US involvement unlikely to alter limited investor concern

USD: Awaiting Trump’s action in the Middle East

The dollar remains at stronger levels after rebounding yesterday as concerns over an escalation in the conflict and the drawing in of the US increased after President Trump called for an unconditional surrender by Iran and stated that US patience was “wearing thin”. There has been increased speculation that the US will take military action to destroy Iran’s underground nuclear facility. Brent crude oil rebounded 4.4% yesterday and closed at the highest level since February. The jump in energy prices may curtail the scope for Fed Chair Powell being dovish this evening in his press conference following the FOMC meeting (see below).

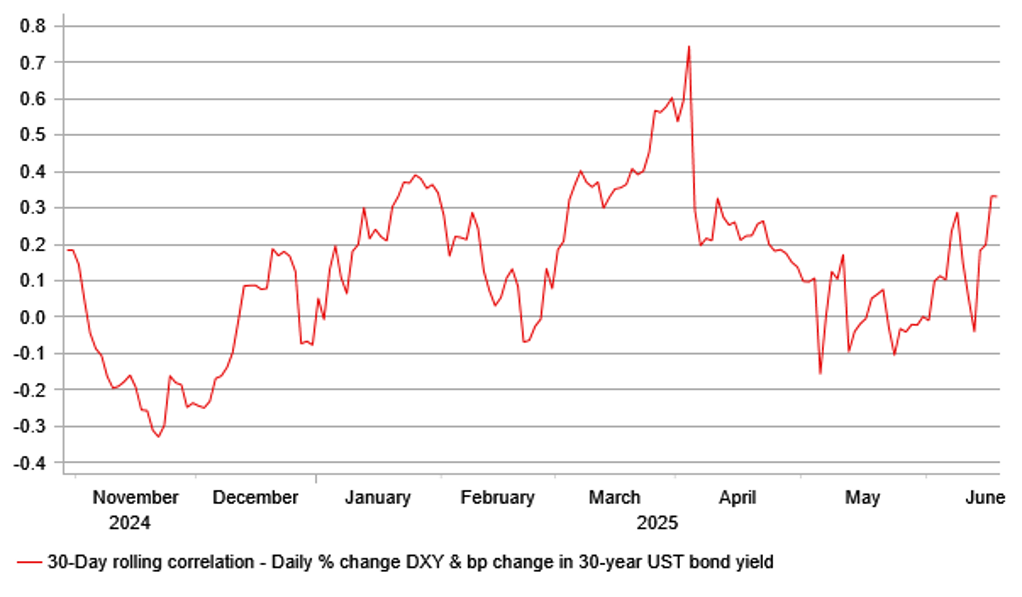

But for all the focus the Israel/Iran conflict is understandably getting, the financial market impact remains very limited with crude oil the primary mover. The S&P 500 is down a mere 1.0% since last Thursday’s close and the UST bond 10-year yield is up 5bps and the 2-year is up 4bps. The price of gold is actually unchanged over the same period. So for FX, it is crude oil that is having the greatest influence. The top two performing G10 currencies since last Thursday’s close are the Norwegian krone and the US dollar. The worst performing currency is the Japanese yen. If global equities remain unperturbed by the escalation in the Middle East, then crude oil and the associated higher global inflation risks will undermine the low-yielders like JPY and CHF. Brent crude oil is about 10% higher from last Thursday’s close and is 23% higher on a month-to-date basis. How much further crude oil prices can go is also questionable. The IEA yesterday released its monthly report that highlighted building crude oil inventories due to slowing world oil demand and increased production from OPEC+. Inventories increased by 1mn b/day since February with a “massive” build last month. Global oil supply was up a significant 1.9mn b/day from a year earlier in May and for 2025 as a whole world oil supply is expected to increase by 1.8mn b/day and by 1.1mn b/day in 2026. The IEA cut its forecast for 2025 consumption growth by 20k to 720k b/day. The IEA also confirmed that peak China oil demand would come sooner than expected. So the global market is clearly well positioned to absorb a supply disruption that as of yet has not even materialised.

If US involvement in the conflict is confirmed in the coming days, it may in fact hasten the end of the conflict and curtail Iran’s incentive to create any crude oil supply disruption. With the global backdrop for crude oil looking quite bearish it could prompt a sudden correction lower that would likely see some of this recent moderate dollar strength reverse as well. The US will certainly not involve itself in any prolonged conflict as it is strongly opposed in general to US conflicts abroad.

