stronger than expected. Yesterday did see the release of RBA minutes suggesting a larger chance of another rate hike while ECB officials in Europe also expressed concerns over energy price rises from the upside inflation risk perspective. Short-end yields did jump in Germany, although not to the extent as in the US. The dollar’s positive momentum may also be suffering due to increased focus on the political gridlock in Washington that is increasingly shaping up for a government shutdown from 17th November. Representative Jim Jordan failed in the vote to become House Speaker and the divisions due to 20 hardcore Republicans look impossible to resolve in order to move budget legislation forward. Whatever the reasons for the failure of the dollar to strengthen, it could well encourage further dollar selling as momentum traders liquidate long positions.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:30 |

ECB's Elderson Speaks |

-- |

-- |

-- |

!! |

|

UK |

09:30 |

House Price Index (YoY) |

-- |

0.3% |

0.6% |

! |

|

EC |

10:00 |

Construction Output (MoM) |

Aug |

-- |

0.80% |

! |

|

EC |

10:00 |

Core CPI (YoY) |

Sep |

4.5% |

5.3% |

!!! |

|

EC |

10:00 |

Core CPI (MoM) |

Sep |

0.2% |

0.3% |

!! |

|

EC |

10:00 |

CPI (YoY) |

Sep |

4.3% |

5.2% |

!!! |

|

EC |

10:00 |

CPI (MoM) |

Sep |

0.3% |

0.5% |

!! |

|

EC |

10:00 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!!! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

0.6% |

! |

|

CA |

13:15 |

Housing Starts |

Sep |

240.0K |

252.8K |

! |

|

US |

13:30 |

Building Permits (MoM) |

Sep |

-- |

6.8% |

!! |

|

US |

13:30 |

Building Permits |

Sep |

1.455M |

1.541M |

!! |

|

US |

13:30 |

Housing Starts (MoM) |

Sep |

-- |

-11.3% |

!! |

|

US |

13:30 |

Housing Starts |

Sep |

1.380M |

1.283M |

!! |

|

US |

17:00 |

Fed Waller Speaks |

-- |

-- |

-- |

!!! |

|

US |

17:30 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!!! |

|

US |

18:00 |

20-Year Bond Auction |

-- |

-- |

4.592% |

!! |

|

US |

18:00 |

FOMC Member Bowman Speaks |

-- |

-- |

-- |

!!! |

|

US |

19:00 |

Beige Book |

-- |

-- |

-- |

!! |

|

US |

20:15 |

FOMC Member Harker Speaks |

-- |

-- |

-- |

!! |

|

US |

23:55 |

Fed Governor Cook Speaks |

-- |

-- |

-- |

! |

Source: Bloomberg