ROLLING 1MTH DAILY % CHANGE CORRELATION OIL & USD HAS PICKED UP

Source: Bloomberg, Macrobond & MUFG GMR

USD: Fed Chair Powell should be more dovish

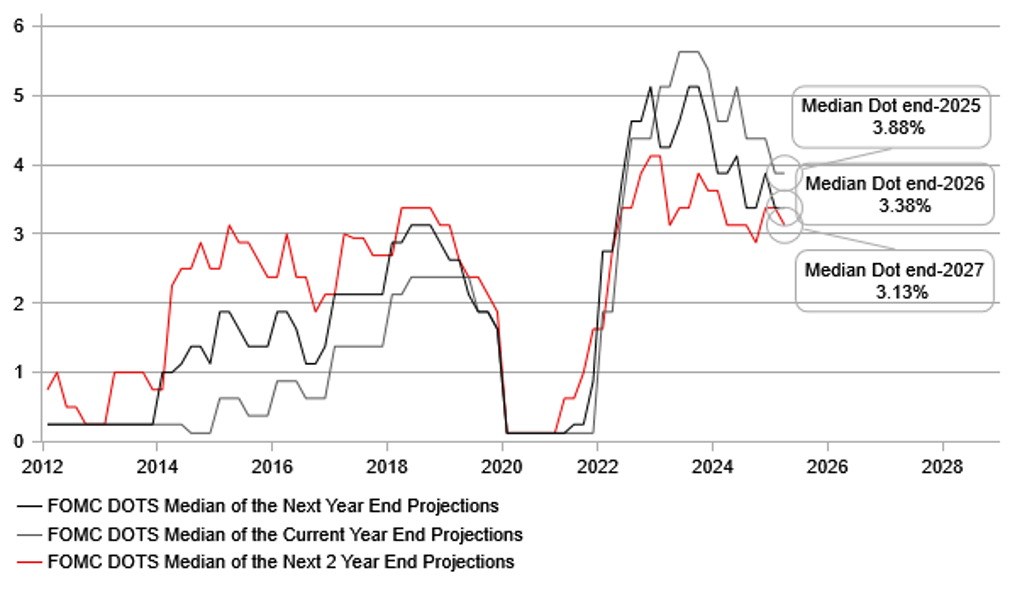

With the Middle East uncertainty adding to the previous trade uncertainty, the scope for Fed Chair Powell to be confident in providing guidance on the near-term outlook is pretty limited. Both uncertainties are more likely to be sources of upside inflation risks and hence Fed Chair Powell will have to communicate cautiously on the timing of possible cuts before the end of the year. In March, the median dot profile revealed two 25bp cuts before the end of this year and then two further cuts in 2026 taking the fed funds rate to a range of 3.25%-3.50%. We think that profile for the median dots is way too cautious and we will reach that end-2026 dot much sooner than that. The Bloomberg consensus for the median 2025 dot is a few basis points higher than the 3.875% level in March pointing to some market participants believing the median dot will drop from two cuts to just one. It would take only two FOMC members who pitched for two cuts in March to change to one to result to the median dropping to one so the risk is certainly skewed that way. Not a lot has changed in terms of clarity on the outlook for the economy and we do now know the reciprocal tariff rate levels that are higher than what was assumed when the last dots were made in March.

But will the reciprocal tariffs be implemented on 9th July? It seems unlikely that Fed officials will shift their views now based on a scenario that might not even be realised. More often than not Trump has backed down (TACO!). Also, the inflation backdrop is certainly better than assumed at this point with limited signs of actual inflation although that may well reflect inventory overhangs as the surge in imports in Q1 suggests. The labour market though does look to have weakened somewhat. Continued claims are ticking higher, private sector job layoffs announcements are rising and the quits rate remains at a level last seen in 2016 (when covid is ignored).

While the Middle East escalation is a potential inflationary risk, the uncertainty it brings with the US on a war-footing could also undermine activity. The tariff uncertainty looks to be playing a role in slowing consumer spending and the demand brought forward to dodge tariffs could now mean weaker consumer spending ahead.

The US dollar is being more determined by the developments in the Middle East with signs of escalation lifting crude oil prices and the dollar (as above). Given the uncertainties it will be difficult for Powell to provide strong guidance although we suspect that the overall tone of his comments could well be interpreted as more on the dovish side given actual inflation and actual labour market data have been softer than expected. That makes it difficult for Powell to sound hawkish and hence the takeaway this evening may be some modest increase in expectations of rate cuts from September onwards. The appetite to sell the dollar though will likely be muted for now until there is a clearer outlook on the Israel/Iran conflict over the coming days.

FOMC MARCH MEDIAN DOTS ARE LIKELY TOO HIGH

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:30 |

House Price Index (YoY) |

-- |

5.6% |

6.4% |

! |

|

EC |

10:00 |

CPI (YoY) |

May |

1.9% |

2.2% |

!! |

|

EC |

10:00 |

CPI (MoM) |

May |

0.0% |

0.6% |

!! |

|

EC |

10:00 |

Core CPI (MoM) |

May |

0.0% |

1.0% |

!! |

|

EC |

10:00 |

Core CPI (YoY) |

May |

2.3% |

2.7% |

!! |

|

EC |

10:00 |

HICP ex Energy & Food (YoY) |

May |

2.4% |

2.7% |

! |

|

EC |

10:00 |

HICP ex Energy and Food (MoM) |

May |

0.1% |

0.9% |

! |

|

US |

13:30 |

Housing Starts |

May |

1.350M |

1.361M |

!! |

|

US |

13:30 |

Building Permits |

May |

1.420M |

1.422M |

!! |

|

US |

13:30 |

Continuing Jobless Claims |

-- |

1,940K |

1,956K |

!!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

246K |

248K |

!!! |

|

EC |

16:00 |

ECB's Lane Speaks |

-- |

-- |

-- |

!! |

|

CA |

16:15 |

BoC Gov Macklem Speaks |

-- |

-- |

-- |

!! |

|

US |

19:00 |

FOMC Economic Projections |

-- |

-- |

-- |

!!!! |

|

US |

19:00 |

FOMC Statement |

-- |

-- |

-- |

!!!!! |

|

US |

19:00 |

Fed Interest Rate Decision |

-- |

4.50% |

4.50% |

!!!! |

|

EC |

19:00 |

ECB's De Guindos Speaks |

-- |

-- |

-- |

!! |

|

US |

19:30 |

FOMC Press Conference |

-- |

-- |

-- |

!!!!! |

|

US |

21:00 |

US Foreign Buying, T-bonds |

Apr |

-- |

123.30B |

!! |

|

US |

21:00 |

Overall Net Capital Flow |

Apr |

-- |

254.30B |

!! |

Source: Bloomberg & Investing.com